Bullish bounce off overlap support?GBP/CAD has bounced off the pivot and could rise tot he 1st resistance.

Pivot: 1.8119

1st Support: 1.7991

1st Resistance: 1.8368

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPCAD trade ideas

Bullish bounce?GBP/CAD is reacting off the support level which is an overlap that is slightly above the 61.8% Fibonacci retracement and could potentially rise from this level to our take profit.

Entry: 1.8139

Why we like it:

There is an overlap support level that is slightly above the 61.8% Fibonacci retracement.

Stop loss: 1.8000

Why we like it:

There is a pullback support level that lines up with the 71% Fibonacci retracement.

Take profit: 1.8385

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish drop?GBP/CAD is reacting off the pivot which is an overlap resistance and could drop to the 1st support.

Pivot: 1.8157

1st Support: 1.7918

1st Resistance: 1.8332

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPCAD bearish view

OANDA:GBPCAD whats next?, we are have two times bounce on trend line,

currently on D is visible DESCENDING TRIANGL,

in triangl we have RECTANGLE PATTERN 4h which is breaked,

below rectangle pattern we have on lower TF better visible BEARISH FLAG pattern 1h (violet doted), which currently looks breaked,

here expecting bearish push now till next trend zone.

SUP zone: 1.85000

RES zone: 1.82250, 1.81600

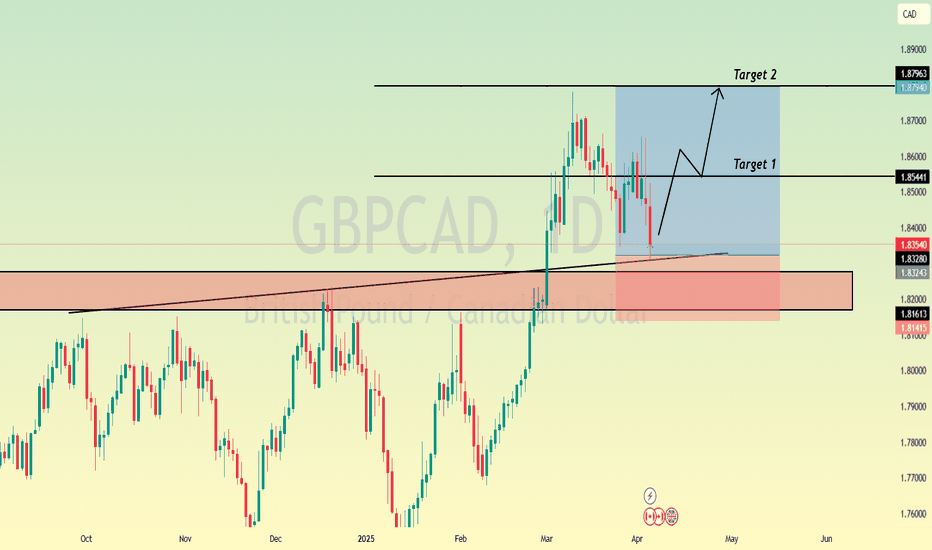

GBPCAD: Bullish Continuation is Expected! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the GBPCAD pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP/CAD Outlook: Support Holding for NowGBP/CAD has stopped falling around the 1.8330 level, which is now acting as support. From this point, the price looks like it might move higher. The target to watch is around 1.8470, which could act as a minor resistance. If the price manages to break above 1.8470, there's a stronger chance it will keep going up.

However, if the price drops below 1.8330, that could mean the market is turning bearish. In that case, the next support level to look for is around 1.8220. So overall, as long as GBP/CAD stays above 1.8330, the outlook remains positive, with a likely move toward and beyond 1.8470.

GBPCAD Its been a month since price broke out of the weekly resistance and now we are retesting. Got an H4 support that has been broken, if price goes back above the zone giving a retest we could see movement to the next week resistance zone of 1.90000. Also price action is similar to what happened on 5th Jan 2023.( Daily TF)

GBPCAD will Fly , All Confirmations are in the Bullish SideHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD Set To Grow! BUY!

My dear friends,

Please, find my technical outlook for GBPCAD below:

The instrument tests an important psychological level 1.8357

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.8460

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBP/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

We are targeting the 1.851 level area with our short trade on GBP/CAD which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCAD: Will Start Growing! Here is Why:

The recent price action on the GBPCAD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCAD - Is Bullish Breakout Ahead?TF: 4h

GBPCAD is initiating along opportunity by completing 4th intermediate wave at 1.83464 . We can expect a retracement then reversal with near the lower trendline of the parallel channel.

Once price comes down, we will have the opportunity to go long with minimum stop level at low of the wave 4 at 1.83640 . The bullish scenario is capable GBPCAD to provide 1.8654 - 1.8748 targets to the buyers.

If the breakdown occurs, wave (4) will go deep. We update this chart time to time. Traders should only buy after a clear reversal.

Gbpcad SellPrice has been making LL pointing to strength in downtrend and now price closed below the oh so very important 1.85172. the stop i wouldve like to put it above the last high but its ok im still is comfortable with it due to the volume nice scalp based on how fast the trade should hit tp or sl.