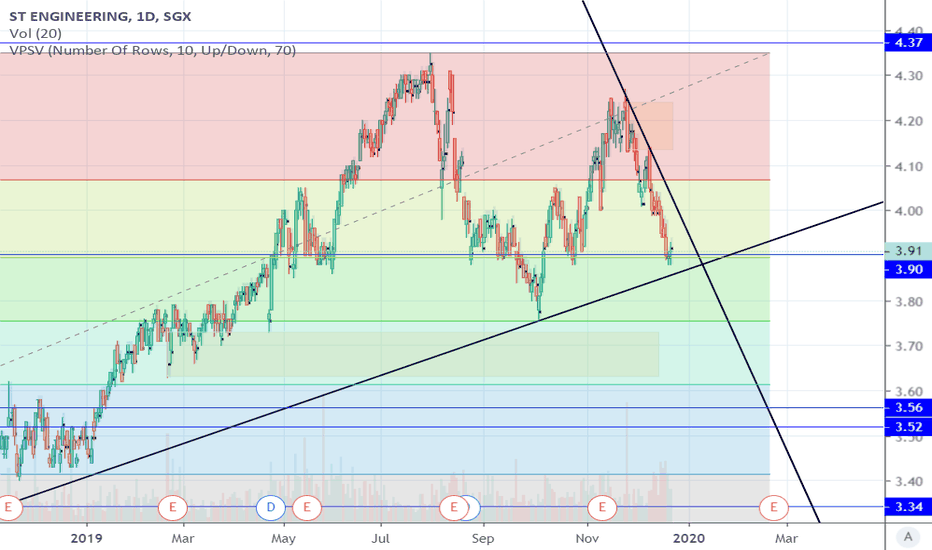

ST Engineering Break $4 - Is it a Good Buy?ST Engineering's share price finally breaks $4, records a 52-week high at $4.04 today.

From what I saw on Moomoo forum. The break out signals has captured investor attention excited them for a trading opportunity.

In fundamental speaking, ST Engineering has demonstrated robust performance. Its annual revenue surpassed $10 billion, marking a 12% increase from the previous year. Net profit also saw a healthy growth of 10% to $586 million. The debt reduced by 7% records a a lower debt-to-EBITDA leverage ratio of 5.2 to 4.2.

Notably, the commercial aerospace segment experienced remarkable 31% revenue growth, surpassing the 2026 target. The order book stands strong at $27.4 billion, with $7.9 billion expected to be delivered in 2024.

Benefits from regional confrontation?

The increasing of the global arms conflicts has strengthen the demand for military supplies, leading to record-high military budgets and spending for countries like the USA, China, Japan, Singapore, Poland, etc.

To be noted that: ST Engineering isn't a pure play defence player, like Raytheon and Lockheed Martin. The management's have restructure the business segment from 5 to 4 with emphasis on city solutions and ICT.

Would you buy ST Engineering? Let's discuss

SJX trade ideas

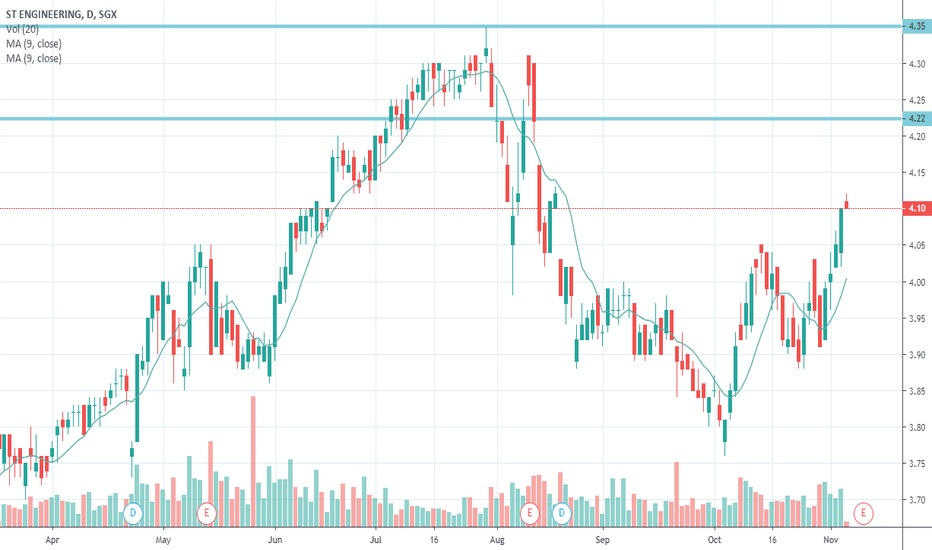

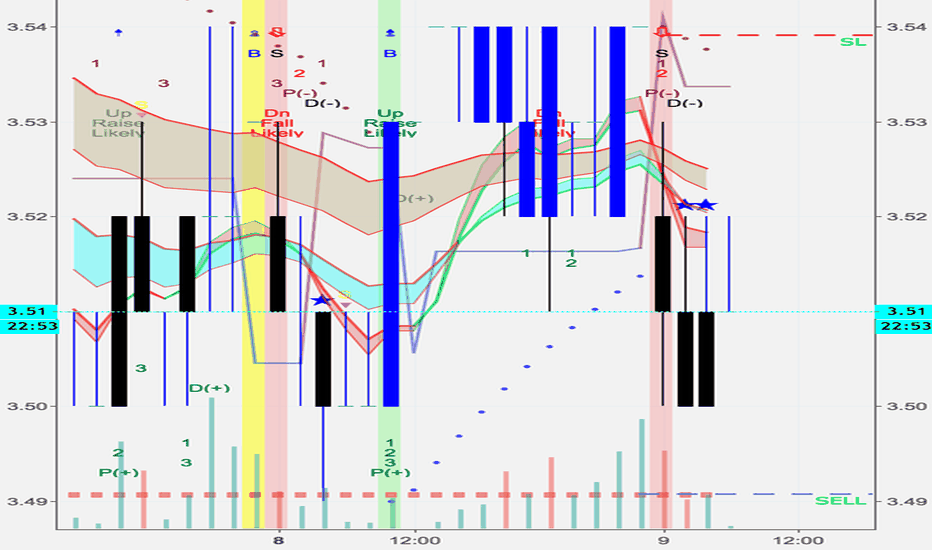

S63 - new trend formation - possible bullish biasTarget as shown - with stop loss indication.

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

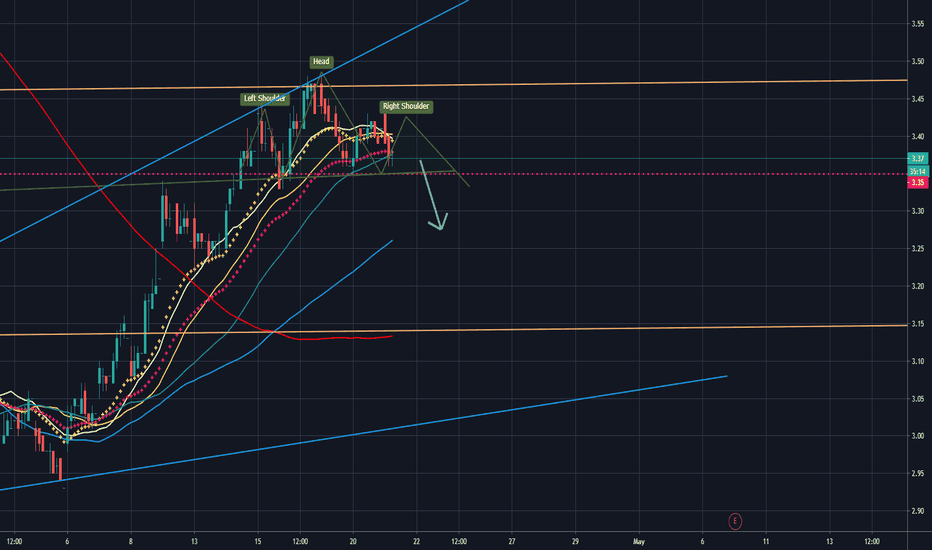

S63 - Is it possible in formation of Head & Shoulder?With the current oil crisis, market is in sort of jitters right now... this counter seems to follow the down trend (possibly) as well. Will the head & shoulder formation plays out in short term duration? or will it break out of the current formation and become bullish?

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

ST Engineering (Still Can go Higher)View On ST Engineering (25 Feb 2018)

Just a quick write up.

We may be late but it is still under strong Bullish composition.

Do not short as it may be short-lived.

If you want to long, wait patiently to go in.

It can easily go to 3.85 regions again.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.