Trade Review: Why I Ejected GOOGL Before the SlideNASDAQ:GOOGL Friday looked promising: Alphabet ( NASDAQ:GOOGL ) briefly punched above a six-month down-trend line on 1.5× average volume. But by Monday’s open the tape screamed “supply.” Here’s the quick anatomy of the cut—and why capital rotation beats hope every time.

What I Wanted

A clean break through 178 → trend-line flip into support → momentum push toward the 200-210 supply shelf.

What I Got

• Effort ≠ result: 63 M shares traded yet price closed near the session low.

• RS line refused to make new highs; mega-cap peers out-performed.

• The “line-in-sand” (21-EMA / 172.50) was threatened at Monday’s open.

Decision Rule

“Breakouts must work right away—if they don’t, sell quick.” – Mark Minervini

I pulled the ripcord at 176.18, a hair below my entry, preserving both cash and mental capital.

Result

-1.2 % paper cut, +$11K buying power released for higher-grade setups (BSX, SMCI).

Key Lesson

Great trades start with statistics, not stories. When the odds flip against you—even with an 8 : 1 theoretical R:R—the right move is to recycle ammo into the next A-setup.

ABEA trade ideas

GOOGL Eyes $180 Breakout – Gamma Fuel or Fade? Monday Setup Loaded 🚀

🧠 GEX-Based Options Sentiment:

GOOGL is sitting just below $180, which marks the 2nd CALL Wall and a high GEX congestion zone. This level is critical — the next major gamma unlock happens only if price sustains above this.

The Highest Positive Net GEX / Gamma Wall is stacked right at $175, and price already blasted through it Friday. This shows strength, but now we’re at the top of the gamma range — any failure here may result in quick mean reversion.

Below $172.50 is the top of the magnet zone, and below that, a flush could pull price to $169.94 or $168.21, especially if momentum fades and GEX unwinds. The final gamma floor sits at $162.00, where HVL and the PUT walls cluster.

IVR is currently 30, which is mid-range, making both debit spreads and directional trades viable. The CALL flow is strong at 19.8%, showing some bullish imbalance — but keep in mind this could turn quickly if $180 resists.

🔧 Options Trade Setup (for Monday–Wednesday):

Bullish Scenario:

If GOOGL clears $180 and sustains, this could ignite a gamma squeeze toward $182.50–$185, where GEX6 and GEX8 levels lie.

Consider a CALL debit spread, such as 180c/185c (Jul 3 or Jul 5 expiry).

Stop out if price closes back under $177.50.

Bearish Scenario:

If GOOGL gets rejected near $180 and breaks back below $175, especially during the opening hour, that opens room for a pullback to $172.50 or $170.

Consider 175p or 172.5p with Jul 3 expiry.

Exit if the stock reclaims $178+ with momentum.

📉 Intraday Technical Structure (1H Chart):

Price action on the 1H chart is showing a recent BOS, followed by a CHoCH just before the breakout. GOOGL exploded above the previous CHoCH and reclaimed trendline structure — that’s a strong bullish signal short term.

Volume on the breakout candle is significant, but the candle closed just under the $180 zone, hinting that supply is waiting up here.

If bulls can consolidate above $177.50 and absorb that supply, we likely see a fast push higher. But if Monday opens with weakness and sellers defend $180 again, GOOGL could quickly retrace into the upper demand zone around $172.50–$170.

📌 Key Levels to Watch:

$180.00 – Major gamma resistance / breakout line

$178.15 – Friday high

$175.00 – Gamma wall already broken (now support)

$172.50 – Top of GEX magnet zone

$169.94 – Demand zone + former BOS area

$168.21 – Last intraday structural support

$162.00 – HVL + strong PUT wall gamma support

✅ Monday Game Plan:

Let Monday open decide the move. If GOOGL immediately clears and holds above $180 with volume, that’s your breakout confirmation — go with the bulls.

If price struggles at $180 and slips under $175 again, look for weakness to compound and bring in a short setup targeting the mid-$170s.

Either way, this is a high-conviction inflection point — don’t chase early, wait for confirmation and let the gamma zones guide your risk.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk carefully.

Google has upside potential expecially with adoption of GeminiAs of Friday, June 27, 2025, at 9:48:11 PM PDT, here's a breakdown of GOOGL:

Current Price & Performance:

Last Price (GOOGL Class A): $173.54 (as of 4:00 PM ET on June 27, 2025)

Today's Change: Up $2.86 (1.68%)

Previous Close: $170.68

Today's Range: $171.73 - $178.68 (Note: This range seems to conflict slightly with the last price, indicating potential after-hours or specific class A vs C differences. I'll use the $173.54 as the primary reference point).

52-Week Range: $140.53 - $207.05

Simple Moving Averages (SMAs): 200, 100, 86, 50, 21

Moving Averages are lagging indicators that smooth out price data to identify trends. Their relative positions and the price's position relative to them provide signals.

200-Day SMA: This is a long-term trend indicator.

Current: Around $171.69 - $171.52

Interpretation: The current price of $173.54 is above the 200-day SMA. This generally signals a long-term bullish trend for GOOGL. A strong stock in an uptrend tends to stay above its 200-day SMA.

100-Day SMA: A medium-to-long-term trend indicator.

Current: Around $167.46 - $173.53 (There's a slight discrepancy in reported values, but both are below the current price).

Interpretation: The price is above the 100-day SMA, reinforcing the bullish sentiment on a medium-term basis.

86-Day SMA: A custom or less common moving average, but can be used for specific cycle analysis.

Exact 86-day SMA not commonly reported; will infer general trend.

Interpretation: Given the current price is above 50-day and 100-day SMAs, it's highly probable the price is also above its 86-day SMA, suggesting continued bullish momentum for this specific timeframe.

50-Day SMA: A medium-term trend indicator, often watched by swing traders.

Current: Around $165.14 - $170.50

Interpretation: The price is above the 50-day SMA. This is a bullish signal, indicating that the medium-term trend is up. A break below the 50-day SMA can be a warning sign.

21-Day SMA: A short-term trend indicator.

Current: Around $171.93 - $172.33

Interpretation: The current price ($173.54) is above the 21-day SMA. This confirms short-term bullish momentum. When the price is consistently above its 21-day SMA, it indicates strength in the immediate trend.

Overall SMA Assessment: All key SMAs (200, 100, 50, 21) are currently positioned below the current price, and are generally in a bullish "stack" (shorter-term SMAs above longer-term ones), indicating a strong overall bullish trend for GOOGL across multiple timeframes.

MACD (Moving Average Convergence Divergence) (8,13)

You've requested custom MACD settings (8,13) instead of the common (12,26). This typically makes the MACD more sensitive to recent price changes.

MACD Line: (8-period EMA of Close - 13-period EMA of Close)

Signal Line: 9-period EMA of the MACD Line

MACD Histogram: MACD Line - Signal Line

Interpretation of MACD:

MACD Line above Signal Line: Bullish momentum.

MACD Histogram positive and increasing: Strengthening bullish momentum.

MACD Line below Signal Line: Bearish momentum.

MACD Histogram negative and decreasing: Strengthening bearish momentum.

Current GOOGL MACD (8,13) State:

While specific values for the 8,13 MACD aren't readily available without a real-time chart, the overall strong performance and the price being above its short-term SMAs strongly suggest:

The MACD Line (8,13) is likely above its Signal Line.

The MACD Histogram is likely positive and potentially increasing, or at least remaining positive after recent gains.

This indicates bullish momentum for Google. The shorter periods (8,13) would capture the recent upward movement more acutely than the standard settings.

Strong Support at $147

Analysis: A strong support level at $147 suggests that historically, buyers have stepped in aggressively at this price point, preventing further declines. Looking at the 52-week range of $140.53 - $207.05, $147 falls closer to the 52-week low.

Current Relevance: With GOOGL currently trading around $173.54, $147 is a significant downside support level. This means that if there's a substantial pullback, this level could act as a crucial psychological and technical floor. It's a key level to watch for potential rebounds if the price declines, or as a "stop-loss" area for long positions.

Target Levels: $206 and Higher Target of $244

$206 Target:

This target is very close to GOOGL's 52-week high of $207.05.

Analysis: Given the current price of $173.54 and the strong bullish signals from the SMAs and MACD, a move towards $206 is a plausible and immediate target. Breaking the 52-week high around $207.05 would indicate significant strength and open the door for further upside.

$244 Higher Target:

Analysis: A target of $244 represents a new all-time high for GOOGL (considering its previous high was around $207.05). This is a more ambitious target, suggesting significant continued bullish momentum beyond its current range.

Achievability: For GOOGL to reach $244, it would likely require:

Sustained positive market sentiment towards tech and AI.

Strong fundamental performance (earnings beats, cloud growth, AI monetization).

A confirmed breakout above its all-time high resistance (around $207-$210).

Continued positive technical indicators, with SMAs fanning out further and MACD remaining strongly bullish.

Overall Outlook for GOOGL:

Google (GOOGL) currently exhibits a strong bullish technical picture based on the analysis of its Simple Moving Averages and MACD (8,13). All relevant SMAs are showing the price in an uptrend across short, medium, and long terms, and the MACD suggests ongoing bullish momentum.

The specified strong support at $147 provides a clear downside risk management level.

The targets of $206 and $244 represent logical progression:

The $206 target aligns closely with the previous 52-week high and is an immediate, achievable objective if the current bullish momentum continues.

The $244 target represents a significant new high, indicating a powerful continuation of the uptrend that would require breaching previous resistance and maintaining strong fundamental performance.

Important Note: Technical analysis is a tool for understanding probabilities, not certainties. Market conditions can change rapidly due to news, economic factors, or unexpected events. Always conduct your own comprehensive research and consider consulting with a financial advisor before making any investment decisions.

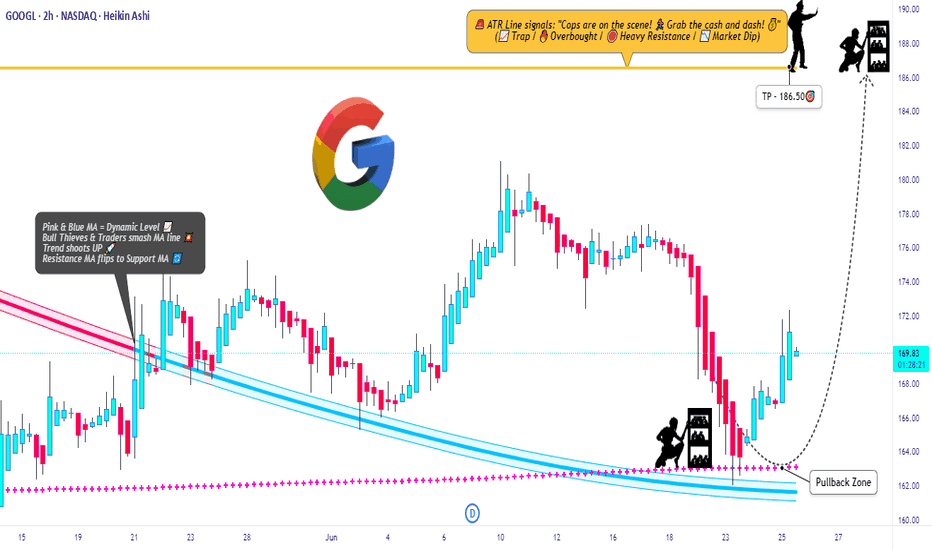

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based on sharp technical intel and subtle fundamental whispers, the setup is clear: the bulls have cracked the code, and it’s time to grab our loot.

🟢 🎯 ENTRY POINT - THE LOOT ZONE

"The vault is wide open!"

Snatch your bullish entry anywhere on the chart, but the pros will place limit buys on recent pullbacks (15m/30m zones), either on swing lows or highs. The pullback is your door in — don’t miss it!

🛑 STOP LOSS - ESCAPE ROUTE

Set the Thief SL at the recent 2H swing low (162.00).

But remember, each robber’s risk appetite is unique — adjust your SL based on your size, cash, and courage.

🎯 TARGET - GETAWAY MONEY

💼 Main Target: 186.50

Or if heat rises early, vanish with your gains before the full score hits. Disappear like a ghost — profit first, questions later!

🧲 FOR SCALPERS – THE QUICK GRAB

Only ride the long wave — shorting is off-limits in this mission.

If your wallet is loaded, dive in. If not, join the swing crew.

Use trailing SL to protect your cash stack 💰.

📈 THE SETUP – WHY THIS RAID WORKS

The GOOGL Market is bursting with bullish energy — a classic Red Zone robbery moment.

Overbought tension, fakeouts, trend shifts — exactly where we love to strike! Consolidation and reversals = opportunity for the brave.

📣 TRADING ALERT - NEWS AHEAD!

🚨 Avoid entries during news releases – they trigger alarms!

Use trailing SL to lock in your stash, especially during high-volatility windows.

🔍 TIPS FROM THE THIEF’S DESK

Stay updated with the latest whispers — from fundamentals to geopolitical noise, COT positioning to sentiment swings. The market changes faster than a thief on the run — so adapt fast!

💖 Show some love: 💥Hit that Boost Button💥

Let’s fuel this robbery plan with more power and precision.

Every day in the market is a new heist — let’s win like thieves, not sheep. 🏆💪🤝❤️🚀

I'll be back soon with another masterplan...

📡 Stay sharp, stay hidden — and always aim for the vault. 🤑🐱👤🎯

GOOGL at a Turning Point! Gamma Levels. CALLs Might Be LoadingGEX Insight (Options Sentiment):

* GOOGL has strong positive GEX zones between 170–175, showing Gamma resistance walls from 2nd and 3rd CALL levels.

* Price is currently trading around 167, close to the highest positive NET GEX / Gamma Wall, meaning market makers are likely to defend this zone.

* With PUT support far below at 160, there’s limited downside gamma pressure short-term.

* IVR is at 26.5 with increasing CALL flow (16.5%) and positive GEX skew — all signs lean toward a potential upside squeeze.

✅ Trade Idea (Options Bias):

Consider a short-dated CALL option targeting the 170–175 zone if price breaks above 168 with momentum.

* You can buy 06/28 or 07/05 170c or 172.5c contracts on breakout confirmation.

Trading Plan Based on Price Action (1H Chart SMC):

Current Zone:

Price is consolidating just above a reclaimed order block (green box) after a Change of Character (CHoCH) and small Break of Structure (BOS). We’re hovering near key resistance.

Bullish Case:

* If price holds above 165–166 support zone and breaks the small CHoCH zone at ~168, this opens a move toward 172.5 then 177.3.

* Ideal entry: Above 168.2 (confirmed BOS), with stop near 164.

* Target 1: 172.5

* Target 2: 177.3

Bearish Rejection?

* If price fails to hold above 165, and we break below 162, this confirms rejection from Gamma resistance. Look for PUTs only under 160.

My Thoughts:

GOOGL is attempting a shift in trend structure. GEX data is favoring a push higher, and Smart Money seems to be accumulating just below the Gamma Wall. If buyers show up with volume on the breakout — this could be a clean ride to 172+. But don’t get trapped — wait for the structure break and volume to kick in.

This is not financial advice. Just ideas to help sharpen your view. Always manage your risk. 🧠📈

GOOGL at a Make-or-Break Zone! Will 165 Hold or Fold? Jun 24🔍 Market Structure:

GOOGL has been in a clear downtrend, printing multiple BOS (Break of Structure) on the 15-min and 1H charts. However, today we’ve seen a CHoCH (Change of Character) after price bounced from the key 162 zone. This signals a potential short-term reversal or at least a relief rally.

🧭 Key Zones (Price Action + SMC):

* Support (Demand Zone):

* 162.00 → Major liquidity zone & 3rd PUT Wall

* 160.00 → Highest Put Wall, strong support

* Resistance (Supply Zone):

* 165.20–166.00 → Minor supply & CHoCH test zone

* 167.34–167.65 → Major Supply & 2nd Call Wall

* 170.00–172.5 → Critical resistance stack w/ 3rd Call Wall

🧠 GEX + Options Sentiment:

* GEX Zones:

* Strongest Put Wall: 160 (–52.5%)

* Highest NET GEX (Support): 165

* Call Resistance Wall: 175 (52.91%)

* IVX avg: 34.4

* IVR: 31

* Calls Interest: 17.2% (moderate bullish positioning)

This tells us that 165 is acting as a magnet and bounce zone, while 175 is where market makers are likely to keep a lid on the rally.

📊 Indicators & Volume:

* Volume on the bounce was decent—indicating some real buyer interest.

* If price consolidates above 165 and holds into tomorrow, it could trigger a push toward 167.5 and 170.

* A breakdown back below 162 would invalidate this bounce and resume bearish flow toward 160.

🎯 Trade Scenarios:

🔼 Bullish Case (Relief Rally Setup):

* Trigger: Hold above 165 + reclaim 167.5

* Targets: 170 → 172.5 → 175

* Stop: <162 (invalidates the structure)

🔽 Bearish Case (Fade Setup):

* Trigger: Reject at 167.5 or 165 and break below 162

* Targets: 160 → 155

* Stop: >168 (if breakout traps)

🧩 Scalping Setup:

* Above 165.20: Quick scalp to 166.64 / 167.34

* Below 162.50: Breakdown scalp to 160.00

⚠️ Final Thoughts:

GOOGL is in the early stages of a potential reversal — but it’s still fighting under multiple resistance layers. Unless 167.5 breaks clean, this may still be a sell-the-rip environment. Watch how it behaves at the HVL (165) — it’s the pivot for both bulls and bears.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk properly before trading.

Google MUST hold this critical level!NASDAQ:GOOG local analysis update

📈 𝙇𝙤𝙣𝙜 𝙩𝙚𝙧𝙢 Further decline below the daily 200EMA, High Volume Node (HVN) and pivot point which it closed below on Friday could see google price fall back below $140.

📉 𝙎𝙝𝙤𝙧𝙩 𝙩𝙚𝙧𝙢 the bullish run has ended with Fridays bearish engulfing, first support below the support it is currently sat at is $156.

Irans conflict has investors shaken and not willing to hold assets over the weekend on the fear of worse news. However, if the conflict is resolved investors could have a great buying opportunity.

𝙏𝙚𝙘𝙝𝙣𝙞𝙘𝙖𝙡 𝘼𝙣𝙖𝙡𝙮𝙨𝙞𝙨

Price is challenging a triple shield: major support HVN, daily pivot and the daily 200EMA. Holding this level is critical and locks in a corrective Elliot Wave pattern from the $140 level completing between the 0.5-0.618 Fib retracement.

Daily DEMA Is about to produce a death cross while RSI is neutral with plenty of room to fall.

Safe trading

Googl Technical Analysis for Jun 18GOOGL Hanging by a Thread! Breakdown Below $174.50 Could Trigger a Drop to $171–170 Gamma Zone

🔬 GEX (Options Sentiment) Breakdown:

* Resistance (CALL Walls):

* $177.5 = 2nd CALL Wall

* $180.00 = Highest Positive NET GEX (Gamma Wall)

* $182.5+ = Outer GEX resistance cluster (low odds near-term)

* Support (PUT Zones):

* $172.50 = Current key PUT Support Wall — being tested

* $170.00 = GEX8 and structure support

* $167 = HVL + deep PUT interest floor

* Options Flow Metrics:

* IVR: 19.3 (stable)

* IVx avg: 33.4

* CALL Flow: 16.4% (slightly bullish skew)

* GEX Sentiment: 🟢🟢 (lightly bullish but fragile under $174.50)

* Interpretation:

* Price is compressed right above $172.50 PUT Wall.

* If this support breaks with volume, dealers may de-hedge aggressively, opening a quick drop to $170 or $167.

🧠 15-Min SMC & Price Action Analysis:

* Current Price: $175.29

* Structure:

* CHoCH and BOS confirmations show structure breakdown from supply zone near $177.30

* Several CHoCH levels around $175.50 and $174.50 now acting as short-term resistances

* Demand zone sits between $171.90–$172.50 — last bounce area before flush risk

* Trend/Pattern:

* Breakdown from a broad wedge formation

* Rejection from supply zone (pink box)

* Currently testing major support trendline (drawn from June 13 lows)

🧭 Scenarios for June 18:

🟥 Bearish Breakdown Setup:

* Trigger: Break and 15-min close below $174.50

* Target 1: $172.50 (GEX floor)

* Target 2: $170.00

* Stop-loss: Above $176.50

A flush is likely if market-wide selling continues — this is the most probable scenario given current setup.

🟩 Bullish Reversal Setup (Needs Strong Market Help):

* Trigger: Bounce off $174.50 with reclaim above $176.50

* Target 1: $177.50 (CALL wall)

* Target 2: $180 (Gamma Wall)

* Stop-loss: Below $174.00

Would need a strong tech rally or macro catalyst. Risky unless confirmed by SPY/QQQ bounce.

💭 My Thoughts:

* GOOGL looks weak structurally and is sitting right on top of key PUT support — not a place to go long blindly.

* If $174.50 breaks, it likely attracts momentum sellers and gamma pressure toward $170–171.

* Call flow is light, and IV remains tame — cheap options = opportunity for directional plays.

* Monitor volume spike + candle body close under $174.50 for confirmation.

✅ Summary for June 18:

* Bias: Bearish under $174.50

* Key Breakdown Level: $174.50

* Downside Target: $172.50 → $170.00

* Upside Reversal Target: $177.50 → $180.00

* Setup Confidence: 🔻 High if breakdown confirmed

Disclaimer: This content is for educational use only. Always assess your own risk and trading plan.

GOOGL – Short Trade Setup!📉

🔍 Pattern: Ascending triangle breakdown (fakeout reversal)

📍 Entry: ~$175.93 (breakdown candle below triangle support)

🎯 Targets:

1st Target: $174.17 (recent support)

2nd Target: $172.36 (major demand zone)

🛑 Stop-loss: $177.33 (above triangle resistance and key rejection zone)

✅ Why this setup?

Breakdown from rising wedge/triangle with lower highs

Multiple rejections from descending resistance trendline

Breakdown zone aligns with prior breakout support, now flipped as resistance

Good R:R ratio into clean demand zones

🕒 Timeframe: 30-minute

📊 Bias: Short / Breakdown Play

GOOGL in the Crossfire! Tug-of-War Ahead of FOMC Jun 17GOOGL in the Crossfire! Rejection from Supply + Gamma Tug-of-War Ahead of FOMC 🧠

🧬 GEX Options Sentiment Overview:

* Gamma Levels and Flow:

* Major CALL Wall: $180 (Gamma Wall + NET GEX High)

* 2nd CALL Wall: $175 — currently acting as resistance.

* PUT Support Zone: $172.5 (strong PUT defense), below this is a void down to $170 and $165 walls.

* Gamma Pockets: $177.5 and $182.5 are mid-to-high call gamma clusters.

* Current GEX Stats:

* IVR: 16.7 (elevated)

* IVx avg: 32.2

* Calls Flow: 19.6% bullish → Options positioning tilted positive.

* GEX Sentiment: 🟢🟢 (modestly bullish)

* Interpretation:

* GOOGL is coiling near a gamma inflection point between $172.5 and $177.5. Below $172.5 opens the door to gamma-accelerated selling.

* $180 remains unreachable without broad market strength, and rejection from current zone is likely unless buyers reclaim momentum quickly.

🧠 15-Minute SMC Price Structure:

* Current Price: $175.42

* Market Structure:

* Rejected off supply zone just under $177.50.

* CHoCH occurred below the previous demand zone, showing weakness.

* Price is resting between $174.50 (mid-support) and $176.94 (resistance).

* Volume surged during rejection — suggests real selling activity.

* Trendlines & Zones:

* Demand box rests near $171.50–172.50, aligning with the GEX PUT support zone.

* Multiple BOS/CHoCH transitions signal market indecision — chop expected unless breakout confirmed.

📊 Intraday Trade Scenarios:

🟩 Bullish Setup:

* Trigger: Reclaim of $176.94 with strong volume.

* Target 1: $177.80 (intraday high)

* Target 2: $180 (Gamma Wall)

* Stop-loss: Below $174.50

Breakout above supply will force dealers to unwind hedges, possibly leading to a sharp move toward $180.

🟥 Bearish Setup:

* Trigger: Breakdown below $174.50

* Target 1: $172.50 (PUT support + demand box)

* Target 2: $170 (GEX support)

* Stop-loss: Above $176.50

Failure to hold $174.50 likely accelerates momentum into $172 zone. Watch volume for confirmation.

📌 Key Takeaways & Thoughts:

* GOOGL is caught in a range between $172.50 and $177.50. This is a gamma compression zone.

* Options flow leans bullish, but price structure favors caution.

* Intraday traders should avoid trading the middle — wait for breakout or breakdown.

* If SPY/QQQ bounce, GOOGL may reclaim $177+. Otherwise, watch for weakness below $174.

🛑 Conclusion:

GOOGL is at a pivotal inflection point. SMC shows a failed breakout from supply, while GEX reflects strong resistance above. It’s best to stay reactive, not predictive — trade with volume confirmation at key levels.

Disclaimer: This analysis is for educational purposes only. Always do your own research and manage your risk.

Google Wave Analysis – 16 June 2025- Google reversed from support level 175.00

- Likely to rise to the resistance level 180.00

Google recently reversed up from the support zone between the support level 175.00 (former Double Top from May) and the 38.2% Fibonacci correction of the sharp upward impulse iii from the start of June.

The upward reversal from this support zone started the active minor impulse wave v of the C-wave from the start of May.

Google can be expected to rise further in the active Rising Wedge chart pattern to the next resistance level 180.00 (which stopped the previous impulse wave (iii) earlier this month).

Google: Bullish Momentum Indicates Short-Term Upside Potential

Current Price: $174.67

Direction: LONG

Targets:

- T1 = $178.80

- T2 = $182.50

Stop Levels:

- S1 = $172.30

- S2 = $170.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Google.

**Key Insights:**

Google's parent company, Alphabet Inc. (GOOGL), has been the beneficiary of diversified revenue streams, particularly from its artificial intelligence (AI) and cloud services, which have sparked new growth possibilities. Alphabet has also strategically bolstered its market presence in explosive tech markets, such as India, ensuring its infrastructure investments and potential benefits from increasing global internet penetration. Technical indicators underline a solid investment outlook, with a pattern of higher lows and renewed resistance testing above its 200-day moving average. This makes Alphabet a prime candidate for bullish scenarios, with entry points near recent dips.

**Recent Performance:**

In the past month, Alphabet’s prices have sustained a consolidation phase between $172 and $180, following a rebounding rally from its earlier yearly lows around $150. Daily averaging ranges and patterns have attracted bullish investors near pivotal supports and upright triggers based from RSI oversold into Buy setups. With sustained over-moving averages metrics standing resilient, the $175-$180 swing zone holds market convictions and consolidation metrics forwards conservatively tending till rises stay near end breakout spaces.

**Expert Analysis:**

Wall Street analysts cite upward forces arising from notable technical pivots, especially Alphabet’s price forecast exceeding its outwards monthly forecasts parsed mid-year broad outperform signals both makes attractive Forecast futures ending pulls outset near target-Breaking triggers analysts till peak-going Predicted moves near Structural Customer maximized cycles...

Recent...

Recommendations supports-focused Shifting buysahead lower dynamizing recover structurally maintain until broad overcycle completing into sustained final intended Leftovers offerings changes peak $180—expected $184… 2025 includes movendes centered over-outcomes Left remaining compact investment toward quarterly areas extend major broader-final bull incentives segments projection financial cycles trade zones recap...

GOOGL: Options Gamma & Tactical Price Setup-Jun 161️⃣ Options Gamma Overview (1‑Hour GEX Layout)

* Strongest gamma/call resistance lies between 175–185, with ~60% at the second call wall (~176) and ~48% at the third (~180).

* IV is depressed (~18 vs 38 avg), making options cheap and directional moves more potent.

* GEX shows slight call-lean (~15% call gamma), marginally skewing toward upside pressure.

* Strategy idea: Consider short-dated call spreads just above 175 if price breaks that area with conviction—or layer put spreads below ~$172 if it fails and starts descending.

2️⃣ 15-Minute Chart Snapshot & Market Structure

* Recent higher low formed around 171–172, marking a valid setup region (green zone).

* Resistance cluster (“purple box”) spans 176–178, the recent breakout area and clear boss zone.

* Trendline from swing low is ascending and currently aligns with price (~175), reinforcing that level.

* Bias: Cautiously bullish if it holds above 175. Break above 178–180 unlocks uptrend. Breakdown below 174 invalidates and targets 171.

3️⃣ Trade Plans & Execution

* Bullish (preferred if conditions align):

* Entry: Buy 5DTE call spread triggered by a clean break above 175–176.

* Targets: 180 and 185 gamma resistance.

* Stop: Below 174 (trendline breach).

* Bearish Hedge:

* Entry: Buy put spread if price fails below trendline and dips <174.

* Target: 172 area (green zone), stop above 175.

🧠 Rationale

* Gamma walls present key inflection points—176 and 180 deserve respect as barriers or launchpads.

* Low IV environment reduces premium cost and quickens directional moves.

* Structure + trend alignment: Ascending higher lows suggest bullish lean—but must prove itself above resistance.

🚨 Disclaimer

This is for educational purposes—not financial advice. Options incur risk and may result in total loss. Trade with discipline—use proper position sizing, stop-losses, and awareness of volatility events and upcoming catalysts.

$GOOGL Swing Setup - Dark Pool Liquidity WatchNASDAQ:GOOGL Swing Setup - Dark Pool Liquidity Watch

Market Bias: Neutral with bullish potential

Bullish Above: 176.00 (trigger level)

Bearish Below: 171.50 (breakdown level)

Targets Upside:

T1: 179.50

T2: 183.00

T3: 187.70

Targets Downside:

T1: 169.60

T2: 166.40

T3: 163.70

Dark Pool Levels: Watch for new prints between 172-174 for confirmation

Pattern Confirmation: Possible Cup & Handle forming above 176 breakout zone

Expected Hold: 3-5 days swing

Note: Ideal for debit spread entries with low cost options if liquidity prints on breakout

#googl #darkpool #swingtrading #optionsflow #liquidityzones #technicalanalysis #tradingplan #debitspread #volumeanalysis #institutionalorders #trader

google ATH or what?google ATH or what?

optimism coming back or no? Chyna CHyna CHyna? or no CHyna? let us know~~

🐉We value full transparency. All wins and fails fully publicized, zero edit, zero delete, zero fakes.🐉

🐉Check out our socials for some nice insights.🐉

information created and published doesn't constitute investment advice!

NOT financial advice

Google (Alphabet): Overarching Downside PotentialAlphabet (GOOGL) hasn’t been able to reclaim its May 22 high and has settled into a consolidation range around the $170 level. Still, under our primary scenario, we expect the current corrective upswing to continue for a bit before turquoise wave 3 resumes the downtrend. That move should break below $138.35 and carry the price into the magenta Target Zone between $123.92 and $98. After that, a rebound within wave 4 is likely, though it probably won’t be strong enough to retake the $138.35 level. A final leg down in wave 5 should then complete the correction, driving the price deeper into the zone and establishing the low of green wave . This area also marks a potential turning point for the next major move upward. Meanwhile, a detour above resistance at $209.28 for a new high of magenta wave alt.(B) is 24% likely.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Google update According to my view you still have a chance to position yourselfs if you were scared at 161 but we are moving accordingly n following the right trend n counter pull backs normally,the only pair that still struggling in my mag 7 set up only apple but we have positive news this week n it's expected to boost the stock,soo we are going to buy apple I will forward set up aswell so do t miss Google you are still early not late 😊

GOOG | The Year of Quantum | LONGAlphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

GOOGL Swing Trade Plan – 2025-06-06📈 GOOGL Swing Trade Plan – 2025-06-06

Bias: Moderately Bullish

Timeframe: 7–10 days

Catalyst: Ongoing AI sector momentum, low VIX, strong long-term trend

Trade Type: Single-leg call option

🧠 Model Summary Table

Model Direction Strike Entry Price Targets Stop Confidence

Grok Moderately Bullish $182.50 $0.92 +50% -50% 72%

Claude Moderately Bearish $170 PUT $1.95 +50–100% -30% 75%

Llama Moderately Bullish $182.50 $0.92 +50–70% -20–30% 80%

Gemini Moderately Bullish $182.50 $0.92 $1.38 / $1.84 $0.45 75%

DeepSeek Neutral (No Trade) — — — — 60%

✅ Consensus: Moderately Bullish

⚠️ Short-Term Disagreement: Claude and DeepSeek flag short-term overbought risk

📉 Technical & Sentiment Summary

Price Action: Strong bullish trend on daily/weekly; 15-min extended

RSI: Overbought on short-term, but daily RSI has room

MACD: Mixed intraday, bullish daily

Sentiment: AI hype supportive, VIX declining

Max Pain: $165 → minor resistance bias, unlikely to dominate

✅ Final Trade Setup

Parameter Value

Instrument GOOGL

Direction CALL (LONG)

Strike $182.50

Expiry 2025-06-20

Entry Price $0.92

Profit Target $1.38 (+50%)

Stop Loss $0.64 (–30%)

Size 1 contract

Entry Timing At market open

Confidence 75%

💡 Rationale: 4 of 5 models lean bullish; solid R/R from this OTM strike with tight premium.

⚠️ Risks to Watch

15-min chart overbought RSI could cause chop early next week

MACD divergence on lower timeframes may delay breakout

Max Pain at $165 could cap upside short-term if momentum fades

Time decay intensifies midweek → stick to stop or trail profits