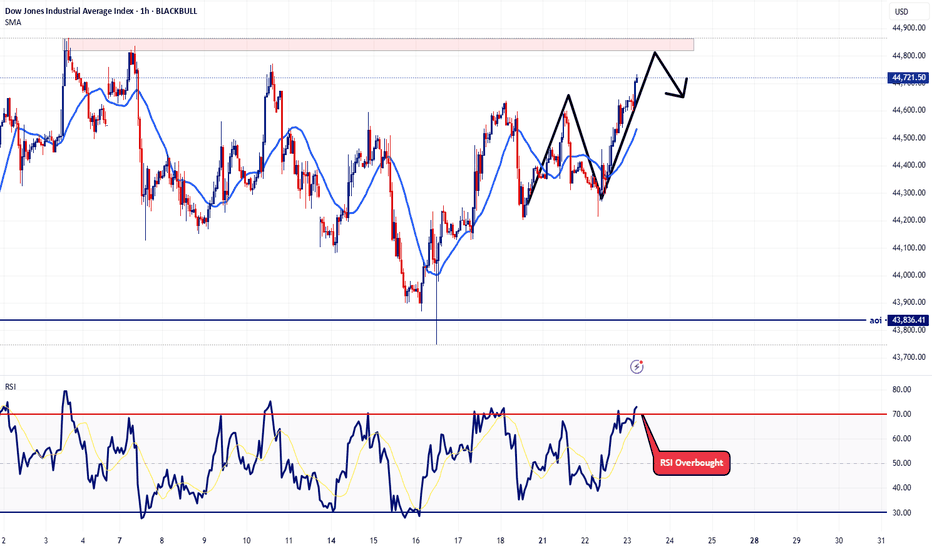

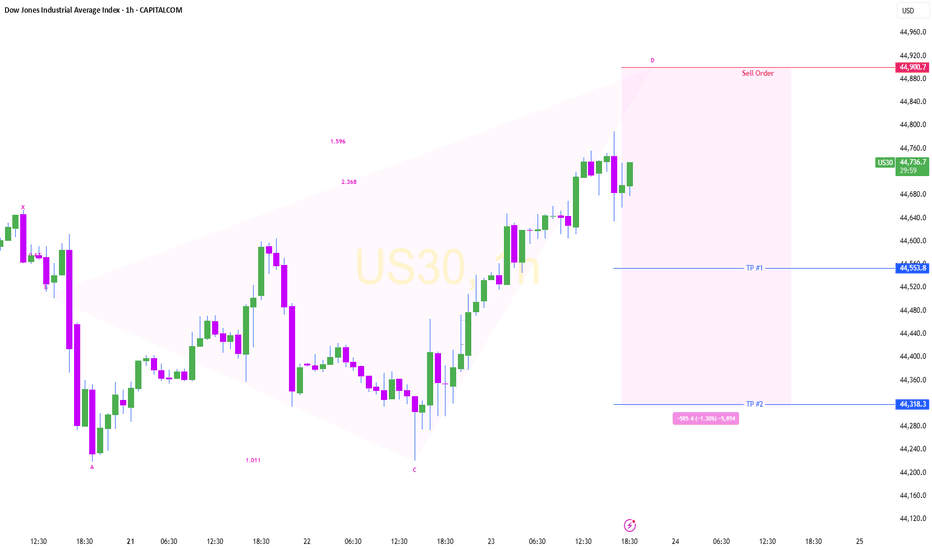

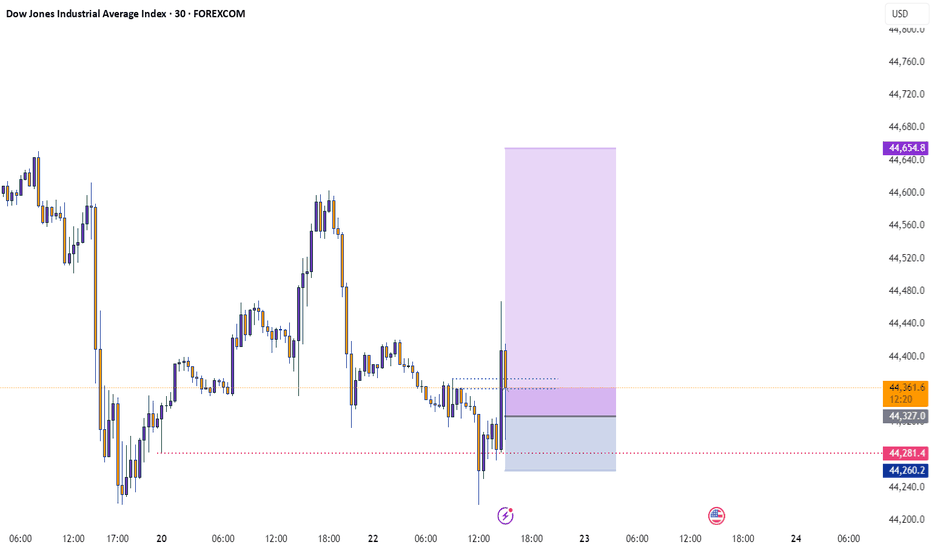

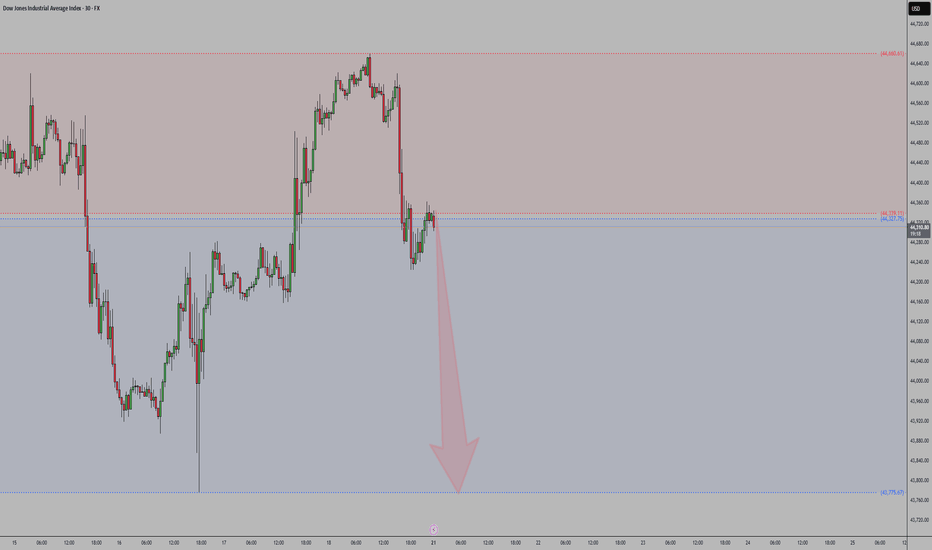

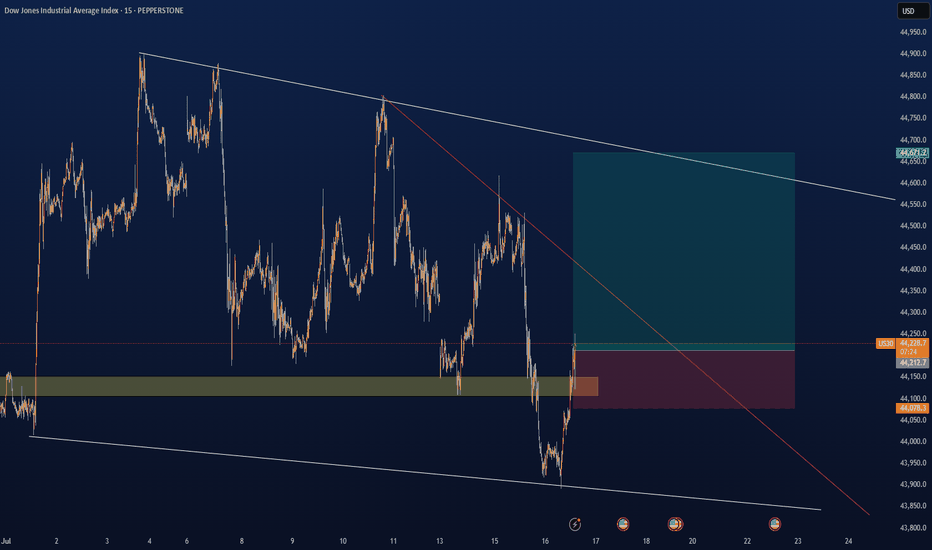

US30 - What I believe will happen todayConsidering today is now Wednesday and Wednesday's have a consistency of being one of those off days. Primarily because usually there are Fed speeches on this day that manipulate the market. With that said, I'm expecting price action to play out how I plotted the arrows on the chart. I believe there is still some further upside for today but then I believe we might get that intraday correction around 11:am - noon EST.

Let's see how today plays out. Trade safe

US30 trade ideas

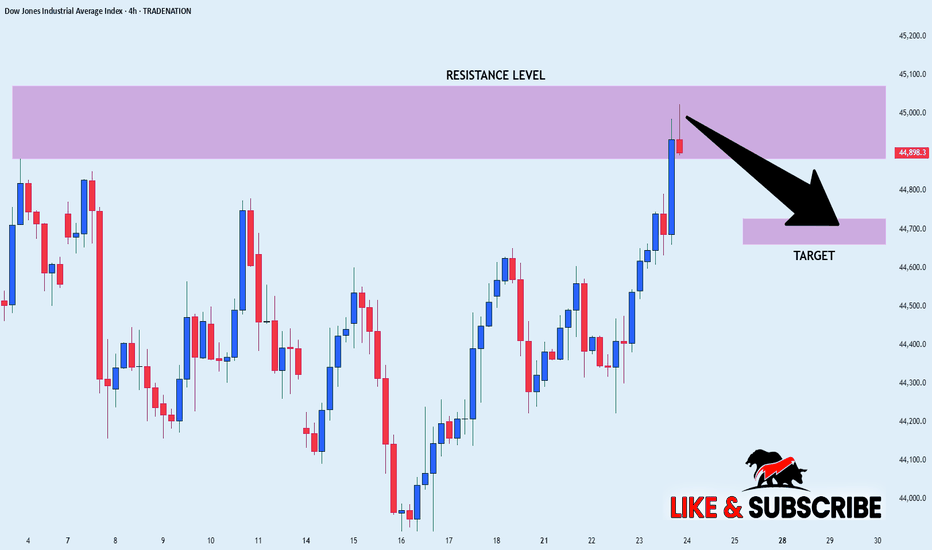

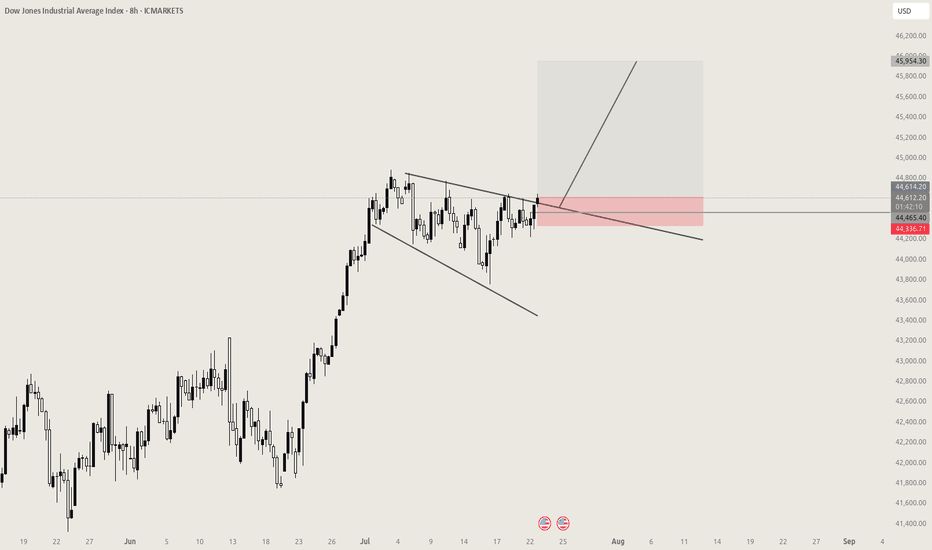

US30 SHORT FORM RESISTANCE|

✅DOW JONES index keeps

Growing in a strong uptrend

And we are bullish biased long-term

However the price has hit an all-time-high

Resistance level of 45,072(which can be seen

Further left you zoom out on higher TF)

So as we are already seeing a local

Bearish reaction we will be

Expecting a local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

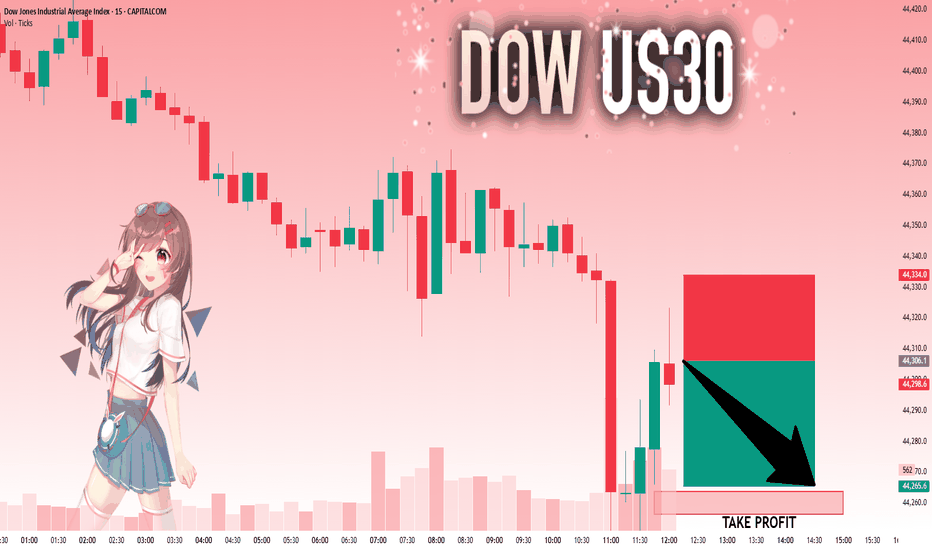

US30: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 44,306.1 will confirm the new direction downwards with the target being the next key level of 44,263.8..and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

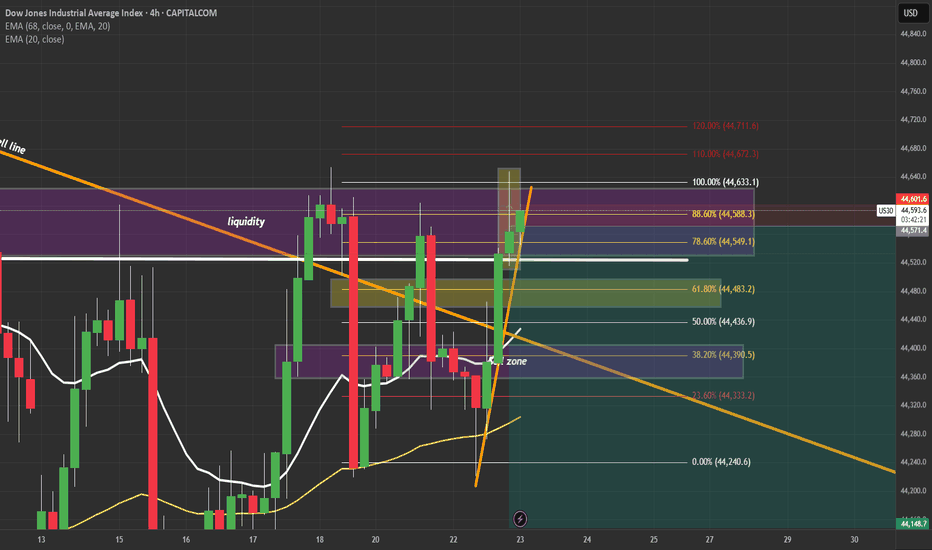

US30 | Inverted Hammer at Key Supply Zone – Reversal or BreakoutUS30 just printed an inverted hammer on the 4H at a major supply zone (44,550–44,600). This is a critical decision point:

✅ Bearish Case:

If price rejects and closes back below 44,530, sellers could take control with targets at 44,380 → 44,180 → 44,020.

✅ Bullish Fakeout:

If price breaks and holds above 44,620, expect a push toward 44,700 and 44,900.

📌 What I’m Watching:

Rejection candle + bearish close → short entries.

Strong breakout candle with retest → long continuation.

Key Levels:

🔴 Resistance: 44,550–44,600

🟢 Support: 44,380 → 44,020

⚠️ Manage risk carefully. Volatility is high and liquidity hunts are common in this zone.

💬 Do you think we reject here or break out higher? Drop your thoughts below!

#US30 #DowJones #PriceAction #SmartMoney #TradingView #TechnicalAnalysis #IndicesTrading

US30 continues to exhibit bullish momentumThe US30 index continues to exhibit bullish momentum, driven by strong earnings reports and robust U.S. economic data. The key support zone around 44,300 has held firm, reinforcing confidence among buyers.

As long as the price remains above 44,300, the uptrend is expected to persist Upside target: 45,000 remains in focus. a focus on the 1H Candle close above 44,000 we could expect price could push more upside.

You may find more details in the chart Trade wisely best of luck buddies

Ps: Support with like and comments for better analysis Thanks for Supporting.

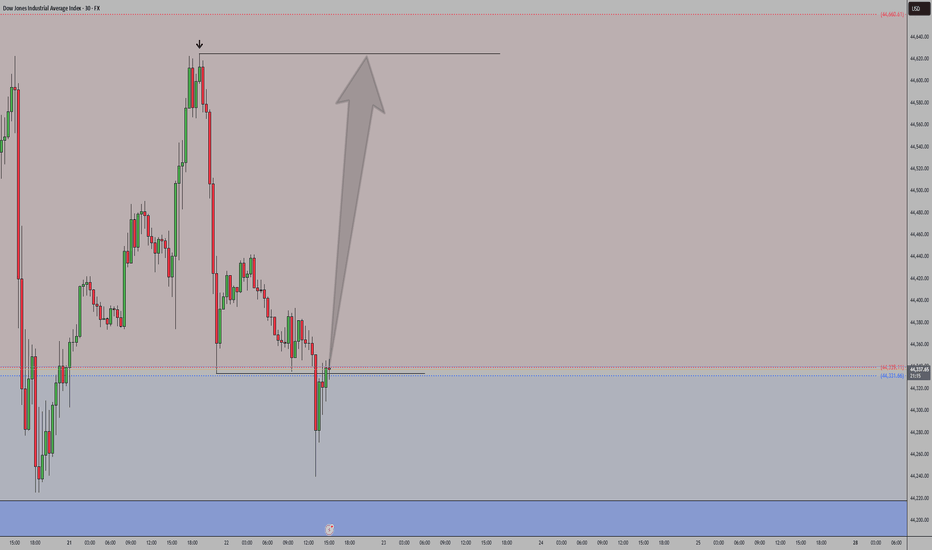

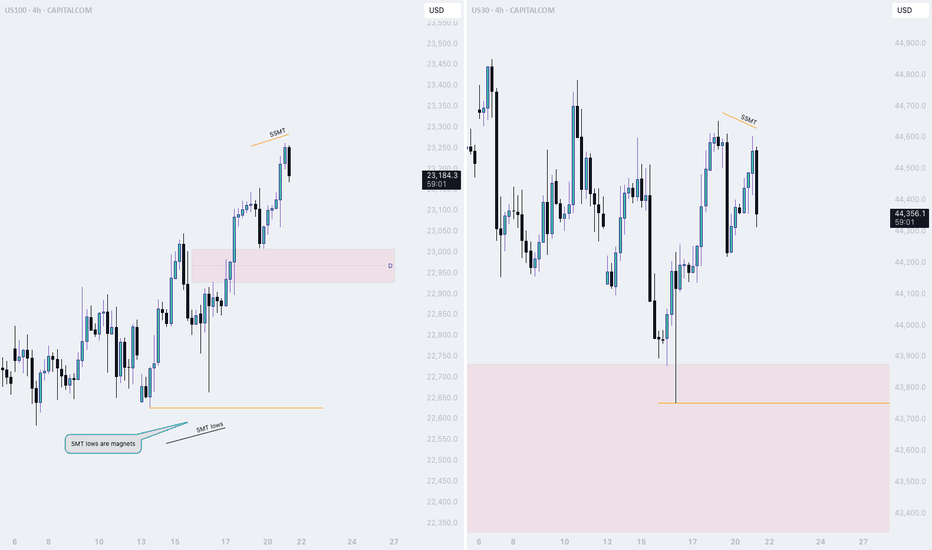

NQ thread: Short ideaMonday started off bullish, but only to drop at the end of the session.

Here is a thread on what is happening and on which narratives I view the market

Starting off with the 4H Time frame, we witnessed NQ and ES taking last weeks high.

YM did not.

This is the first stage of the movement. To find the second stage, we need to dive deeper into the lower timeframes..

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 44,300 zone, Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 44,300 support and resistance area.

Trade safe, Joe.

US30 Rejected Support at 43340 – Bearish Below 43960US30 – Overview

The price rejected perfectly from the projected support at 43340 and currently maintains a bearish momentum as long as it trades below the pivot level at 43960.

As long as the price remains under this level, we expect a move toward 43630, and a break below that may lead to a retest of 43340.

However, a 4H candle close above 43960 would shift the outlook to bullish, with upside potential toward 44170 and possibly 44360.

Support: 43630 • 43340

Resistance: 44170 • 44360

Bias:

🔻 Bearish below 43960

🔺 Bullish confirmation on 4H close above 43960

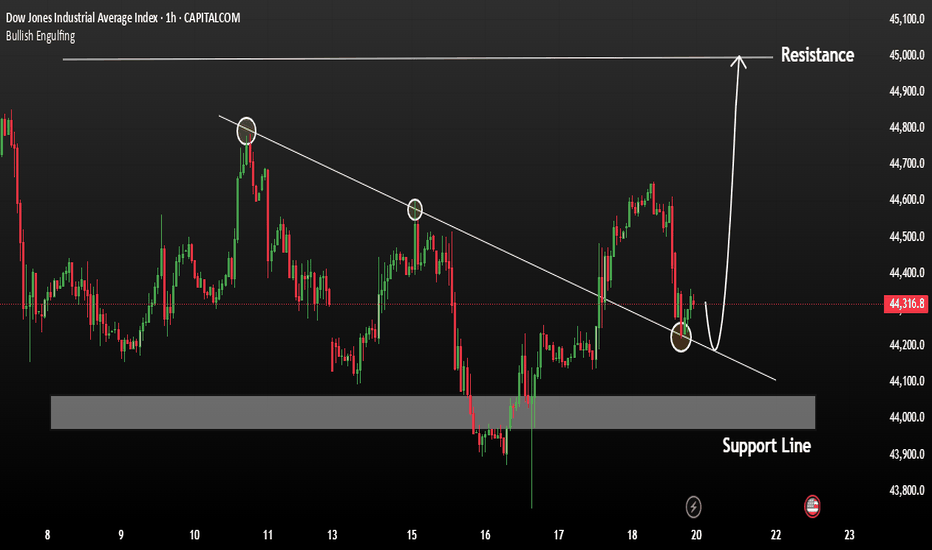

US30 ShortUS30 Short Setup – Bearish Retest Play

Idea: Looking for a short opportunity after a clean break of structure and trendline.

Breakdown:

Trendline Break: The rising trendline (yellow) has been decisively broken, signaling a shift in market structure.

Structure Shift: We saw a strong impulsive move to the downside, breaking previous higher lows and confirming bearish intent.

Key Resistance Zones: Price is now pulling back toward a key supply zone between 44,100 – 44,300, which aligns with previous support-turned-resistance.

Plan: I’m anticipating a potential lower high formation around this zone, followed by rejection and continuation to the downside.

Target Zone: My short target is the demand area around 42,900 – 42,600 where price last consolidated before the previous rally.

Invalidation: If price reclaims and holds above 44,400, the short idea becomes invalid.

Falling towards pullback support?Dow Jones (US30) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 42,889.86

1st Support: 41,750.90

1st Resistance: 43,936.63

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

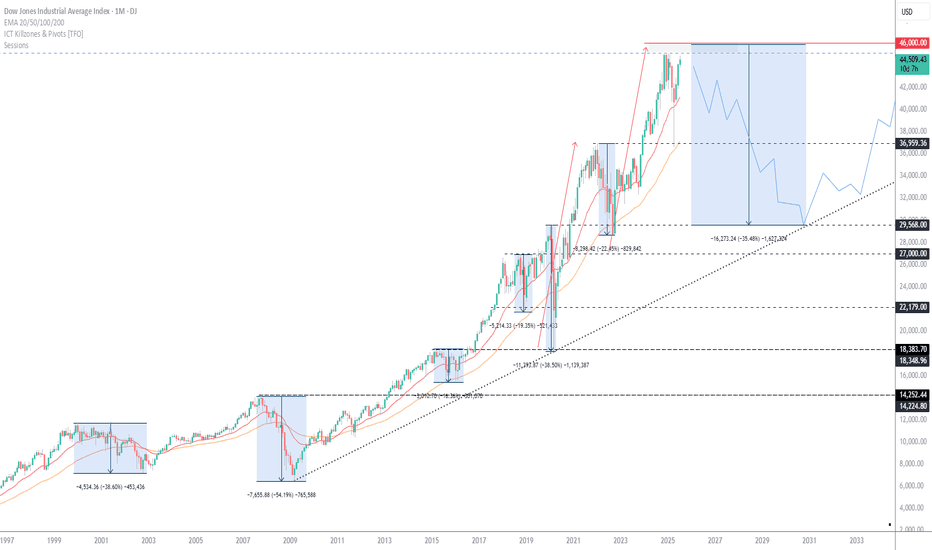

Anticipating DJIOn the daily timeframe, the current position of the Dow Jones Industrial Average (DJI) is projected to follow one of three possible scenarios:

Scenario 1 (Black Label):

DJI is currently in the process of forming Wave iv of Wave , implying that any short-term rebound is likely to be limited. The index may test the resistance area between 43,953–44,142, but remains vulnerable to further downside correction thereafter.

Scenario 2 (Red Label):

In this scenario, Wave 4 is considered complete, allowing DJI to resume its upward momentum. A breakout would signal the start of Wave 5, targeting the 45,324–46,465 range for a potential new higher high.

Scenario 3 (Blue Label):

Here, DJI is assumed to be in the midst of Wave 4 of Wave (5). A corrective move is expected first, potentially revisiting the support zone around 42,262–43,028, before continuing its bullish trend to form a new higher high.