RRU1 trade ideas

Rolls Royce Stock Analysis HOLDThe Rolls-Royce (LSE:RR) share price has slumped to 84p. Today’s share price crash is due to over 6bn new shares hitting the market.

Since each share now represents a far smaller slice of ownership of Rolls-Royce, they are all worth less today compared to yesterday.

If you have 300 existing shares, for example, you have the right to buy 1,000 new shares at 32p.

By buying all your rights for a total price of £320, you now have 1,300 shares and own the same percentage of the company as you did before the rights issue.

Rolls-Royce’s £2bn cash call has been “overwhelmingly” backed by shareholders, unlocking a rescue package totalling £5bn.

Investors supported the 10-for-3 rights issue in which they can buy new shares at 32p - a 41pc discount.

Agreeing to the rights issue allows Rolls to access £2bn of bonds it has sold, and the Government has backed a potential £1bn of further debt.

RR - ROLLS ROYCE Technical AnalysisPrices have been moving inside the channel and now that the prices are closer to the top resistance level the following Options canbe possible: (hold before going for one of the below options)

Option 1 - 50% Only if the resistance level of 2.40 Pound will be broken

Option 2 - 50% Only if the resistance level of 2.40 Pound will NOT be broken

A Breakout of a support/resistance line could be considered valid only if the close price of a daily candlestick for at least two consecutive days is below/above the support/resistance level

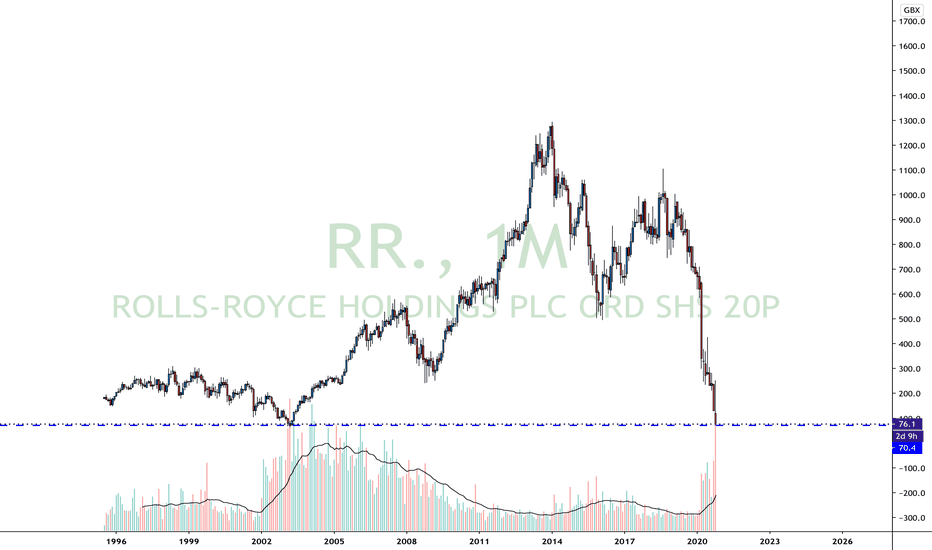

ROLLS ROYCE WAS AN ABSOLUTE BUY AT 100 PSYCHOLOGICAL AREA Rolls Royce was an absolute buy at 100 psychologycal area last week,and in fact it reacted with an epic bounce.

By the way, looks like other juicy targets are still available for long term investors.

After a massive collapse in price started on january 2014, the price seems to have found a bottom last week.

Actually, we are still at prices seen even 15 years ago in 1996, so for investors who truly believe in the company, this looks like a great oppurtunity to accumulate some positions, without looking too much to the possible turbolences that we could see on next months.

In case the world would come close to an end(lol),there is also the support in green, that was the absolute bottom of the whole company history in 2003.

Rolls Royce Stock AnalysisRolls Royce Stock Analysis - Rolls-Royce stock forecast today (week 03/08/20) - RR. Stock Analysis

Prices are moving inside the channel, generally technical analysis suggests to go long as they are close to the bottom flat trendline, but the best option is to hold as the bottom trend line has been broken and prices might keep going down.