ASOS 500% GAINWhat we have seen in the last years was that ASOS always reached heights of around 60. I wouldn't doubt that it will happen again.

So far the peaks were usually at the beginning of the years (January-March). Since it didn't happen this year so far maybe there will be a climb starting up to a new peak in January-March 2024.

Even if it "only" goes to 40 it will still be a huge gain.

DYQ trade ideas

Trading Idea - #ASOSMy trading idea for ASOS - Buy / LONG

TARGET: 24.00 EUR (+125 %)

STOP: 6.50 EUR

ASOS PLC is a global fashion retailer. The company sells its merchandise through ASOS.com. The company's segments include the UK, the US and the EU. ASOS sells approximately 85,000 branded and private label products, including jewellery and beauty collections as well as men's and women's fashion, footwear and accessories.

1) The ASOS share price is at a historically relevant low (EUR 10 to 12).

2.) Several directors invested in shares of Asos on Friday, 17/05/2022.

3.) The final sales targets were not quite achieved. However, this is seen across the industry and can be explained by falling purchasing power due to high inflation.

4) The current share price is far below the average price target of the most influential analysts, even though they have slightly lowered their price targets in recent weeks. This can be an indication of a possible increase in value.

ASOS - Long term long tradePrice hasnt been at these lows since the pre-pandemic crash last March. It is a significant historic low which is also a monthly support level. Its a good price for a stock that will certainly do well in the longer term. For a swing trade, getting in now and targeting range-bound resistance (confluence with 50% fib retracement zone) looks a solid, low-risk play.

Trading Idea - #ASOSBUY. Take the chance!

ENTRY: 3235 Pence

TARGET: 5782 Pence (+78%)

STOP: 2658 Pence

ASOS PLC is a global fashion retailer. The company sells its goods on ASOS.com. The company's segments include UK, US and EU. ASOS sells approximately 85,000 branded and private label products, which include jewelry and beauty collections, as well as men's and women's fashion, footwear and accessories.

1.) The share price of ASOS is at a decisive support level (2800 to 3000 Pence).

2.) The share price weakness despite the ongoing online boom offers some attractive opportunities for investors.

3.) At online fashion retailer Asos, the conditions are good that sales will ultimately meet market expectations. This is decisive for the further development of the share price.

4.) The current price is far below the average price target of the most influential analysts, even though they have lowered their price targets slightly in recent weeks. This may indicate a potential increase in value.

ASC - ASOS LongsThis will be a long term holding for me.

I have entered my first buy at 2339 small position as I am getting in a little early.

I have a larger buy for 2195 and another at 2135 as price approaches the weekly support area highlighted.

Shares have tumbled 60% from their post pandemic high, and 71% from their ATH.

The company has been rocked by the sudden and unexpected departure of their CEO, rising supply chain cost pressures, and consumers returning products at their pre pandemic levels (during the pandemic the company noted there was a sharp decline in returns which gave a £67m cost saving).

This has resulted in a warning that profits could fall by as much as 40%

It feels like the market has over reacted to the news, especially given that sales rose 22% and the brand continues to be a leading player in the online fashion industry despite an intensely competitive landscape. RSI also is into oversold territory on the weekly. Losing the £67m in cost saving due to lower rate of returns should always have been expected given it was a result of pandemic / lockdowns.

Asos PE is 13.8 VS UK Online Retail average of 24.6

The company is DEBT FREE

Just to repeat the first line, this will be a long term holding for me. It doesn't look as if there is a near term catalyst that will rocket shares up in the coming days - but happy to hold these for a while.

More upside after STRONG support and a 420% move for ASOS?In December 2018, the share price of ASOS fell 38% in a single day after the company announced an unexpected profit warning after a poor November of trading - it was amongst a number of British retailers to be hit by weak consumer confidence and increased discounting. Shares tumbled to 2307p , the lowest since January 2015. The price recovered 5 months later in April 2019 only to continue to fall to new lows by a further 75% as a result of CV19, despite previous positive earning.

ASOS has benefitted from a shift in online shopping trends of young people with demand for activewear and loungewear soaring. Its own brand line of comfort casualwear, Collusion, was searched for more than 7.1 million times during lockdown, and they sold over 1.5 million T-shirts and 760,000 pairs of tracksuits.

It is worth noting that ASOS founder and director Nick Robertson has offloaded £13.6 million worth of shares after revealing it had more than quadrupled its pre-tax profits. For the year ended 31 August, profit before tax was up 329%.

Since its low on the 3rd of April, and after again announcing a big earnings beat, its share price has rocketed over 420% where the price found resistance in early October. Price retraced to the 0.618 Fibonacci level and has since found major support at the 4334p zone, creating a parallel trading channel. The 4334p zone has been tested at least 10 times since the 9th November Fibonacci retracement event. Despite price holding above this strong level of support, it is facing selling pressure from a declining trend line from its October highs.

ASC is currently supported by the lower bullish price channel, it is above the 4334p zone and if it can break the trend line, may see some more upside. A retest of the all time highs would see a 20% move.

Summer shopping - ASOS breakoutASOS looking to the upside after a strong breakout of a congestion zone which dates back to October 19 (excluding the CV19 drop in March). Three strong candles have pushed the stock above a previous high / resistance level in April 19 on reasonable volume. Looking for a target of 5500 which acted as a resistance / support zone from Oct 16 through to Nov 18 before a breakdown at that level. Fundamentally things are looking up with a lot more shoppers choosing to shop online, rather than hitting the high street under restrictions. Feedback and thoughts welcome.

ASOS pushing higher - to July earnings report ASOS has clearly done well during the first half of 2020 driven by the increase in consumer online purchases. With these trends set to continue, ASOS is in a prime position to take advantage of online spending coming into the summer months.

With first Q earnings towards the end of July, I expect a steady rise in the price to around 4086 over the next month. Providing we don't get a global second wave of course.

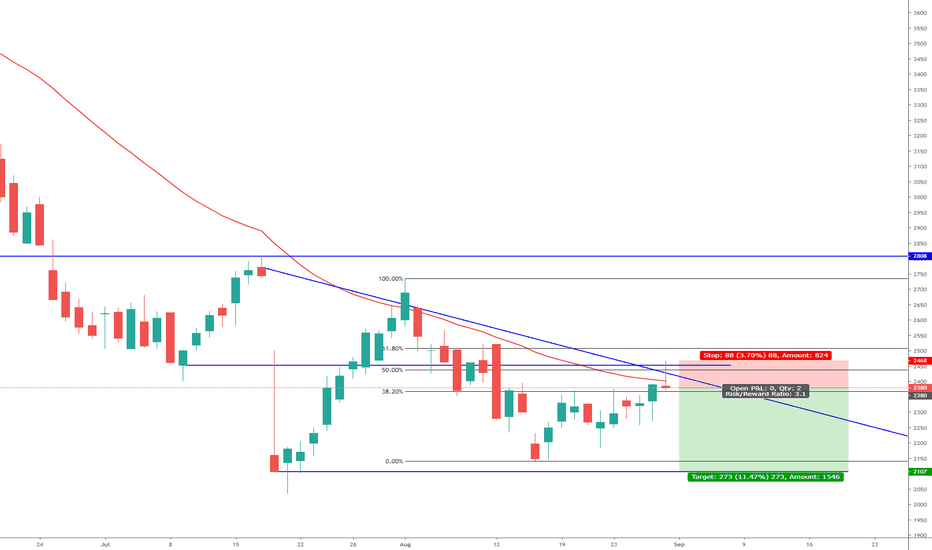

ASC Asos Short Opportunity Price action analysis identified LSE:ASC (ASOS) downtrend continuation and short opportunity. Reversal pin bar candle trigger, confluence with; rejection of falling trend line, rejection of 50% fib retracement, rejection of 50 WMA and rejection of previous support becomes resistance.

ASOS update...we have a breakout.Asos LSE:ASC breaks through previous high after bouncing off the 50 simple moving average.

See previous analysis

This breakout helps us to confirm the buyers are in control for now but will things stay that way.

Underneath price we have the 50 moving average which has proven time again that it is a strong support level

so this can help keep price up.

Contrary to that we have the £80 round number above price which could act as a strong psychological resistance area and hinder price from rising.

Right now we don't know what will happen until we reach that point so it would be worthwhile holding back from

jumping into a trade until the battle is over and there is a clear winner.

If price does breakout through £80 then that area will be a support area and with the 50 moving average also as

support then the probability weighs in the favour of a continued bull trend.

Any comments or questions, do not hesitate to leave them below.

Sublime Trading

Can ASOS break the all-time high?Asos LSE:ASC looked like it was failing to stay above the previous resistance level

but price has started to show resilience again. This is thanks to the daily 50 moving average which it has used twice this year as support.

Price is also above the weekly 50 and 200 moving averages so the overall trend is up.

The high of the 27th February is the point that will confirm a continuation of the bull trend so if price can manage to break

above that high at £76.70 then a trade will look likely.

This stock has trended well in the past and could potentially repeat that pattern so it would be best to keep this stock on your watchlist to be ready for a long trade opportunity.

Any comments or questions, do not hesitate to leave them below.

Sublime Trading

Can ASOS continue to RISE?With ASOS LSE:ASC recently breaking out through the previous all-time high

which was around £72 back in 2014 we may have a trading opportunity soon.

So far price seems to be struggling to gain some steam and currently appears to have found some comfort

around the previous all-time high and is gravitating towards that zone again.

When we see a break of an all-time high we can usually expect to see price retest it which is what we may see happen here

before price starts a trend to the upside.

The alternative is that we may see price drop back below the previous all-time high.

The best thing for now is not to predict the next move but instead to wait and see which direction price decides to move.

If price drops lower then we definitely have to stand aside.

If price breaks above the previous resistance pivot at £76 then we can look at buying this stock.

Preserve your capital and only trade once the direction is actually confirmed.

For now I will just keep this stock on my watchlist and will trade this as soon as the time is ready which could happen real soon.

Going Long on ASOS w/c 18/09 [2017] - TP w/e 25/09 [2018]I think the Bearish candle of w/e 08/09 suggests further slumping of ASOS until w/e 15/09 where the middle-line of the Andrew's Pitchfork trend should be tapped; I suggest climbing aboard w/c 18/09 and pending the outcome of the following reports (see below) Q2 2018 results should have proved a nice investment, jumping out w/e 25/05 or w/c 28/05 is suggested:

09/20/17: Bank of America Merrill Lynch Global Consumer & Retail Conference;

10/17/17: FY 2017 Earnings Release;

11/07/17: Societe Generale The European ESG / SRI Conference;

11/30/17: Annual General Meeting;

The above results information came from the following page: www.4-traders.com