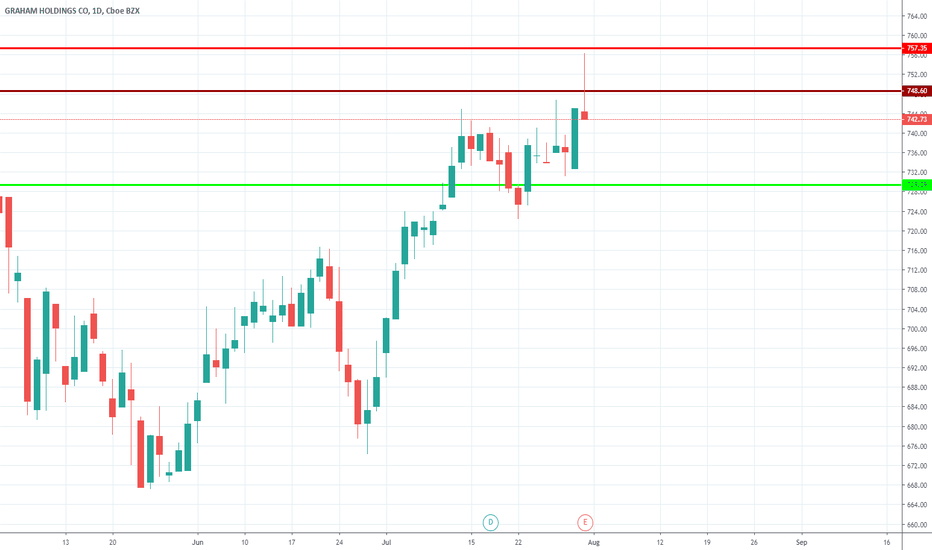

Graham Holdings Co. (NYSE: $GHC) Meteoric RiseNYSE:GHC spiked in price yesterday to as high as 32.90 %. Can it maintain this momentum?

Graham Holdings Stock is trading above its 200-day simple moving average with the 50-day Moving average above the 200-day Moving Average.

NYSE:GHC is also trading near the top of its 52-week range with Inv

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

135 EUR

695.25 M EUR

4.63 B EUR

3.17 M

About Graham Holdings Company

Sector

Industry

CEO

Timothy J. O'Shaughnessy

Website

Headquarters

Arlington

Founded

1877

FIGI

BBG000GPXGH6

Graham Holdings Co. engages in the provision of education and media services. It operates through the following segments: Education, Television Broadcasting, Manufacturing, Healthcare, SocialCode, and Other Businesses. The Education segment includes professional training and postsecondary education businesses largely outside the U.S. and English-language programs provided by Kaplan, Inc. The Television Broadcasting segment conducts operations through seven television stations serving the Detroit, Houston, San Antonio, Orlando, Jacksonville, and Roanoke television markets. The Manufacturing segment focuses on the manufacturing operations of Hoover Treated Wood Products, Inc., a supplier of pressure impregnated kiln-dried lumber and plywood products for fire retardant and preservative applications, Dekko, a manufacturer of electrical workspace solutions, architectural lighting and electrical components and assemblies, Joyce/Dayton Corp., a manufacturer of screw jacks and other linear motion systems, and Forney, a global supplier of products and systems that control and monitor combustion processes in electric utility and industrial applications. The Healthcare segment encompasses home health, hospice, and palliative services. The SocialCode segment provides marketing solutions managing data, creative, media, and marketplaces to accelerate client growth. The Other Businesses segment consists of the online publishing and printing of magazines and automotive dealerships. The company was founded by Stilson Hutchins in 1877 and is headquartered in Arlington, VA.

GHC is looking very bullishNYSE:GHC is a solid stock which did not recover well after the pandemic fall, I expect a pull back to around 500$ which IMO would be a good opportunity to take a position. Anticipated price action is shown on the chart, target is the 640$ area. Stop level is 440$.

Hit the like button and follow if

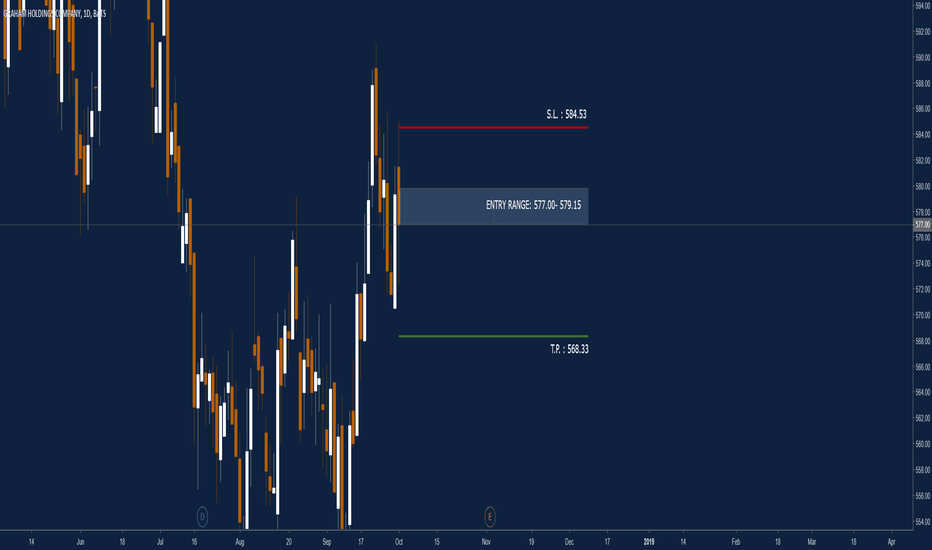

Sell GHCGreen shoot star at the top

See Gap red hammer on 4 hour

Volume very low on lower time frames, suspect

Note: Director sold 1100 shares on 10/9/18... Why?

Insider selling is always a clue/hint

Stoch in oversold area, no confirmation yet ;)

S/L

T/P 586.05 (fair value per Tenken san)

T/P 563.90 (gap

GHC: Sort opportunityAn intraday high potential, Back Tested Sort Analysis.

We ll try to enter into the correction of the uptrend movement.

DETAILS ON THE CHART

NOTE: Entry range area above the entry point, is calculated upon 80% of the recorded pullback back tested past performances

DISCLAIMER: This is a te

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GHC4637989

Graham Holdings Company 5.75% 01-JUN-2026Yield to maturity

5.99%

Maturity date

Jun 1, 2026

GHC4637990

Graham Holdings Company 5.75% 01-JUN-2026Yield to maturity

—

Maturity date

Jun 1, 2026

See all WPOB bonds

Related stocks

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange GRAHAM HLDGS CO. stocks are traded under the ticker WPOB.

We've gathered analysts' opinions on GRAHAM HLDGS CO. future price: according to them, WPOB price has a max estimate of 682.03 EUR and a min estimate of 682.03 EUR. Watch WPOB chart and read a more detailed GRAHAM HLDGS CO. stock forecast: see what analysts think of GRAHAM HLDGS CO. and suggest that you do with its stocks.

WPOB reached its all-time high on Mar 3, 2025 with the price of 945 EUR, and its all-time low was 140 EUR and was reached on Sep 5, 2011. View more price dynamics on WPOB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

WPOB stock is 1.75% volatile and has beta coefficient of 0.77. Track GRAHAM HLDGS CO. stock price on the chart and check out the list of the most volatile stocks — is GRAHAM HLDGS CO. there?

Today GRAHAM HLDGS CO. has the market capitalization of 3.72 B, it has increased by 1.75% over the last week.

Yes, you can track GRAHAM HLDGS CO. financials in yearly and quarterly reports right on TradingView.

GRAHAM HLDGS CO. is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

WPOB earnings for the last quarter are 5.04 EUR per share, whereas the estimation was 9.98 EUR resulting in a −49.54% surprise. The estimated earnings for the next quarter are 8.97 EUR per share. See more details about GRAHAM HLDGS CO. earnings.

GRAHAM HLDGS CO. revenue for the last quarter amounts to 1.08 B EUR, despite the estimated figure of 1.11 B EUR. In the next quarter, revenue is expected to reach 1.04 B EUR.

WPOB net income for the last quarter is 21.95 M EUR, while the quarter before that showed 526.55 M EUR of net income which accounts for −95.83% change. Track more GRAHAM HLDGS CO. financial stats to get the full picture.

Yes, WPOB dividends are paid quarterly. The last dividend per share was 1.58 EUR. As of today, Dividend Yield (TTM)% is 0.73%. Tracking GRAHAM HLDGS CO. dividends might help you take more informed decisions.

GRAHAM HLDGS CO. dividend yield was 0.79% in 2024, and payout ratio reached 4.21%. The year before the numbers were 0.95% and 15.06% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 8, 2025, the company has 21.45 K employees. See our rating of the largest employees — is GRAHAM HLDGS CO. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GRAHAM HLDGS CO. EBITDA is 422.38 M EUR, and current EBITDA margin is 9.45%. See more stats in GRAHAM HLDGS CO. financial statements.

Like other stocks, WPOB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GRAHAM HLDGS CO. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GRAHAM HLDGS CO. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GRAHAM HLDGS CO. stock shows the buy signal. See more of GRAHAM HLDGS CO. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.