Potential Top in CostcoCostco Wholesale has been quietly limping, and some traders may see downside risk in the big-box retailer.

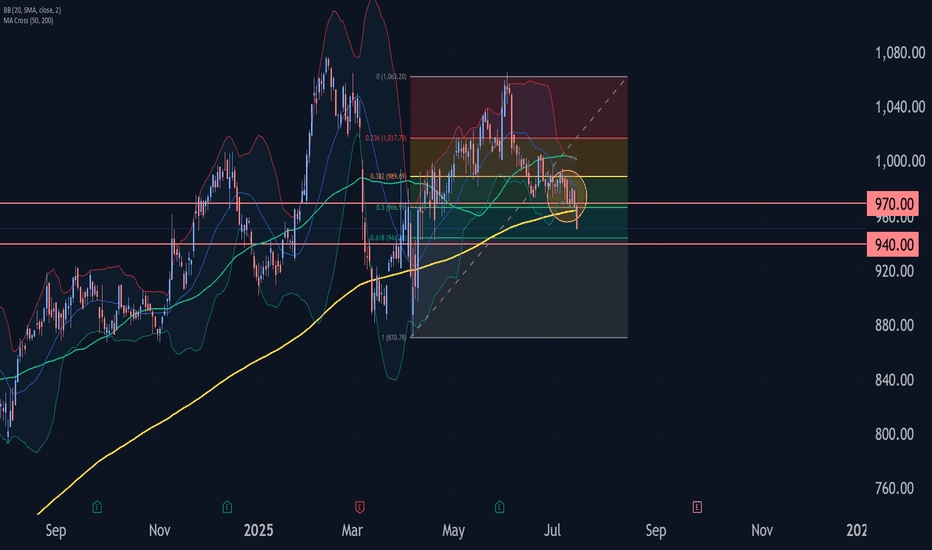

The first pattern on today’s chart is the June low of $973.90. COST made lower highs while trying to hold that level but is now sliding below it. That may be viewed as a potentially bearish tr

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

15.6 EUR

6.67 B EUR

230.35 B EUR

442.62 M

About Costco Wholesale

Sector

Industry

CEO

Roland M. Vachris

Website

Headquarters

Issaquah

Founded

1983

FIGI

BBG000F9XW06

Costco Wholesale Corp. engages in the provision of operation of membership warehouses through wholly owned subsidiaries. It operates through the following geographical segments: United States, Canada, and Other International Operations. The company was founded by James D. Sinegal and Jeffrey H. Brotman in 1983 and is headquartered in Issaquah, WA.

Related stocks

Costco is in the Wyckoff distribution phaseThis Week (July 8 - 11):

Support: The immediate floor is at $965. Below that, the low from the initial sell-off around $955 is critical.

Resistance: The 20-day moving average (that green line) at ~$992 is the first ceiling. If it gets frisky, look for sellers to appear at $1,030.

Next Month (July

Costco: Strong Membership Model Suggests Bullish Upside Current Price: $987.02

Direction: LONG

Targets:

- T1 = $1,016.00

- T2 = $1,032.00

Stop Levels:

- S1 = $957.00

- S2 = $940.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective i

Costco Wave Analysis – 16 July 2025

- Costco broke the support area

- Likely to fall to support level 940.00

Costco recently broke the support area located between the pivotal support level 970.00 and the 50% Fibonacci correction of the upward impulse from April.

The breakout of this support area accelerated the C-wave of the activ

COST Daily Chart Analysis: Key Levels, and Price StructureCostco Wholesale Corporation (COST)

Historical Context and Trend Channel:

From September 2024 through early 2025, COST was observed trading within a well-defined upward channel (indicated by the grey shaded areas). This channel represented a consistent bullish trend during that period. Howeve

COST ABC Structure CompletedThe ABC correction may have completed, with the final C leg forming inside a diagonal structure. A sharp drop started from $1,066. Traders should wait for a potential corrective reaction before entering a short position.

It's important to note that as long as the diagonal channel remains intact, th

Costco Wave Analysis – 5 June 2025

- Costco reversed from the resistance zone

- Likely to fall to support level 985.00

Costco recently reversed down sharply from the resistance zone located between the key resistance 1080.00 (which stopped the previous impulse wave 5) and the upper weekly Bollinger Band.

The downward reversal from

COST Short – Double Top Rejection with Bearish CCI SignalNASDAQ:COST

📅 Entry: June 5, 2025

📉 Price: 1,055

✋ Stop: 1,078

🎯 Target: 1,013

⚖️ Risk-Reward: 1:2

✅ Status: Target hit earlier than expected

🧠 Trade Idea:

COST tested a major resistance zone at 1,078 — aligning with:

A historical horizontal resistance

The top boundary of a rising channel

Meanwhi

Costco (COST) Breakout Alert! Ready to Soar? Costco (COST) Breakout Alert! Ready to Soar?

Hey traders! Check out this bullish setup on Costco Wholesale (COST) . The stock just broke out above key resistance at $987.72 after a solid consolidation phase, with a clear target of $1,052.87 (+4.91% potential gain). The risk-reward ratio here is a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

COST4977644

Costco Wholesale Corporation 1.75% 20-APR-2032Yield to maturity

4.81%

Maturity date

Apr 20, 2032

COST4977643

Costco Wholesale Corporation 1.6% 20-APR-2030Yield to maturity

4.51%

Maturity date

Apr 20, 2030

COST4495548

Costco Wholesale Corporation 3.0% 18-MAY-2027Yield to maturity

4.03%

Maturity date

May 18, 2027

COST4977642

Costco Wholesale Corporation 1.375% 20-JUN-2027Yield to maturity

4.00%

Maturity date

Jun 20, 2027

See all CTO bonds

Curated watchlists where CTO is featured.

Frequently Asked Questions

The current price of CTO is 826.0 EUR — it has decreased by −2.34% in the past 24 hours. Watch COSTCO WHOLESALE DL-,005 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange COSTCO WHOLESALE DL-,005 stocks are traded under the ticker CTO.

CTO stock has fallen by −2.37% compared to the previous week, the month change is a −4.48% fall, over the last year COSTCO WHOLESALE DL-,005 has showed a 6.25% increase.

We've gathered analysts' opinions on COSTCO WHOLESALE DL-,005 future price: according to them, CTO price has a max estimate of 1,045.24 EUR and a min estimate of 759.40 EUR. Watch CTO chart and read a more detailed COSTCO WHOLESALE DL-,005 stock forecast: see what analysts think of COSTCO WHOLESALE DL-,005 and suggest that you do with its stocks.

CTO stock is 1.11% volatile and has beta coefficient of 0.56. Track COSTCO WHOLESALE DL-,005 stock price on the chart and check out the list of the most volatile stocks — is COSTCO WHOLESALE DL-,005 there?

Today COSTCO WHOLESALE DL-,005 has the market capitalization of 362.63 B, it has decreased by −1.36% over the last week.

Yes, you can track COSTCO WHOLESALE DL-,005 financials in yearly and quarterly reports right on TradingView.

COSTCO WHOLESALE DL-,005 is going to release the next earnings report on Sep 25, 2025. Keep track of upcoming events with our Earnings Calendar.

CTO earnings for the last quarter are 3.77 EUR per share, whereas the estimation was 3.73 EUR resulting in a 1.01% surprise. The estimated earnings for the next quarter are 5.00 EUR per share. See more details about COSTCO WHOLESALE DL-,005 earnings.

COSTCO WHOLESALE DL-,005 revenue for the last quarter amounts to 55.71 B EUR, despite the estimated figure of 55.65 B EUR. In the next quarter, revenue is expected to reach 73.82 B EUR.

CTO net income for the last quarter is 1.68 B EUR, while the quarter before that showed 1.72 B EUR of net income which accounts for −2.68% change. Track more COSTCO WHOLESALE DL-,005 financial stats to get the full picture.

Yes, CTO dividends are paid quarterly. The last dividend per share was 1.15 EUR. As of today, Dividend Yield (TTM)% is 0.50%. Tracking COSTCO WHOLESALE DL-,005 dividends might help you take more informed decisions.

COSTCO WHOLESALE DL-,005 dividend yield was 0.49% in 2024, and payout ratio reached 26.32%. The year before the numbers were 0.71% and 27.12% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 333 K employees. See our rating of the largest employees — is COSTCO WHOLESALE DL-,005 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. COSTCO WHOLESALE DL-,005 EBITDA is 10.97 B EUR, and current EBITDA margin is 4.53%. See more stats in COSTCO WHOLESALE DL-,005 financial statements.

Like other stocks, CTO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade COSTCO WHOLESALE DL-,005 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So COSTCO WHOLESALE DL-,005 technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating COSTCO WHOLESALE DL-,005 stock shows the buy signal. See more of COSTCO WHOLESALE DL-,005 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.