Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry. It has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe, and elsewhere.

Master Drilling has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry worldwide. This technology enables the drilling of horizontal tunnels or tunnels inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast-and-clear methods currently in use. At the moment, it requires three operators, but the company is working on a completely automated, remote-controlled version.

In its results for the six months to 30th June 2024, the company reported revenue up 17.3% and headline earnings per share (HEPS) down 3.2% (in US dollars). The company's net asset value (NAV) increased 8% to 135c per share. The company said, "...operating profit decreased by 67.6% to USD6.9 million due to impairment losses recognised on reverse circulation and mobile tunnel-boring equipment."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 16.4% and 26.4%. It is now trading at about 62% of its net asset value (NAV) and on a price:earnings (P:E) multiple of 5.25 - which looks like good value.

We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry. It extends the life of some mines and makes others viable again. While this is a risky share due to its link to the commodities markets, it has the potential to offer strong growth because of its new technologies. These innovations could revolutionise the mining industry.

In our view, this is an interesting company with the potential to perform well as its new horizontal boring machine gains traction.

I49 trade ideas

Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company specializing in drilling exploration and other services for the mining industry, with a diversified portfolio that now includes drilling for hydro-electric projects and construction. The company has strategically shifted its focus away from the South African mining sector, extending its services to North and South America, Europe, and other regions globally.

A key innovation from Master Drilling is its development of new horizontal drilling technology, or tunnel boring machines, which could potentially revolutionize the mining industry worldwide. This technology facilitates the drilling of horizontal tunnels or tunnels inclined at up to 12 degrees, offering a faster and more cost-effective alternative to traditional blast-and-clear methods. Currently, this technology requires three operators, but the company is actively working towards a fully automated, remote-controlled version.

In its results for the six months ending 30th June 2024, Master Drilling reported a 17.3% increase in revenue but a 3.2% decline in headline earnings per share (HEPS) in US dollars. The company's net asset value (NAV) increased by 8% to 135c per share. However, operating profit decreased significantly by 67.6% to USD 6.9 million, primarily due to impairment losses on reverse circulation and mobile tunnel-boring equipment. Despite this, the company is currently trading at about 52% of its NAV and has a price-to-earnings (P:E) ratio of 4.39, suggesting it may be undervalued.

The company's horizontal drilling technology holds promise as a disruptive force in the mining industry, with the potential to extend the life of some mines and make others viable again. While the share carries risk, particularly due to its links to the commodities markets, the potential for strong growth is evident as the new technologies gain traction.

In our view, Master Drilling is an intriguing company with significant growth potential, particularly as its horizontal boring machine continues to prove its value in the industry. This could make it a worthwhile consideration for investors looking for exposure to innovative mining technologies.

Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company specializing in drilling exploration and other holes for the mining industry, and it has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe, and elsewhere. It has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionize the mining industry worldwide. This technology enables the drilling of horizontal tunnels or tunnels that are inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast and clear methods currently in use. At the moment, it requires three operators, but the company is working on a completely automated remote-controlled version.

In its results for the year to 31st December 2023, the company reported revenue up 7.2% in dollars and headline earnings per share (HEPS) up 15.1% in rands. The company said, "Stable order book of USD288.3 million - Healthy pipeline of USD535.3 million - Dividend of 52.5 cents per share in ZAR terms declared, an increase from the 47.5 cents per share in 2022 - Cash generated from operating activities increased by 42.0% from USD25.0 million to USD35.5 million." In a trading statement for the six months to 30th June 2024, the company estimated that HEPS (in rands) would be between 1.9% lower and 18.1% higher than in the previous period. The company said, "These lower EPS for the current period were largely the result of non-cash adjustments deemed appropriate in the interim results."

It is now trading at about 50% of its net asset value (NAV) and on a price:earnings (P:E) multiple of 4.22, which looks like good value. We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry, which extends the life of some mines and makes others viable again. So, while this is a risky share because it is linked to the commodities markets, it has the potential to offer strong growth because of the new technologies it has that could revolutionize the mining industry. In our view, this is an interesting company with the potential to perform well as its new horizontal boring machine gains traction.

Our opinion on the current state of MDIMaster Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry, and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe and elsewhere. It has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry world-wide. This technology enables the drilling of horizontal tunnels or tunnels which are inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast and clear methods currently in use. At the moment it requires three operators, but the company is working on a completely automated remote-controlled version. In its results for the six months to 30th June 2023 the company reported revenue up 12,1% and headline earnings per share (HEPS) up 25%.The company's net asset value (NAV) increased 3,3% to 125c (US) per share. The company said, "Net cash generated from operations decreased by USD0.8 to USD12.6 million. Master Drilling will continue to manage debtors actively to ensure robust conversion to cash. Cash resources continue to be managed prudently to cater for emerging opportunities that require specific design, planning and investment". It is now trading at about 68% of its net asset value (NAV) and on a price:earnings (P:E) multiple of 4,92 - which looks like good value. We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry which extends the life of some mines and makes others viable again. So, while this is a risky share, because it is linked to the commodities markets, it has the potential to offer strong growth because of the new technologies which it has that have the potential to revolutionise the mining industry. In our view, this is an interesting company with the potential to perform well as its new horizontal boring machine gains traction.

Our opinion on the current state of MDIMaster Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry, and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe and elsewhere. It has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry world-wide. This technology enables the drilling of horizontal tunnels or tunnels which are inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast and clear methods currently in use. At the moment it requires three operators, but the company is working on a completely automated remote-controlled version. In its results for the six months to 30th June 2023 the company reported revenue up 12,1% and hyeadline earnings per share (HEPS) up 25%.The company's net asset value (NAV) increased 3,3% to 125c per share. The company said, "Net cash generated from operations decreased by USD0.8 to USD12.6 million. Master Drilling will continue to manage debtors actively to ensure robust conversion to cash. Cash resources continue to be managed prudently to cater for emerging opportunities that require specific design, planning and investment". It is now trading at about 68% of its net asset value (NAV) and on a price:earnings (P:E) multiple of 4,88 - which looks like good value. We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry which extends the life of some mines and makes others viable again. So, while this is a risky share, because it is linked to the commodities markets, it has the potential to offer strong growth because of the new technologies which it has that have the potential to revolutionise the mining industry. In our view, this is an interesting company with the potential to perform well as its new horizontal boring machine gains traction.

Master Drilling Interim ReportJSE:MDI came out with positive figures; 34% revenue growth, 57% EPS increase, and 19% cash increase from continuing operations. No interim dividend as per company's dividend policy.

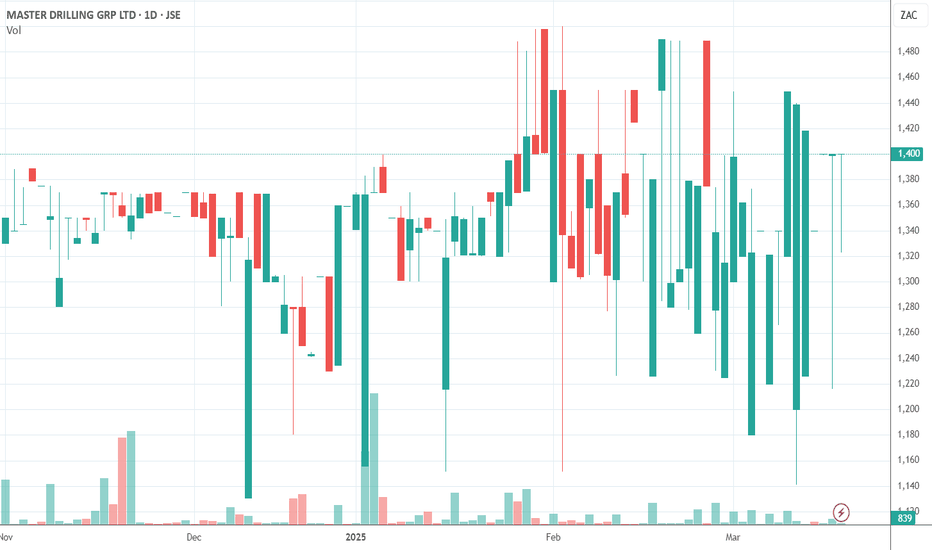

Technically, the stock is on an uptrend, at an area of value. Potential buy area, R14.50/share.

$JSEMDI Master Drilling Company. Consolidating Master drilling has been consolidating in a flag pattern since the strong move up from 520c levels to 900c levels. A convincing (volume) break above 800c could see this share go to 930c and 978c levels.

Warning: Low liquidity on this share could see some wild swings.