DXY trade ideas

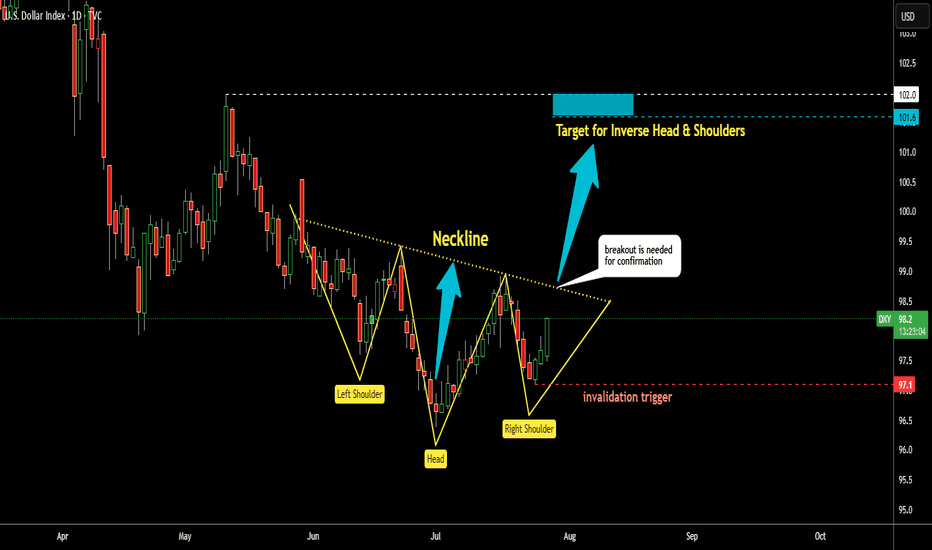

Dollar Index (DXY): Possible Reversal | Inverse Head & ShouldersThe dollar has had a tough year, but that might be changing.

I’ve spotted a well-known reversal pattern: an Inverse Head & Shoulders.

This pattern features three dips, with the middle one—the "head"—being the deepest.

Now, the price has rebounded from the Right Shoulder and is heading higher.

It’s approaching the Neckline at $98.7, which needs to be broken for a bullish confirmation.

If that happens, the projected target is around $101.6, based on the depth of the pattern.

This lines up closely with the previous high of $102 from May. The target area is highlighted in the blue box.

However, if the price falls below the Right Shoulder’s low at $97.1, the pattern would be invalidated.

Anyone else see this pattern?

Could this be the bottom for the dollar?

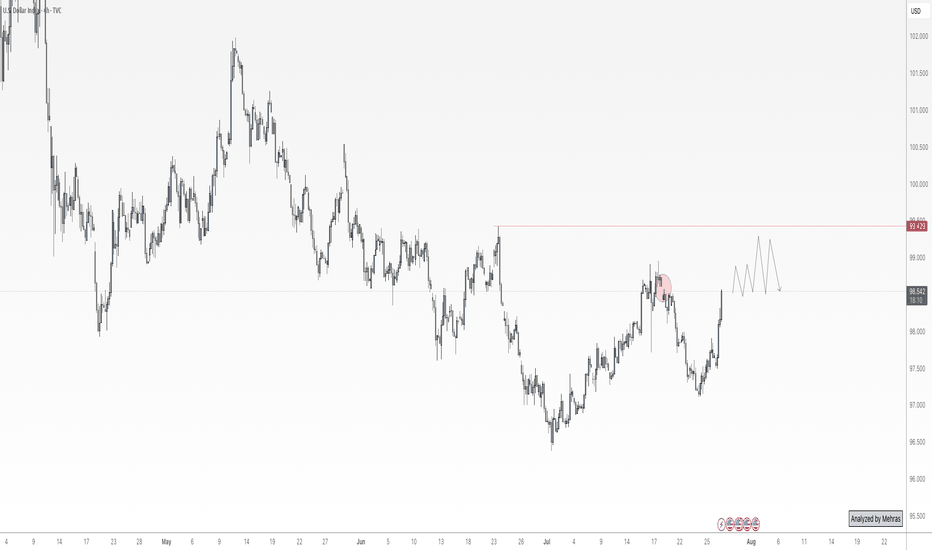

USD Working Strongest Month Since April 2022After a decisive sell-off ran for most of the first-half of the year, USD bulls have stepped up in July and DXY is currently up 3.3% for the month.

That's the strongest monthly outing in the currency since April of 2022- and that's just after the Fed had started their rate hike campaign that year. It led into a massive rally that ran through September as the USD set fresh 20-year highs.

The question now is one of continuation, and motive seems to be fairly clear. I've outlined the technical backdrop as this shift has taken place over the past month, as the Dollar held a higher-low last week and that drove into a higher-high this week.

There's likely some short squeezing contributing to the rally but with U.S. data remaining strong, and inflation on the way back up, the rate cuts that markets had priced-in back in March and April for 2025 are now in question.

This brings attention to the next major item - with Non-farm Payrolls tomorrow morning.

On a short-term basis the USD move has already started to show overbought conditions on the four-hour chart, and daily RSI is getting close to the 70-level. So perhaps ideal would be a soft report tomorrow at which point a pullback could show. It's from that that we can see whether bulls will come in to defend higher-lows, and there's now support potential at prior resistance of 99.40 in DXY.

If we do see a strong report, the 100 level is the spot for bulls to reckon with and at that point, we may be looking at an overbought RSI scenario on the daily chart - which doesn't necessarily preclude bullish continuation although it will make it more difficult to chase topside breakouts. - js

Dollar Index Update – Holding Gains After NFP Data📈 DXY Outlook – Ready for the Next Leg Up?

Last Friday, as NFP data hit the market, I published an analysis highlighting this exact move—and so far, price has respected the roadmap perfectly.

Now, with momentum building and structure aligning, the Dollar Index looks poised to continue its bullish run—first toward the 101 zone and potentially higher toward 102.

But here’s the key point for swing traders and risk-conscious setups:

🔍 If we’re aiming for higher targets with minimal drawdown, tonight’s daily candle close will be crucial.

A bullish close above yesterday’s high would not only confirm strength, but significantly reduce entry risk for long positions.

So, whether you’re already in the trade or waiting for confirmation, patience tonight could pay off.

Let’s see if the bulls can seal the deal with a strong daily close.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

USDX-SELL strategy 6 horuly chart Reg.ChannelThe index has moved up sharply, and as always, when over speeding, one may get a speeding ticket. :) anyway, on a serious note, we are quite overbought and above the Reg. Channel a bit. This means over time we may see a pullback, which can bring us to lower 99.00s.

Strategy SELL @ 100.00-100.40 and take profit near 99.07 for now.

DXY at Its Most Critical Level of 2025 — Will the 100 Bank LevelThe Dollar Index (DXY), just like several other majors, is approaching a very important level. We’re now near the 100 mark, which is not only a psychological level — but also a key institutional (bank) level.

There’s also a gap zone left behind that price is about to fill. I believe the index will stay in a range over the next 1–2 days as it waits for critical data later this week — especially Wednesday’s announcements and Friday’s NFP report, which could set the tone for what’s next.

Based on current market sentiment, Trump’s remarks, Powell’s upcoming speech, and broader macro factors, I believe DXY has the potential to break above 100 and move toward 102–104, if that level is broken cleanly.

Let’s also not forget — price bounced from a monthly demand block near 96, and we’re seeing weak support across majors like EUR and Gold. That adds confluence for potential dollar strength.

📌 What do you think — is dollar strength just around the corner?

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

the retail trader outlookWe see that the wedge pattern has been completed and the bullish market is strong as the candles a huge, this is a high risk low reward trade as it clear and obvious to the vest public that the markets wants to rally. the role of the dollar price plays a vital role in this not happening as we see that the dollar has formed the yearly low as is starting to move up in an increasingly high speed suggesting that Gold is more likely to be affected by the sudden Rally in the dollar currency and the opposite is true given a drop in dollar.

Dollar Falls as Traders Price In Two 2025 Rate Cuts on Weak JobsDollar Falls as Traders Price In Two 2025 Rate Cuts on Weak Jobs Data

Introduction

In a significant turn of events for the global currency markets, the U.S. dollar has taken a sharp tumble as traders brace for a more dovish Federal Reserve. A weaker-than-expected U.S. employment report for July 2025 has prompted market participants to price in two interest-rate cuts by the Fed before the end of the year. This shift in monetary policy expectations comes during a time of heightened global uncertainty, much of it triggered by President Donald Trump's aggressive trade policies, which have already disrupted the $7.5 trillion-a-day foreign exchange market.

The Bloomberg Dollar Spot Index, a key gauge of the dollar’s strength against major currencies, plunged as much as 1%—marking its worst single-day performance since April 21, 2025. The greenback’s decline was mirrored by strong gains in rival currencies, with the Japanese yen appreciating 2.2% and the euro climbing more than 1% against the dollar.

This article delves into the recent developments surrounding the U.S. dollar, the implications of weak jobs data, the Federal Reserve’s likely response, and how Trump’s trade policies are shaping the broader economic landscape.

________________________________________

Weak Jobs Data Sparks Policy Shift

The July 2025 employment report came in well below expectations. Non-farm payrolls growth fell short, and revisions for May and June showed fewer jobs were added than previously reported. These figures suggest that the U.S. labor market is cooling more rapidly than anticipated, raising concerns about the sustainability of the post-pandemic economic recovery.

According to Helen Given, a foreign exchange trader at Monex Inc., “It’s now clear that the U.S. labor market is cooling fairly sharply. There’s a good chance that Trump’s crusade against Chair Powell ratchets up further in the coming days, and there could be further losses for the dollar to come as a result.”

The disappointing employment data has led traders to adjust their expectations for U.S. monetary policy. Futures markets are now pricing in two 25-basis-point rate cuts by the end of 2025, a stark reversal from the earlier outlook that suggested the Fed would remain on hold or even consider tightening if inflation remained sticky.

________________________________________

The Federal Reserve’s Dilemma

The Federal Reserve now finds itself in a precarious position. On one hand, inflation has moderated in recent months, giving the central bank more room to maneuver. On the other hand, a weakening labor market could indicate a broader slowdown that might require immediate action to prevent a recession.

Fed Chair Jerome Powell has come under increasing political pressure from President Trump, who has publicly criticized the Fed for keeping rates too high. Trump argues that rate cuts are necessary to support U.S. exporters and counteract the negative effects of his own tariffs and trade restrictions.

Historically, the Fed has maintained its independence from political influence, but in an election year, the pressure to act can become intense. If the Fed moves to cut rates, it will be seen as responding to both economic data and political dynamics—a delicate balancing act.

________________________________________

The Global Currency Market Reacts

The ripple effects of the dollar’s decline are being felt across the globe. The $7.5 trillion-a-day foreign exchange market, already under strain from geopolitical uncertainty and shifting central bank policies, has seen increased volatility in recent weeks.

The Japanese yen, often viewed as a safe-haven currency, surged 2.2% against the dollar following the release of the jobs data. Meanwhile, the euro gained over 1%, reflecting investor sentiment that the greenback’s era of dominance may be waning—at least for now.

Emerging market currencies also found some relief, as a weaker dollar generally eases pressure on countries with large dollar-denominated debts. However, the overall picture remains complex, as trade tensions and capital flow volatility continue to weigh on risk sentiment.

________________________________________

Trump’s Trade Policies: A Double-Edged Sword

President Trump’s trade strategies have been a central feature of his second term in office. From imposing tariffs on Chinese imports to renegotiating trade agreements with the European Union and Canada, Trump has sought to reshape the global trading system in favor of American manufacturers.

Yet these policies have produced mixed results. While some sectors have benefited from protectionist measures, others—particularly those reliant on global supply chains—have suffered from rising costs and retaliatory tariffs. The uncertainty generated by these policies has also dampened business investment, slowed global trade, and disrupted financial markets.

“The dollar had tumbled this year as Trump’s aggressive trade policies rocked the $7.5 trillion-a-day currency market, weighing on global growth outlook,” Bloomberg reported.

Investors are increasingly concerned that continued trade friction, combined with growing political pressure on the Fed, could lead to policy missteps that undermine the U.S. economy and erode confidence in the dollar.

________________________________________

Market Implications

The dollar’s recent decline has far-reaching implications for various asset classes:

1. Equities

U.S. equities have shown mixed reactions. While lower interest rates are typically supportive of stock prices, the underlying reason—economic weakness—has investors on edge. Sectors such as technology and consumer discretionary are expected to benefit from cheaper borrowing costs, but cyclical sectors may struggle if growth slows further.

2. Bonds

Treasury yields have fallen sharply as traders anticipate rate cuts. The 10-year yield dropped below 3.8%, its lowest level in months. The yield curve has also flattened, a potential warning sign of slowing economic momentum.

3. Commodities

A weaker dollar typically supports commodity prices, as most are priced in dollars. Gold, oil, and industrial metals all saw gains in the wake of the jobs report. However, demand-side concerns stemming from a global slowdown could limit the upside.

4. Emerging Markets

For emerging markets, a softer dollar offers both relief and risk. On the positive side, it reduces debt servicing costs and can attract capital flows. On the negative side, if the dollar’s weakness reflects a broader global slowdown, risk appetite could remain subdued.

________________________________________

Looking Ahead: What to Watch

As markets digest the latest economic data and policy signals, several key developments will be closely monitored:

1. Upcoming Fed Meetings

The Federal Open Market Committee (FOMC) will meet again in September. Markets will be keenly watching for any changes in tone or new forward guidance. A rate cut in September now appears increasingly likely, especially if subsequent data confirms a labor market slowdown.

2. Inflation Trends

While inflation has moderated, it remains a key concern for policymakers. If inflation rebounds unexpectedly, it could complicate the Fed’s ability to cut rates without stoking price pressures.

3. Geopolitical Risks

Trade tensions, particularly with China and the EU, remain unresolved. Any escalation could further destabilize markets and weigh on the dollar. Additionally, developments in the Middle East, Eastern Europe, and Southeast Asia could add to the uncertainty.

4. U.S. Presidential Politics

With the 2026 presidential election campaign already underway, Trump’s rhetoric and policy decisions will continue to influence market sentiment. His ongoing criticism of the Fed could erode confidence in U.S. institutions, particularly if it leads to perceived politicization of monetary policy.

________________________________________

Conclusion

The sharp fall in the U.S. dollar following weak July jobs data marks a pivotal moment in 2025’s economic narrative. With traders now pricing in two Federal Reserve rate cuts by year-end, the stakes have never been higher for policymakers, investors, and political leaders.

While a softer dollar can provide some temporary relief to exporters and boost inflation expectations, it also reflects deeper concerns about the strength of the U.S. economy and the unintended consequences of aggressive trade policies. President Trump’s confrontational approach to global trade, combined with mounting pressure on the Fed, is creating a complex and potentially volatile environment for markets.

As the year progresses, all eyes will be on the Federal Reserve’s response, the resilience of the U.S. labor market, and the evolving political landscape. In a world where headlines can move markets in seconds, clarity, stability, and sound policy have never been more critical.

________________________________________

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice.

DOLLAR INDEX (DXY), Position Trade Bullish Point of ViewLooking at the DOLLAR INDEX (DXY), DXY might turn bullish after tapping the potential inversion fair value gap around 100.182 suggesting a macro continuation of the long-term uptrend, with price likely to retest the 103.197 IFVG (inversion fair value gap) area, break above 114.778 liquidity, and continue higher toward the 132.345 FVG from 1st of July 1985.

DOLLAR INDEX (DXY), Position Trade Bearish Point of ViewLooking at the DOLLAR INDEX (DXY), DXY might turn bearish after tapping the FVG above, potentially falling below the long-term ascending channel on the quarterly timeframe, suggesting a macro trend reversal, with price likely to break and retest 98.393 before continuing down toward the 84.464 FVG area.

US Dollar Index (DXY) Reaches One-Month HighUS Dollar Index (DXY) Reaches One-Month High

The US Dollar Index (DXY) has risen to its highest level since early July. According to media reports, the bullish sentiment in the market is driven by the following factors:

→ Optimism around US trade agreements. A new trade deal with the EU — which includes a 15% tariff on European goods — is being perceived by the market as favourable for the United States.

→ Confidence in the resilience of the US economy. Strong Q2 corporate earnings have acted as an additional bullish catalyst. Investors may have started covering short positions against the dollar, viewing concerns over a US slowdown as overstated.

→ Expectations that the Federal Reserve will keep interest rates on hold.

From a technical standpoint, today’s DXY chart reflects strengthening bullish momentum.

Technical Analysis of the DXY Chart

Two U-shaped formations (A and B) that developed over the summer have created a bullish сup and рandle pattern — a formation that suggests waning bearish pressure, as evidenced by the shallower second dip.

This setup points to the potential for a bullish breakout above the trendline (marked in red) that has defined the downward movement in the DXY throughout the first half of 2025.

As previously analysed, there are signs that the dollar index may have found a base following a period of decline. This could indicate a shift in market sentiment and the possible end of the recent bearish phase.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DOLLAR INDEX The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is approximately 4.25% to 4.5%.

The federal funds rate is a key benchmark that influences broader interest rates across the economy, including loans, credit cards, and mortgages. When the Fed changes this rate, it indirectly affects borrowing costs for consumers and businesses. For example, increasing the rate makes borrowing more expensive and tends to slow down economic activity to control inflation, while lowering the rate stimulates growth by making credit cheaper.

The Fed adjusts this rate based on economic conditions aiming to maintain stable prices and maximum employment. It is a vital tool of U.S. monetary policy, impacting economic growth, inflation, and financial markets.

In summary:

It is the overnight lending rate between banks for reserve balances.

It is set as a target range by the Federal Reserve's FOMC.

It influences many other interest rates in the economy.

Current range (July 2025) is about 4.25% to 4.5%.

1. ADP Non-Farm Employment Change (Forecast: +82K, Previous: -33K)

Above Forecast:

If ADP employment is much stronger than expected, the Fed would see this as a sign of ongoing labor market resilience. Robust job growth would support consumer spending, potentially keep wage pressures elevated, and could make the Fed less likely to ease policy soon. This reinforces the case for holding rates steady or staying data-dependent on further cuts.

Below Forecast or Negative:

If ADP jobs gain falls short or is negative again, the Fed may interpret it as a weakening labor market, raising recession risk and reducing inflationary wage pressures. This outcome could increase the chances of a future rate cut or prompt a more dovish tone, provided it aligns with other softening indicators.

2. Advance GDP q/q (Forecast: +2.4%, Previous: -0.5%)

Above Forecast:

A GDP print above 2.4% signals surprisingly strong economic growth and likely sustains the Fed’s view that the U.S. economy is avoiding recession. The Fed may delay rate cuts or take a more cautious approach, as stronger growth can support higher inflation or at least reduce the urgency for support.

Below Forecast or Negative:

Weak GDP—especially if close to zero or negative—would signal that the economy remains at risk of stagnation or recession. The Fed may then pivot to a more dovish stance, become more willing to cut rates, or accelerate discussions on easing to avoid a downturn.

3. Advance GDP Price Index q/q (Forecast: 2.3%, Previous: 3.8%)

Above Forecast:

A significantly higher-than-expected GDP Price Index (an inflation measure) points to persistent or resurgent inflationary pressures in the economy. The Fed might see this as a reason to delay cuts or maintain restrictive rates for longer.

Below Forecast:

If the Price Index prints well below 2.3%, it suggests that inflation is cooling faster than anticipated. This outcome could allow the Fed to move toward easing policy if other conditions warrant, as price stability is more clearly in hand.

Bottom Line Table: Data Surprises and Likely Fed Reaction

Data Surprise Fed Outlook/Action

All above forecast Hawkish bias, rate cuts delayed or on hold

All below forecast Dovish bias, higher chances of rate cut

Mixed Data-dependent, further confirmation needed

Summary:

The Fed’s interpretation hinges on how these figures compare to forecasts and to each other. Stronger growth, jobs, and inflation = less rush to cut; weaker numbers = lower rates sooner. If growth or jobs are especially weak or inflation falls sharply, expect more dovish Fed commentary and a greater likelihood of future easing. Conversely, if the data all surprise to the upside, hawkish (rate-hold) messaging is likely to persist.

The U.S. Dollar Index (DXY) is a financial benchmark that measures the value of the United States dollar relative to a basket of six major foreign currencies. It provides a weighted average reflecting the dollar's strength or weakness against these currencies. The DXY is widely used by traders, investors, and economists to gauge the overall performance and health of the U.S. dollar on the global stage.

Key Features of the DXY:

Currencies included and their weights:

Euro (EUR) – 57.6%

Japanese Yen (JPY) – 13.6%

British Pound (GBP) – 11.9%

Canadian Dollar (CAD) – 9.1%

Swedish Krona (SEK) – 4.2%

Swiss Franc (CHF) – 3.6%

It was established in 1973 after the collapse of the Bretton Woods system to serve as a dynamic measure of the dollar's value.

The index reflects changes in the exchange rates of theses versus the U.S. dollar, with a higher DXY indicating a stronger dollar.

The DXY influences global trade dynamics, commodity prices (like oil and gold)

US Dollar Bottom: Don’t Rush InSince the beginning of the year, the US dollar (DXY) has been the weakest currency in the floating exchange market (FX). However, since mid-July, a technical rebound has begun, fueled by several fundamental factors, notably the Federal Reserve’s monetary hawkishness. But can this upward move be interpreted as a true annual bottom?

Or is it merely a temporary short squeeze before a return to the lows? As high finance fundamentals swing back and forth, let’s assess the technical outlook for the US dollar (DXY).

1) Rate cut expected on Wednesday, September 17 – fundamentals in flux

The recent rebound in the US dollar coincides with the Federal Reserve's firm stance in refusing, for now, to resume rate cuts, which have been on hold since late 2024. In its latest monetary policy decision on July 30, the Fed reaffirmed that no tangible factors justify a rapid rate cut. Disinflation appears paused, and the institution prefers to wait until fall to assess the impact of tariff measures on the core PCE index (inflation excluding food and energy).

However, a major red flag emerged with the release of a very poor Non-Farm Payrolls (NFP) report on August 1, reflecting a significant weakening in the labor market — a fundamental red alert!

The Fed has made it clear that the evolution of employment will be a key factor in its September decision. A weaker labor market could accelerate a monetary policy shift, renewing downward pressure on the US dollar.

2) Technical analysis of the US dollar (DXY): short-term rebound... but no medium-term trend reversal yet

From a technical standpoint, July's rebound is based on medium/long-term support levels that have so far acted as potential reversal bases. Can we legitimately speak of an annual low for the DXY? Has a major resistance been broken? The answer remains NO for now.

Weekly and monthly charts do not yet show a clear bullish reversal pattern. Some bullish divergence signals are emerging, notably on the RSI and LMACD, but they remain insufficient to confirm a lasting regime shift. A comparison with the 2018 and 2021 lows is telling: at those times, technical divergences were far more pronounced and bullish reversal structures had been confirmed.

The Elliott wave approach suggests a rebound is plausible within a corrective structure, but it does not yet guarantee a major trend reversal.

Data from the CFTC’s Commitments of Traders (COT) report and ETF flows tied to the dollar indicate some hesitation among institutional investors. While short positions have declined, there’s no clear evidence of large-scale buying.

In summary, the US dollar rebound since mid-July is real but fragile. As long as technical signals remain unclear and the labor market is flashing red, betting on a sustainable trend reversal remains risky. The annual low may be in place, but it is not yet confirmed from a technical, macroeconomic, or behavioral standpoint.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Bullish bounce off pullback support?The US Dollar Index (DXY) is reacting off the pivot, which is a pullback support that lines up with the 50% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 98.64

1st Support: 97.14

1st Resistance: 100.09

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD, DXY rejected at 100 but can bulls hold a higher-low?You find out the true test of a trend during the counter-trend episodes. Do buyers show up to hold higher-lows? Or does fear and skepticism cause them to take a back seat as sellers continue to dominate. If that's the case, then supports are vulnerable and there could be motive for continued selling. But, if bulls do stand up and hold a higher-low, that can be a sign that the market is still harboring longer-term oversold dynamics after a heavy one-sided move drove for so long.

That's where we're at with the US Dollar.

The USD finished July as its strongest month in more than three years. And it followed that up with its largest sell-off in three months as multiple factors hit the greenback on Friday. There was the NFP report, with massive revision to the headline number for the prior two months. And then Trump fired the head of the BLS and then towards the end of the session, the resignation of a Fed governor which will allow Trump to appoint a more-dovish FOMC member about six months earlier than expected.

Collectively this served to push up rate cut expectations in September and that's what hit the USD so hard. And at this point markets are widely-expecting that next cut in September to a current 87.8% probability as of right now per CME Fedwatch.

But will these dynamics lead to a more dovish Fed? Powell didn't sound as though he was ready to cut rates on Wednesday and he said it was the unemployment rate that the Fed will be watching - and that came in right at the expected 4.2%, which is very close to the 'full employment' level. There's also the Core PCE report from Thursday, which showed inflation is still moving higher - even without a Fed rate cut, and that follows a similar reading of CPI from earlier in the month.

The big question here is whether that can all allow for the USD to sink down to fresh lows and from the daily chart, there's a big spot of support potential around the April and early-June swing lows, spanning from 97.60-97.92. - js

DXY testing 100.00 resistanceThe US dollar index has risen to rest a key resistance area around the 100.00 level. Previously a key support and resistance zone, what happens here could determine the near-term technical direction for the US dollar.

Key support below this zone is at 98.95, marking a prior resistance. Given the short-term bullish price structure, I would expect this level to hold if the greenback were to ease back from here.

If the bullish momentum gathers pace, then 101.00 could be the next stop, followed by the recent high of 101.97.

From a macro point of view, resilient economic data and persistent core inflation concerns continue to support the Federal Reserve’s cautious policy approach. Today’s core PCE inflation reading came in slightly above forecast, at 2.8% year-over-year versus the expected 2.7%. In addition, jobless claims were better than anticipated, registering 218,000 compared to the 224,000 forecast. The Q2 Employment Cost Index also surprised to the upside, rising 0.9% quarter-on-quarter.

These figures follow yesterday’s stronger-than-expected GDP report and a solid ADP private payrolls release, further underscoring the strength of the U.S. economy.

Attention now turns to Friday’s nonfarm payrolls report, which could have a meaningful impact on rate expectations. Fed Chair Jerome Powell has emphasized the importance of the unemployment rate as a key metric, so any upside surprise could reinforce the Fed’s current position.

However, expectations are not very high for the non-farm payrolls report. Current forecasts suggest an increase of 106,000 jobs, with average weekly earnings rising 0.3% month-over-month, and the unemployment rate edging up to 4.2%. Yet, the scarcity of strong leading indicators this month adds a layer of uncertainty to the outlook.

By Fawad Razaqzada, market analyst with FOREX.com

DXY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.