LOM trade ideas

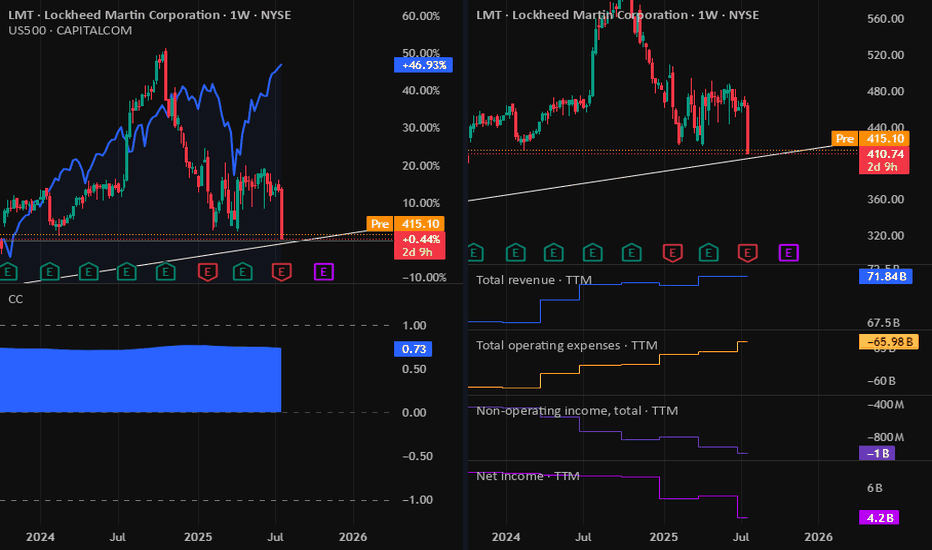

LMT: Lookheed Martin Dropped on Earnings 23-07-2025The dividends now is around 3% which is good for a strong company like Lookheed Martin. But as we are seeing a drop in company profits & Equity, and the stock price is near to a support level, we have to monitor the stock for the next few days or weeks. If all is ok, I will consider buying it.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

LMT – Long Setup IdeaLMT – Long Setup

Current: \$463.01 | Premarket: \$464.01 (+0.22%)

---

📊 Why I’m Eyeing the Long:

✅ Strong base at \$450–460 – buyers defending this level hard for months. Solid floor.

✅ Premarket green after red day = possible bounce play incoming.

✅ Deutsche Bank PT \$472 – not huge, but confirms it’s not dead weight.

✅ Defense sector = safety play in choppy markets. War tension = bullish tailwind.

✅ Low vol + tight range = setup for breakout. Watching for volume push.

---

🎯 Trade Plan:

• Entry: $460–464 zone

• Short- Term TP: $480

• Medium-Term TP: $500+

• SL: Clean below $450 (tight risk)

---

📅 Earnings in 13 days – this could move early.

⚠️ Watch volume at open.

---

Just my setup – trade your plan. Let’s see what the tape gives us.

Buy Idea: LMT @ around $480This war is really happening right now between Israel, Iran, and the United States.

Because of this, countries are spending more money on weapons, defense systems and military gear.

The U.S. and its friends are about to increase their defense budgets and Lockheed Martin is one of the biggest companies that supplies fighter jets, missiles, and radar systems.

A buy signal just appeared near $480 and the stock has strong support around $454. That means it has a good chance of going up without falling too much. If this uptrend continues, we could see the price go back to $600 or even higher.

This is a good time to buy because everything is working in Lockheed’s favour right now.

The war is growing, defence spending is rising and national security is a big topic. Lockheed could also win more government contracts soon.

U.S. – Iran Tensions: How Geopolitics Could Rattle the MarketsRising tensions between the United States and Iran are once again casting a shadow over global markets. From oil prices to defense contractors and transport stocks, this situation has the potential to ignite volatility across several key sectors.

🔍 What Traders Should Watch:

Oil & Energy Stocks – If conflict escalates, crude oil prices could spike due to potential supply disruptions in the Strait of Hormuz, a vital chokepoint. Keep an eye on:

XOM (ExxonMobil)

CVX (Chevron)

SLB (Schlumberger) – oil services could ride the volatility.

Defense & Aerospace – Rising geopolitical risk often boosts defense budgets and demand for military equipment. Critical stocks to watch:

LMT (Lockheed Martin)

RTX (RTX Corp)

NOC (Northrop Grumman)

Airlines & Transportation – Higher oil prices and risk aversion usually hit these hard:

DAL (Delta)

AAL (American Airlines)

FDX (FedEx)

Gold & Safe Havens – In uncertain times, money often flows into safer assets:

GLD (Gold ETF)

TLT (20+ Year Treasury Bond ETF)

📊 This setup could offer both long and short opportunities depending on your strategy. Stay updated on news and technical levels to avoid getting caught on the wrong side of the move.

💬 What sectors do you think will benefit the most if this tension escalates? Drop your thoughts below 👇

🛑 Disclaimer: This is not financial advice. Always do your own research before investing.

What happens when war whispers... and Wall Street listens? 🦅🔥

"🌍 📉📈

Lockheed Martin ( NYSE:LMT ) just pierced through a tightening triangle 🔺— like a fighter jet breaking the sound barrier ✈️💥

Coincidence? 🤔 Or is this price action a signal of something brewing behind the scenes? 🕵️♂️

⚔️ Global tension is rising.

💰 Defense budgets are booming.

And NYSE:LMT ?

Quiet no more. 📢

🎯 Trade Setup:

📌 Entry: $470.50

📈 Target: $481+

🛑 Stop-loss: Below trendline

The chart speaks 📊. The world watches 🌐.

👁️🗨️ Are you paying attention?

#LMT #DefenseStocks #StockBreakout #WarTrade #TradingWithEdge #MarketMoves #Geopolitics #TradingViewSetup

How will Israel-Iran war affect Lockheed Martin?Why LMT Could Go Up

Defense Stocks Rally on Tensions

-LMT surged ~3–4% recently after Israel’s major strike on Iran’s nuclear facilities, similar to gains seen in other defense names like RTX and Northrop Grumman.

F-35 & Advanced Weapons in Spotlight

-Israel deployed its F‑35I Adir (built by Lockheed) in the strike, demonstrating the jet’s central role in modern military operations.

-With growing international demand for advanced fighters and missile systems, sales could accelerate.

Backlog & Contract Strength

-LMT carries a massive order backlog (~$55 billion), recently securing large contracts like Patriot missile updates and naval systems—critical as global militaries boost budgets .

Analyst Upgrades

-JPMorgan, among others, upgraded LMT to “Buy” in response to geopolitical risk benefiting defense spending.

Risks & Headwinds

Volatility is Short-Term

-Defense stocks often jump in response to geopolitical escalation but can also retreat swiftly once tensions de-escalate .

Broader Market Pressures

-While LMT benefits directly, overall markets declined (~1–2%) and oil spiked on conflict fears—this broader risk sentiment can limit long-term flows into equities .

Execution & Budget Risk

-LMT depends on consistent defense budgets. Any shifts in U.S. or allied priorities, or cost overruns, could weigh on future growth.

Valuation Uncertainty

-Even after the recent rise, LMT trades around $486, likely pricing in many upside expectations. Limited catalysts beyond ongoing conflict could constrain further gains.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

Lockheed Martin (LMT): Defense Supercycle + Trend ContinuationOverview Summary

Lockheed Martin ( NYSE:LMT ), one of the largest defense contractors globally, is entering a critical inflection point, both technically and geopolitically. With rising global conflict risk and structural shifts in defense spending, Green Zone Capital is re-accumulating long-term positions across the defense sector, particularly in LMT.

Recent geopolitical escalations, such as the ongoing Russia–Ukraine war, tensions between Israel and Iran, and broader global instability sparking WW3 discussions, are fueling a sustained rise in defense budgets. As a primary supplier to the U.S. Department of Defense and allied nations, LMT is uniquely positioned to benefit from this potential multi-year war cycle.

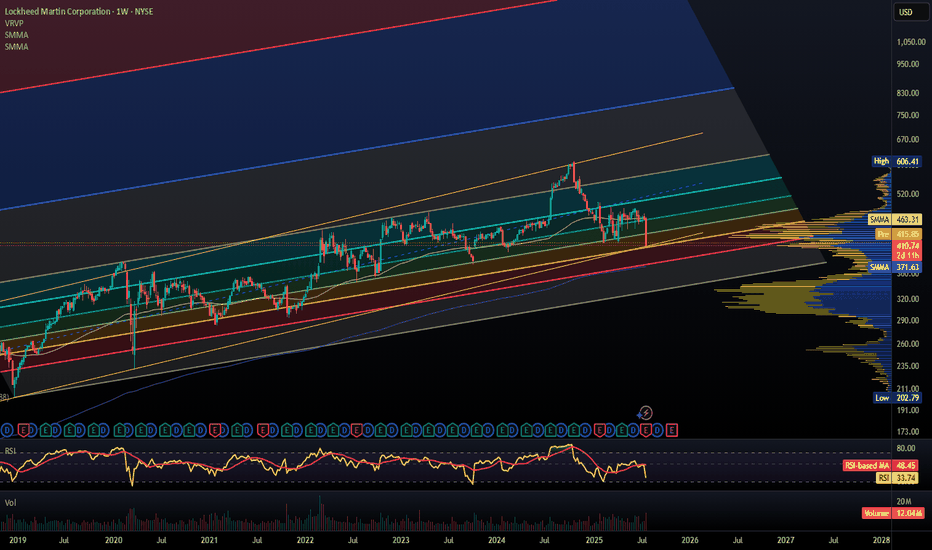

Technical Setup

LMT has traded in a clearly defined long-term rising channel for years, and it recently pulled back to the lower bounds of this channel near $450, a historically strong support level that has acted as a major accumulation zone since early 2023.

Key Technical Highlights:

Major pullback from $600 highs in late 2024

Established support zone $450 confirmed with multiple rejections

Breakout from recent consolidation structure signals momentum shift

Targeting $600–$620, the upper range of the channel, which aligns with prior highs

This bounce offers a strong risk-reward setup, especially for long-term investors seeking stability, dividends, and exposure to defense-driven macro trends.

Macro Tailwinds for LMT

Defense Supercycle: Global conflicts are shifting defense budgets upward, with NATO allies pushing toward the 2% GDP defense spending threshold.

Product Dominance: Flagship programs like the F-35, THAAD missile systems, and space assets remain top priorities for governments worldwide.

Reliable Cash Flow & Dividends: LMT generates consistent free cash flow and rewards long-term shareholders with increasing dividends.

Increased Demand for Aerospace, Satellites, and ISR systems as modern warfare requires more data, AI-powered decision support, and space-based command infrastructure.

Green Zone Capital Outlook

We believe Lockheed Martin is undervalued at current levels given the asymmetric risk profile of today’s geopolitical landscape. With defense spending likely to remain elevated through 2025–2028 and potential for prolonged global military operations, LMT offers long-term exposure to a defensive compounder with upside momentum.

This position is now part of Green Zone Capital’s defense and industrial equities allocation, and we will continue monitoring global macro catalysts and trend development. Our current outlook targets a move back toward $600+, supported by both fundamental strength and long-term technical structure.

LMT sky high rocket stock LMT has been experiencing some intense changes in geopolitical conflict for next week. Leading analysts to observe closely LMT price behavior according to avg volume. We’re al expecting LMT to rise just above $520 by next week in order to accommodate some liquidity. Keep buying if not yet more.

LMT Bull rally NOW LMT has seen major consolidation in the last month. Analysis agrees that although a rough match was felt with recent US shorting orders this was a minor bump on the road since many other project are abead and other kitties such as Germany and Italy are ramlling up defense and air capabilities. LMT is going towards $520 by next week.

Took a Small Position in $LMT (Lockheed Martin)Spotted a solid risk/reward setup here on the daily.

✅ Entry: $469.98

🎯 Target: $495.61 (+5.45%)

🛑 Stop: $461.52 (–1.80%)

🔁 R:R = 3.03

🕹️ Trading just above the cloud with support from the base line — if momentum builds and breaks the recent resistance range, this could move fast.

Just nibbling for now, watching for confirmation before scaling.

#LMT #DefenseStocks #SwingTrade #Ichimoku #RiskReward #TradingView #StockMarket

Safe Entry LMT Currently stock price near P.High (Previous High) which acts as strong resistance, Current stock news with USA golden defense shield (wutever it called) support the stock to change tides and to start moving UP strongly.

Each Take Profit Line is where you focus and check for any selling pressure to secure your profit as swing trader if you mid term trader just wait till it hits the last Take Profit Line.

In worse case scenario if price didnt go Above Current strong resistacne (which I strongly believe it will go higher and go through it easily) the P.Low(Previous Low) Acts as Strong Support level for safest entry.

And to get in easily and safely wait for this scenario to happen:

Scenarios One: strong buying volume with reversal Candle.

Any Pre-market strong buying also Confirm the direction from current price level.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

Note: at Take Profit Lines Always watch out for any selling pressure to exist your position and secure profit.

Golden Dome: the new space shield redefining global securityBy Ion Jauregui – Analyst, ActivTrades

In the full-throttle race for orbital supremacy, the U.S. government has unveiled its ambitious “Golden Dome” plan, a next-generation missile-defense system that builds on the newly established Space Force. With an estimated budget of USD 175 billion and an operational target date of 2029, the project aims to detect and neutralize threats using space-based interceptors and a network of sensors and communications capable of near-real-time alerts.

A rebooted heir to Reagan’s “Star Wars”

In the 1980s, Ronald Reagan launched the Strategic Defense Initiative—widely dubbed “Star Wars”—to shoot down enemy missiles in mid-flight. That effort collapsed under technological constraints and fears of uncontrolled proliferation. Today, however, evolving strategic challenges have revived the need for a deep-layered defense before a long-range weapon can threaten national security.

Threats without borders or predictable trajectories

The danger spectrum has expanded: from Russian satellites carrying offensive payloads to Chinese nuclear-capable hypersonic glide vehicles. Added to that are coordinated swarms of drones and erratic missiles—like the one Iran launched at Israel in April 2024. “By 2050, we should expect ultra-precise threats launched from any domain, including space,” warned Frank Kendall, former Secretary of the Air Force, in a December report. “There will be no sanctuary. Space will be recognized as the decisive domain for almost all military operations.”

L3Harris and Lockheed Martin front and center

Defense giants are already lining up. L3Harris Technologies (LHX) will supply next-generation satellite communications and infrared sensors, while Lockheed Martin (LMT) will refine space-based interceptors and ground integration. Both predict Golden Dome will generate billions in revenue for over a decade, with the technology potentially exportable—under strict controls—to allied nations keen to bolster their defenses.

Lockheed Martin: fundamentals under the spotlight

In fiscal 2024, Lockheed Martin smashed its own sales record, reaching USD 71,043 million versus USD 67,571 million in 2023. Yet net profit dipped from USD 6,920 million in 2023 to USD 5,336 million in 2024, weighed down by higher R&D costs and accelerated space-program spending on Golden Dome. The momentum continues into 2025, with Q1 sales of USD 18,000 million (+4 % YoY) and net earnings of USD 1,712 million, although margins have stalled slightly amid heavy investment in orbital infrastructure and interceptor satellites. On the markets, LMT closed at USD 475.82 on May 20, 2025—2.5 % below its USD 485.94 year-open high—after swinging between lows near USD 419 and highs above USD 509, reflecting investor jitters over Golden Dome’s costs and new Space Force contracts.

A security gap and the future of treaties

Deploying an orbital shield poses vast diplomatic challenges. The ability to intercept missiles in their boost phase would undermine the doctrine of mutual assured destruction and accelerate obsolescence of the 1967 Outer Space Treaty, which bans weapons of mass destruction in orbit. Several nations, notably Russia and China, have already voiced objections and warned they may respond by expanding their own counter-space arsenals.

Toward a new arms race?

As the West grapples with these questions, Golden Dome looms as a prime catalyst for a potential space arms race. Beyond tangible gains in homeland defense, the real test will be balancing deterrence without triggering a tit-for-tat cycle that leads to irreversible militarization of Earth’s orbit.

Conclusion

Golden Dome is more than a technological evolution of an ’80s dream—it is America’s bet to retain strategic advantage in the final frontier. With L3Harris and Lockheed Martin at the vanguard and an international stage fraught with recriminations, the project will shape global security and space law for years to come. As development advances, the world community must decide whether a defensive shield can coexist with orbital peace or, conversely, usher in an unprecedented era of tension.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

LMT eyes on $462.68: First of 3 barriers to painting a BottomLMT price has been struggling for a long time.

Currently testing a proven zone from underside.

Looking for a Break-n-Retest to start a position.

$ 459.44-462.68 is the immediate resistance

$ 474.33-476.30 will be a minor resistance

$ 486.35-489.04 is the next major resistance

=========================================

Previous Analysis that called the TOP

=========================================

.

$LMT began scaling the world’s most expensive weapons programLockheed Martin began scaling the world’s most expensive weapons program back in 2013. A nice match with Palantir? Isn't it? ;)

Since 2013, NYSE:LMT has been on a long-term upward trajectory - marked by consistent higher lows and major consolidation zones.

But here’s what most people don’t ask:

Why 2013? Why then?

The Real Catalyst: F-35 Lightning II

That single event? It triggered:

→ Full-rate production across the U.S. and allied nations

→ Huge visibility into long-term defense revenues

→ Global adoption (UK, Israel, Japan, Australia…)

Look closely at the chart and you’ll see:

→ Key support zones (red lines) from $430–$450

→ Massive consolidation in 2017–2020 and again 2022–2024

→ A textbook bullish structure on the weekly time frame

Price is sitting at ~$469. If this support holds… we may be at the start of the next leg up.

This wasn’t just a product launch. It was a multi-decade defense bet. And it paid off.

Post-2011 U.S. defense budgets started climbing again.

And where did that money go?

→ Aerospace

→ Missile defense

→ Cybersecurity

All categories where Lockheed Martin dominates.

Major wins that anchored the trend

From 2013 to today:

→ Multi-billion dollar Pentagon F-35 contracts (Lot 6 to Lot 17 — $18B in 2023 alone)

→ International THAAD defense system deals

→ Long range hypersonic weapon delivery

→ Space wins via NASA’s Artemis program

Each of these was a fundamental “trust” signal to the market.

LMT bias upside on Ride with the trend method18 May 2025

Lockheed Martin (LMT) – Bullish Setup Supported by Saudi Arms Deal

The U.S. has agreed to a $142 billion arms package with Saudi Arabia, which has sparked positive sentiment around defense contractors. Lockheed Martin (LMT), a potential key beneficiary of the deal, may gain momentum as the news develops.

From a technical analysis perspective, LMT is currently trading near an ascending trendline support, which coincides with the 200-day moving average (MA)—a strong confluence zone suggesting continuation of the current uptrend.

Bias remains to the upside, with immediate resistance seen around $500, which may act as the first hurdle. A break above this level could open room for further gains, in line with the prevailing trend.

Strategy: Ride the trend as long as price respects the ascending support.

LMT Outlook long termMy strategy is to gradually add to my position using the following entry points:

• 446

• 411

• 399

• 360

Once the price begins to move higher, I’m planning to take profits in stages. My first profit target is 467, followed by 478, and if the momentum continues, I’m aiming for 500+.

This trading plan is based on my personal analysis and trading strategy, and it should not be considered financial advice. Always conduct your own research and consult with a professional financial advisor before making any trading decisions, as trading involves significant risks and past performance does not guarantee future results.

LOCKHEED MARTIN Stock Chart Fibonacci Analysis 042525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 464/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

LMT Lockheed Martin Corporation Options Ahead of EarningsIf you haven`t bought LMT before the recent rally:

Now analyzing the options chain and the chart patterns of LMT Lockheed Martin Corporation prior to the earnings report this week,

I would consider purchasing the 490usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $18.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.