Advanced Auto Parts | AAP | Long at $64Advanced Auto Parts NYSE:AAP has gone through an exquisite shakeout of shareholders. Currently trading near $64, the stock is currently testing my "stock crash" simple moving average (seen green SMA lines). From a technical analysist standpoint, it's in a personal buy zone. This stock has tested t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−5.200 EUR

−324.36 M EUR

8.78 B EUR

58.97 M

About Advance Auto Parts Inc.

Sector

Industry

CEO

Shane M. O'Kelly

Website

Headquarters

Raleigh

Founded

1929

FIGI

BBG000D64BT1

Advance Auto Parts, Inc. engages in the supply and distribution of aftermarket automotive products for both professional installers and do-it-yourself customers. It operates through the following segments: Advance Auto Parts/Carquest U.S., Carquest Canada, Worldpac, and Independents. The company was founded by Arthur Taubman in 1929 and is headquartered in Raleigh, NC.

Related stocks

AAP to $40-43 on positive earnings report in 2 days?1. Fundamentals

The company was beaten down because of losing competition. This is a retail auto parts store chain, and not az OEM supplier.

The company presented a relatively good 2024 Q4 earnings in February, but fell on weak guidance.

Insiders bought shares in 2025 March

They completed a re

Looking for an immediate buy on AAP! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

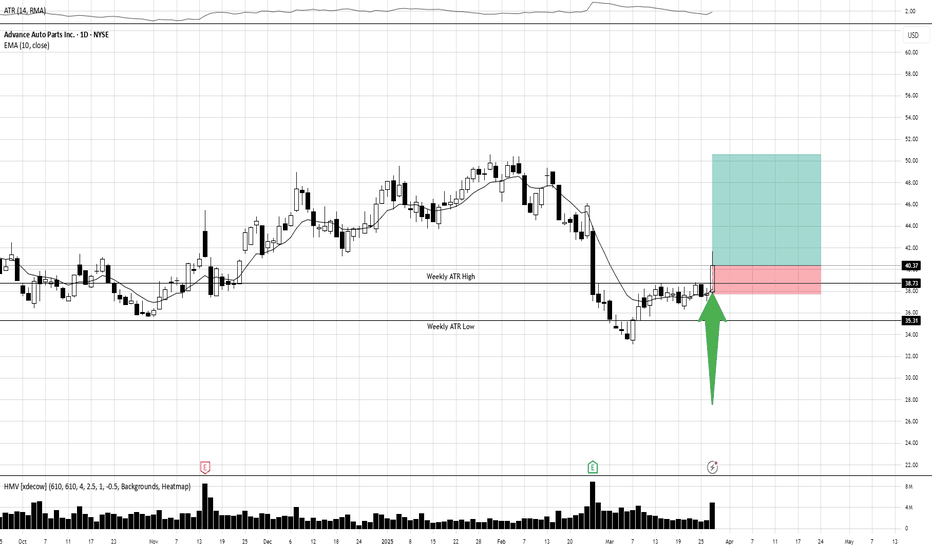

AAP/USD – 30-Min Long Trade Setup !📌 🚀

🔹 Asset: AAP (Advance Auto Parts Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $34.35 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $33.66 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $35.42 (First Resistance Level)

AAP Trading Idea AAP is showing potential for a solid move. You can consider entering at $36 or $35, or even at the current market price if momentum is strong.

🎯 Profit targets:

$42 (first resistance)

$48 (next key level)

$50+ (potential breakout)

🔹 Always manage risk wisely and set stop losses based on your strat

Short Opportunity? Earnings were bad with a initial drop in price, followed by heavy buying with reports that the stock was still a buy. Today's option activity shows a potential rotation into calls from puts inline with that opinion.

I don't think it will move much higher considering the earnings and store closures

AAP to $49MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading system is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM

AAP to $53 by 10/4MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading system is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM

Advance Auto Parts Sells Worldpac for $1.5 BillionAdvance Auto Parts (NYSE: NYSE:AAP ), one of North America's leading automotive aftermarket parts providers, has made a significant strategic decision to sell its wholesale arm, Worldpac, for $1.5 billion. The sale, made to funds managed by the Carlyle Group, is a critical part of Advance Auto Part

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AAP5372191

Advance Auto Parts, Inc. 3.5% 15-MAR-2032Yield to maturity

6.25%

Maturity date

Mar 15, 2032

AAP5009293

Advance Auto Parts, Inc. 3.9% 15-APR-2030Yield to maturity

5.75%

Maturity date

Apr 15, 2030

AAP5552143

Advance Auto Parts, Inc. 5.9% 09-MAR-2026Yield to maturity

5.61%

Maturity date

Mar 9, 2026

AAP5049981

Advance Auto Parts, Inc. 1.75% 01-OCT-2027Yield to maturity

5.39%

Maturity date

Oct 1, 2027

AAP5552144

Advance Auto Parts, Inc. 5.95% 09-MAR-2028Yield to maturity

5.05%

Maturity date

Mar 9, 2028

AAP4976332

Advance Auto Parts, Inc. 3.9% 15-APR-2030Yield to maturity

2.82%

Maturity date

Apr 15, 2030

See all AWN bonds

Frequently Asked Questions

The current price of AWN is 42.655 EUR — it has increased by 1.97% in the past 24 hours. Watch ADVANCE AUTO PA. DL-,0001 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange ADVANCE AUTO PA. DL-,0001 stocks are traded under the ticker AWN.

AWN stock has risen by 1.94% compared to the previous week, the month change is a −2.36% fall, over the last year ADVANCE AUTO PA. DL-,0001 has showed a −30.51% decrease.

We've gathered analysts' opinions on ADVANCE AUTO PA. DL-,0001 future price: according to them, AWN price has a max estimate of 56.31 EUR and a min estimate of 25.99 EUR. Watch AWN chart and read a more detailed ADVANCE AUTO PA. DL-,0001 stock forecast: see what analysts think of ADVANCE AUTO PA. DL-,0001 and suggest that you do with its stocks.

AWN stock is 1.93% volatile and has beta coefficient of 0.60. Track ADVANCE AUTO PA. DL-,0001 stock price on the chart and check out the list of the most volatile stocks — is ADVANCE AUTO PA. DL-,0001 there?

Today ADVANCE AUTO PA. DL-,0001 has the market capitalization of 2.57 B, it has increased by 0.60% over the last week.

Yes, you can track ADVANCE AUTO PA. DL-,0001 financials in yearly and quarterly reports right on TradingView.

ADVANCE AUTO PA. DL-,0001 is going to release the next earnings report on Aug 26, 2025. Keep track of upcoming events with our Earnings Calendar.

AWN earnings for the last quarter are −1.14 EUR per share, whereas the estimation was −1.21 EUR resulting in a 5.85% surprise. The estimated earnings for the next quarter are 0.47 EUR per share. See more details about ADVANCE AUTO PA. DL-,0001 earnings.

ADVANCE AUTO PA. DL-,0001 revenue for the last quarter amounts to 1.93 B EUR, despite the estimated figure of 1.87 B EUR. In the next quarter, revenue is expected to reach 1.71 B EUR.

AWN net income for the last quarter is 21.19 M EUR, while the quarter before that showed −400.67 M EUR of net income which accounts for 105.29% change. Track more ADVANCE AUTO PA. DL-,0001 financial stats to get the full picture.

Yes, AWN dividends are paid quarterly. The last dividend per share was 0.22 EUR. As of today, Dividend Yield (TTM)% is 2.02%. Tracking ADVANCE AUTO PA. DL-,0001 dividends might help you take more informed decisions.

As of Jun 24, 2025, the company has 62.8 K employees. See our rating of the largest employees — is ADVANCE AUTO PA. DL-,0001 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ADVANCE AUTO PA. DL-,0001 EBITDA is −165.99 M EUR, and current EBITDA margin is −1.48%. See more stats in ADVANCE AUTO PA. DL-,0001 financial statements.

Like other stocks, AWN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ADVANCE AUTO PA. DL-,0001 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ADVANCE AUTO PA. DL-,0001 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ADVANCE AUTO PA. DL-,0001 stock shows the sell signal. See more of ADVANCE AUTO PA. DL-,0001 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.