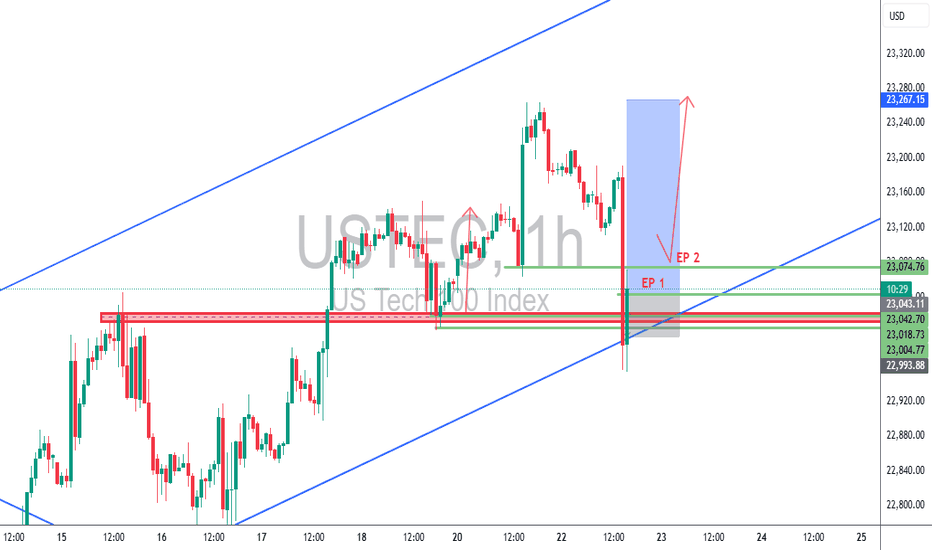

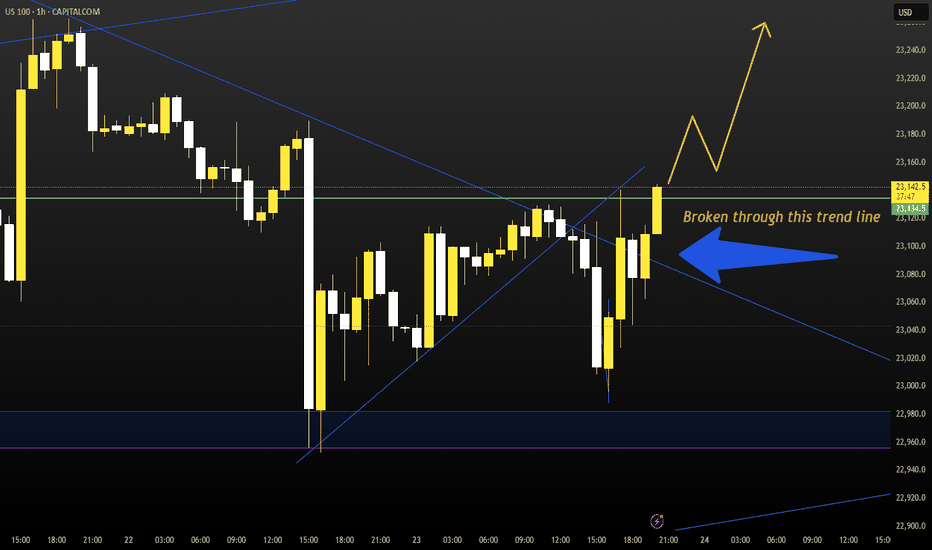

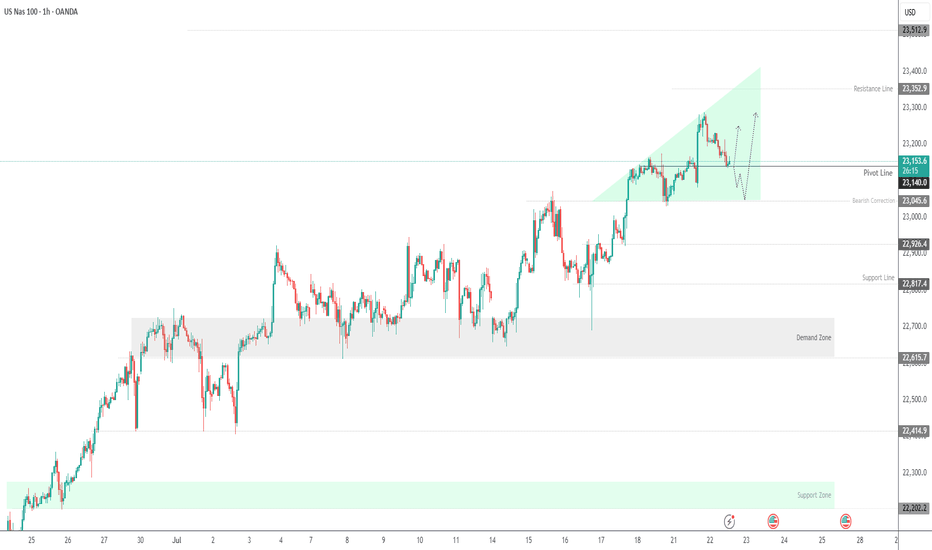

USTEC 1H – Dual Entry Precision | TCB Trend Phase SetupUSTEC 1H – Dual Entry Precision | TCB Trend Phase Setup

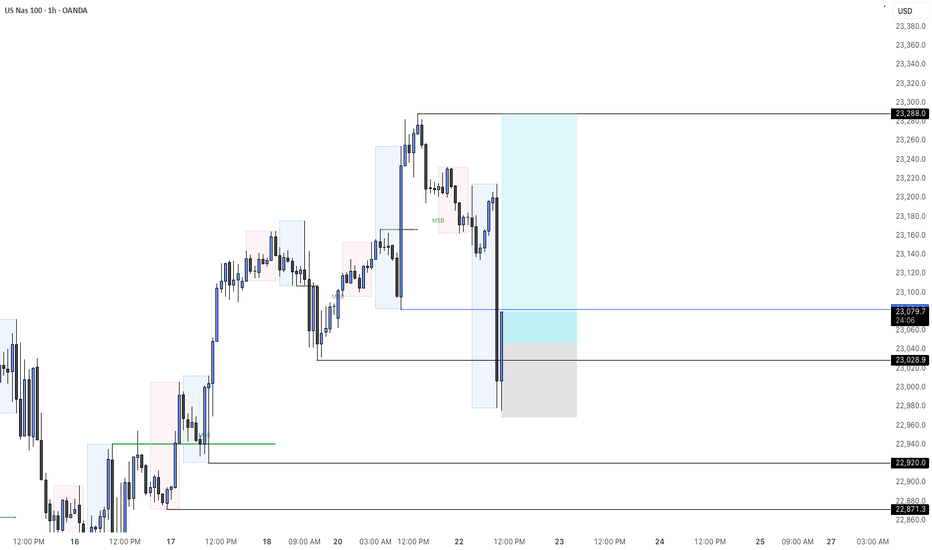

Market remained bullish with clear channel structure. After a pullback into the previous breakout zone, price swept liquidity and wicked below, offering two refined entries (EP 1 & EP 2) inside the demand zone.

🔸 EP 1 – Aggressive entry on first touch

🔸 EP 2 – Confirmation entry after rejection

🔸 SL placed below structural liquidity sweep

🔸 Target: Mid-channel + price inefficiency fill above

Trade Summary

🧠 Trend Phase entry with TCB logic

📌 Demand zone = Key structure

⏱️ Low drawdown

💥 RRR ~1:3

📈 TP in motion (or hit, if price reached 23,267)

📎 #Hashtags:

#USTEC #US100 #Nasdaq #SmartMoneyConcepts #SniperTrader #ForexTrading #PriceActionTrading #TCBSetup #TrendTrading #LiquiditySweep #RiskReward #TradingViewAnalysis

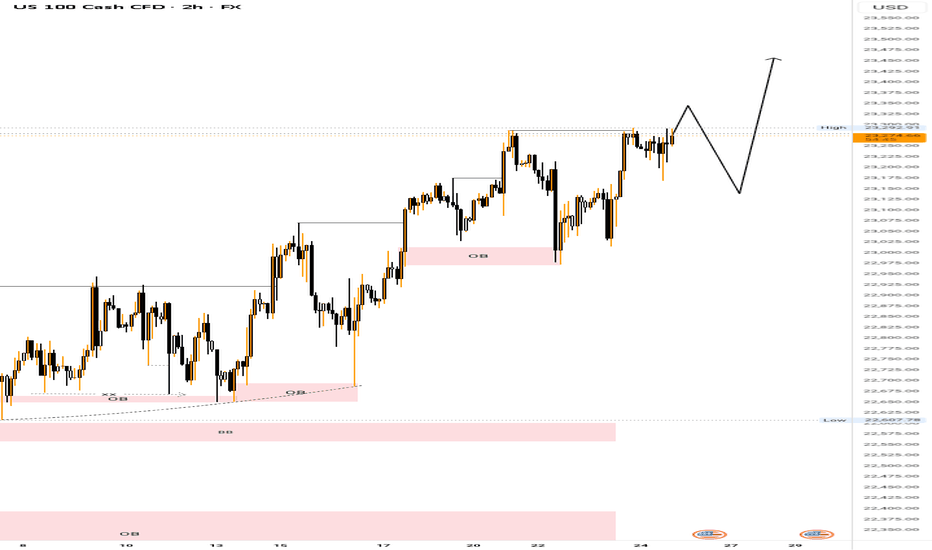

NAS100 trade ideas

NAS100 (LONG IDEA)🟦 NAS100 (US Tech 100) – LONG SETUP 🟦

📅 Posted: 24 July 2025

🚦 Bias: BULLISH (Long)

🎯 Entry: 23,262 (market) or 23,170–23,250 (limit on dip)

🛑 Stop Loss: 22,617 (HTF structure protection)

🏁 Take Profits:

• TP1: 23,800

• TP2: 24,500

• TP3: 25,800

🔍 Technical Breakdown:

📈 Multi-Timeframe Confluence:

Monthly/Weekly/Daily: All show strong bullish structure, with price making new highs and respecting key demand zones.

4H/1H: Price is consolidating above a Fair Value Gap (FVG) at 23,170–23,250, showing strong demand and absorption.

🟩 FVG Support: 23,170–23,250 is the high-probability dip buy zone, aligning across all timeframes.

🟦 Structure: Higher highs and higher lows, with no signs of exhaustion.

🟢 Momentum: Bullish, with buyers stepping in on every dip.

🛡️ Invalidation: Clean break and close below 22,730 would invalidate the setup.

🔥 Fundamental & Sentiment Context:

💻 Tech/AI Leadership: US tech and AI stocks are driving index strength.

💵 Earnings Momentum: Strong earnings season, macro resilience.

🧑💻 Sentiment: Retail is long but not euphoric; institutions still net buyers.

🌍 Macro: No major headwinds; risk-on flows support further upside.

🛠️ Execution Plan:

💸 Buy now @ 23,262 or scale in on dips to 23,170–23,250 (FVG retest).

🛡️ Stop Loss: 22,617 (structure break).

🎯 Targets:

TP1: 23,800 (first liquidity target)

TP2: 24,500 (extension)

TP3: 25,800 (ATH zone)

⚡ Summary:

All signals GO! 🚦 Multi-timeframe bullish structure, FVG support, and strong momentum. Risk is well-defined below 22,730. Targeting new highs as tech/AI leadership continues.

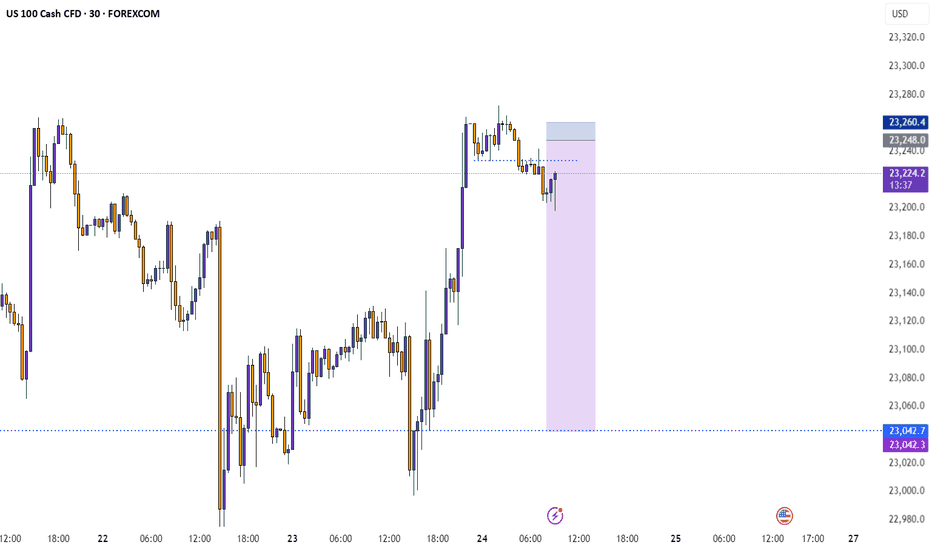

USNAS100 - Tech Index Pulls Back After Testing 23,295USNAS100 | OVERVIEW

The index came close to registering a new ATH at 23,295 before pulling back slightly.

Today, it appears to be in a bearish correction phase toward 23,200 and 23,150, as long as the price trades below 23,270.

Market sentiment may remain cautious, especially with no major earnings reports scheduled before the open, although Intel’s report after the close could have a notable impact.

A 1H close above 23,290 would invalidate the correction and open the way toward 23,350 and 23,500.

Key Levels:

Support: 23,200 · 23,150 · 23,050

Resistance: 23,350 · 23,520

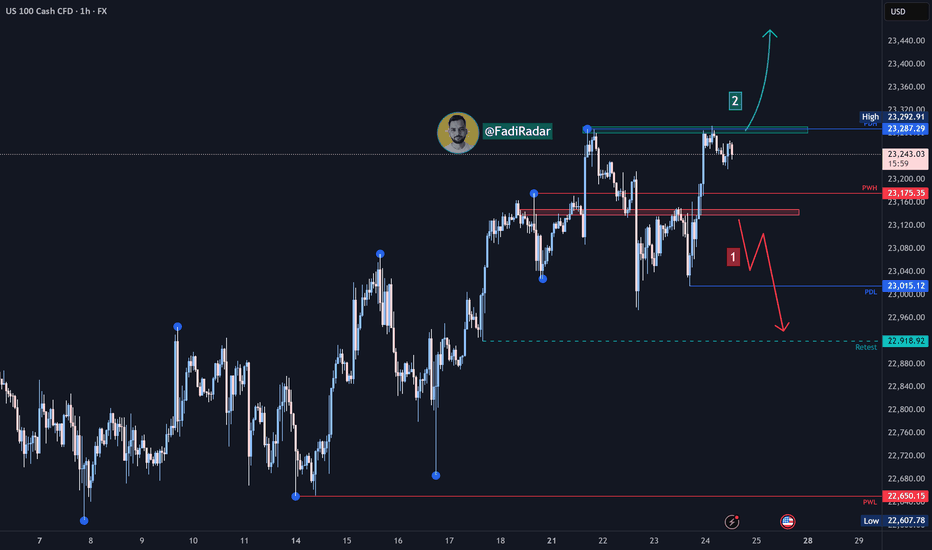

Nasdaq Index Analysis (US100 / NASDAQ):The Nasdaq index continues its upward trend in the medium to long term. Yesterday, it tested the 23,000 USD level and bounced higher toward 23,290 USD.

1️⃣ If the price breaks below 23,100 USD and closes beneath it, we may see a decline toward 23,000 USD, followed by 22,920 USD.

2️⃣ However, if the price holds above 23,290 USD, further bullish momentum could lead to a new high around 23,400 USD.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor the markets and analyze the data carefully before making any investment decisions.

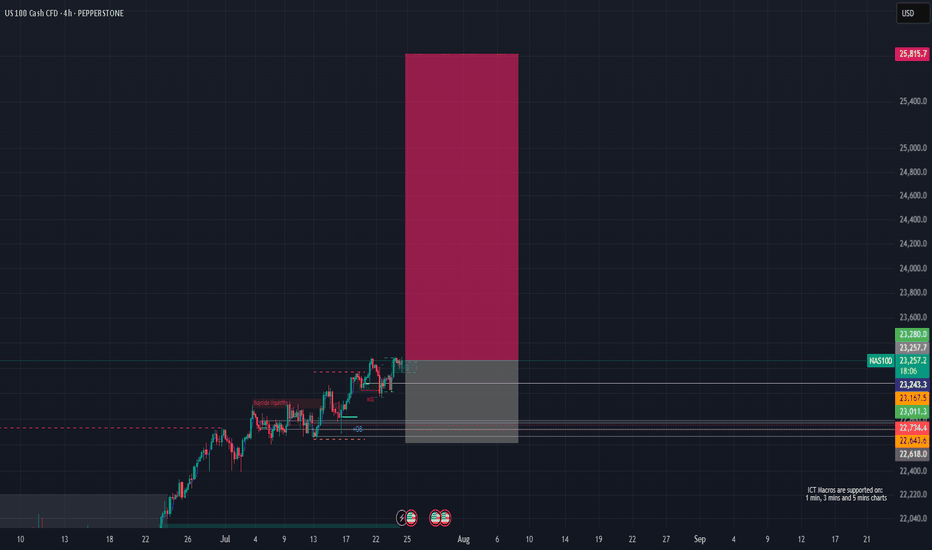

Will USTEC Continue Its Rallies Amid Better Market Sentiment?Macro approach:

- USTEC advanced modestly this week, supported by upbeat corporate earnings and resilience in economic data amid ongoing policy uncertainty.

- The index benefited from strong expected results in major tech firms such as Microsoft (MSFT) and Nvidia (NVDA), as top giant AI leadership, helping to bolster sentiment despite lingering concerns about tariffs and Fed policy direction.

- US macro data showed sticky inflation in key categories, robust retail sales, and falling jobless claims. This prompted the Fed to retain its cautious stance on rate cuts while markets reassessed policy expectations. Policy-related headlines and manufacturing sector developments also partly drove market volatility.

- USTEC could remain sensitive to incoming tech earnings, the 29-30 Jul Fed meeting, and potential US tariff announcements in early Aug. Persistent inflation and any surprises in central bank communication may drive volatility in the sessions ahead.

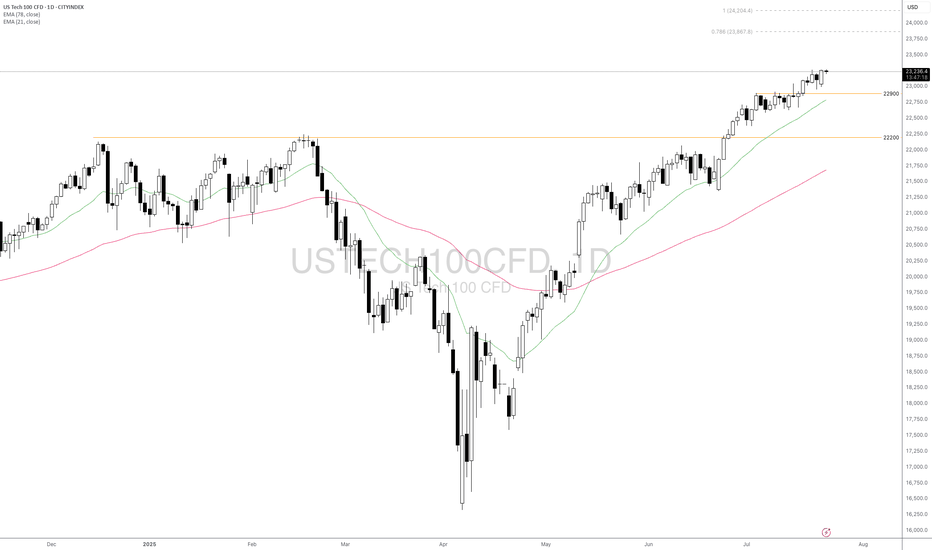

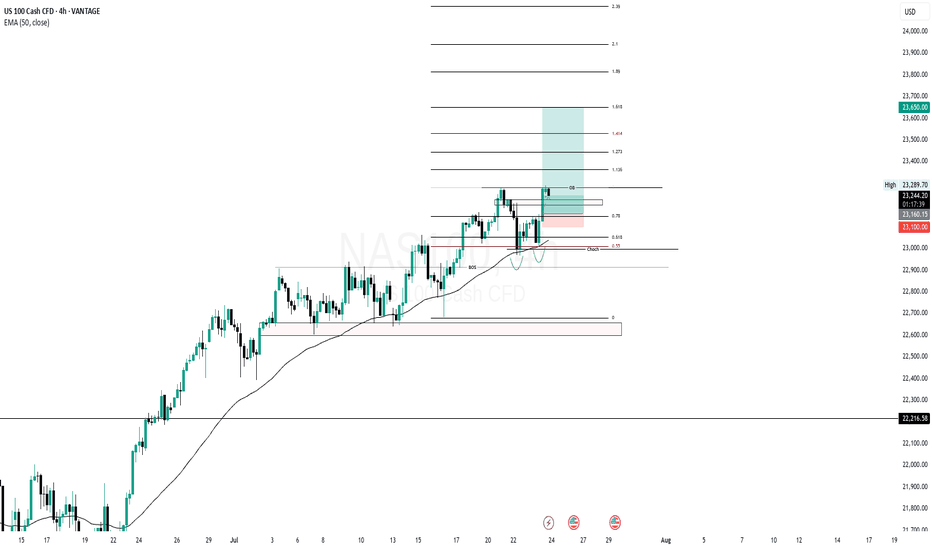

Technical approach:

- USTEC trended higher and created a new record high. The price is above both EMAs, indicating a strong bullish momentum.

- If USTEC stays above the support at 22900, the price may continue toward the 78.6% Fibonacci Extension at around 23867.

- On the contrary, breaking below the support at 22900 and EMA21 may prompt a deeper correction to retest the following support at 22000.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

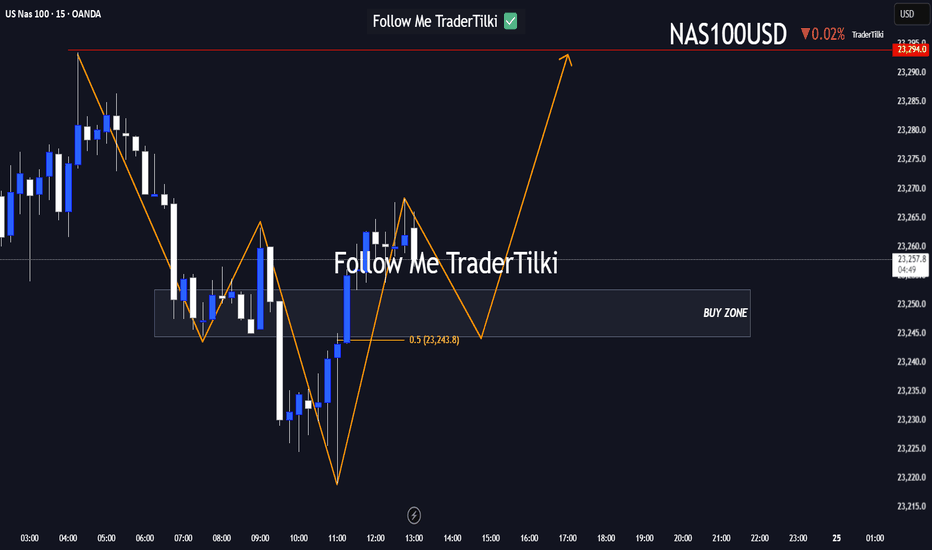

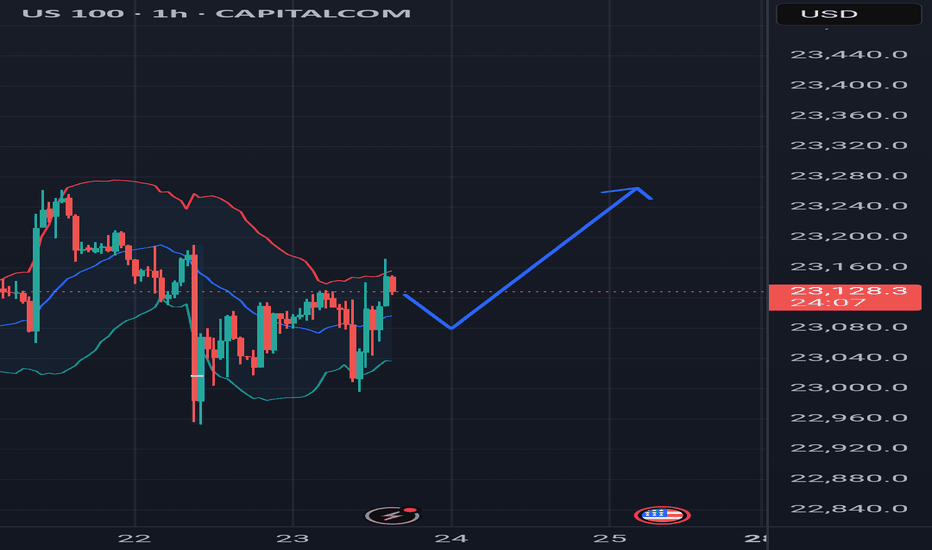

Here’s a fresh Nasdaq100 analysis I’ve put together for you.Hey Guys,

Here’s a fresh Nasdaq100 analysis I’ve put together for you.

I’ve marked the buy zone between 23,252 and 23,240. If price dips into that range, I’m anticipating a potential move upward toward 23,294.

Your likes and support are my biggest source of motivation to keep sharing these insights.

Huge thanks to everyone backing me with a thumbs-up!

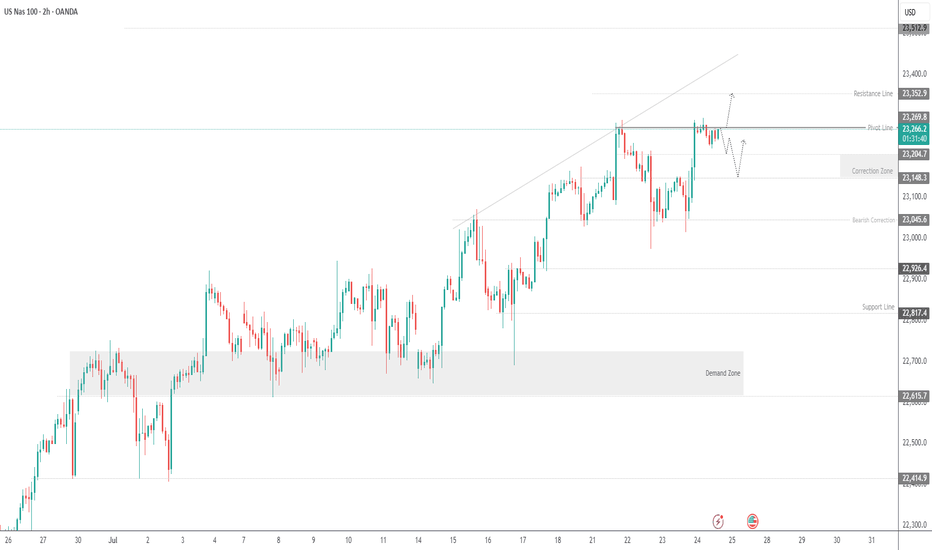

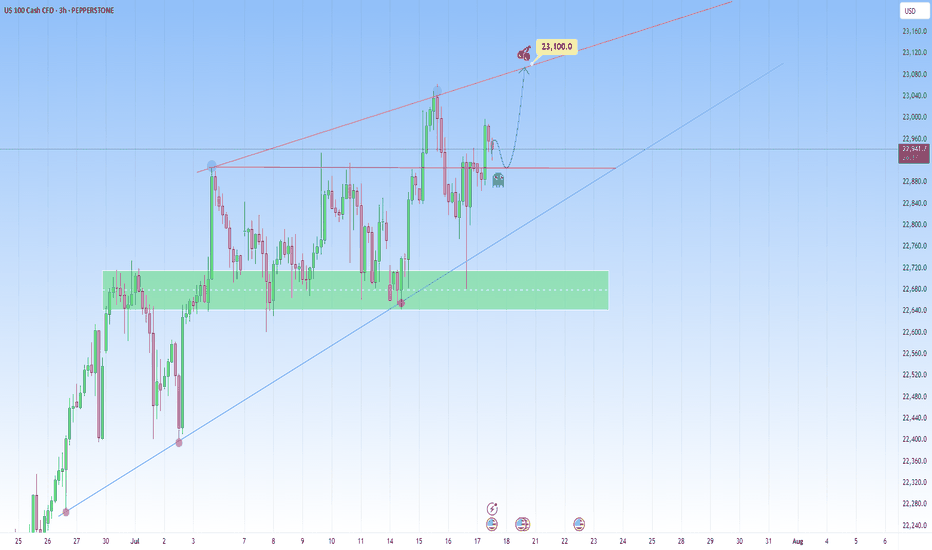

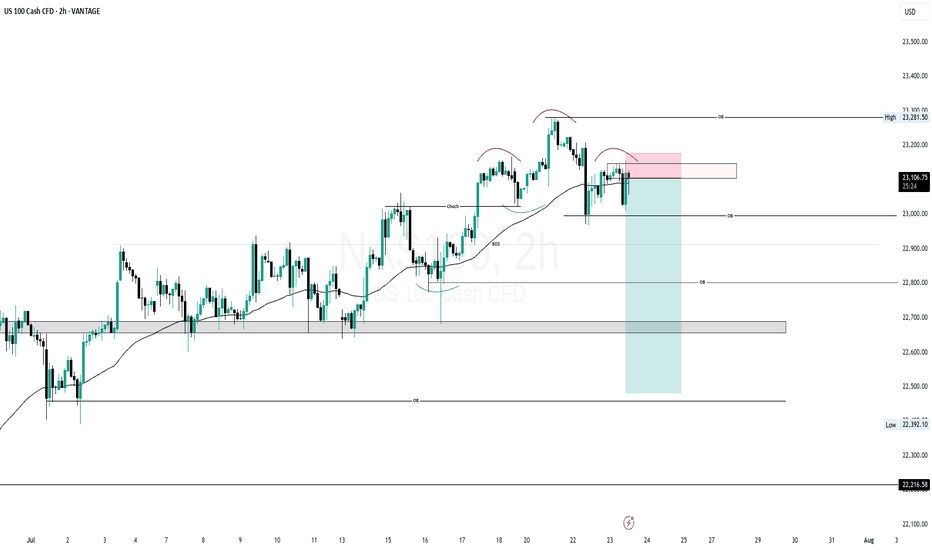

NAS100 Bigger Picture. Uptrend to be resumedLooking at the current structure through the lens of a trend trading approach, what we saw on NAS100 is more than a simple price bounce, it’s a trend continuation trading within a high-volatility environment. As price is approaching a key resistance level, how price is behaving around this dynamic trendline will be key.

This recent retracement and rejection happening near what we can call a demand zone cluster, was confirmed by a beautiful bounce off the support range. And right now price is respecting the upper and lower bounds nicely.

What happens next? Price is showing signs of bullish exhaustion, but the higher-timeframe structure supports a continuation.

My projected target is towards the upper resistance line, that’s my 23,100 zone as shown.

Nasdaq Ascending Trend has been broken.Good night traders.

With Tuesday & today's move. NQ has broken the ascending trend, and retested the highs.

A total of 107 daily candles, 7,000pips move.

Reasons for taking this trade:

Current monthly candle has 2.9m volume, compared to a 6m & 7million from last 2 months. With only 8 days missing to end the month, how to fill all that pending volume?

Ascending trend has been broken and retested.

Expect a deep correction, around 2000-2400-2600 pips. There is correlation between 38.2 Fibo level.

Last week there was a manipulation with Powell dismiss rumor on Wednesday, next day on Thursday NQ rallied to the upside. Today being also Wednesday we saw a huge rejection to the upside, but there is no continuation.

DXY reaching bottom, + has a deeper short trend initiation, starting on January 13.

Trade will be validated if NQ creates a LL followed by a LH within the next 2 days.

What do you think of this analysis?

Thank you.

Enjoy

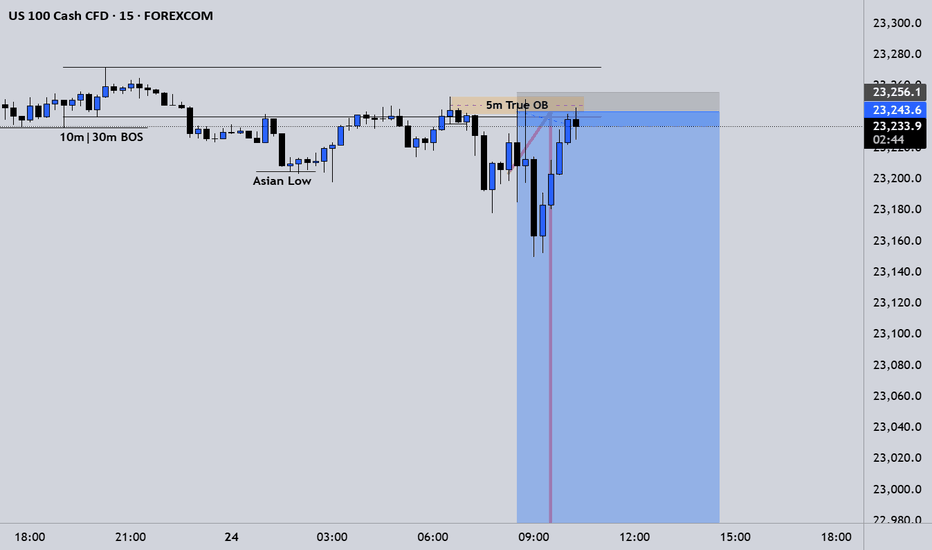

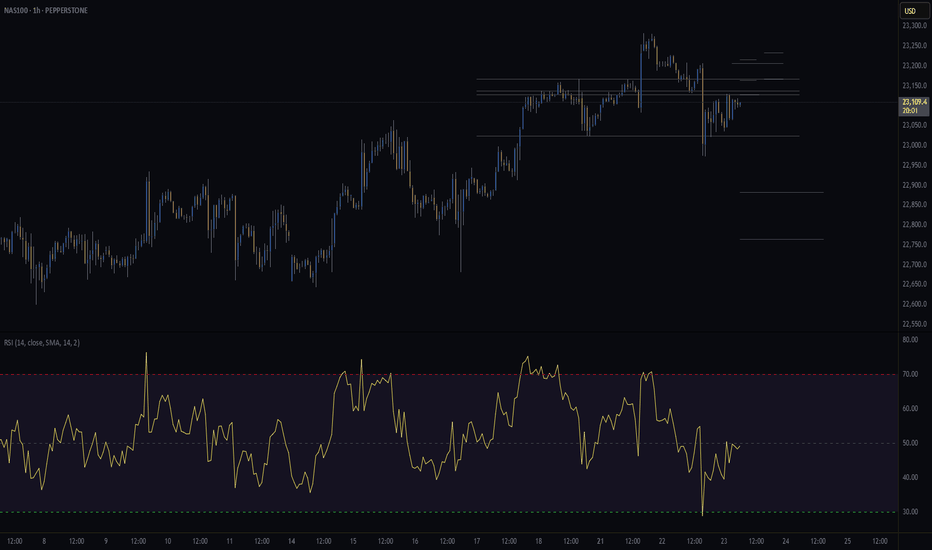

NASDAQ100| - Bullish Bias RemainsPrice didn’t give me the deep candle retrace into my 30M OB — just a wick tap — but that was enough. That wick shows me smart money touched in.

Dropped to the LTF and got my shift in structure confirming bullish intent.

Now I’m locked in, watching for price to sweep a 5M sell-side liquidity pocket into a clean LTF order block for the next entry.

🎯 Target: Short-term 5M highs

🚀 Bias: Still bullish unless structure breaks

This is a patience game now — execution only after confirmation.

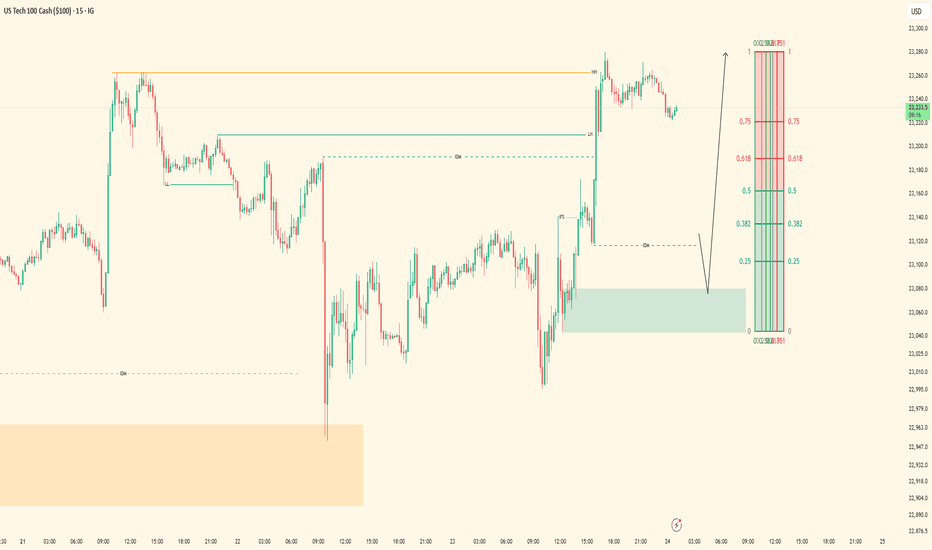

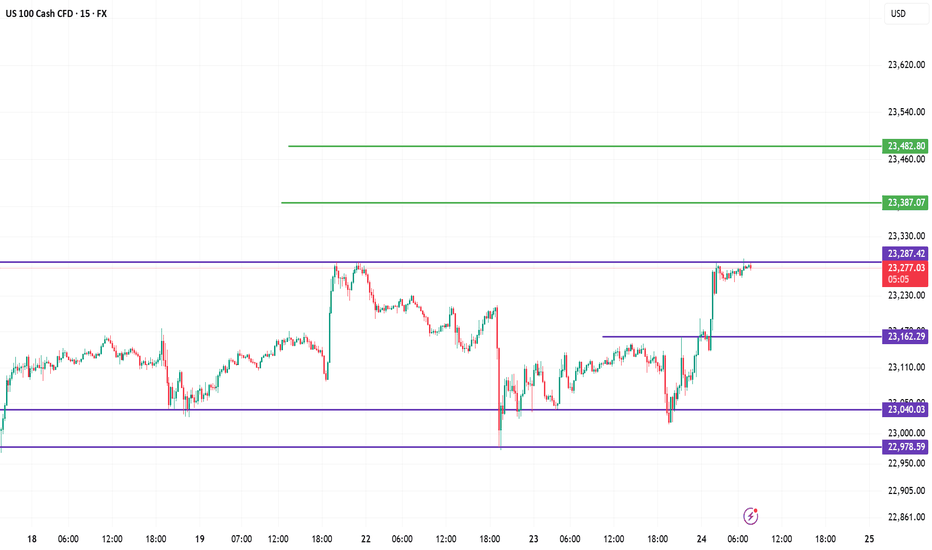

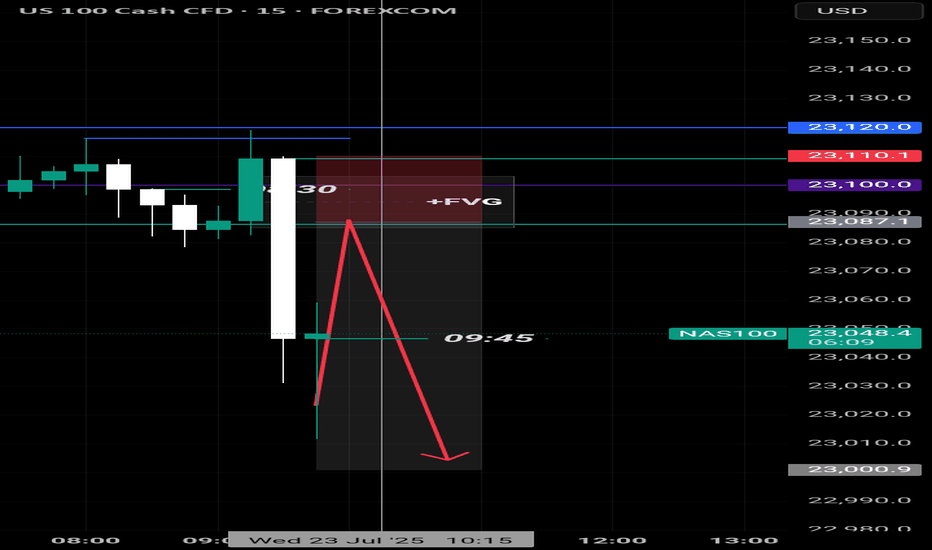

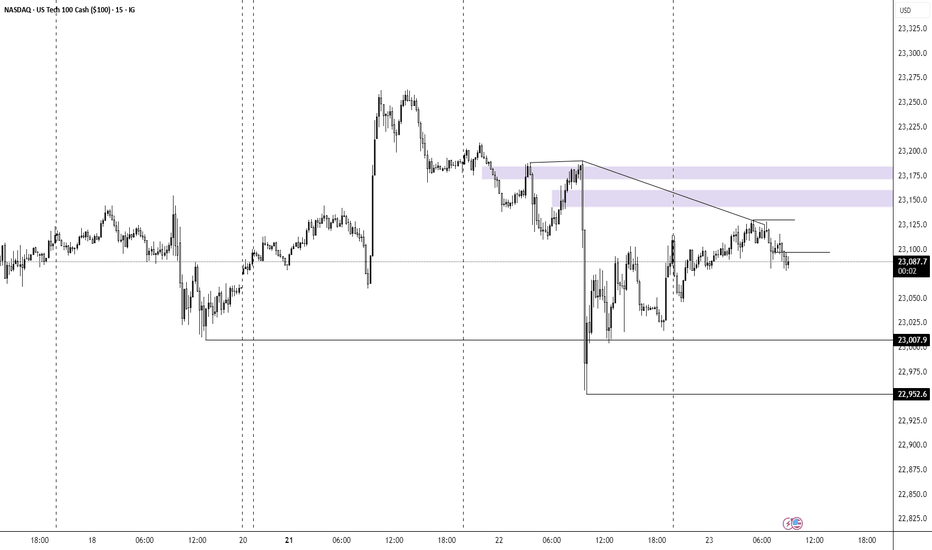

US100 Analysis Report (15m Chart)1. 🔍 Liquidity Grab (Sell-side taken)

Price swept below 23,040 and sharply reversed from 22,978, clearing out weak sellers.

2. 📈 Break of Structure (BOS)

A bullish BOS occurred after price broke above 23,162, confirming short-term bullish intent.

3. 🟪 Rejection Zone

Price is now testing 23,287.42 — a supply/resistance zone. Watch for signs of rejection or breakout.

4. 📊 Bullish Scenario

If price breaks 23,287 cleanly, expect next moves towards 23,387 and then 23,482.

5. 📉 Bearish Setup Possibility

Rejection from 23,287 could pull price back to 23,162 or 23,040 before the next move.

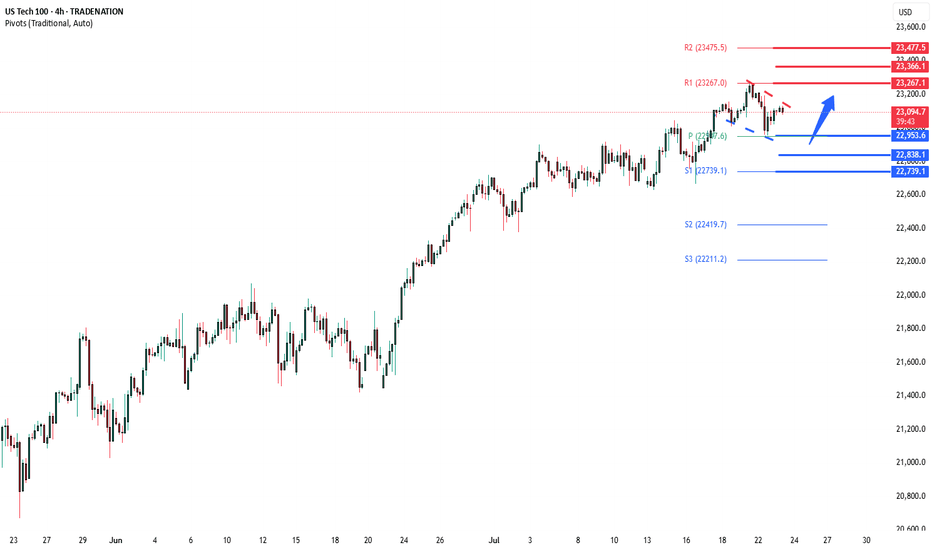

NSDQ100 another bullish flag developing ?Donald Trump has agreed a new trade deal with Japan, setting 15% tariffs on US imports like cars and launching a $550 billion fund to boost investment in the US. This is lower than his earlier 25% tariff threat. Other allies saw mixed outcomes—the Philippines got a small tariff cut, while Canada’s talks stalled. Goldman Sachs now expects the US baseline tariff rate to rise to 15%.

Trump also suggested that Fed Chair Jerome Powell may not stay in his role much longer, and he’s considering removing capital gains tax on home sales, which could affect the housing market.

Separately, a Chinese-linked cyberattack breached the US nuclear weapons agency, though no classified data was stolen. Meanwhile, SpaceX’s investor documents flagged Elon Musk’s political activity as a potential risk as the company targets a $400 billion valuation.

Conclusion for Nasdaq 100:

The Nasdaq 100 faces short-term uncertainty due to rising trade tariffs, Fed leadership questions, and geopolitical risks. While some US-focused investments could benefit, traders should stay cautious as policy and global tensions evolve.

Key Support and Resistance Levels

Resistance Level 1: 23265

Resistance Level 2: 23670

Resistance Level 3: 23480

Support Level 1: 22953

Support Level 2: 22840

Support Level 3: 22740

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920