GBPCHF trade ideas

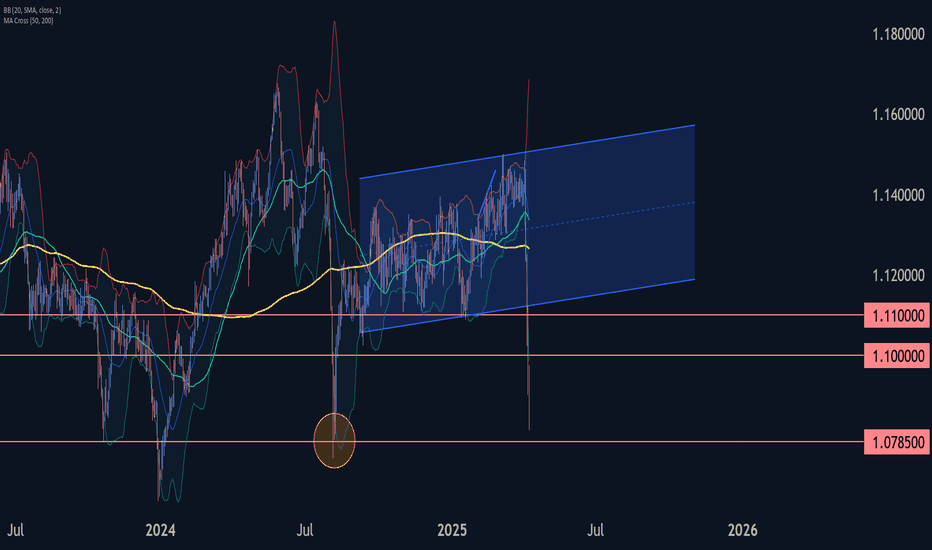

GBP/CHF SHORT FROM RESISTANCE

GBP/CHF SIGNAL

Trade Direction: short

Entry Level: 1.140

Target Level: 1.128

Stop Loss: 1.148

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Range Play on GBP/CHF – Buy Support, Sell ResistanceThe OANDA:GBPCHF is sitting on a strong weekly support zone between 1.0900 and 1.0600, where previous bullish reactions have occurred. The current price is also below the Ichimoku cloud (Span A at 1.1055 and Span B at 1.1203), indicating bearish conditions in the medium term.

Both TSI indicators are in oversold territory:

TSI(10): -0.7

TSI(20): -0.3

This setup suggests a possible short-term bounce from current levels, especially considering price is testing the bottom of the long-established range. If the market reacts bullishly, the supply zone between 1.1400 and 1.1650 becomes a high-probability area to watch for short entries, as it aligns with prior rejections and sits just below the cloud.

However, if price breaks below 1.0600, the structure would turn fully bearish. In that case, we would expect a retest of the broken support followed by continuation to the downside, confirming a possible longer-term downtrend.

Bullish Rejection (Short Setup Later)

Long-term resistance: 1.14 – 1.1650 (supply zone)

Short bias from this zone with stop above 1.1650

Downside targets: 1.09, then 1.06

Bearish Breakdown

Break of 1.0600 invalidates bounce scenario

Watch for retest and continuation lower

Structure supports deeper bearish move toward psychological levels near parity

GBP/CHF remains sensitive to both UK and Swiss economic signals. The Bank of England is currently under pressure due to slowing inflation and stagnant growth, which may push it closer to rate cuts. Meanwhile, the Swiss National Bank (SNB) already began cutting rates in early 2024, weakening the franc slightly, though safe-haven flows still support CHF during global uncertainty. This creates a mixed environment for GBP/CHF: structurally bearish but with room for short-term rebounds, especially if UK macro data stabilizes.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF: Pullback Trade From Key LevelAnother potential pair to consider buying from a key support level is 📈GBPCHF.

Following a test of an important daily structure, the price has formed a cup and handle pattern.

A bullish breakout of the neckline serves as a strong confirmation of an upward trend.

It is likely that the pair will continue to rise and reach the 1.1000 level in the near future.

GBPCHFSmall idea for GBPCHF, with the dollar seemingly at support where it might hold I think GBP pairs will to the opposite and from this exact area we are currently in is where we could potentially see this move happen. Unfortunately I will not be entering a trade from this exact spot even though It would be good to to minimize risk but to stay inline with my trading plan I will be awaiting the break of structure on the 1hr timeframe.

GBPCHF is BullishPrice was in a strong downtrend, however now it seems that bulls are assuming control of the price action. A triple bottom reversal formation with bullish divergence confirms bullish notion. If previous lower high is broken with good volume then we can expect a good reversal as per Dow theory. Targets are mentioned on the chart.

LONG ON GBP/CHFGBP/CHF Has a Perfect Double bottom pattern at a major demand area.

Price has broken the neckline of the double top and is currently pulling back to sweep liquidity and balance out price at any FVG's (Fair Value Gaps)

Liquidity sits behind the 2 wicks on the double bottom, so price may sweep that BEFORE rising.

Must give you stop loss space behind the wicks to survive the trade.

I have a buy limit order setup to take advantage of the pullback which will place me in the trade at discount price.

From there im looking to catch 300 pips to the previous swing high.

GBPCHF INTRADAY oversold bounce back capped at 1.1120The GBP/CHF currency pair remains under bearish pressure, in line with the broader downtrend. Recent price movement reflects an oversold rally that stalled near a key resistance level at 1.1120, which previously acted as an intraday consolidation zone.

This level now serves as a crucial pivot. If price fails to break above 1.1120 and faces rejection, it could trigger a continuation of the bearish trend with downside targets at:

1.0690 – Initial support

1.0600 – Medium-term target

1.0460 – Long-term support level

On the flip side, a confirmed breakout and daily close above 1.1120 would invalidate the bearish bias. This would open the door for a recovery toward:

1.1200 – First resistance above the breakout

1.1250 – Key upside target

Conclusion

The bearish bias remains intact below 1.1120, with oversold rallies likely to attract selling interest. A daily close above 1.1120 would be a bullish signal, potentially shifting momentum toward higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCHF PoV - BUY POINT 1.07000???The GBP/CHF exchange rate has shown a significant bearish trend, especially after breaking the support at 1.110. Currently, the pair is heading towards the 1.07 area, indicating sustained selling pressure.

One possible cause of this movement could be related to tariff issues and the economic uncertainties associated with them. Trade policies, including tariffs, can significantly affect currencies as they impact expectations about economic growth and international trade. Recent news about the introduction or tightening of tariffs between the UK and other countries may have contributed to a negative sentiment toward the British pound, strengthening the Swiss franc as a safe-haven currency.

To fully understand the reasons behind the current trend of GBP/CHF, it's essential to monitor the latest economic and political news, especially those related to trade policies and the UK's international relations. A close examination of economic data and political developments can provide clearer insights into the future outlook for this currency pair.

GBPCHF Wave Analysis – 8 April 2025- GBPCHF broke the support zone

- Likely to fall to support level 1.0785

GBPCHF currency pair recently fell sharply through the support zone between the support levels 1.1000 and 1.1100. The breakout of this support zone was preceded by the breakout of the daily up channel from September.

The breakout of these support levels accelerated the active intermediate impulse wave (3) from the start of August.

Given the strongly bullish Swiss franc sentiment seen recently, GBPCHF currency pair can be expected to fall to the next support level 1.0785, the target price for the completion of the active intermediate impulse wave (3).