Will Aston Martin return to its former glory ? LSE:AML

Aston Martin shares are down around 35% since the beginning of 2024. Shares continues to decline since august 2023 what´s around another 30% (65% from august 2023 till now). Aston Martin shares don´t look fresh even from wider perspective as you can see the historic chart.

Company itself has occurred in kind of transition since Lawrence Stroll became executive chairman in early 2020 with 16,7% stake in the company. Moreover he re-branded F1 team Racing Point as the Aston Martin F1 Team in 2021. He´s really into it.

Briefly about Aston Martin F1 Team 🏎️:

- Lawrence Stroll´s given his son every opportunity to become an F1 driver. He became a stable part of F1

- Stroll said Aston Martin sees its first victory in F1 this year

- building new Aston Martin factory

Company signed new CEO Adrian Hallmark as a part of transition. Former Chairman and CEO of Bentley Motors will replace Amedeo Felisa no later than 1st October 2024.

Aston Martin also announced the delivery of four new models in 2024 (Vantage, upgraded DBX707, V12 flagship sports car and more) which would power growth in the second half of the year and beyond.

All these news sounds good. ✔️ However the finances don´t look so great.

Aston Martin´s still BLEEDING. 💉

- widening losses in the first quarter due to stopped production of its core models ahead of a launch a new vehicles

- revenue fell 10% to 267.7£

- debt increased 20% to 1.04£

- wholesale volumes slumped by 35% in Americas, by 30% in the U.K., by 14% in Asia-Pacific and by 17% in the wider Europe, ME and Africa region

Will Aston Martin shine again ? Well, it seems that only time will tell us whether they´ll succeed

Fun fact:

Aston Martin officially opened new "Aston Martin Residences Miami", an ultra-luxury brand´s first real estate project.

You can read more about the project at official Aston Martin page.

Sources:

cnbc.com

astonmartin.com

A5SA trade ideas

Aston Martin reverse to retest key support cluster Aston Martin Lagonda Global Holdings (LSE:AML)

Aston Martin’s share price had raced higher during the summer after Chinese carmaker, Geely doubled its stake in the historic British brand.

Geely, a long-standing admirer of Aston Martin, had previously made multiple attempts to acquire the company. In May, Geely acquired 42 million shares from Aston Martin's ownership consortium, solidifying their investment while providing components and technology to the automaker.

However, recent market dynamics have caused Aston Martin's share price to reverse course, experiencing a substantial pullback from its summer peak of nearly £4. This extended retracement has brought the stock into close proximity to a cluster of support levels.

Firstly, there's the gap that emerged in May after Geely's investment, which has now been closed. During the recent gap-closure phase, several long-tailed bullish hammer candles have appeared, indicating potential reversal signals.

Secondly, the Volume Weighted Average Price (VWAP) anchored to the key October lows assumes significance, as it reflects the average price of buyers who entered just before the Geely rumours surfaced.

Lastly, we find swing support, which represents the psychologically important £2 level. This confluence of support levels is likely to attract the attention of long-term investors, and it remains to be seen whether it will be sufficient to reverse the recent pullback.

AML Daily Candle Chart

Risk management

It's essential to remember that support and resistance levels serve as guides and are not foolproof guarantees. While technical analysis is valuable, it should complement fundamental analysis. It's noteworthy that Aston Martin is currently a loss-making company, making it susceptible to short sellers.

Additionally, please take into account that Aston Martin is scheduled to release its Q3 2023 Earnings on Wednesday, November 1st.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance.

AML: A Speculative Buy06 October 2023

The Professional Trader

The article and the data is for general information use only, not advice!

3 min read

Aston Martin: A Speculative Buy

Aston Martin is a luxury car manufacturer with a long and storied history. The company is known for its high-performance, handcrafted vehicles. However, Aston Martin has also had a history of financial struggles. Here are some of the reasons why I would rate Aston Martin shares as Speculative Buy:

Strong brand: Aston Martin is a well-known and respected brand in the luxury car industry. The company's cars are associated with luxury, performance, and style.

Growth opportunities: Aston Martin is well-positioned for growth in the luxury car market. The company is expanding its product range and entering new markets. For example, Aston Martin is planning to launch a new SUV in the coming years.

Valuation: Aston Martin shares are currently trading at a relatively low valuation. The company's price-to-earnings ratio is around 6, which is below the average for the luxury car sector.

However, there are some risks to consider before investing in Aston Martin shares. These include:

Financial performance: Aston Martin has a history of financial losses. The company has been struggling to generate positive cash flow and earnings.

Debt: Aston Martin has a significant amount of debt. This could make the company vulnerable to a downturn in the luxury car market.

Competition: Aston Martin faces competition from other well-known luxury car brands, such as Ferrari and Porsche.

Overall, I believe that Aston Martin shares are a good investment for investors who are willing to take on risk. The company has a strong brand, growth opportunities, and a relatively low valuation. However, investors should be aware of the financial risks associated with investing in Aston Martin shares.

Risk Disclaimer!

Stock Rating I would rate Aston Martin shares as a Speculative Buy for the mid- to long-term. The company has strong brand and growth opportunities for the near and long term future.

Trading with options as an alternative support to investment in Aston Martin sharesTrading with options can be a good alternative support to investment in Aston Martin shares. Options give investors the right, but not the obligation, to buy or sell shares at a certain price on or before a certain date. This can be used to hedge against risk or to speculate on the future price of Aston Martin shares.For example, an investor who believes that Aston Martin shares are undervalued could buy call options. This would give the investor the right to buy shares at a certain price, even if the share price rises above that level.

This can be a good way to limit losses if the share price falls.Conversely, an investor who believes that Aston Martin shares are overvalued could buy put options. This would give the investor the right to sell shares at a certain price, even if the share price falls below that level. This can be a good way to profit if the share price falls.It is important to note that options are a risky investment and should only be used by experienced investors. Options can expire worthless, and investors can lose more money than they invest.If you are considering trading with options, it is important to do your research and understand the risks involved. You should also consult with a financial advisor to get personalized advice.

My opinion on trading with options as an alternative support to investment in Aston Martin sharesI believe that trading with options can be a good way to support an investment in Aston Martin shares. Options can be used to hedge against risk or to speculate on the future price of the shares.For example, an investor who is bullish on Aston Martin in the long term could buy shares and also buy call options. This would give the investor the opportunity to profit if the share price rises, but it would also limit their losses if the share price falls.Conversely, an investor who is bearish on Aston Martin in the short term could buy put options. This would give the investor the opportunity to profit if the share price falls, but they would lose their investment if the share price rises.It is important to note that options trading is complex and risky. Investors should carefully consider their investment goals and risk tolerance before trading with options.

Risk Warning

Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses.

Risk Disclaimer!

General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss

Rating: Speculative Buy

Risk Disclaimer!

The article and the data is for general information use only, not advice!

Aston Martin Formula 1Aston Martin Aramco Cognizant Formula 1 team is driving the stock, at its peak, it is up 61% from the AMR 23 Reveal, with the biggest price rise coming the morning after a magic podium for Fernando Alonso, and a stunning upset for Ferrari and Mercedes. The question is, will this happen again? in Jeddah, Melbourne, or later in the season?

Aston Martin- the bigger picture, start of a bull runHi all,

Here we have Aston Martin on a 4HR chart and in the bigger picture it looks like a falling wedge with a major line acting as support, and also a double bottom (with a green candle on the 2nd bottom - although we can wait for a break of the neckline to confirm, depending how aggressive you want to trade)

This support line has acted as good support 1 2 3 4 times, with two good bull moves higher in the process, in the bigger picture we can see the downward wedge could be seen as a pull back..possibly meaning a bull move to new highs,

Set and take profits to suite yourself

Plan B - If price breaks and shorts I have marked a possible area (red dashed line) to where price may fall to.

* This is not financial advice this is my person opinion and for educational purposes only, all feedback back is welcomed *

Good luck and trade safe

L

Aston Martin in uptrend (buy)I recently added Aston Martin Lagonda LSE:AML to my portfolio, after AML looked at bottoming out around 1900.

The start of the new F1 season where Aston Martin starts as a branded team under Stroll's wings offers great amount of brand exposure.

Aston Martin also shares the safety car and medical car for half of the season with Mercedes, which adds marketing value.

This should translate in increased sales for the years to come, and AML should be able to turn into a profitable company in 3-5 years from now.

I anticipate the share price can rise further on the short term to around 2450-2500 where we'll see some resistance from earlier lows.

Aston Martin Retrace Made, Time To LongThis has been playing out perfectly to my expectation in my previous ideas. Now it has retraced to find support this should rise to break the previous high. May drop a touch more but an entry here will be good. Mood on this is still very bullish as can be seen on MACD across timeframes. Target is 2849, then a retrace should be expected from there.

Aston Martin Pushing HigherThis has broken resistance and is now pushing higher. I have done very well out of this stock for the past few months and it has enormous potential to grow. If you need an entry to this wait for it to retrace back to the previous resistance level marked with the blue rectangle, this should act as the new support. For a short/medium term trade the target can be 2849 where there may be some resistance. In the long term target can be around 9000.

Head & Shoulders on the horizonThe AML stock had a very optimistic rally before Christmas.

Although, vaccination's progressing at a decent pace, keeping the stock (and market) hot, the reality will creep in as indicated by a chart pattern.

I always look behind the scene to get a better idea of risk / reward and atm I don't see any solid "buys" here. Most likely we'll find support at 50p (£10) in the near future.

Split & consolidation in one year, what's it all about?

OK, the former action which took place in March was, perhaps, a necessity but I'm not convinced about the latter. Will it reduce the liquidity of the stock? ( Please share your thoughts in the comments ) What about the psychological barrier? Do you have a feeling that the stock is "too expensive"?

Aston Martin Long term HoldI think there will be huge growth in AML in the long run. The price recently broke resistance and has now retested it as support so I believe this is the time to go long. Next target is 2525 which is 38.2 Fibonacci on the fall at the start of Covid. Unfortunately the chart on here does not show this since the stock split last month.

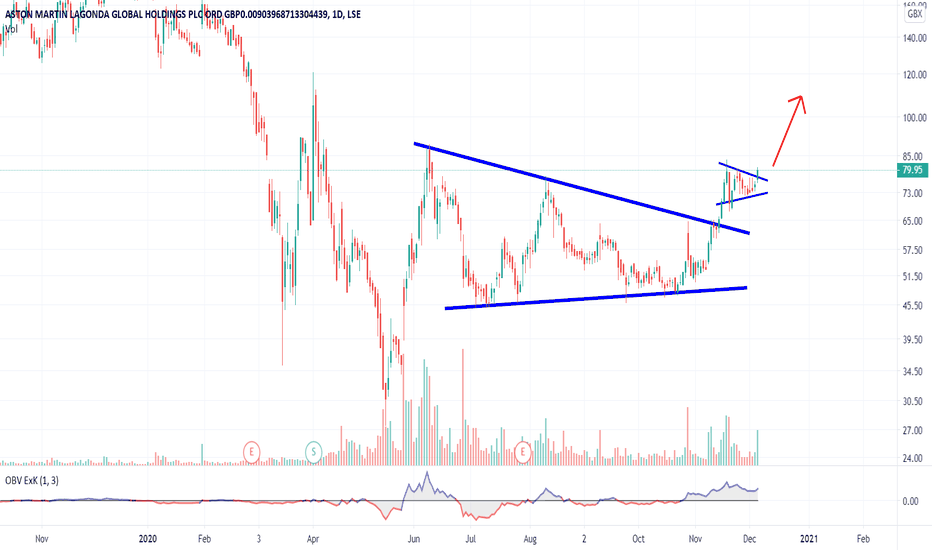

Long if breaks the point Hello friends,

After our first analysis on the stock, which gave us a good result, now we see a possible flag pattern.If it breaks the above level, maybe we will have a movement to 100.You can see in the chart.

Thanks

P.S.

This is not an investment advice, is only for educational material.