Related currencies

EURGBP Will Collapse! SELL!

My dear subscribers,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8667 pivot level.

Bias - Bearish

My Stop Loss - 0.8675

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.8650

About

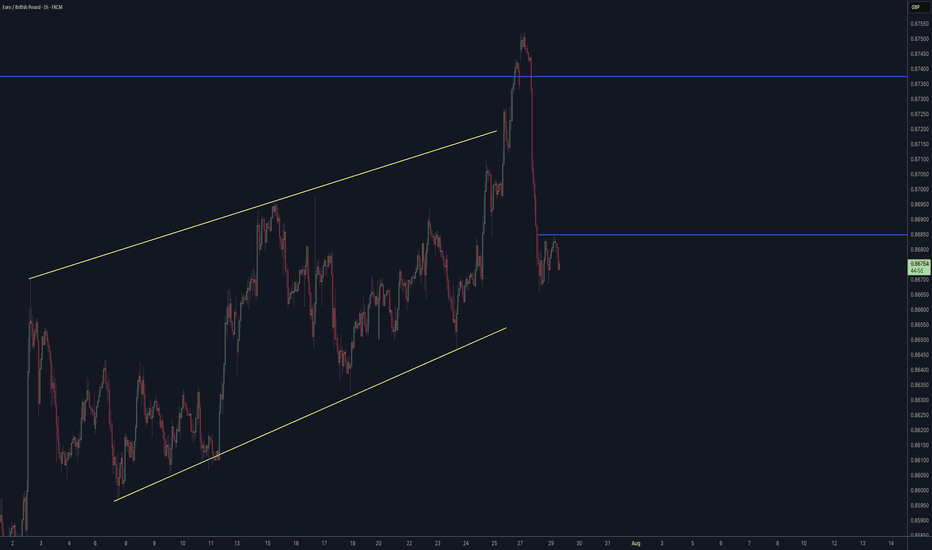

EURGBP Long Swing Trade OANDA:EURGBP Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets m

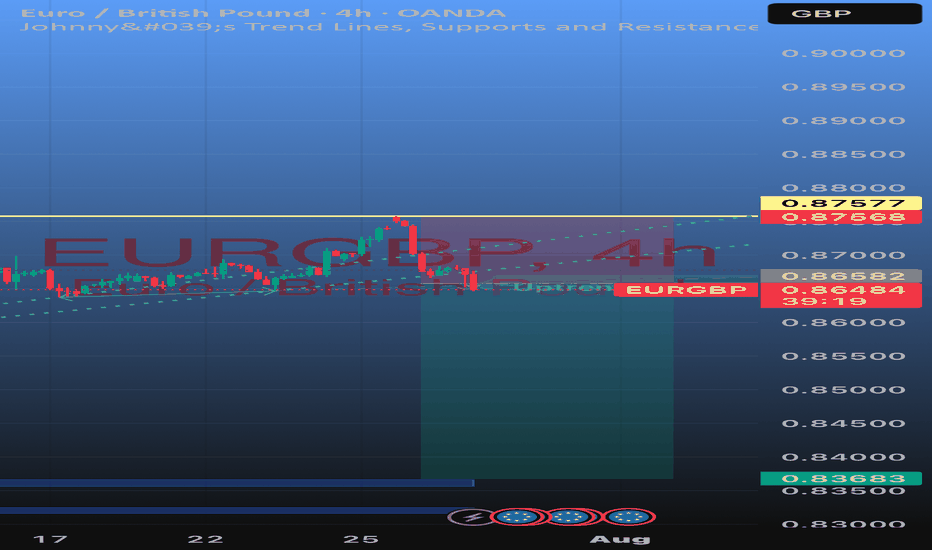

EURGBP: Bearish Continuation from Reclaimed Order Block!Greetings Traders,

In today’s analysis of EURGBP, we observe that institutional order flow on the H4 timeframe has recently shifted bearish. This provides us with a clear directional bias to look for shorting opportunities in line with the prevailing higher timeframe trend.

Higher Timeframe Conte

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPEUR is 1.1474 EUR — it has increased by 0.31% in the past 24 hours. See more of GBPEUR rate dynamics on the detailed chart.

The value of the GBPEUR pair is quoted as 1 GBP per x EUR. For example, if the pair is trading at 1.50, it means it takes 1.5 EUR to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPEUR has the volatility rating of 0.52%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPEUR showed a 0.48% rise over the past week, the month change is a −1.03% fall, and over the last year it has decreased by −2.75%. Track live rate changes on the GBPEUR chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPEUR is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPEUR right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPEUR technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPEUR shows the sell signal, and 1 month rating is strong sell. See more of GBPEUR technicals for a more comprehensive analysis.