EQT – 30-Min Long Trade Setup!📈

🔹 Ticker: EQT (NYSE)

🔹 Setup Type: Triangle Breakout + Support Retest

🔸 Breakout Price: ~$53.84

📊 Trade Plan (Long Position)

✅ Entry Zone: $53.70–$53.90 (breakout above yellow zone)

✅ Stop Loss (SL): Below $53.13 (white structure support)

✅ Take Profit Targets:

📌 TP1: $55.00 (red zone – short-ter

Key facts today

EQT Corporation's shares rose 3.2%, becoming the second-largest S&P 500 gainer after UBS upgraded its rating from 'neutral' to 'buy' and raised the price target to $64.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.545 EUR

222.73 M EUR

5.04 B EUR

593.46 M

About EQT Corporation

Sector

Industry

CEO

Toby Z. Rice

Website

Headquarters

Pittsburgh

Founded

1888

FIGI

BBG000J8Y432

EQT Corp. is a natural gas production company, which engages in the provision of supply, transmission, and distribution of natural gas. The company was founded in 1888 and is headquartered in Pittsburgh, PA.

$EQT - BREAKOUT INCOMING LONG TERM BULLISHEQT Corp. is a leading natural gas production company that's been around for over 135 years! Founded in 1888, this Pittsburgh-based company specializes in providing supply, transmission, and distribution of natural gas.

Whether you're interested in the energy industry or just want to learn more abo

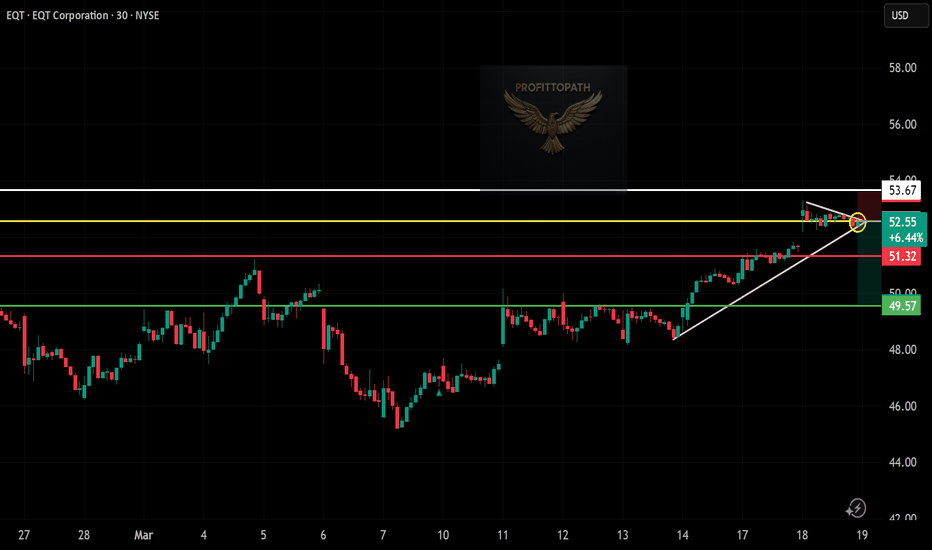

EQT (EQT Corporation) – 30-Min Short Trade Setup! 📉🚨

🔹 Asset: EQT – NYSE

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown (Rising Wedge Reversal)

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $52.50 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $53.67 (Key Resistance Level)

🎯 Take Profit Targets

📌 TP1: $51.32 (Support Level)

📌 TP

EQT – 30-Min Long Trade Setup !📌🚀📈

🔹 Asset: EQT Corporation (NYSE: EQT)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above 46.99 (Breakout Confirmation)

✅ Stop-Loss (SL): Below 45.91 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: 48.40 (First Resistance Level)

📌

E-cutieAll year EQT, an unloved natural gas producer has been a swing trader's paradise. I've harvested so many gains from these E-cutie trees I thought I'd make a thread just for it and post trading updates.

The macro technical picture is clear. Years of being battered by shorts ended with capitulation i

Building long term position in $EQT I’m changing the process for picking tickers to make it more affordable while avoiding risky penny lots. Comment your favourite TSX tickers under $150 & NYSE or NAS under $100.

Key Stats:

• Market Cap: ~$30B

• P/E Ratio: ~61.21

• Dividend Yield: ~1.5%

• Next Earnings Date: February 1

EQT Corporation (EQT) Analysis Company Overview:

EQT Corporation NYSE:EQT is the largest natural gas producer in the United States, headquartered in Pittsburgh, PA, and focused on the prolific Appalachian Basin. The company’s strategy centers on operational excellence, disciplined financial management, and maximizing shareholde

EQT Corporation. Oil Gas & Consumable FuelsKey arguments in support of the idea.

▪ Rising natural gas prices.

▪ Undervaluation.

Investment Thesis

EQT Corporation is one of the largest natural gas producers in the US. Natural gas

constitutes over 90% of the Company's hydrocarbon revenues, with LPG sales

comprising 8% and oil contributing

Natural Gas - Time to buy? Natural Gas is going through some much needed consolidation.

Holding above the 50 & 200 MA, a golden cross is setting up.

Typically golden cross signals see sellers in the near term before medium and ling term buyers step in.

Nat gas equities have been struggling lately and appear to be needi

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

E

EQT4647467

EQM Midstream Partners, LP 6.5% 15-JUL-2048Yield to maturity

7.02%

Maturity date

Jul 15, 2048

E

EQT5422708

EQM Midstream Partners, LP 7.5% 01-JUN-2030Yield to maturity

6.91%

Maturity date

Jun 1, 2030

E

EQT5758335

EQM Midstream Partners, LP 6.375% 01-APR-2029Yield to maturity

6.44%

Maturity date

Apr 1, 2029

E

EQT5422706

EQM Midstream Partners, LP 7.5% 01-JUN-2027Yield to maturity

6.40%

Maturity date

Jun 1, 2027

E

EQT5002743

EQM Midstream Partners, LP 6.5% 01-JUL-2027Yield to maturity

6.37%

Maturity date

Jul 1, 2027

See all EQ6 bonds

Curated watchlists where EQ6 is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Related stocks

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange EQT CORP. stocks are traded under the ticker EQ6.

We've gathered analysts' opinions on EQT CORP. future price: according to them, EQ6 price has a max estimate of 65.41 EUR and a min estimate of 30.94 EUR. Watch EQ6 chart and read a more detailed EQT CORP. stock forecast: see what analysts think of EQT CORP. and suggest that you do with its stocks.

Yes, you can track EQT CORP. financials in yearly and quarterly reports right on TradingView.

EQT CORP. is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

EQ6 earnings for the last quarter are 1.09 EUR per share, whereas the estimation was 0.95 EUR resulting in a 14.94% surprise. The estimated earnings for the next quarter are 0.39 EUR per share. See more details about EQT CORP. earnings.

EQT CORP. revenue for the last quarter amounts to 1.99 B EUR, despite the estimated figure of 2.00 B EUR. In the next quarter, revenue is expected to reach 1.57 B EUR.

EQ6 net income for the last quarter is 223.82 M EUR, while the quarter before that showed 404.16 M EUR of net income which accounts for −44.62% change. Track more EQT CORP. financial stats to get the full picture.

Yes, EQ6 dividends are paid quarterly. The last dividend per share was 0.14 EUR. As of today, Dividend Yield (TTM)% is 1.18%. Tracking EQT CORP. dividends might help you take more informed decisions.

EQT CORP. dividend yield was 1.37% in 2024, and payout ratio reached 140.56%. The year before the numbers were 1.57% and 14.40% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 7, 2025, the company has 1.46 K employees. See our rating of the largest employees — is EQT CORP. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EQT CORP. EBITDA is 3.10 B EUR, and current EBITDA margin is 40.78%. See more stats in EQT CORP. financial statements.

Like other stocks, EQ6 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EQT CORP. stock right from TradingView charts — choose your broker and connect to your account.