GBPAUD trade ideas

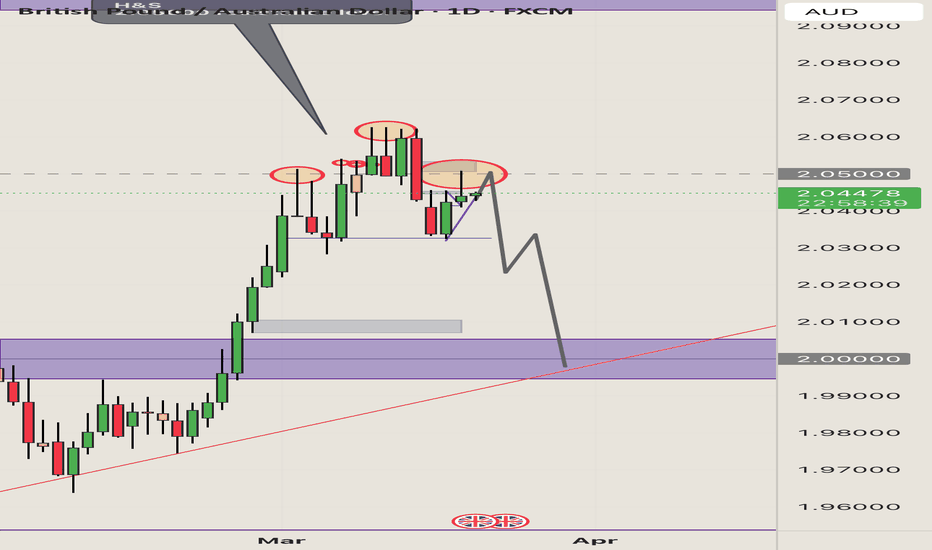

GBPAUD - SHORTFrom a technical standpoint, GA is forming a head & shoulders on a resistance level which is a strong indicator of a reversal. Once it breaks below the neck line, sell entries will be confirmed. AU also seems to be bullish, AU is a correlative pair with GA. If AU goes up, GA goes down. News this week will also be a factor in confirming whether or not this bias goes.

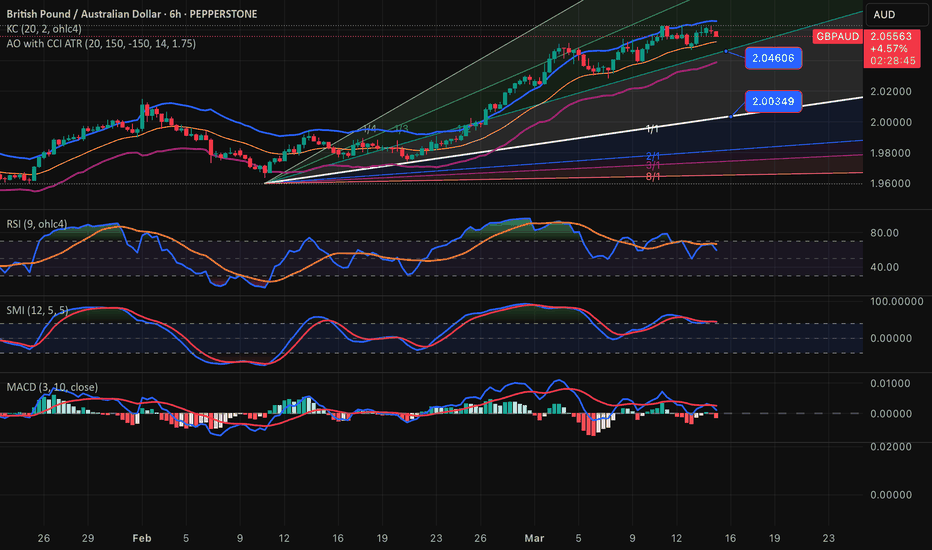

GBPAUD What Next? BUY!

My dear subscribers,

GBPAUD looks like it will make a good move, and here are the details:

The market is trading on 2.0415 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.0488

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

———————————

WISH YOU ALL LUCK

GBPAUD Wave Analysis – 18 March 2025- GBPAUD reversed from the support zone

- Likely to rise to resistance level 2.060

GBPAUD currency pair recently reversed from the support area between the support level 2.0290 (former multi-month resistance from December) and the 38.2% Fibonacci correction of the upward impulse from February.

The upward reversal from this support zone stopped the previous short-term ABC correction 4.

Given the strong multi-month uptrend, GBPAUD currency pair can be expected to rise to the next resistance level 2.060 (which reversed the previous upward impulse wave 3).

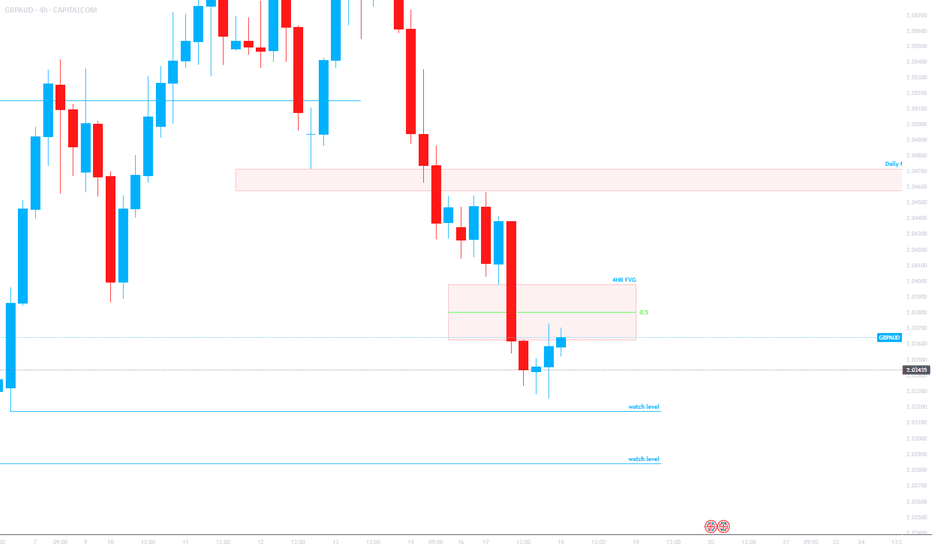

GBPAUD Selling Trading IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPAUD 4HR Trade OutlookGBPAUD made a strong bearish move yesterday and formed a 4HR imbalance, we are now watching how price reacts to that 4HR imbalance created. If it respects it, we'll dial down to a lower timeframe and look for Sells, if it breaks it, we can look for Buy Setups. Remember, Patience is your edge. PEPPERSTONE:GBPAUD

GBPAUDAlthough OANDA:GBPAUD largely remains bullish, a consolidation phase might just be in view. Looking at how price is currently attempting to create a 3 triple top on the H4 TF a breakout to the bullish side (2.06013) will mean a continued bullish move however a breakout to the lower side (2.04704) would indicate a potential market reversal. I would rather wait to see either move before making any trading decision on this pair.

GBP_AUD LONG SIGNAL|

✅GBP_AUD is moving down

Down now to retest a horizotnal

Support level of 2.0327 from

Where we can enter a long

Trade with the Take Profit

Of 2.0413 and SL of 2.0270

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD💡The chart shows a technical analysis of the GBP/USD pair on the 4-hour timeframe. Rising Wedge Pattern: There is a clear shape of a rising wedge pattern, a reversal pattern where the price is within a narrow, upward-sloping channel. Typically, a break of this pattern downward indicates a reversal from bullish to bearish. The MACD indicator shows that momentum is beginning to shift to the downside (red), supporting the idea of a continued downward trend.

⛔️Not investment advice for educational purposes only.