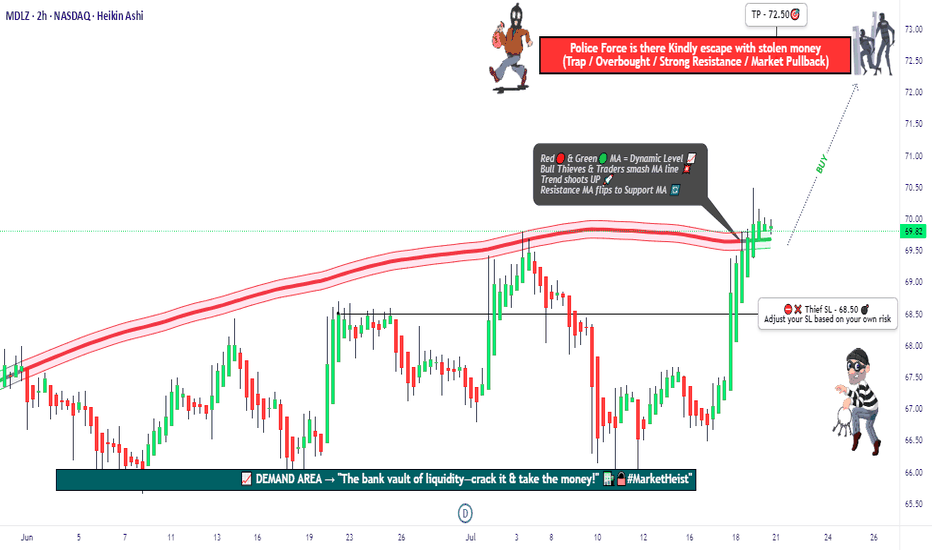

"MDLZ Heist LIVE! Quick Profit Grab Before Reversal!"🚨 MONDELEZ HEIST ALERT: Bullish Loot Zone! (Swing/Day Trade Plan) 🚨

Thief Trading Strategy | High-Risk, High-Reward Play

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba!

To all Money Makers & Strategic Robbers 🤑💸—this is your blueprint to plunder "MONDELEZ INTERNATIONAL, INC" with precision.

🔎 THIEF TRADING ANALYSIS (Technical + Fundamental)

The Vault is Open! Bullish momentum detected, but caution—this is a high-risk police barricade zone (resistance level).

Overbought? Consolidation? Reversal? Yes. Bears lurk here, but we’re stealing profits before the trap snaps.

🎯 Target: 72.50 (or escape earlier if momentum fades).

🚨 Scalpers: Long-only! Use trailing stops to protect gains.

📈 ENTRY: How to Swipe the Loot

"Buy the Dip" Strategy: Optimal entries on pullbacks (15m/30m timeframe).

DCA/Layering Tactics: Spread limit orders for better risk control.

Aggressive Robbers: Enter now. Patient Thieves: Wait for retests.

🛑 STOP LOSS: Survival Rules

SL at 68.50 (nearest swing low wick on 2H chart).

Adjust based on risk/lot size—protect your capital!

⚡ CRITICAL ALERTS

📰 News Volatility: Avoid new trades during major releases. Lock profits with trailing stops!

📊 Fundamental Drivers: Check COT reports, macro trends, and sector sentiment Klick the 🔗.

⚠️ Reminder: This is NOT financial advice. DYOR and manage risk!

💥 BOOST THE HEIST!

Like 👍 + Boost 🔄 to fuel our next market robbery plan. Together, we trade smarter, steal bigger, and profit faster!

🚀 Stay tuned—more heists coming soon! 🤑🔥

KTF trade ideas

MDLZ - Bullish Flag patternBullish Flag pattern

The Bull Flag pattern forecasts in the near future. Currently, it's just early planning with small profits and a reminder to set a stop loss if the pattern cannot breakout upwards.

Both the M50 and MACD indicators suggest the potential for price increase.

The volume is still low so it cannot break out yet.

The price now (Closed on 05.23.2025): $66.14

Price target: $70.11/ $74.64/ $84.60.

Stop loss: $63.43

IMO, amateur trader.

Mondelez (MDLZ): Snack Giant Preps for Possible BreakoutMondelez International, Inc. (MDLZ) is a global snacking powerhouse, best known for beloved brands like Oreo, Chips Ahoy, Cadbury, Ritz, and Toblerone. With a presence in over 150 countries, the company continues to grow by focusing on high-margin snacks, expanding into emerging markets, and boosting its digital and direct-to-consumer capabilities. Mondelez has consistently shown resilience during economic shifts thanks to its strong brand loyalty and consistent demand for comfort foods and on-the-go snacks.

On the technical side, MDLZ is currently holding above the 0.236 Fibonacci retracement level, placing it firmly in the momentum zone. The stock is testing recent highs, showing bullish strength and signaling the potential for a breakout if buyers continue to step in with volume. The setup suggests that the uptrend could continue if this consolidation near the top resolves higher.

Reversal on Mondelez Looking Favorable. MDLZA clear Elliott 5 wave impulse down is complete, along with classical divergences on the momentum indicator. Willing to bet that this is a reversal with MIDAS line cross and US/vWAP acting as resistance in synchronicity. Interestingly, there's a double harmonic that formed in the more long term aspect - a deep Bat and a butterfly within deep bat. VZO and Ehlers Stoch/RSI are divergent, so disregarding the readings in this instance.

Mondelez at the Edge: Can Bulls Hold the Line?A Pivotal Moment for Mondelez – Will the Bulls Step Up?

Mondelez International (NASDAQ: MDLZ) is trading at $58.05, clawing back some ground but still down 26.1% from its all-time high of $78.59. The stock has been oscillating near a critical resistance level at $58.40, testing the patience of both bulls and bears. Technical indicators suggest a market at a crossroads: the 50-day MA sits at $57.63, while the RSI hovers at 52.97, keeping the stock in neutral momentum. Meanwhile, Money Flow Index (MFI) remains weak at 38.09, signaling a lack of strong accumulation.

Adding to the tension, the last few sessions have flashed sell-heavy VSA patterns, with a significant increase in selling volume on January 31st. This raises an important question: Is Mondelez on the brink of a breakdown, or will buyers defend the $57 zone and push for a breakout above $58.40?

The answer may come from broader market forces. Inflation remains a key macro factor, and any shifts in consumer sentiment could dictate the next leg for Mondelez. Traders should watch for confirmation: if bulls fail to reclaim ground above $58.40, the path downward toward $56.50 support may accelerate. But if the stock finds strength, a breakout could set sights on the next resistance near $59.86 and beyond.

One thing is certain—this is a defining moment for MDLZ. Are you ready for what’s next?

MDLZ Roadmap: Tracing the Footsteps of Market Makers

Mondelez (NASDAQ: MDLZ) has been dancing on the edge of key price levels, with a series of Volume Spread Analysis (VSA) patterns defining its trajectory. The past few sessions reveal a battle between buyers and sellers, but the roadmap is becoming clearer. Let’s break it down.

January 27 – Sell Volumes Max: This pattern signaled an aggressive sell-off, closing at $58.37 from an opening of $58.595. Given the magnitude of the sell pressure, it was crucial to watch the next sessions for validation.

January 28 – Buy Volumes Max: A reversal attempt came in with increased buy volumes, pushing the stock up to $56.88 from a low of $56.68. This bounce hinted at possible accumulation, but the lack of follow-through kept the market on edge.

January 29 – Sell Volumes: Sellers regained control, pushing MDLZ to $57.13, marking another bearish shift. This played into the broader downtrend, reinforcing that buyers weren’t ready to step in just yet.

January 30 – VSA Sell Patterns Dominate: The day saw a series of manipulation-based sell patterns, with MDLZ closing at $57.695. These patterns typically indicate smart money positioning for further downside.

January 31 – Sell Volumes Max Returns: Another spike in sell volumes appeared, reinforcing the previous direction and closing at $58.00. This was a strong confirmation that the previous bearish signals were working.

Key Takeaways: The main direction has remained bearish, and each sell-based VSA pattern has been validated by subsequent price action. Bulls attempted a fightback on January 28, but weak follow-through suggested it was merely a liquidity grab. Until we see a buy pattern confirming with sustained upward movement, the path of least resistance remains downward.

MDLZ traders should keep an eye on support zones near $56.50, as breaking this could trigger further downside momentum. Will buyers finally step in, or are we looking at another leg lower? Stay tuned.

Technical & Price Action Analysis: Key Levels to Watch

Mondelez (NASDAQ: MDLZ) is moving in a tight range, and key levels are setting up for potential breakout or breakdown plays. Whether you’re scalping the swings or positioning for a bigger move, here’s what matters right now.

Support Levels: If buyers want to step up, they’ll need to hold $56.51 and $55.72—otherwise, expect them to flip into resistance, making the path even harder for bulls.

Resistance Levels: The first roadblock for upside sits at $58.40, followed by $59.86 and $60.71. If these levels don’t hold sellers back, expect them to become the next battle zone for bulls trying to break through.

Powerful Support Levels: The real lifeline sits way higher at $65.27 and $69.65—far from current prices, but if the stock ever reclaims these zones, the trend structure could shift bullish again.

Powerful Resistance Levels: The ultimate ceiling remains $75.68, but let’s be real—MDLZ has a long way to go before challenging that zone again.

If support fails, those same levels will be a brick wall on the next bounce attempt. Traders should be watching price reactions closely—levels don’t break without a fight, and smart money is always one step ahead.

Trading Strategies Based on Rays: Optimistic & Pessimistic Scenarios

The "Rays from the Beginning of Movement" method provides a dynamic approach to market structure, using Fibonacci-based rays to map out price movements. Unlike static support and resistance, these rays adapt in real time, helping traders react to the market instead of predicting exact levels.

Each price interaction with a ray indicates one of two scenarios:

Reversal – A bounce off a ray signals a potential turn in trend.

Continuation – A breakout or clean movement along the ray suggests an extension toward the next key zone.

Trade entries are only valid after price interacts with a ray and confirms movement in the expected direction. The first ray hit acts as the initial target, with subsequent rays marking extended take-profit levels.

Optimistic Scenario: Bulls Take Control

If price holds $58.40 resistance and breaks above, we look toward $59.86 as the next target.

If momentum continues, $60.71 becomes the secondary take-profit zone.

If buyers manage to push beyond $66.07, we could see a structural shift towards the powerful resistance zone at $69.22.

Pessimistic Scenario: Bears Regain Control

A rejection at $58.40 or a break below $56.51 signals downside pressure.

If sellers dominate, the next key level is $55.72.

A further breakdown could push MDLZ toward the $54.72 absolute low, a must-hold zone for bulls.

Dynamic Moving Averages as Confirmation

Moving averages (MAs) will play a key role in defining momentum:

50 MA at $57.63 – A flip above this level supports bullish continuation.

100 MA at $57.45 – A break below signals a short-term bearish trend shift.

200 MA at $57.33 – The ultimate line in the sand; a loss here opens the door for deeper declines.

Potential Trade Setups Based on Ray Interactions

Long on Break Above $58.40 → Target $59.86, Stop Below $58.00

Short on Rejection from $58.40 → Target $56.51, Stop Above $58.70

Long on Bounce from $56.51 → Target $58.40, Stop Below $56.00

Short on Breakdown Below $56.51 → Target $55.72, Stop Above $56.80

As always, these setups work in confluence with the VSA rays already mapped out. Each move from ray to ray defines a structured trade, and positioning should only occur after confirmation of movement.

Let’s Talk: Your Thoughts & Custom Analysis Requests

Trading is all about levels and reactions, and now it’s your turn—drop your questions in the comments! Let’s discuss how MDLZ moves next, and whether the price will respect these mapped-out levels.

Hit Boost and save this idea so you can check back later—watch how the market moves exactly along the rays. That’s the key to profitable trading: knowing where price action matters before it happens.

By the way, my private indicator automatically plots all rays and key levels, but it’s only available in Private Access. If you’re interested in using it—send me a message.

Need an analysis for a different asset? No problem! I can chart any market—some setups I post for free, while others we can arrange privately. If you have a specific request, let me know in the comments and hit Boost—I’ll do my best to include it in upcoming ideas.

And of course, follow me here on TradingView so you don’t miss future updates. Let’s trade smart! 🚀

Long-Term Target Analysis for Mondelēz International (MDLZ):Bullish Long-Term Scenario:

If MDLZ reverses course and breaks above the $60.50-$65.00 resistance zone, a long-term bullish trajectory could emerge. Historical price action and Fibonacci projections suggest:

First bullish target: $67.00, the 200-day EMA level and a previous key resistance point.

Second bullish target: $73.00-$75.00, near its 2023 highs, which aligns with a 127.2% Fibonacci extension and analyst estimates for a recovery.

A longer-term breakout above $75.00 could target $85.00-$90.00, contingent on strong earnings growth, favorable market conditions, and a shift in sentiment.

Bullish Long-Term Target: $75.00, with an extended target of $90.00 in a strong recovery scenario.

MDLZ $72.00 - Don't Miss Out on This 18%NASDAQ:MDLZ announced it would like to buy NYSE:HSY which led to a drop to $60. The sell-off came with a high volume and an oversold RSI. The buyers were able to buy the stop up to $61.44 getting it into the support zone. The sell-off did also respect the current bearish channel we're in. From this point on we could see a little bounce or the start of a new bullish phase inside this huge sideways channel.

Our first target would be the resistance at $64.22. If we bounce from this we could see another leg down which is why we should take profit here and move the stop-loss to break-even. If the stock decides to use its momentum for more we could target the area at $73.00. We exit this trade if the stock closes on the daily chart with a candle below the support zone of $60.67.

Resistance / Target Zones:

$64.22

$73.00

Support Zone:

$60.67

Let me know what you think!

MDLZ - 1W - Trade in ProgressThis trade was initiated when the price reached our area of interest, where the bottom of the uptrend channel, the EMA200, medium-term support, and the weakening downtrend converged.

The target is the top of the bullish channel, but the trade will likely be closed at the first signs of weakening on the upside.

MDLZ: +17% or Bye Bye BullsTechnical Analysis of Mondelez Internation, Inc (MDLZ)

From Left to Right (Monthly - Weekly - Daily - Hourly)

First of all, this was discovered as potentially interesting using the Screener to identify assets with ADX moving above 15 on the Weekly chart.

"Some of the best buy signals are found when ADX is below 15 and begins to rise." - Chuck Le Beau (Author of 'Technical Traders Guide to Computer Analysis of the Futures Markets')

All Timeframes View :

Monthly :

Here a pattern repeats 2 times previously and I expect it may happen again now. The price is trending up with SMA 10 above EMA 30. Price pulled back into the Sweet Spot between the two and provides a buying opportunity to Swing Traders. The Stochastics (5,3,3) go low and cross bullish while creating a bullish candlestick reversal pattern. RSI (5) crosses above 50.

Weekly :

A Fibonacci Channel connects the first two shown uptrend lows and the highest high between them (all candlestick reversal patterns). The circled areas on the Weekly chart are the same ones on the Monthly. Notice that they all occur on the 200 period EMA.

Note: What is different this time around is the black candle of sellers at the 0.236 Fibonacci level. This did not happen the previous two times. Perhaps this is indicative that price will not this time hit the 0.618 level as it did the previous two times. If that's the case we have an important bearish clue here. The S&P 500 Index (SPX) just had a Weekly TD Sequential 9 Sell signal which precipitated the market turning around and this was further reflected in chart patterns on stocks like Apple (AAPL) which showed a Head & Shoulders on the Daily chart (not illustrated). The recent large gap down (Falling Window) patterns across the market coincided with the shoulder line. In any case, you may have observed like I have that price has steadily and with continued bullish vigor risen above the shoulder line. Steve Nison quoted someone saying, "There's nothing more bullish than a failed Head & Shoulders". What is a failed Head & Shoulders if not one which promptly regains the shoulder line as AAPL is demonstrating. In that case, if things are as bullish as they may appear, then the black candle on the Weekly Mondelez chart simply captures this market experience but will not negate repeating the pattern of now heading to target the 0.618 price area around $82.

Daily :

The white circles on this chart are the current and previous circles on the Weekly and Monthly charts. Note the Falling Window on the left. This was supposed to be an area of resistance but bulls broke out of it and then pulled back to test it for support (first circle). The current up move started with the Bullish Engulfing Pattern at this confirmed Falling Window resistance-turned-support level (Change of Polarity). Price gapped up after that and later pulled back to test the new Rising Window for support. This behavior led the crossing of the moving averages.

Price broke out of the green rectangle which was previously resistance. It was tested multiple time for support and buyers were present in numbers to carry price up to the previous pink polarity resistance level. You can see the long upper shadow confirming sellers at this level.

Hourly :

So what do you see? A buying opportunity in the Sweet Spot between the moving averages on a new Pivot Low or does this represent the final hopes and delusions of bulls? :)

MDLZ rally prior to earnings 71-75$Good technical trendline based set up with two potential profit areas that can transpire prior to the JUL 23 earnings date.

Bounce on support

RSI oversold

Good RRR

I plan on taking profits at the POC level right around 71$ and holding a smaller portion up to 75$ in case we do break out. Don't really want to hold into earings because of the uncertainty!

Stocks pairs trading: EXPD vs MDLZLet's examine the trade potential for Expeditors International (EXPD) and Mondelez International (MDLZ) by analyzing their key financial metrics and recent performance to determine reasons for going long on MDLZ and short on EXPD.

Price-to-Earnings (P/E) Ratio:

EXPD: P/E ratio of 26.94

MDLZ: P/E ratio of 21.22

A lower P/E ratio suggests that MDLZ is potentially undervalued compared to EXPD. Investors might expect higher growth prospects from MDLZ or believe it's currently priced more attractively relative to its earnings.

Earnings Growth:

EXPD: EPS next Y of 5.90%

MDLZ: EPS next Y of 6.27%

Both companies exhibit modest earnings growth, but MDLZ has a slightly higher expected EPS growth rate. This indicates better future profitability prospects for MDLZ compared to EXPD.

Summary of Recent News:

EXPD: Expeditors International recently reported a quarterly earnings beat but faced a revenue miss due to weak logistics demand. Analysts have mixed views with some projecting a downside risk, citing soft freight shipping demand and a competitive market environment.

MDLZ: Mondelez International, although facing some short-term challenges, has been focusing on strategic acquisitions and expansion in emerging markets, which could drive future growth. Analysts remain optimistic about its long-term potential due to its strong brand portfolio and global reach.

By leveraging these insights, the recommended strategy is to go long on MDLZ, capitalizing on its growth potential and relatively attractive valuation, while shorting EXPD, given its challenges in revenue growth and market outlook

Decision:

Long on: 2 MDLZ

Short on: 1 EXPD

MDLZ - BullishThe general market is over extended as we all know, and I have and still are waiting for that pull back. However I will not allow my sentiment to get in the middle of opportunities. We look at data, and if it makes sense, we get in. Right now MDLZ makes sense for a long position. If that changes, we get out and preserve capital. Remember, risk management is key. In my opinion, you need to get at least a 1:2 RR for the opportunity to be worth it.

Not financial advice

MDLZ Potential Buy setupReasons for bullish bias:

- Price is making new Highs

- Price is near all time high, hence Buy stop order above it

- SL will be updated to new HL once the order gets triggered

- TP will be set accordingly using Fib extension

Entry Level (Buy stop): 77.68

Stop Loss Level: 68.63

MDLZCurrent price action and uptrend looks to be continuing towards earnings, currently as volume as been propping up the current valuation there has been a slightly but slow accumulation to the upside, I am leaning towards a positive earnings release followed by MDLZ breaking its ATH or 52 weeks high as it has attempted to do so in july and aug 2023 but failed to break the curren t resistance of 76 and higher.

Price should be able to break 80 before end of year is complete.

Last cycle of Mondelez International ( Neowave Forecast)Hi Everyone

This another trading form US Stocks, This is an medium term forecast of Mondelez International. Currently its medium term bullish cycle is just started but it is the last leg. Therefore do not hold, wait or average if invalidation level is broke.

Thank You

MDLZ Entry, Volume, Target, StopEntry: when price clears 78.59

Volume: with daily volume greater than 14.862M

Target: 87 area

Stop: Depending on your risk tolerance; 75.80 gets you 3/1 Risk/Reward.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.