Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.034 EUR

3.34 B EUR

11.71 B EUR

43.74 B

About BANK MANDIRI (PERSERO) TBK

Sector

Industry

CEO

Darmawan Junaidi

Website

Headquarters

Jakarta

Founded

1824

ISIN

ID1000095003

FIGI

BBG000H0B9Q0

PT Bank Mandiri (Persero) Tbk engages in providing general banking services. It operates through the following segments: Corporate Banking, Commercial Banking, Institutional, Retail Banking, and Treasury and International Banking. It operates through the following geographical segments: Indonesia, Asia, Western Europe, and Cayman Islands. The Asia segment include Singapore, Malaysia, Hong Kong, Timor Leste, and Shanghai. The Western Europe segment refers to England. The company was founded in 1824 and is headquartered in Jakarta, Indonesia.

Related stocks

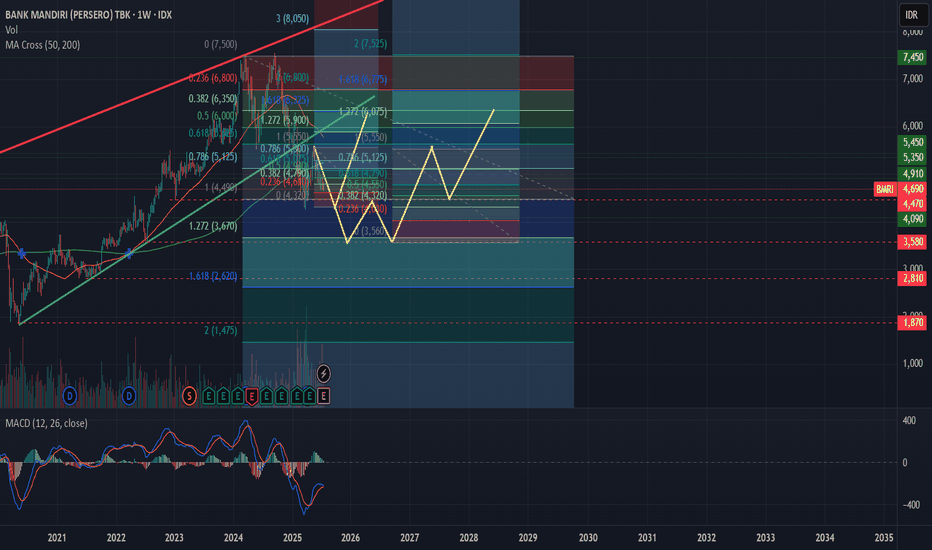

Buy on Weakness BMRI, relatively close to the Bottom.

BMRI has been in a downtrend for 4 months, with the last breaking through the support level of 5400 (January 14, 2025).

cutloss level at support 4450 (-10%) and Target Price 6000 (upper trend line).

Risk and reward ratio 1 : 2.

Buy on Weakness BMRI 4910.

Prediction About Mandiri Bank BMRIBank Mandiri IDX:BMRI is currently trading at 5,050, showing signs of weakness as it struggles to hold key support levels. If the stock fails to maintain support, we could see further downside movement, potentially testing levels around 4,500. This scenario aligns with the broader market sentiment

BMRI - CUP WITH HANDLEI bought the stock today

September 11, 2024

Reasons:

1. Low-risk entry point

2. Long base cup development

3. Formed a classic cup with a nice drifting handle

4. VCP characteristics on the handle

5. One of the leaders in banking sector beside IDX:BRIS

6. We're in a general market bull campaign

$BMRI - Is Bearish Coming?IDX:BMRI is developing a huge Falling Wedges (Weekly Chart).

The Uptrend Line has been tested a few times and finally broke down on early May.

The target from the Falling Wedges pattern is around 3700-3800, is it too far? We might think so.

Here it is some of the interesting point to watch:

1)

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PPERF5573094

PT Bank Mandiri (Persero) Tbk. 5.5% 04-APR-2026Yield to maturity

4.72%

Maturity date

Apr 4, 2026

PPERF5184388

PT Bank Mandiri (Persero) Tbk. 2.0% 19-APR-2026Yield to maturity

4.72%

Maturity date

Apr 19, 2026

See all PQ9 bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange BK MANDIRI (PERS) RP 125 stocks are traded under the ticker PQ9.

We've gathered analysts' opinions on BK MANDIRI (PERS) RP 125 future price: according to them, PQ9 price has a max estimate of 0.40 EUR and a min estimate of 0.20 EUR. Watch PQ9 chart and read a more detailed BK MANDIRI (PERS) RP 125 stock forecast: see what analysts think of BK MANDIRI (PERS) RP 125 and suggest that you do with its stocks.

Yes, you can track BK MANDIRI (PERS) RP 125 financials in yearly and quarterly reports right on TradingView.

BK MANDIRI (PERS) RP 125 is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

PQ9 earnings for the last quarter are 0.01 EUR per share, whereas the estimation was 0.01 EUR resulting in a 0.04% surprise. The estimated earnings for the next quarter are 0.01 EUR per share. See more details about BK MANDIRI (PERS) RP 125 earnings.

BK MANDIRI (PERS) RP 125 revenue for the last quarter amounts to 2.06 B EUR, despite the estimated figure of 2.02 B EUR. In the next quarter, revenue is expected to reach 1.95 B EUR.

PQ9 net income for the last quarter is 731.93 M EUR, while the quarter before that showed 824.42 M EUR of net income which accounts for −11.22% change. Track more BK MANDIRI (PERS) RP 125 financial stats to get the full picture.

Yes, PQ9 dividends are paid annually. The last dividend per share was 0.02 EUR. As of today, Dividend Yield (TTM)% is 9.98%. Tracking BK MANDIRI (PERS) RP 125 dividends might help you take more informed decisions.

BK MANDIRI (PERS) RP 125 dividend yield was 8.18% in 2024, and payout ratio reached 78.00%. The year before the numbers were 5.85% and 60.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 12, 2025, the company has 38.9 K employees. See our rating of the largest employees — is BK MANDIRI (PERS) RP 125 on this list?

Like other stocks, PQ9 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BK MANDIRI (PERS) RP 125 stock right from TradingView charts — choose your broker and connect to your account.