MS51 trade ideas

I'm shorting thisTwo weekly timeframe for a better understanding. Looks like a large bearish flag forming. Price just bounce off the bottom of the flag. But I think is a dead cat bounce. Is hitting a resistance level 35-36. Doesn't look too sting to break it up. SL triggers if a weekly candle breaks up the resistance and closes above it.

SMCI Is it still a buy following the Q3 revenue and profit cut?Super Micro Computer Inc (SMCI) cut its third-quarter revenue and profit expectations due to delays in customer spending, amplifying worries of a pullback in AI-linked investments and pushing its shares down -16% pre-market.

It has been 6 months since we issued a major buy signal on SMCI (November 07 2024, see chart below):

Even tough our $122.50 long-term Target still stands, we have to move it later on the time-line until the economic outlook shows the positive signs of 2024 again.

Until then, we have a more medium-term Target of $80.00, which is on the 0.786 Fibonacci retracement level, the same level the price hit in March 2019, following the first U.S. - China Trade War in 2018.

As you can see, the recovery patterns in terms of 1W RSI between the two fractals are almost identical.

Right now the stock is basically consolidating within the 1W MA50 (blue trend-line) and 1W MA200 (orange trend-line), waiting for the next round of expansion news for the market, to break above the Triangle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SMCI ONCE IN A LIFETIME DIP BUY!!!Ive taken a $600 position on SMCI I will be looking to size into as it works. You can clearly see what happened last time we were at this price area. I have less than a $1 stop loss if price were to return below the green line. This will be a LONGGGGGGGGGGG hold into the future.

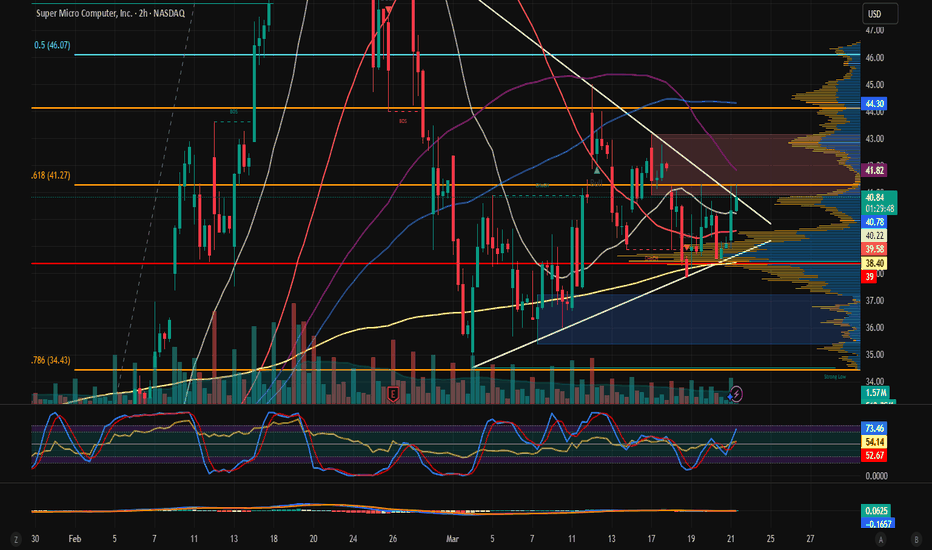

SMCI – 30-Min Long Trade Setup!📈 🟢

🔹 Asset: Super Micro Computer, Inc. (SMCI – NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Breakout Retest at Key Supply Zone

📊 Trade Plan – Long Bias

✅ Entry Zone: Around $36.67 (breakout + retest confirmation)

✅ Stop-Loss (SL): $34.25 (below structure & recent low)

🎯 Take Profit Targets:

📌 TP1: $39.51 – Prior resistance zone

📌 TP2: $43.36 – Major structure / supply zone

📐 Risk-Reward Calculation

🟥 Risk: $36.67 - $34.25 = $2.42/share

🟩 Reward to TP2: $43.36 - $36.67 = $6.69/share

📊 R/R Ratio: ~1 : 2.76 – Strong long setup

🔍 Technical Highlights

📌 Trendline breakout with retest at resistance ✔

📌 Holding above yellow resistance zone ✔

📌 Strong bullish momentum on breakout ✔

📌 Good volume + clean continuation structure 🔼

📉 Risk Management Plan

🔁 Move SL to breakeven after TP1

💰 Take partial profits at TP1

📈 Let runners target TP2

📏 Discipline over impulse – follow chart

⚠️ Setup Invalidation If:

❌ Breaks and closes below $34.25

❌ Reversal with strong bearish engulfing

❌ Fails to hold above yellow zone

🚨 Final Thoughts

✔ Clean technical breakout with volume and structure

✔ Defined stop, solid R/R = smart trade setup

✔ Great candidate for swing traders looking for momentum

🔗 #SMCI #StockBreakout #ProfittoPath #ChartSetup #TechnicalAnalysis #BullishTrade #NASDAQStocks #SmartTrading #RiskReward #MomentumPlay

SMCI: Enormous buy opportunity for a $70 Target.Super Micro Computer went from oversold to almost neutral on its 1D technical outlook (RSI = 42.789, MACD = -2.030, ADX = 39.343) as it is having an enormour turnaround on the 1W MA200 and the bottom of the Channel Up today. This is so far the biggest 1D green candle since January 19th 2024. The 1D RSI is on the same rebound as the February 3rd bottom was, so at least a +158.65% bullish wave is to be expected. Go long, TP = 70.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Opening (IRA): SMCI April 17th 34 Covered Call... for a 32.13 debit.

Comments: High IVR/IV. Selling the -84 delta call against shares to emulate the delta metrics of a 2 x expected move 16 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 32.13/share

Max Profit: 1.87

ROC at Max: 5.82%

50% Max: .94

ROC at 50% Max: 2.91%

Will generally look to take profit at 50% max, roll out short call if take profit is not hit.

How far will it eventually fall SMCI?During such a general crisis, things are very complicated for all stocks and everything depends. The fundamentals are key here and any decision by Trump can change things in a second and that is why we say how far, not how far will it fall. Given the possible further decline of the SP500 to around $5360-5400 and based on the 4-hour chart, it is clearly seen that the dynamic support line from the accumulated volume lies at around $29.5 and $30.5. The reversal signals are clear (the green triangles below). Therefore, it is very unlikely that we will see a drop below $30 . This is a very good entry point, but I do not advise anyone to trade until April 2, although I think things will become clear later today or tomorrow.

Super Micro Trade IdeaA risky trade, but with great risk comes great reward. We are at the trendline touching for the third time, and we have pivot off it in the pre market. A company who has demonstrated strong growth potential and the AI bubble starting to come together this will be a stock I will hold onto for sometime.

SMCI is a bargain here. Target $90.Super Micro Computer Inc / SMCI is trading inside a Channel Up.

The new bearish wave has already completed a -47% decline, same as the previous one, and the symmetry inside this pattern seems very high.

The price is now very close to the Channel's bottom and is technically a strong buy opportunity.

We expect a new higher high close to the 1.618 Fibonacci extension.

Buy and target $90.

Follow us, like the idea and leave a comment below!!

Bullish Reversal Setup SMCI!📊 Falling Wedge Breakout Forming 🚀

SMCI is showing signs of a bullish reversal after a strong downtrend. Price is consolidating inside a falling wedge pattern and now testing support near $36.55. This setup offers a high reward-to-risk opportunity for an upside breakout.

✅ Trade Plan (Long Position)

• Entry: Above $37.05 (wedge breakout confirmation)

• Stop-Loss: Below $35.44 (structure support + wedge base)

🎯 Take Profit Targets:

• TP1: $39.82 (key resistance zone)

• TP2: $43.32 (major recovery level)

• TP3: $44.00+ (extended upside zone)

📈 Risk-Reward Breakdown

• Risk: $37.05 - $35.44 = $1.61

• Reward to TP1: $2.77 → ~1:1.7

• Reward to TP2: $6.27 → ~1:3.9

• Reward to TP3: $6.95 → ~1:4.3

💡 Strong potential with price bouncing near demand + wedge breakout.

🔍 Technical Analysis

✅ Falling Wedge Pattern: Classic bullish reversal setup

✅ Support Zone: Horizontal and diagonal support at $36.55

✅ Volume Check: Monitoring for spike as confirmation

✅ Price Action: Buyer reaction visible near lower trendline

🧠 Strategy & Risk Management

• Wait for a 30-min candle close above $37.05 to confirm breakout

• Move SL to breakeven after hitting TP1 at $39.82

• Take 50% profit at TP1, ride remaining position toward TP2 & TP3

• Protect gains with a trailing stop on higher timeframe

📚 Value for Traders:

This setup is a great example of how falling wedges often signal trend exhaustion. Combined with support and declining volume, it suggests a shift in momentum. Breakouts from such structures can be explosive when confirmed with price and volume.

⚠️ Risk Factors

❌ Weak breakout without volume

❌ Breakdown below $35.44 invalidates the setup

✅ Focus on execution and not prediction

🎯 Final Thoughts

High-probability long opportunity on a quality setup.

Follow the plan. Stick to the levels. Let the chart lead the way. 📈

🔗 #SMCI #StockSetup #ProfittoPath #BreakoutStrategy #ChartAnalysis #TradingView #SmartTrading #BullishReversal #FallingWedge 💰📊

SMCI Wants to Go HIGHERIn recent developments, Super Micro has experienced significant stock volatility. After filing delayed financial reports to regain Nasdaq compliance, the stock initially surged but faced declines due to broader market factors and investor concerns. Analysts have mixed views: Mizuho Securities assigned a neutral rating with a $50 price target, citing competition in the AI server market, while Goldman Sachs highlighted both opportunities in AI demand and risks like increased competition and margin pressures.

I am tracking this using Elliott wave theory. I will update periodically. The white line is my current cost basis.

SMCI pampThe company provides its products to enterprise data centers, cloud computing, artificial intelligence, 5G, and edge computing markets. It sells its products through direct and indirect sales force, distributors, value-added resellers, system integrators, and original equipment manufacturers.

SMCI: Channel Up bottomed on the 1D MA50. Long term Target: $148Super Micro Computer Inc is neutral on its 1D technical outlook (RSI = 52.184, MACD = 0.800, ADX = 28.146), the ideal condition to go on a long term buy as the price has been holding the 1D MA50 for 2 straight weeks. The goal now is to cross again above the 1D MA200 but that was already done on February 18th and the pattern that has been established is a Channel Up. The market however may be aiming at much higher as the November 14th 2024 bottom was priced on the Head of an Inverted Head and Shoulders pattern, a technical bullish reversal formation that targets its 2.0 Fibonacci extension once completed. The trade is long, TP = 148.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##