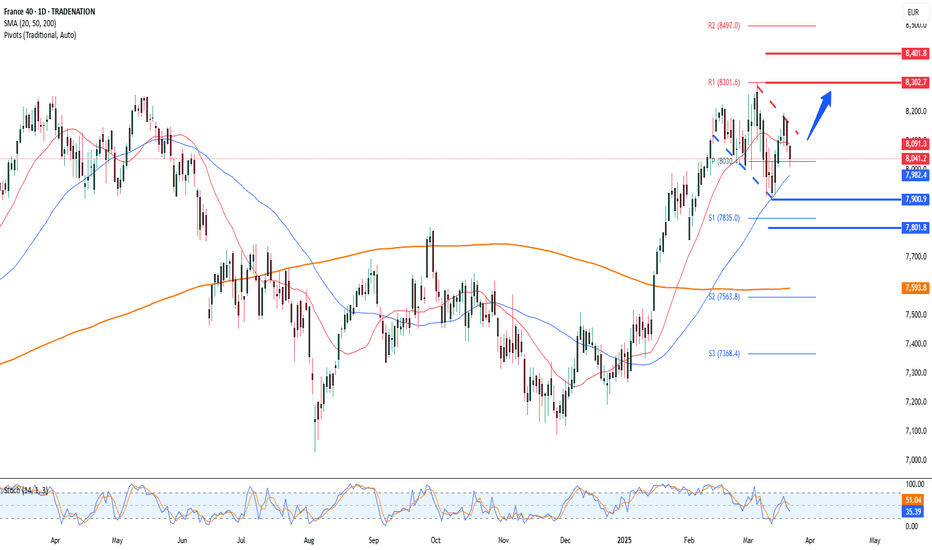

France 40 is priming up for strong upside to 8,673France is definitely setting itself for upside to come.

We have positive data from the love country including:

📈 Oversold Conditions

The CAC 40 was heavily sold off — now it’s ripe for a bounce.

🏦 ECB Rate Cuts

Lower interest rates fuel investor appetite for European equities.

💼 Strong Corporate Earnings

French companies are reporting resilient profits despite volatility.

💰 Foreign Investment Flowing In

Global funds see value and are buying the dip in France.

Technicals also look great including:

W Formation is forming but hasn't broken the neckline just yet.

Price>20 and 200MA

Target 8,673

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

F40 trade ideas

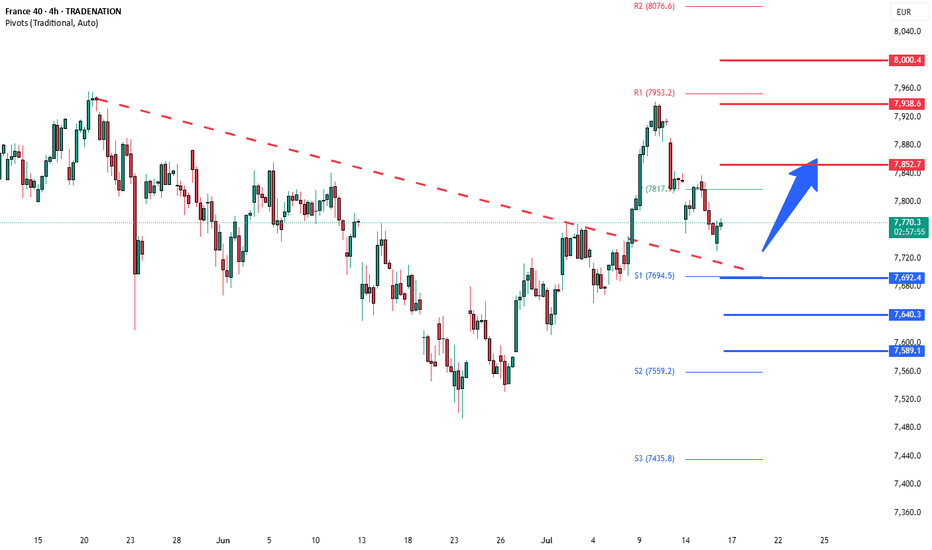

CAC40 Bullish breakout retest support at 7690The CAC40 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7960 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7690 would confirm ongoing upside momentum, with potential targets at:

7850 – initial resistance

7940 – psychological and structural level

8000 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7690 would weaken the bullish outlook and suggest deeper downside risk toward:

7640 – minor support

7590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the CAC40 holds above 7690. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FRANCE 40 Heist in Progress | Bullish Reversal Zone Spotted.💼 CAC40 Market Heist: Thief Trading Blueprint for Smart Traders (Swing/Day Trade Edition) 💼

🌍 Bonjour, Hola, Hallo, Marhaba, Ola, Hello! 🌍

Welcome to all Market Hustlers, Silent Snipers, and Profit Seekers! 🤑💸🎯

We're back with a precision-built Thief Trading Plan — this time targeting the FRANCE40 / CAC40 Index, using a combination of street-smart technicals and sharp macro insights.

🧠 Game Plan: The “Market Heist” Strategy

This strategy revolves around a Long Entry setup aiming for the high-risk Red Zone. Price is pushing into potential overbought territory, with signs of consolidation and trend exhaustion. That’s exactly where reversal opportunities and big moves live — right before the herd wakes up. 🐂💰

🔓 Entry Plan – "The Vault’s Open"

📍 Enter on bullish setups – recommended through:

Recent 15/30 min support levels or

Swing low/high based buy limit zones

💡 Pro Tip: Set alerts at those critical swing levels so you’re always one step ahead.

🛑 Stop Loss – "Stay Out of Jail"

🎯 Suggested SL: Near the recent 3H swing low (~7600 zone)

🧩 Adjust SL based on:

Risk tolerance

Lot size

Multiple entries

Trading strategy preference

🎯 Take Profit – "The Great Escape"

📌 Primary TP: 7830.00

🔐 Trailing SL advised to secure profits during the climb

🚨 If market shifts or trap signs emerge, exit early and protect the bag.

⚔️ Scalpers vs Swingers – Choose Your Crew

Scalpers: Only ride the long waves. Use momentum & micro breakouts.

Swing Traders: Follow the blueprint. This is your time to rob the trend cleanly. 🕶️📈

🧩 Market Insight & Fundamentals

This bullish momentum is backed by key drivers:

Economic releases

Institutional positioning (COT Reports)

Sentiment & intermarket flows

Geopolitical & macro factors

📌 Always update your narrative. Markets shift fast. Stay informed. Stay sharp.

⚠️ Important Trading Notice – News Risk & Management

🚫 Avoid fresh entries during high-impact news events

🔄 Use trailing SLs to lock gains

🧠 Be aware of volatility traps

❤️ Support the Strategy – Hit Boost & Join the Crew

If this strategy made sense to you, smash that Boost Button.

You're not just supporting a post — you're fueling a Thief Trader movement where smart, fearless traders take what’s theirs from the market. 🚀💰

🎉 Keep winning, stay alert, and I’ll see you in the next heist! 🧠💸🐱👤

CAC40 Bullish breakout supported at 7560Key Support and Resistance Levels

Resistance Level 1: 7850

Resistance Level 2: 7930

Resistance Level 3: 7995

Support Level 1: 7560

Support Level 2: 7490

Support Level 3: 7410

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

France 40: A short/medium term buyHello,

The France 40 Index is currently forming a compelling bullish setup, characterized by a contracting triangle pattern—typically a continuation structure that signals the potential for further upward movement. Price action is consolidating within this triangle, indicating that a breakout could be imminent.

Supporting this view, the moving average is aligning with the current price zone, suggesting an attractive entry point for medium-term traders looking to position early for the next leg up.

Additionally, the MACD (Moving Average Convergence Divergence) is showing early signs of a bullish zero-line crossover, reinforcing the bullish sentiment and adding further conviction to the setup.

We identify 8,206 as a potential upside target for investors willing to capitalize on this opportunity. For prudent risk management, a stop-loss order placed just below the lower boundary of the triangle pattern is advisable.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAC40 corrective pullback support at 7480Key Support and Resistance Levels

Resistance Level 1: 7850

Resistance Level 2: 7930

Resistance Level 3: 7995

Support Level 1: 7480

Support Level 2: 7400

Support Level 3: 7330

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 protracted coiling consolidation support at 7630Key Support and Resistance Levels

Resistance Level 1: 7788

Resistance Level 2: 7920

Resistance Level 3: 7995

Support Level 1: 7630

Support Level 2: 7578

Support Level 3: 7500

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 INTRADAY coiling pattern- energy buildupKey Support and Resistance Levels

Resistance Level 1: 7890

Resistance Level 2: 7970

Resistance Level 3: 8070

Support Level 1: 7700

Support Level 2: 7620

Support Level 3: 7510

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Slow upside for France - But is it inevitable to 8,645?France and Germany and I guess Europe in general is just slow.

Lifestyle is slow and steady, not major developments.

Life continues with a somewhat socialistic form of living.

And so moves the indices in Europe the same way.

We established a Cup and Handle, and was waiting for a breakout above the brim level. Which We kind of got.

But now we are in consolidation mode, and we can expect some sideways before it breaks out of what looks like a Descending Triangle.

The funny thing is Descending Triangles generally have breakouts to the downside, but we are anticipating it breaks up.

Biased maybe. Intuition - Yes.

Cup and handle

Price>20 and 200MA

Target 8,645

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"FR40 TIME-BOMB TRADE: PROFIT BEFORE THE CLOCK RUNS OUT!"🔥 FRANCE 40 HEIST: STEAL THE TREND LIKE A MARKET BANDIT! 🚨💰

Locked & loaded for the FR40 (FRANCE 40) heist? This slick blueprint cracks the code to loot profits—blending killer technicals with macro intel. Ride the bullish wave, but dodge traps near the Overbought Zone. Bears lurk, so secure your bag before the reversal hits! 🐻💨

🎯 ENTRY: STRIKE LIKE A PRO THIEF

Long the breakout near 7900.0 (or) ambush pullbacks at 7620.0 or above.

Set stealth alerts to catch moves in real-time. 🕶️🔔

🛡️ STOP LOSS: ESCAPE ALIVE

Hide stops under the last 4H swing low/wick—no reckless bets!

Adjust for your risk—survivors play smart. ⚡

💸 TAKE PROFIT: VANISH WITH THE LOOT

Main Target: 8150.0 (or bail early if momentum fades).

Scalpers: Trail stops & ghost out with quick wins. 🏃♂️💨

📡 WHY THIS HEIST WORKS

FRANCE 40's on fire: Fundamentals + COT data + macro tides align.

Sentiment’s bullish, but stay sharp—links below for the full intel. 🔍🌐

⚠️ WARNING: NEWS = POLICE SIRENS

Avoid new trades during high-impact news. 📢

Lock profits with trailing stops if you’re already in. 🔐

🤝 JOIN THE TRADING MAFIA

Smash LIKE, drop a comment, & let’s dominate the US100! �

Ready for the next big move? Stay tuned. 👀

Happy hunting, chart pirates! 🏴☠️📉

Analysis of CAC 40 IndexIn our recent analysis, we predicted a price decline based on harmonic patterns, with an anticipated bottom of €7,200.

However, recent fluctuations indicate that French shareholders have yet to liquidate their holdings. This suggests a potential shift in market sentiment that could impact future trends.

We foresee that these declines may continue until reach the golden level of the Golden Crab pattern. As savvy investors, staying informed and adapting to market movements is crucial.

SEYED.

CAC40 France is looking parfait for upside to 8,645Another Index ready to rumble is way up again.

The sideways chop has broken above and we are seeing more signs of strength for the bulls on major international markets.

UNless this is all a dead cat bounce, the analyses right now are poised for upside.

Here are some fundamentals.

📉 Trade Tensions Ease

U.S.-China tariff cuts lift global markets — CAC 40 joins the rally.

🏗️ Europe Builds Big

New EU infrastructure spending boosts industrial stocks in France.

🏦 Banks & Industry Up

French banks and factories post strong earnings and drive gains.

💶 ECB May Cut Rates

Rate cut hopes make stocks like CAC 40 more attractive.

🛍️ Luxury Demand Surges

LVMH and other French luxury brands benefit from global spending.

ANd let's tackle the technicals.

Cup and handle

Price>20 and 200MA

Target 8,645

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAC40 INTRADAY rising wedge capped at 7705The CAC40 index shows a bearish sentiment, with the overall trend remaining negative. Recent price action suggests a short-term oversold rally that could face resistance near the 7705 level — a key previous consolidation area.

Key Resistance: 7705

A failure to break above this level could lead to renewed selling pressure.

Bearish Scenario:

If the price is rejected at 7705, downside targets include:

7500 (initial support)

7456

7330 (longer-term target)

Bullish Scenario:

A confirmed breakout and daily close above 7705 would invalidate the bearish outlook and open the door for a rally toward:

7830

7900

Conclusion:

The outlook remains bearish unless CAC40 can break and hold above 7705. Watch this level closely for directional clues.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 IMPORTANT resistance retest at 7454

The CAC40 continues to exhibit bearish sentiment, aligning with the prevailing downward trend. Recent price action suggests that the index experienced an oversold rally, which was subsequently rejected near a key resistance zone — the previous intraday consolidation level around 7454.

This area now serves as a critical pivot point. A failure to break above 7454, followed by renewed selling pressure, would likely confirm a bearish reversal, with downside targets at:

7170 – Near-term support

7000 – Medium-term support

6828 – Long-term support level

However, if price breaks and closes firmly above 7454 on a daily basis, the bearish scenario would be invalidated. In that case, the DAX40 could extend gains toward:

7592 – Immediate resistance

7754 – Major upside target

Conclusion

The bias remains bearish below 7454, with rallies into that level offering potential short opportunities. A daily close above 7454, however, would shift sentiment and open the door for bullish continuation toward higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 INTRADAY oversold boumce back capped at 7186The CAC 40 continues to exhibit bearish sentiment, in line with the prevailing downtrend. Recent price action has confirmed a break below a key consolidation support zone, reinforcing the downside bias.

Key Technical Levels:

Resistance Zone: 7000 (short-term), 7186 (major resistance / former consolidation zone)

Support Levels: 6760 (initial target), 6630 (intermediate), 6474 (longer-term support)

Bearish Scenario:

The loss of support at 7186 has shifted the bias to the downside. A potential oversold rebound may occur, but unless price reclaims and holds above 7000 on a daily closing basis, rallies are likely to face selling pressure. A bearish rejection at 7186, if retested, would confirm the continuation of the downtrend toward the stated support levels.

Bullish Alternative:

A confirmed breakout above 7000, with a daily close above this level, would challenge the current bearish outlook. In such a case, the index may regain bullish momentum, opening the path for a retest of 7186, followed by 7290.

Conclusion:

The technical outlook for the CAC 40 remains bearish unless a decisive breakout above 7000 occurs. Traders should watch for rejection patterns near 7000–7186 for potential short entries, while a daily close above 7000 would be a key trigger for a trend reversal and a shift in sentiment.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Analysis of CAC 40 Index The CAC 40, France's leading stock market index, has recently captured the attention of investors as it nears a significant milestone of 8160 points.

According to technical analysis, the index might be on the verge of a notable downturn, potentially influenced by the bearish "Crab" harmonic pattern.

This formation hints at the possibility of a sharp retracement following a peak, driven by shifts in market sentiment and economic factors.

As the CAC 40 approaches this crucial level, investors should exercise caution, as a potential break below this threshold could trigger heightened volatility and put further downward pressure on stock prices.

CAC40 capped by resistance at 7,900The CAC40 index is exhibiting bearish sentiment, aligning with the prevailing downtrend. The recent price action suggests an oversold bounce, which may be temporary before the downtrend resumes.

Key Level: 7,900

This level represents the previous intraday consolidation zone and serves as a crucial resistance point.

Bearish Scenario: If the index faces rejection at 7,900, it could resume its decline, targeting 7,728, followed by 7,680 and 7,552 as long-term support levels.

Bullish Scenario: A confirmed breakout above 7,900 with a daily close beyond this level would invalidate the bearish outlook, potentially leading to rallies toward 7,980 and 8,060.

Conclusion:

The CAC40 remains in a bearish trend unless a strong breakout above 7,900 confirms a shift in momentum. Traders should watch for rejection or confirmation at this key level to determine the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 INTRADAY Bullish sideways consolidation The CAC 40 Equity Index remains in a prevailing uptrend, with recent intraday price action indicating a corrective pullback toward a key support level.

Key Levels to Watch:

Support Levels: 7967 (critical level), 7893, 7778

Resistance Levels: 8160, 8270, 8344

Bullish Scenario:

A bullish bounce from the 7967 support level, previously a resistance zone, could trigger renewed buying momentum. If confirmed, the next upside targets are set at 8160, 8270, and 8344 over a longer timeframe.

Bearish Scenario:

A daily close below 7967 would weaken the bullish outlook, potentially leading to a further retracement toward 7893, with an extended decline targeting 7778.

Conclusion:

The overall market sentiment remains bullish, but the 7967 level is a pivotal support zone. A successful retest and rebound from this level could drive the next leg higher, whereas a confirmed breakdown would shift the outlook to bearish, favoring deeper corrections. Traders should monitor price action closely around these levels for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

French Diamond ready to break up and glimmer to upsideFrance is another European market that seems to be outperforming many of the large markets in 2025.

There are strong catalysts apart from foreign investments to Europe compared to the US.

Including:

1. 🛡️ France boosts defense spending

€1.7B added to support the military.

2. 💰 Strong French earnings

Big companies like L'Oréal beat forecasts.

3. 💶 Euro stays steady

Helps exports and investor confidence.

4. 📉 Lower energy costs help

Trade balance improves, lifting the CAC.

And technically, there is a Strong Diamond formation in the making.

We are approaching the second half of the diamond to complete. And once price breaks above it could signal a strong rally going forward.

French Diamond

Price> 20 and 200

Target 8,848

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAC40 The Week Ahead 24th March '25CAC40 bullish & overbought, the key trading level is at 7900

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 INTRADAY Bullish Breakout supported at 8050. The CAC40 equity index remains in a bullish technical structure, underpinned by the prevailing uptrend. Recent intraday price action has shown a breakout above a sideways consolidation pattern, suggesting renewed bullish momentum towards the previous resistance area.

Key Levels:

Support: The critical support level is at 8050, which corresponds to the previous consolidation price range. A corrective pullback to this level, followed by a bullish bounce, could reinforce the uptrend.

Resistance: On the upside, the next resistance levels are positioned at 8190, 8300, and 8400, representing potential profit targets over a longer timeframe.

Bearish Scenario: A decisive break below the 8050 support level and a daily close beneath this mark would invalidate the bullish outlook. Such a move could initiate a deeper retracement, targeting the 7900 support level, followed by 7800 if selling pressure intensifies.

Conclusion: The prevailing sentiment remains bullish as long as the 8050 support holds. Traders should monitor any corrective moves toward this level for potential buying opportunities. A confirmed loss of 8050 would signal caution, as it may trigger further downside pressure.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 (FR40) The Week Ahead 17th March '25CAC40 INTRADAY bullish & oversold, key trading level is at 7917

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.