GBPAUD Analysis: Bullish Momentum Ahead with EASY Trading AI SigAnalyzing GBPAUD using our EASY Trading AI strategy reveals a clear Buying opportunity at 2.06408. Current algorithmic indicators confirm bullish momentum gaining strength, supporting a projected rise towards our target at 2.07540667. The structured setup, derived from advanced trend recognition and volatility analysis in EASY Trading AI, positions Stop Loss reliably at 2.05014667 to mitigate risk. Precise risk-reward alignment and steadily rising volume validate this bullish expectation on GBPAUD.

GBPAUD trade ideas

GBPAUD - Already Over-Bought!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been bullish trading within the rising channels in orange and red.

Currently, GBPAUD is retesting the upper bound of the channels.

Moreover, the $2.085 - $2.1 is a strong resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper trendlines and green resistance zone.

📚 As per my trading style:

As #GBPAUD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD - One More Leg!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPAUD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/AUD Prepares for a major correction? The current technical situation of the GBP/AUD peaks the eye of the bears on the weekly chart

From a technical perspective we have 2 factors that that provide interest to the sellers

- a full Elliot wave sequence is in the process of completion with the 5th wave at terminal status, even tough this might move higher, but...

-i believe this is potential tipping point , considering the price action hasn't visited this area since march 2020 (and considering the amount of rejection it faced back then, there is a chance this might happen again

If the correction plays out we could possibly see some down moves all the way to psychological level of 2.000

Even if your not a weekly trader, keeping this information in mind might help with future trades on the pair on the down side , just remember to take risks into consideration

- Always make your own analysis before taking a financial decision

- Risk/Reward ratio is your friend

This is not financial advice !

GBP/AUD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

It makes sense for us to go long on GBP/AUD right now from the support line below with the target of 2.061 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD BUY TRADE PLAN🔥 GBP/AUD TRADE PLAN

📅 Date: April 2, 2025

🔖 Plan Type

Main Swing Plan

📈 Bias & Trade Type

Bullish Reversal Setup – Long-term trend continuation after pullback

🔰 Confidence

⭐⭐⭐⭐ (80%)

Reasons:

– D1 bullish BOS structure

– H4 OB + Liquidity sweep alignment

– Rejection wicks and EMA defense

– AUD weakness and GBP relative strength

– Macro sentiment moderately Risk-On

📌 Status

✅ Waiting for first tap into zone

(Zone not touched – fresh institutional entry opportunity)

📍 Entry Zones

Primary Buy Zone: 2.0490 – 2.0515

(H4 OB + FVG + EQ lows liquidity sweep)

Secondary Buy Zone: 2.0445 – 2.0465

(Deeper liquidity + refined OB with inducement)

❗ Stop Loss

SL: 2.0390

(Under all key structural lows and invalidation wick)

🎯 Take Profits

🥉 TP1: 2.0625 – Partials & SL to BE

🥈 TP2: 2.0700 – Swing liquidity pocket

🏆 TP3: 2.0785 – D1 premium zone target

📏 Risk:Reward

Minimum R:R = 1:3.4

Optimized for swing precision setups

🧠 MANAGEMENT STRATEGY

– Enter only after confirmation in zone

– Move SL to BE after TP1

– Scale partials at TP2

– Let final position run with trailing SL toward TP3

– If missed: wait for rejection candle + consider refined re-entry

⚠️ Confirmation Criteria

– H1 bullish engulfing or pin bar in zone

– MACD or RSI momentum shift on M30+

– Volume spike near OB or FVG

– Rejection during London or NY open for best fill

⏳ Trade Validity

Valid for 1–3 days (H4 swing bias)

❌ Invalidation if H4 closes below 2.0390

🌐 Fundamental Alignment

✅ GBP remains resilient on wage/inflation expectations

✅ AUD pressured by weak commodities + dovish RBA

✅ Risk-On tilt mildly favors GBP flows

📋 Final Summary

We are looking to buy GBP/AUD from 2.0490–2.0515 zone, with deeper buffer at 2.0445–2.0465. Structure, liquidity, OB + momentum all align for a clean bullish swing continuation. Only execute after proper zone confirmation. Smart Money model fully supports this setup.

OPPORTUNITY FOR SELL GBPAUDEven though this pair is above all major levels and probably will continue higher, now should be a good time to sell.

We have these indicators for SELL opportunity:

- Reflection from the top of the parallel channel

- Resistance from previous peak (2020)

- Low volume to continue the current direction

- Potential for retest: Year high + 6M high + 3M high + 1M high

We define 3 goals:

TP 1 = 80 pips

TP 2 = 200 pips

TP 3 = 400 pips

GBPAUD Wave Analysis – 1 April 2025

- GBPAUD reversed from long-term resistance level 2.0820

- Likely to fall to support level 2.030

GBPAUD currency pair recently reversed from the resistance area located between the long-term resistance level 2.0820 (former multiyear high from 2020), resistance trendline of the weekly up channel from 2024 and the upper weekly Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term impulse wave 3 of the weekly upward impulse sequence (3) from the start of 2024.

Given the strength of the resistance level 2.0820 and the overbought weekly Stochastic, GBPAUD currency pair can be expected to fall to the next support level 2.030.

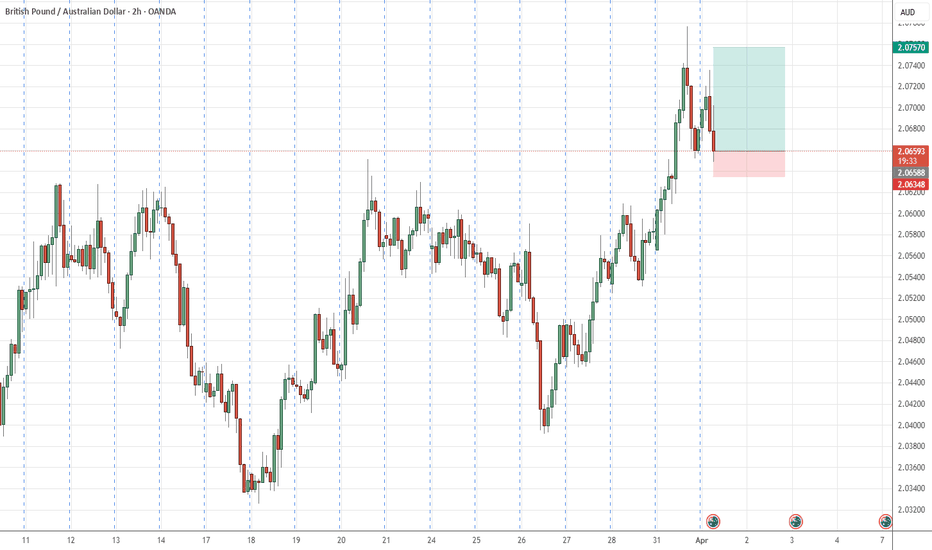

GBP-AUD Free Signal! Buy!

Hello,Traders!

GBP-AUD is trading in a

Local uptrend and the pair

Made a local correction

Of the horizontal support

Level of 2.0634 so we can

Enter a long trade with the

Take Profit of 2.0724 and

The Stop Loss of 2.0582

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD-LONGCash rates came out at 4.10% as expected, causing a small retracement on GA. Im still bullish on GA. Its been consolidating in this zone for a couple of days now and to see price break above confirms bullish momentum and a possible push to our next key level. We will wait for price to reject previous resistance level from our consolidation, and for news that align with our bias before entering buys.