Our opinion on the current state of MTN-GROUP(MTN)MTN is a leading emerging market mobile operator, serving 290 million people (including 29 million in South Africa) in 19 countries across Africa and the Middle East. MTN's three largest subscriber bases are in Iran, Nigeria, and South Africa. Generally, companies supplying a mobile service have faced very stiff competition and declining voice revenue. The sharp increase in data usage has, to some extent, mitigated this change, but these companies remain quite risky. MTN is especially risky because of the political risk in Iran and Nigeria.

MTN is working with Sanlam to offer insurance products to its clients in the hopes that "fintech" will become a major part of its business. The goal is to turn MTN into a "...digital operator with a major focus on the fintech, digital, enterprise, and wholesale business areas." MTN has rolled out its mobile money services in both Nigeria and South Africa. It is currently offering these services in 14 out of the 21 countries where it operates, and it has 41.8 million mobile money customers. It is trying to increase that number to 60 million. MTN has now listed on the Nigerian stock exchange.

On 13th January 2023, MTN received an assessment from the Ghanaian tax authorities that it owed $773 million (about R13.3 billion). This is seen as a "shakedown" of a wealthy international company by a cash-strapped national government—similar to what happened in Nigeria. The company announced that Mastercard would take a R100 billion stake in its fintech business and partner with it to expand that business.

In its results for the six months to 31st December 2024, the company reported data revenue up 21.9% and fintech revenue up by 28.5% in constant currencies. Headline earnings per share (HEPS) fell by 68.9% and total subscribers increased by 2.2% to 290.9 million. The company said, "Active data subscribers increased by 7.7% to 157.8 million - Mobile Money (MoMo) monthly active users (MAU) increased by 0.9% to 63.1 million - Data traffic increased by 32.6% to 19 459 Petabytes (PB) - Fintech transaction volumes increased by 15.3% to 20.3 billion."

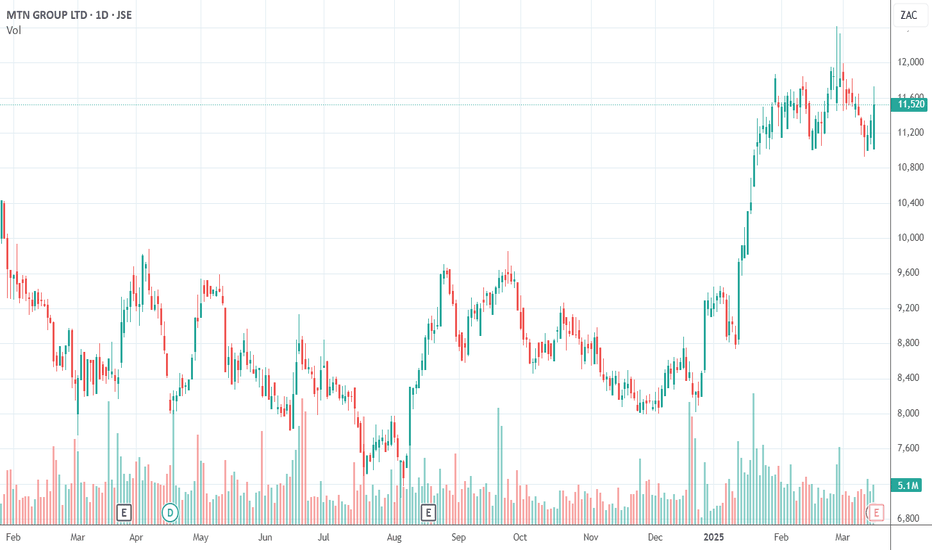

Clearly, the company is being impacted by the volatility in the Nigerian economy, which has been a large part of its business. The share was falling from its cycle high in March 2022. We recommend applying a downward trendline from that peak and waiting for a clear upside break before investigating further. That break came on 7th December 2024 at a price of 9289c, and the share has since moved up to 11519c. It was added to the Winning Shares List (WSL) on 14-1-25 at 9729c.

LL6 trade ideas

MTN Group Ltd MTN Group Ltd (JSE: MTN) has been in a downtrend since September, failing to break the resistance around 96.00.

A bullish falling wedge is forming, suggesting a potential breakout with a target around 95.00. The current price is testing a key support zone at 81.70, which has held in 3 out of the last 4 tests. RSI and MACD indicators are showing signs of bullish momentum, with the RSI potentially breaking its downtrend line, similar to past upward movements.

Watch for a breakout above the wedge and RSI trend line for confirmation of a bullish shift.

Target: 88.50 (initial) and 95.00 (major).

$JSEMTN - MTN: Is The Bottom Finally In? 7043cps Holds The KeySee link below for previous analysis.

MTN did not take long to reverse aggressively after the previous analysis.

The bounce from 7043 cps looks impulsive and has broken above an intermediate trendline with wave 5 of (C); I will get more conviction with a break above 9876 cps as that will confirm that wave 5 is complete in the context of the ending diagonal.

The MACD also shows positive signals; there has been strong convergence below the zero line and the momentum indicator has broken a strong resistance trendline above the zero line.

I am bullish above 7043 cps with a buy the dips strategy.

MTN BUllish signal kicked in to R131.91 - SELL!I am the absolute worst person to do analyses on MTN.

I never get it right (over the last 20 years), and yet I keep providing analyses.

SO if you want to actually make money with MTN, just do the opposite of what MATI Trader system says lol.

W Formation (Breakout)

Price above 20 and 200MA

Target R131.91.

So in other words SELL and don't listen to me.

MTN just took a nose dive with a scary down target of R47M Formation formed on MTN, with the price breaking out on 13 June 2024.

We see price below 20SMA and 200SMA showing a high probability analysis.

And there are two downtrend lines confirming the momentym of downside.

First target will be set to R47.34

LONG MTN Group pending trend reversalJSE listed telecommunication entity, one that has a footprint in many African countries has had their share price under some pressure for some time now. Trading near near it's lowest levels pre-covid, which it broke due to panic selling during the pandemic. It then made significant recovery since those lows that hammered values with over 200% gains. All those gains have lost in the past 2 years of trading. MTN is a large South African entity with dominance considering it only has 2 other competitors it wrestles for market share. Earnings should be coming out soon, hopefully these will change investor sentiment positively.

Looking for price to close above previous support of R78.32 to signal buying taking place. This will be a value play for me, meaning I'll be looking to hold the stock as part of portfolio till I enough valid reasons to sell it. Current yield is at 4.8%, an increase in the share price would cover the below inflation return

$JSEMTN - MTN: 7753 Invalidated, Now What?See link below for previous analysis.

7753 cps eventually gave way triggering an update of the wave count.

I have shifted the terminal wave E of the (B) wave triangle and I an now counting the sell-off from 14289 cps as an ending diagonal/falling wedge.

I maintain that a bottom is near and I will monitor price at the low trendline of the wedge.

The MACD is still giving a bullish convergence signal, indicating that selling momentum is weak.

I am neutral at this juncture as it is a bit late to be bearish.

$JSEMTN - MTN: 7753 Holds For Now, Maintaining Bullish OutlookSee link below for previous analysis.

MTN had a deep pullback since the previous analysis.

Critically, 7753 held and stock looks to be catching big again.

This re-test of 7753 can be seen as the bears failing to make a new low which is bullish.

I maintain the bullish outlook so long as 7753 holds.

$JSEMTN - MTN: Is The Bottom Finally In? 7753 Needs To HoldSee link below for previous analysis.

MTN released its FY'23 results on the 25th of March and it was a mixed bag of results.

Salient features:

Group service revenue grew by 6.9% (13.5%*) to R210.1bn (2022: R196.5bn)

EBITDA (before once-off items) down by 0.5% (9.8%*) to R90.5bn (2022: R90.8bn)

EBITDA margin lower by 3.0 percentage points (pp) to 40.9% (1.2 pp* lower to 41.5% *)

Basic earnings per share (EPS) decreased by 78.5% to 227cps (2022: restated 1 054cps)

Reported headline earnings per share (HEPS) down by 72.3% to 315cps (2022: restated 1 137cps);

non-operational impacts decreased HEPS by 888cps

Holding company (Holdco) leverage improved to 1.4x (December 2021: 0.8x)

Adjusted return on equity (ROE) increased by 0.2pp to 24.4% (restated 2022: restated 24.2% )

Total subscribers increased by 2.0% to 294.8 million

Final dividend declared of 330cps (2022: 330cps)

These results did not deter investors much as the stock shrugged of the results and the stock trended higher in the following sessions.

Technically, the reversal signals I was looking for have materialized.

*The MACD gave a buy signal and has broken above the zero-line.

*The five wave decline from 14299 looks complete at 7753.

No matter how good the wave count looks, one can never be certain that a bottom is in but I am bullish and this outlook will only be invalidated by a break below 7753

MTN Cycle Has Failed EarlyMTN price went below R131.25 representing a cycle failure, since this is early in the cycle, we can expect price to begin trending downwards with high probability we are going below R107.35 (the previously weekly low). The share has also failed to recover the broadening wedge. In the short-term we can expect a weak bounce out of a half cycle correction.

Our opinion on the current state of MTNMTN, a leading emerging market mobile operator, serves a vast customer base of 290 million people across 19 countries in Africa and the Middle East, with significant subscriber bases in Iran, Nigeria, and South Africa. The company operates in a challenging environment characterized by fierce competition and declining voice revenue, offset to some extent by the growth in data usage. However, political risks in key markets such as Iran and Nigeria add to its overall risk profile.

To diversify its revenue streams and address these challenges, MTN is expanding into fintech services, partnering with Sanlam to offer insurance products and rolling out mobile money services in several countries. The company aims to become a digital operator with a focus on fintech, digital, enterprise, and wholesale business areas.

Despite its efforts to expand into new sectors, MTN faces regulatory and tax challenges in some markets. For instance, it received a tax assessment of $773 million from Ghanaian authorities, reminiscent of similar challenges in Nigeria. However, partnerships such as the one with Mastercard, which took a significant stake in its fintech business, provide opportunities for growth and innovation.

In its financial results for the year ending December 31, 2023, MTN reported a 6.9% increase in service revenue but a significant decline of 72.3% in headline earnings per share (HEPS). The decline in HEPS may be attributed to various factors, including regulatory challenges and economic volatility in key markets like Nigeria.

With a current price-to-earnings ratio (P/E) of 29.14, MTN's stock appears expensive, especially considering its recent downward trend since March 2022. Investors are advised to monitor the stock closely and wait for a clear upside break from the downward trendline before considering further investment.

MTN.JO Potential Bull Flag Study.MTN as we recently have seen, was bashed down.

The recovery is now printing a Bull Flag at certain key Fibonacci Levels, which could signal some further upside in next few months.

The Chart documents my thoughts.

As always get a few Experts advice before making any Investment or Trades.

May 2024 be prosperous to all.

Regards Graham.

Our opinion on the current state of MTNMTN, a prominent mobile operator in emerging markets, serves a vast customer base of 290 million people, including 29 million in South Africa, across 19 countries in Africa and the Middle East. The company's substantial subscriber bases are primarily located in Iran, Nigeria, and South Africa. Like many in the mobile service industry, MTN faces intense competition and a decline in voice revenue, challenges partially offset by a significant rise in data usage. However, the company's operations are deemed particularly risky due to the political instability in Iran and Nigeria.

In a strategic move to diversify its revenue streams, MTN is collaborating with Sanlam to introduce insurance products to its clientele, aiming to establish fintech as a core component of its business model. This initiative reflects MTN's ambition to transform into a digital operator with a focus on fintech, digital services, enterprise, and wholesale business areas. The rollout of mobile money services in Nigeria and South Africa, extending to 14 of the 21 countries where it operates, underscores this ambition. With 41.8 million mobile money customers, MTN is targeting an increase to 60 million users. Additionally, MTN's listing on the Nigerian stock exchange marks a significant milestone in its expansion efforts.

However, MTN's operations have not been without challenges. On 13th January 2023, the company was hit with a $773 million (approximately R13.3 billion) tax assessment by the Ghanaian tax authorities, an action perceived as a financial shakedown similar to a previous incident in Nigeria. Despite these hurdles, MTN reported a 16.5% increase in service revenue and a 7.1% rise in headline earnings per share (HEPS) for the six months ending 30th June 2023. The subscriber count also saw a modest increase to 291.7 million.

The partnership with Mastercard, which involves a R100 billion stake in MTN's fintech business, represents a significant endorsement of MTN's fintech initiatives and its potential for growth. Nevertheless, the company faced challenges in maintaining its performance amidst high inflation rates across its markets, as indicated in the update for the three months ending 30th September 2023, with service revenue up by 9% and a slight increase in total subscribers.

Looking ahead, MTN's financial outlook appears pressured, with an estimated 60% to 80% drop in HEPS for the year ending 31st December 2023, attributed to non-operational factors such as hyperinflation adjustments and foreign exchange losses, particularly from naira depreciation. This situation highlights the impact of economic volatility in Nigeria on MTN's overall performance. With a current P:E ratio of 7.06 and a declining share price since March 2022, the recommendation is to monitor the share's trend closely and consider investing only upon a clear upward trendline break, indicating a potential reversal in its fortunes.

UPDATE: MTN Diamond Break down and heading to R60.65This has been a long winded analysis.

We sent out this one on 22 Dec 2023, which gave a Conservative entry from the Dimaond Breakdown.

And now the momentum is picking up to the downside.

We also have an Reverse Inv Cup and Handle which is rare but also effective.

The Nature is still High probability as the Price is below BOTH 20MA and 200MA.

Target easily still to R60.65

$JSEMTN - MTN: 8700 Invalidated, What's The Alternative Outlook?See link below for previous analysis.

MTN stock had a strong rally from 8700 to 11800 and as per the previous analysis, it turned out to be a dead cat bounce as price has broken below 8700.

I have changed the triangle wave count slightly {previously have wave E of (B) terminating at 14289} which gives a new perspective for the decline from 14299.

The decline from 14299 to the current price can be labelled as a five wave impulse.

There are no signs of a reversal yet so I will not get ahead of myself. I am on the lookout however for a MACD convergence buy signal that could give an early signal of a potential bottom.

I am more interest in upside based on this wave count but i will sit on my hands until I see bullish price action.

UPDATE: MTN on the way to the R60.65 level :(Diamond Formation formed on MTN.

This is a broadening pattern that could have broke either way. The fact that it broke down and almost retested the 200MA showed the momentum was down and bearish.

Now it's on a one way trip down. First to R90.00 at next support

If it breaks below we could very well see our main target at R60.65

FUNDAMENTALS

MTN Group, a big telecom company in Africa, is facing a serious lawsuit in the US.

They are accused of doing business with a group linked to terrorism, which could have helped fund terrorist activities.

This is a big deal because it's the first time a company might be held responsible in the US for helping a terrorist group. Because of these legal issues, investors might be worried about MTN's future.

This concern can lead to a drop in MTN's stock price, as investors might sell their shares fearing potential financial losses or damage to the company's reputation.

MTN Black Diamond to take the price to R60.65?Diamond Formation formed over ther last two years with MTN.

Now initially, you wait for a breakout before you trade a broadening pattern like the diamond.

And then, we saw it break below - showing the momentum and supply was higher to the downside.

I sent this analysis out and called it a short investment. What that means is that this type of trade is a LONG hold and it will take time to hit the target. Luckily with CFDs you'll earn interest on the trade.

And as price is staying below the 200MA, the target is still on to R60.65

Thoughts?

UPDATE: MTN heading to test the mighty 200MA before downsideThe Broadening Diamond formation has finally broken below. The price came down but on weak selling volume.

Now it seems to head up to test the 200MA before deciding which main direction it wants to go.

THe overall prior trend was down and the breakdown was also confirming for the bears.

WIll have to wait for a conservative approach for the price to test the 200MA before taking any action.

MTN GROUP (MTN)Looking at MTN's price action, it's been on a downtrend since breaking out of a sideways range. The RSI shows it's oversold. I'm waiting for the RSI to cross above the downtrend line, similar to what happened in May 2023 after the earnings report.

My plan is to aim for a target of 108-110 initially. If it breaks above that with good support, I'll consider adding to my position, and my next target would be around 130.

$JSEMTN - MTN: Is A Bottom In At 8700 cps? Early Speculative BuySee link below for previous analysis.

MTN stock continued lower from the previous analysis.

The stock has caught a bid at 8700 and might have a relief rally, dead cat bounce, or a bottom could be in at 8700 and this could be the early stages of a longer-tern rally.

There is not much to support a thesis that a bottom is in as the bounce is not on high volume and there was no MACD/price convergence prior the bounce.

It's all about probabilities and risk management so any long trades should use 8700 as a stop-loss level.