LULU LevelsNASDAQ:LULU is approaching June Levels. The next major level on the downside would be the gap 249-251. The sellers have had complete control of the shares the past 3 weeks. The 3 lines are the 50 100 and 200 SMA's respectively, LULU had no problem breaking the most active level shown of 317.02 and quickly broke below the 100 SMA. The 200 SMA acts as support. Furthermore LULU has Recently moved into Oversold levels on RSI and has began to show upside on CCI. The future of this stock likely depends on good sales reports, retail seeing action, and a hold of 287.66 next week.

33L trade ideas

Lululemon (LULU): The Channel of the Yoga Apparel IndustryIf you like this analysis, please make sure to like the post, and follow for more quality content!

I would also appreciate it if you could leave a comment below with some original insight.

In this post, I will be providing an in-depth analysis on Lulu Lemon Atheletica Inc. (LULU), by going over its business model, financials, and technicals as well.

What is Lululemon Athletica Inc. (LULU)?

Lululemon is a company that provides technical athletic apparel for yoga, running, training and most other sweaty pursuits. They differ from other apparel companies in that they offer extremely high end products.

M&A (Mergers and Acquisitions) of Mirror

- Lululemon acquired the indoors fitness company Mirror for $500m.

- Mirror is a company that offers an interactive mirror, which live streams on-demand workout classes for their users at home.

- Classes cost $39 per month

- Essentially, LULU will be offering a very similar subscription service business model to that of Peloton (PTON)

Business Models

Athleisure Products

- LULU’s main business model is in the athleisure (athletic leisure) apparel industry

- They are called the Channel of the yoga apparel industry, not because they simply offer overprices clothing, but because they know exactly who their target audience is

- They target not only people who like to wear yoga pants for workouts, but also people who want to look good in these clothes.

- Their main target, however, are people who pursue ‘mindfulness’ through activities

- There’s definitely a show-off aspect to the apparel as well, as people wear it with pride even on normal occasions.

- While trends change, it appears that the athleisure look won’t be fading away anytime soon.

- The athleisure market for men is growing as well, as the entire market grows 8% every year, with the potential to reach $517.5 billion according to Grand View Research

Direct to Consumer

- Another fact noting is that they operate in D2C (Direct to Consumer)

- They own the sales channels for online and offline consumers

- During this pandemic, they have reinforce their offline sales channels by offering online yoga classes, and introducing SNS-linked shopping features.

- As a result, while offline stores’ revenues have decreased by 48% during the pandemic, online D2C sales have increased by 67%, and their online sales have exceeded their offline sales

Subscription Service

- LULU offers a new subscription service through Mirror

- The mirror is a screen that plays fitness instructional videos

- It’s anticipated that the revenue generated from Mirror will be around $100 million this year

- According to the Bank of America, LULU will be able to raise $700 million in revenue and a subscriber base of 600,000 by 2023.

- There’s a lot of synergy to be expected through LULU Lemon’s acquisition of Mirror, as the demographics of people who purchase $400 yoga pants and $1500 worth mirrors match – high income demographics interested in exercise

Financials

- LULU has shown a 17% yoy revenue increase from their North American regions

- Their 2020 Q1 earnings were extremely disappointing as their shops have been directly targeted by the Corona Virus (COVID-19), but a revenue turnaround is anticipated for Q4

- For 2021, we can anticipate LULU’s revenue to hit $4 billion, with their Earnings per Share (EPS) at $4.23

- LULU shows astonishing EPS growth, as it has essentially doubled since 2018.

- Not having a middleman for their distribution channel significantly increases their operating profits as well, with their current percentage at 22% - much higher than its counterparts such as Adidas (ADS) or Nike (NKE)

- 88% of their revenue is generated from North American countries: Canada and the United States

- The company’s market capitalization is valued at 57 times its net profit, based on the 12 month Forward P/E ratio

- This is strong evidence for the argument that the company is overvalued.

Opportunities

-Given that we could anticipate a 28% yoy growth in the Chinese Pilates Market, LULU’s not having expanded to Asian and European markets yet suggests great opportunities for growth

- Since 2012, the Chinese population interested in Pilates has doubled to 12.5 million by 2019, and the Pilates apparel market has quadrupled to 9.7 Billion Chinese Yuan.

- The founder of LULU invested $100million in Anta – the Chinese Nike- acquiring 0.6% of the company’s share, in regards to their potential penetration of the Chinese market

- Anta does offer some Pilates related clothing, but does not have a Pilates apparel brand.

Competition

-LULU’s demographics also match with that of Peloton (PTON), and as such, we could anticipate fierce competition between the two firms

-They are also in a fierce competition with Athleta, a company that designs performance clothes for active women. Athelta is owned by GAP (GPS)

Technical Analysis

- We can take a look at LULU's daily chart for technical insight

- LULU has bounced on the $288 historic support, currently ranging between the 0.236 and 0.382 Fibonacci retracement levels

- Should we see further downfall, we could expect a bounce at the $265 historic support

- The 20 Simple Moving Average (SMA) is about to form a death cross with the 60 SMA, which has been acting as a strong indicator for uptrends and downtrends

- The Relative Strength Index (RSI) demonstrates the stock having been oversold recently

- The Moving Average Convergence Divergence (MACD) shows decreasing bearish histograms, and a potential for a golden cross

- We have seen these indicators point towards the same direction when the company was hit by the Corona Virus Pandemic, before moving on to triple in price

- While the overall trend still remains bullish, we would need further bullish confirmations to gain confidence on the uptrend

- Such confirmations would include a breakout leading prices to trade above the 60 SMA, or a close above the 0.236 Fibonacci resistance

Conclusion

Lululemon Athletica Inc. (LULU) is an apparel company that moves like a tech stock. It has extremely high potential, as it implements business diversification through its acquisition of Mirror, and is yet to expand to highly lucrative markets with huge potential such as the Asian and European markets.

As I have previously mentioned, ironically, it’ll be the luxury brands/companies that survive through hard times like these. Economic crises is when polarization deteriorates, and spending on luxurious goods increases. LULU does a great job of communicating with its customers and bringing more people in, and as such, their fundamental business model of a luxury brand remains solid.

V Bottom Rising WedgeLULU fell from a rising wedge and perhaps forming a bottom here. Can't be sure tho. Oversold. NV is high

Resistance overhead from gap down.

LuLu broke from a V bottom a while back and has made extraordinary gains

I guess too much buying though without healthy pull backs

Strong stock and I feel sure she will recover.

Monthly candle looks like the stock could fall a bit more.

I see strong support at 297.93ish

Long when a bottom is formed.

Not a recommendation

A new Trend channel for LuLu?When creating a trading channel for all of 2019, LULU showed consistent growth and created this neat and reliable trading pattern. Enter the Ides of March. The raucous movements of all stocks disrupt this pretty uptrend. LULU fell much further than it should and then, subsequently, rallied higher than it should (if it was to stay within the previous trading channel of 2019). IF we assume that this trading channel is Where LuLu should be, then as of 9/12/2020 the stock is still Overbought. However, to delve into a possible change in the trading channel position (a pandemic can stifle or accelerate a company's growth), the Month of June created a pullback from the rally upwards where the width of the pullback matches the width of the 2019 trading channel's extents almost perfectly. Should we move the trading channel up to incorporate these two points as the beginning of a new channel, then a Bullish sentiment should be taken for LuLu as it is approaching the base of this possible new trading channel.

This idea will likely be debunked in the next week if LuLu falls bellow $300 for an entire day.

LULU running to 400 pre-ER? 🚀🚀Looks very bullish, and this is one of my personal favorites, with COST and ROKU... besides the typical market leaders (AAPL & TSLA)...

See many of Tech in bullish positions going into this week, Friday seemed like a bull rush, but mostly put into leaders mentioned above. Not sure how market will react to this ER for LULU, but I imagine that their sales have been strong; regardless, enormous potential for this company-- I already consider them a lifestyle brand, but I'm sure this will be more common view sooner or later.

Let's see what happens!

Rising WedgeV bottom that broke out at 266.3 Perhaps LULU is just tired..dunno

LULU has been in multiple rising wedges throughout it's trip to the top. There was a bull flag earlier and she had just fallen from a rising wedge, only to form a new one

Beat earnings on 9-8 but with rising wedges there are often no buyers left due to lack of pull backs and irrational exuberance. Seems like earnings are when the wedge is broken even if the stock beats

Now there is a gap down to fill and maybe, just maybe..LULU will have a healthy trip back up

Short interest is relatively low. NV is high...strong stock. One of the market darlings

Long after fall complete

Not a recommendation

The trend is your friend until it is not

Earnings LULU: Big Move up that won't holdThis is for fun and just for journaling my intuitive methods in the markets.

What I'm getting is a move up 13.5% (perhaps after hours), and 8% at open tomorrow.

Then she breaks down, likely with the indexes, but sell any rally. Looks like almost 20% down from the high.

LULU - Q2 Earnings ExpectationLululemon had an incredible rally last week heading closer into earnings but sold off about 13% from the top. There was support found around the $346 level. We suspect that this is just a pullback.

We played the run up last week luckily took profit on our short term 2 day swing trade.

We are still bullish heading into Q2 earnings report.

WHY?

Ecommerce. Q2 was one of the best times for digital advertising. CPM on any major ad platforms were as low as 2017 and it was easy for many brands to scale their businesses online.

LULU as one of the leading retailers might surprise a lot of investors with an incredible earnings beat. We'll have to see if their online sales were able to overcome physical store closures.

Due to risk of volatility we're holding onto OTM calls expiring in OCT/NOV 2020.

Good luck traders.

*NOT A FINANCIAL ADVICE, THIS IS JUST OUR PERSPECTIVE AND WE DO NOT RECOMMEND ANY TRADES WE PUBLISH ON OUR CHANNEL. YOU WILL LOSE MONEY.

$LULU - Earnings on the 8th AMCSELL -1 IRON CONDOR LULU 100 (Weeklys) 11 SEP 20 387.5/397.5/387.5/377.5 CALL/PUT @9.20 LMT

Try to build it yourself. And keep the Risk less than $100.

For every $80 Risk. You have a potential to make to $150 (Realistic targets).

Another earning trade. Betting this wont have a severe move.

The Perfect IRC

Bull Flag Trying to break outLULU looks to be trading in a bull flag pattern with break out at 215.5 Has fallen out of rising wedge pattern which can be bearish..so I feel safer to trade it.

Target 1: 385 to 400

Target 2: 480 to 520

My stop would be under 284/we all have a different tolerance, then I would move it as she rolls.

Be safe and good luck!

LULU - 8.49% Potential Profit - Ascending TriangleClear uptrend Support with an Ascending Triangle formed within.

Target price set at a new potential resistance line.

I suggest entering with a Buy Limit order. If limit is not triggered, I wouldn't chase the run.

- Historical uptrend

- RSI + Stoch well above 50

- MACD above Signal.

Suggested Entry $332.94

Suggested Stop Loss $326.66

Target price $361.20

Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss.

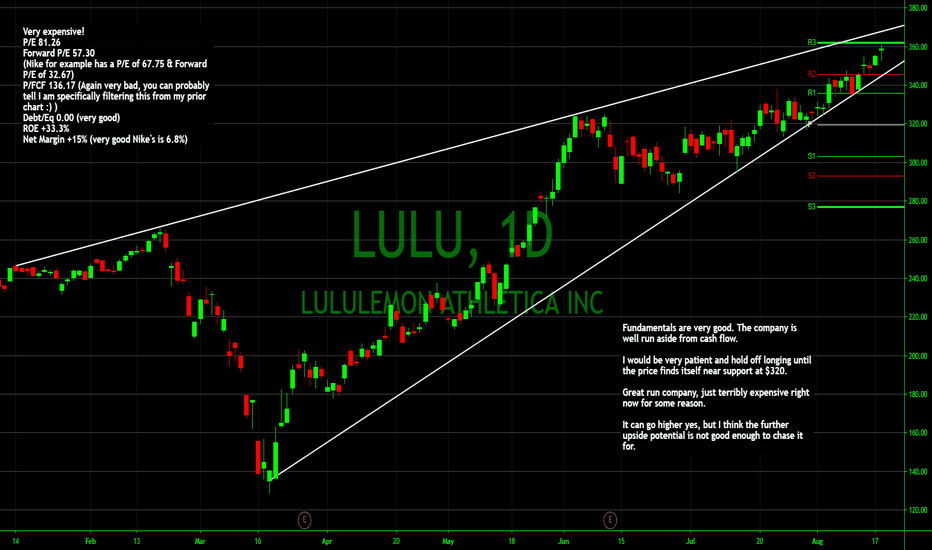

Analysis on Lululemon Athletica - a Canadian Retail CoFundamentals are very good. The company is well run aside from cash flow.

I would be very patient and hold off longing until the price finds itself near support at $320.

Great run company, just terribly expensive right now for some reason.

It can go higher yes, but I think the further upside potential is not good enough to chase it for.