GBPAUD Up Channel 0349SGT 23032025Price is at the upper bound of the up channel now.

Even though if we were to short here, it would be contrarian since price is in an up trend, but as we zoom down to the 4H time frame, we can see that on previous price rejections on the upper bound of the up channel, price made M shape or triple tops, and then the price collapsed back down.

This time round, price has also made similar rejection patterns and now the price is at a good location for shorting opportunities.

I might not be entering on this pair because I want to give myself some space and time to breath, since I broke even on my second set of trading data (4th trade).

Shall see. I need to give myself time, really.

Good to skip trades that are profitable in hindsight, because we never get hindsight on foresight trading.

0352SGT 23032025

I think I might be good at spotting patterns, but I must be careful not to think that I am very good at it, because if I think I could do better and I try to do alot more to prove it, I will go down the slippery slope of losing trades again, even when I am obviously going to be a profitable trader in the long run.(and I will lose in the long run because I alter my trading rules and conditions, and I enter on the dragons tail instead, and get whipped by the dragon that flick its tail.)

0354SGT 23032025

GBPAUD trade ideas

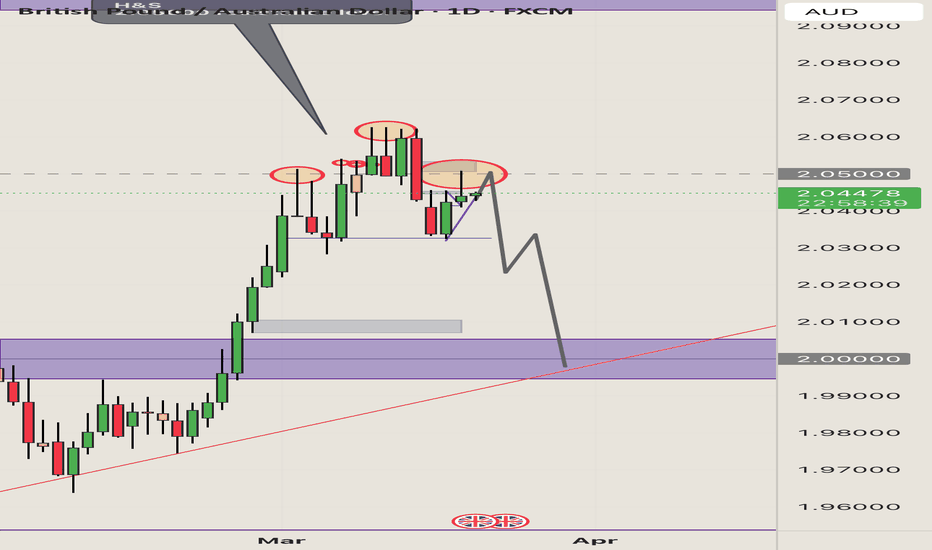

POTENTIAL SHORT TRADE SET UP FOR GBPAUDAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

The price has reached the upper bound of an ascending structure on the higher time frame (HTF) with an ascending structure on the Mid time frame (MTF). We will now monitor for a bearish impulse and continuation structure to identify a potential entry point for the trade.

Expectation: A downward move is expected, initially targeting the base of the MTF ascending structure and subsequently the lower bound of the HTF ascending structure.

⚠️ Reminder: Always conduct your own analysis and apply proper risk management, as forex trading involves no guarantees. This is a high-risk activity, and past performance is not indicative of future results. Trade responsibly!

GBPAUD: Pullback From ResistanceThe GBPAUD pair appears to be showing a bearish trend on the 4-hour time frame after testing a significant intraday resistance.

An inverted cup & handle pattern was formed on the hourly chart, along with strong bearish momentum this morning, indicating a potential downward movement.

I believe that the market may retrace back to the 2.0500 support level at the very least.

GBP/AUD Ready to Fly! 🚀 GBP/AUD Ready to Fly! 🚀

🔹 Pair: GBP/AUD

🔹 Bias: Bullish ✅

🔹 Entry Zone:

🔹 Stop Loss (SL): 🔴

🔹 Take Profit (TP): 🏆

📊 Market Outlook:

✅ Sell-side liquidity grabbed – Market cleared weak hands

✅ Supply zone broken – Buyers stepping in

✅ Bullish market structure – Higher highs forming

✅ Confluence with key demand zone – Strong support holding

📈 GBP/AUD looks ready for a strong bullish move. If price holds above key levels, expect further upside momentum! 🚀

💬 Drop your thoughts below! Are you bullish too? 👇🔥

#GBPAUD #ForexTrading #SmartMoneyConcepts #LiquidityGrab #TradingView #ForexSignals

GBP/AUD Ready To Go Down , Don`t Miss This 250 Pips !Here is my analysis on GBP/AUD , We have an old res forced the price to go down before and now it`s the third touch for the re area , so i think it will be the best place to sell this pair and targeting 250 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

GBP/AUD (2H Chart)1. Trade Type:

This is a Sell (Short) trade on the GBP/AUD currency pair.

2. Key Chart Analysis:

Entry Zone: The trade is entered around the 2.05978 level.

Resistance Zone: Price has reached a strong resistance area (gray-shaded region), which was previously a supply zone.

Support Zone (Take Profit): The target (TP) is around 2.03313, where a previous demand/support zone exists.

3. Risk-Reward Ratio:

The stop loss (SL) is placed at 2.06559, just above the resistance zone.

The take profit (TP) is at 2.03313.

Risk-Reward Ratio (RRR): This setup has an approximately 1:4 risk-reward ratio, meaning for every 1 unit risked, the potential reward is 4 times that.

4. Trade Rationale:

Bearish Rejection at Resistance: The price attempted to break above the resistance but failed, indicating a potential reversal.

Market Structure: The market shows lower highs, confirming a downtrend continuation.

Supply Zone Confirmation: The price tested the supply zone and started forming bearish price action (possible rejection wicks and bearish candles).

Risk Management: A well-placed stop loss above resistance ensures minimal risk.

5. Trade Execution Plan:

Entry: Short GBP/AUD at resistance (2.05978).

Stop Loss: Placed slightly above the resistance at 2.06559.

Take Profit: Positioned near a previous demand/support level at 2.03313.

Trade Expectation: The price is expected to fall towards the support area if selling pressure continues.

6. Potential Trade Outcome:

If price respects resistance and moves downward, the trade will hit TP for a significant profit.

If price breaks above the resistance zone, stop loss will be triggered, cutting losses.

Final Thoughts:

The trade has a high risk-reward ratio, making it favorable.

It aligns with technical analysis principles (resistance rejection and trend continuation).

Proper risk management is applied to limit potential losses.

GBPAUD: Bearish Continuation & Short Signal

GBPAUD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GBPAUD

Entry Point - 2.0619

Stop Loss - 2.0692

Take Profit - 2.0483

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD Will Fall! Short!

Please, check our technical outlook for GBPAUD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 2.060.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 2.029 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPAUD - SHORTFrom a technical standpoint, GA is forming a head & shoulders on a resistance level which is a strong indicator of a reversal. Once it breaks below the neck line, sell entries will be confirmed. AU also seems to be bullish, AU is a correlative pair with GA. If AU goes up, GA goes down. News this week will also be a factor in confirming whether or not this bias goes.