BMPS - 5 months RECTANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.549 EUR

1.95 B EUR

6.80 B EUR

809.42 M

About BANCA MONTE PASCHI SIENA

Sector

Industry

CEO

Luigi Lovaglio

Website

Headquarters

Siena

ISIN

IT0005508921

FIGI

BBG000KJX8V7

Banca Monte dei Paschi di Siena SpA engages in the provision of retail and commercial banking services. It operates through the following business segments: Retail Banking, Wealth Management, Corporate Banking, Larg Corp. And Investment Banking, and Corporate Center. The Retail Banking segment includes sales activities of retail customers. The Wealth Management segment focuses on the sales activities of private banking customers and the subsidiary MPS Fiduciaria. The Corporate Banking segment refers to the sales activities of corporate customers, large corporate area, Foreign Branches and the subsidiaries MPS Capital Services, MPS Leasing & Factoring and the foreign banks BMP Belgio S.A. and MP Banque. The Large Corp. And Investment Banking involves the results of Large Group customers and subsidiary MPS Capital Services. The Corporate Center segment includes the results of the service operations supporting the Group’s business, dedicated to the management and development of information technology systems; companies consolidated at equity and held for sale; and operating units, such as proprietary finance, asset liability management, treasury and capital management. The company was founded in 1472 and is headquartered in Siena, Italy.

Related stocks

BMPS - 1 year ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

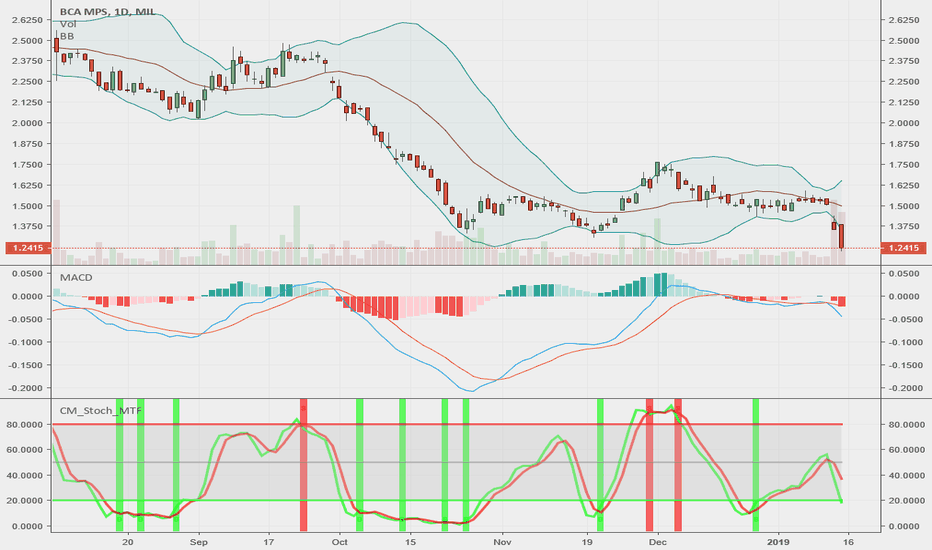

BANCA MONTE DEI PASCHI DI SIENA - SHORT Guys,

A long black candle associated to increased volumes and the widening out of the Bollinger Bands give us a clear indication about the

next direction downwards.

A closure below the horizontal support will be devastating. 1st target at 1 euro. There is much more room to see the stock tumblin

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS2228919739

BcMtPaschiSiena 8,5% 10/09/2030Yield to maturity

8.28%

Maturity date

Sep 10, 2030

IT0004999204

BcMtPaschiSiena FRN 31/12/2025Yield to maturity

4.46%

Maturity date

Dec 31, 2025

XS2676882900

BcMPasch 6.75% 27Yield to maturity

4.39%

Maturity date

Sep 5, 2027

IT565752

BCA PASCH.SI. 25/35 FLRYield to maturity

4.26%

Maturity date

Oct 2, 2035

XS1752894292

BcMtPaschiSiena 5,375% 18/01/2028Yield to maturity

3.46%

Maturity date

Jan 18, 2028

A4EBVU

BANCA MONTE DEI PASCHI DI SIENA SPA 2025-28.05.31 REG S FIXED/FLOATING RATEYield to maturity

3.40%

Maturity date

May 28, 2031

XS2785686523

BcMPasch 4.75% 29Yield to maturity

3.33%

Maturity date

Mar 15, 2029

XS2947917527

BcMPasch 3.625% 30Yield to maturity

3.32%

Maturity date

Nov 27, 2030

XS203192673

MTE PASCHI SI. 19/29 MTNYield to maturity

3.27%

Maturity date

Jul 23, 2029

IT0005497521

MPS TF 2% AP26 COVERED CALL EURYield to maturity

3.01%

Maturity date

Apr 29, 2026

IT565533

BCA PASCH.SI 25/31 MTNYield to maturity

2.99%

Maturity date

Jan 18, 2031

See all MPI0 bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange BCA MONTE D.PASCHI D.SIE. stocks are traded under the ticker MPI0.

We've gathered analysts' opinions on BCA MONTE D.PASCHI D.SIE. future price: according to them, MPI0 price has a max estimate of 9.70 EUR and a min estimate of 7.20 EUR. Watch MPI0 chart and read a more detailed BCA MONTE D.PASCHI D.SIE. stock forecast: see what analysts think of BCA MONTE D.PASCHI D.SIE. and suggest that you do with its stocks.

MPI0 reached its all-time high on May 13, 2025 with the price of 8.426 EUR, and its all-time low was 1.587 EUR and was reached on Nov 7, 2022. View more price dynamics on MPI0 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track BCA MONTE D.PASCHI D.SIE. financials in yearly and quarterly reports right on TradingView.

BCA MONTE D.PASCHI D.SIE. is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

MPI0 net income for the last half-year is 791.58 M EUR, while the previous report showed 1.16 B EUR of net income which accounts for −31.71% change. Track more BCA MONTE D.PASCHI D.SIE. financial stats to get the full picture.

Yes, MPI0 dividends are paid annually. The last dividend per share was 0.86 EUR. As of today, Dividend Yield (TTM)% is 11.97%. Tracking BCA MONTE D.PASCHI D.SIE. dividends might help you take more informed decisions.

BCA MONTE D.PASCHI D.SIE. dividend yield was 12.64% in 2024, and payout ratio reached 55.53%. The year before the numbers were 8.21% and 15.35% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 16.73 K employees. See our rating of the largest employees — is BCA MONTE D.PASCHI D.SIE. on this list?

Like other stocks, MPI0 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BCA MONTE D.PASCHI D.SIE. stock right from TradingView charts — choose your broker and connect to your account.