3V64 trade ideas

Visa Wave Analysis – 19 June 2025

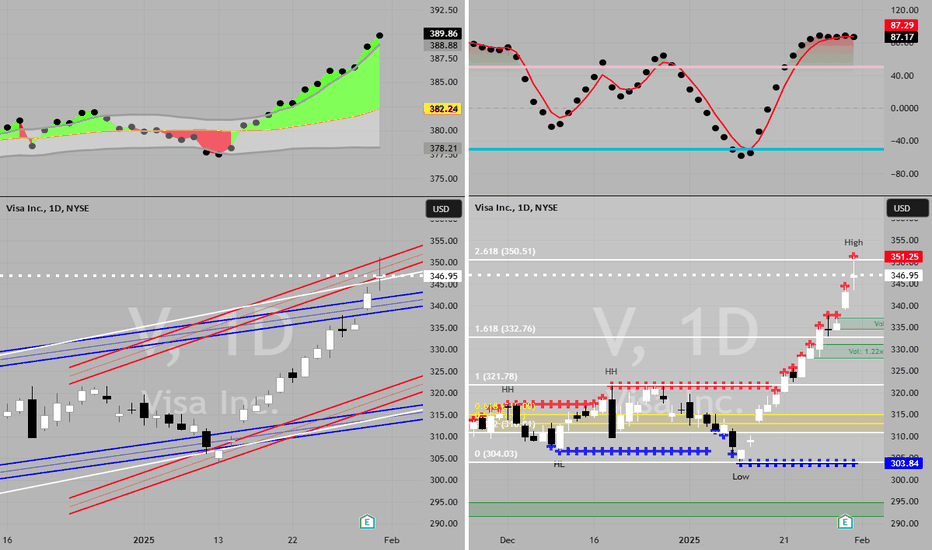

- Visa broke daily up channel

- Likely to fall to support level at 332.90

Visa recently broke the support zone located between the support level 345,00 (which reversed the price earlier this month) and the 38.2% Fibonacci correction of the upward impulse from the start of April.

The breakout of this support zone coincided with the breakout of the daily up channel from April – which accelerated the active wave 4.

Visa can be expected to fall to the next support level at 332.90 (former minor support from April and the target for the completion of the active wave 4).

Visa: Resistance ApproachingThe next key step for Visa should be overcoming resistance at $394.49 during magenta wave . However, if support at $339.61 fails to hold, our alternative scenario (33% probability) will be activated—suggesting the recent high already marked the end of the corrective wave alt. in magenta. In that case, a renewed decline below the $299 mark would be likely, aiming to complete the alternative turquoise wave alt.4 on a larger scale.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

VISA - A Pump & Dump? Help me understand please.To places where no stock price has ever gone before..

What makes VISA so special?

The credit industry is currently staring into the abyss due to massively rising payment defaults.

Why is VISA skyrocketing in price, breaking through every barrier as if they were made of butter?

I don't know, and I'm very puzzled.

What will happen if economic conditions become even more difficult and the madness we're currently experiencing fully hits, and hardly anyone can service their consumer debt anymore?

I think at that point, VISA will look like a

Pump & Dump too like many others.

I'd appreciate any info on why VISA is rising so much.

Strategic Entry in Visa (V): Stability, Growth, and Opportunity📈 Strategic CALL Entry on VISA (V) – All 20 Criteria Met

Today I’m entering a CALL option on Visa (V) based on a comprehensive analysis that aligns with all of our 20-entry criteria, combining technical indicators, fundamental strength, and disciplined risk management.

But beyond that, we are also factoring in key macroeconomic catalysts and upcoming earnings, which strengthen the setup and give us a clear path for growth.

🔍 Why Visa – and why now?

✅ Meets all 20 internal criteria, including:

Price above both the 50- and 200-day moving averages (clear uptrend)

RSI in a healthy range (not overbought)

Volume confirms price action

Consistent earnings performance

Strong sector momentum (payments & fintech)

Sound risk-to-reward structure (<6% of portfolio risk)

Positive analyst sentiment

Solid balance sheet, low debt, global dominance, etc.

📊 Earnings expected in June

Visa is set to report earnings in June. Forecasts suggest strong performance backed by increasing digital transactions and resilient global spending. A positive surprise could trigger a sharp upward move.

🌍 Macroeconomic backdrop: US GDP data out today at 8:30 AM (EST)

GDP expectations stand at +2.2%. If confirmed, it signals continued economic strength — a bullish sign for consumer-facing companies like Visa that benefit directly from transaction volume growth.

💡 Why Visa stands out:

Stability

Steady growth

Low volatility

Strong technical and fundamental alignment

📌 Bottom line:

Visa not only checks all our boxes internally, but also benefits from a favorable macroeconomic context and key catalysts ahead. This is a high-conviction, low-emotion trade backed by structure, not hype.

Visa Challenge Resistance at $362Visa is one of the greatest companies, with a solid business model and a profit margin of 50%.

The stock has hit resistance at $362 and is currently testing that level. If the share price breaks above it, we could see a continued uptrend to new highs. However, if it fails to break out, a pullback might be expected.

"King of Cards" How Does Visa Make Money?NYSE:V

To be honest, VISA stock is the kind of investment that really feels solid and reliable. I bought a bit of VISA a few years ago, and before I knew it, the price had climbed past $300 and I started getting those occasional dividend notifications. The dividends aren’t huge, but it’s nice to see that money coming in automatically. I can see why so many dividend investors like VISA.

VISA is, of course, the same “VISA” you see on your credit cards. Globally, they dominate the credit card market, with nearly half of the market share, and they’re among the top 10 biggest companies in the US by market cap.

These days, cashless payments have become the norm, and that trend really works in VISA’s favor. Most analysts expect VISA to keep growing steadily, with annual revenue and profit increases of around 10%. VISA has also raised its dividend every year for over 16 years, making it a classic “dividend growth” stock. The yield itself is under 1%, but the key is that the dividend keeps getting bigger.

Recently, VISA’s been expanding into new businesses too-like Visa Direct for money transfers-so they’re evolving from just a credit card company into a global payments platform. Maybe that’s why even Warren Buffett has invested in VISA.

Of course, there are risks. There’s always talk of antitrust regulation, and new fintech companies like PayPal are trying to take market share. In fact, VISA’s stock has underperformed the market a bit in the last few years. But VISA’s economic moat (the barriers that keep competitors out) is still very strong.

Looking at the current price, VISA’s P/E ratio is actually a bit lower than its five-year average, so some people think it’s undervalued right now. That’s why I think VISA is a stock you can hold in your portfolio for the long term and feel pretty comfortable about.

- VISA is the clear leader in global payments, and as we move toward a cashless society, its growth prospects look strong.

- The dividend is small but growing every year, and the stock price has trended upward over the long term.

- There are risks like regulation and fintech competition, but most still see VISA as a solid investment.

Maybe you like this Video deal with VISA

below comment!

V | Waiting for Dip | Extended Price | (May 2025)V | Waiting for Dip | Extended Price | (May 2025)

1️⃣ Insight Summary

Visa has been on a strong long-term uptrend and continues to deliver solid financials. However, current price levels seem a bit stretched, and I'm looking for a better risk-reward entry zone.

2️⃣ Trade Parameters

Bias: Long (on pullback)

Entry Zone (Watchlist): $300 – $275

Stop Loss (if entered): Below $251

TP1: $295 (first bounce zone)

TP2: $322

Final Target: $346

Partial Exits: TP1 for early profits, TP2 and beyond for longer-term hold.

3️⃣ Key Notes

💰 Visa posted strong earnings ($2.80 EPS) and impressive revenue ($35B), with a solid net income margin.

🏦 The company benefits from its tight integration with the banking system and steady cash flow (~ SEED_TVCODER77_ETHBTCDATA:4B ).

📉 Debt is manageable at FWB:20B , and Beta at 0.72 shows less volatility than the market—ideal for steady investors.

⚠️ Despite these positives, price looks extended, and I’d prefer a pullback toward $300 or $275 before considering an entry.

📊 Technically, there are signs of a possible bearish divergence forming—this supports the idea of waiting for a better level.

4️⃣ Follow-up Note

Visa remains on my radar, but no trade until we see a clearer technical pullback or structure reset near my ideal buy zone.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

VISA:Respecting the 61.8% Fibonacci Level and Going for New HighWho doesn't know VISA? Almost everyone has or has had a VISA card. VISA stock has an unbeatable bullish outlook, which, like all stocks on the stock market, has retraced its rise.

---> What is its current situation?

If we look at the chart, its appearance is CLEARLY BULLISH (Bull), having gone through a retracement phase. The retracement it has made is EXACTLY THE 61.8% Fibonacci, AND IT HAS RESPECTED IT. Since reaching that retracement on March 14, the price has not stopped rising. It is currently BREAKING KEY ZONES to initiate an attack on NEW HIGHS IN VALUE. If it surpasses the 352 zone, it will go directly to the highs, and will most likely break them to explore new prices for the stock.

--------------------------------------

Strategy to follow:

ENTRY: We will open two long positions if the H4 candle closes above 352.

POSITION 1 (TP1): We close the first position in the 366 zone (+4%) (highs zone).

--> Stop Loss at 336 (-4.2%).

POSITION 2 (TP2): We open a Trailing Stop position.

--> Initial trailing stop loss at (-4.2%) (coinciding with the 336 level of position 1).

--> We modify the trailing stop loss to (-1%) when the price reaches TP1 (366).

-------------------------------------------

SET UP EXPLANATIONS

*** How do I know which two long positions to open? Let's take an example: If we want to invest €2,000 in the stock, we divide that amount by 2, and instead of opening one position of €2,000, we'll open two positions of €1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but it automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance. This specified distance is the trailing Stop Loss.

--> Example: If the trailing Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% during increases. Therefore, the risk decreases until the position enters a profit. This way, you can take advantage of very strong and stable price trends, maximizing profits.

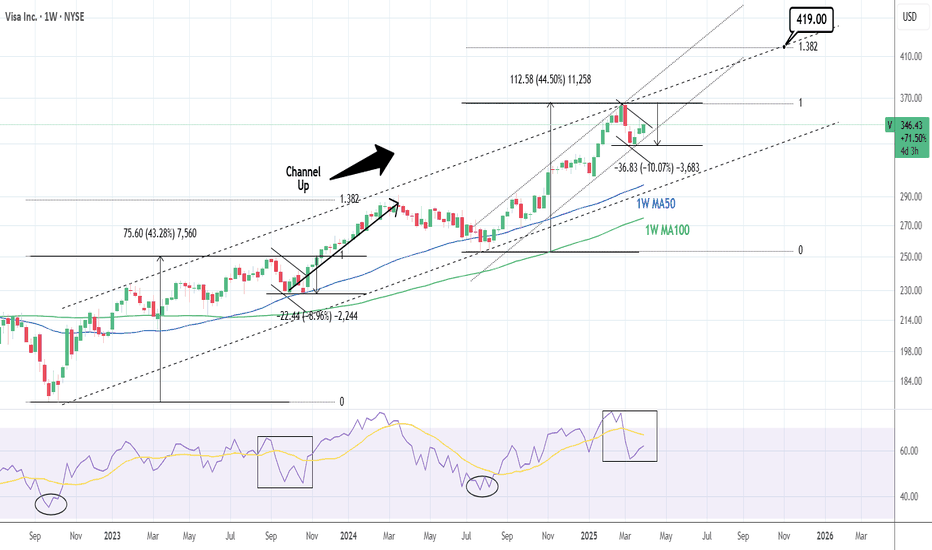

VISA: One of the steadiest 2025 stock picks.Visa remains bullish on 1W and is about to do so on its 1D technical outlook as well (RSI = 54.200, MACD = 1.140, ADX = 29.207). The 1W Channel Up is what keeps the long term trend bullish and 1D is just recovering from neutral grounds the correction of March's first 2 weeks. This is nothing new for the stock as it had the same -9% correction in September 2023 after a symmetric +43.28% bullish wave. After this correction, the index extended the rally to the 1.382 Fibonacci extension before the stronger correction.

You can see that the 1W RSI pattern now is identical to then. Consequently, we again expect a technical rebound to the 1.382 Fib extension either at or over the 2 year Channel Up (TP = 419.00) by the end of the year.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Free Report #1:How To Build A Solid WatchlistFinding this chart pattern took about two days.

First i had to create a screener to find the momentum

then today i looked at the watch list.

While looking at the watchlist i tried to screen

for a candle stick pattern,

This candlestick pattern is called the lower long shadow.

It is part of another chart pattern called the frying pan

bottom.

This means the chart price has hit higher new low

as you can see from the drawing on the chart

that looks like a triangle

ALso remember that on this chart is

a technial analysis system called

the rocket booster strategy.

Check out the references to learn about this

strategy.

Also take note of one the best osicllators

in technical analysis called the MACD

look close you will see two lines Crossing

This is rare sight to behold

and this is why i have to document this

and share it with you as well

Trade safe.

Rocket boost this content to learn more

Disclaimer: Trading is risky please learn risk management

and profit taking strategies.Also feel free

to use a simulation trading account before you

trade with real money

Visa: Bottom Already Established?Visa might have already reached the low of the magenta wave ; however, for now, we allow slightly more room for the downside. Nonetheless, once this interim correction has concluded, the price should proceed higher during the magenta wave and surpass the resistance at $366.34. We currently consider it 34% likely that the stock will break above this level to form a fresh high with the magenta wave alt. . But primarily, we view the regular wave as already complete.

Selling Short Like a Pro: Secrets of successful selling shortLearn the important aspects of how to sell short with consistent success and higher profits. There are many myths about selling short that this video training will explain. Selling Short is something all traders need to learn to do. However, it requires an understanding of the downside price action that is totally different than buying long whether you swing trade, velocity trade or day trade.

The sell side is not an inversion of the upside. What drives price down is different. Learn how simple tips that enable you to watch for a good low risk entry for selling short.

Learn how indicators confirm the sell short entry signal.

Increase your trading profits by being able to buy long or sell short as the market conditions shift and change over time.

The Breakout Of Visa Stock + 3 Step System I have not been feeling well these past days hence why I have been quiet.

Am getting much better a a friend of mine

Gave me some oranges in exchange for avocados .

😏He got more avocado 🥑 compared to the oranges i got from him.

Anyway look at this chart.Notice that by using a CCI indicator you can see that the price has reached a breakout point

This point is called a New high

Also we are using the trend analysis system called the rocket booster strategy

The rocket booster strategy has 3 Steps:

1️⃣ The price has to be above the 50 EMA

2️⃣ The price has to be above the 200 EMA

3️⃣ The price should Gap up to a New high

-

Remember don't use any margin.

Rocket boost this content to learn more.

Disclaimer ⚠️ Trading is risky please learn risk management and profit taking strategies. Also feel free to use a simulation trading account.

V to $325My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price at top of channels (period 100 52 & 26)

Stochastic Momentum Index (SMI) at overbought level

VBSM is spiked positive and over top of Bollinger Band

Price at 2.618 Fibonacci level

Entry at $348

Target is $325 or channel bottom

VISA bullish outlook like Mastercard - Target to $380Visa is looking good fundamentally and technically.

Strong Financial Performance: Visa reported a 14% earnings increase and 10% revenue growth, exceeding expectations.

Growth in Payment Volumes: Payments volume grew 9%, with a 16% rise in cross-border transactions.

Positive Market Sentiment: Analysts view Visa as a top pick due to its strong travel-related spending and valuation.

Strategic Partnerships: Visa partnered with X to launch the X Money Account, enhancing its digital payment services.

Price> 20 and 200MA

W Formation

Target $380.00