GBPEUR trade ideas

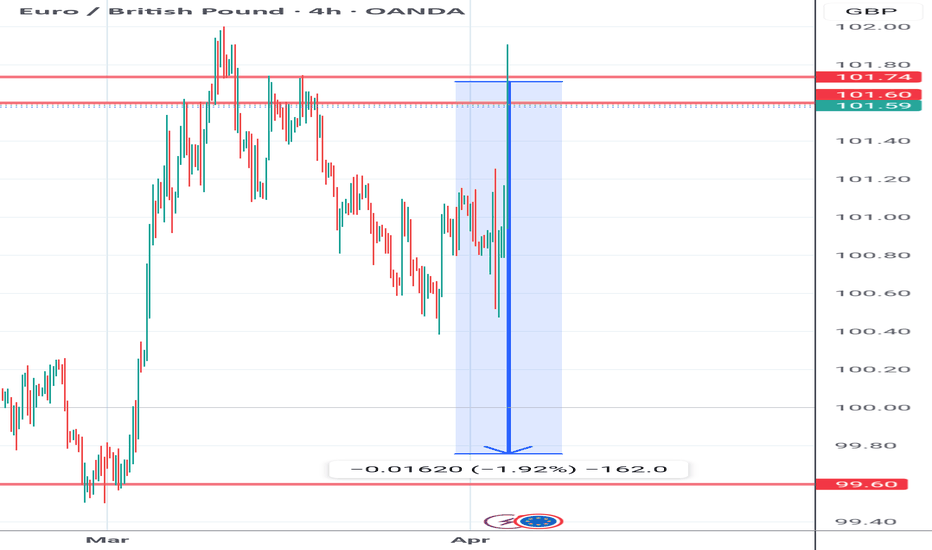

UPDATE ON EURGBP BUY BIASThis pair took us out once but our buy bias was still the same so we looked for another buy opportunity and lurkingly for us we found one.

The confluences were the same, both normal retail head and shoulders structural patterns and some others. Trade is running about 8:1 RR. What a good catch!!!

EURGBP SELL TRADE PLAN🔥 EUR/GBP TRADE PLAN 🔥

✅ Analysis Timeframe: D1, H4, H1

✅ Market Bias: Bearish 📉

✅ Trade Type: Trend Continuation

📌 ENTRY TYPE: Sell Trade – Pullback Entry

⭐ Confidence Level: ⭐⭐⭐⭐⭐ (90%)

(Structure + OB + EMA Rejection + Momentum + Fundamentals)

📌 STATUS: Waiting for entry confirmation within zone

📍 ENTRY ZONE (SELL):

Primary Zone: 0.8355 – 0.8375

Secondary Zone (Deeper Pullback): 0.8395 – 0.8410

(Rejection zone aligning with bearish OB and EMA dynamic resistance)

📌 STOP LOSS:

Single SL for both entries: Above 0.8425

📌 TAKE PROFIT TARGETS:

🥉 TP1: 0.8300 (Secure partials & move SL to BE)

🥈 TP2: 0.8250

🥇 TP3: 0.8200 (Final swing target)

📌 RISK-REWARD (Approx.):

Primary Zone: ~1:3

Secondary Zone: ~1:4

📌 REASON FOR ENTRY:

Overall bearish market structure on D1/H4

Institutional OB rejection at confluence zone

EMA dynamic resistance aligning with zone

Momentum shift toward GBP strength (EUR weakness in sentiment data)

📌 CONFIRMATION REQUIRED:

H1 Bearish Engulfing or Pin Bar in the zone

Bearish divergence or failure to break recent high

Spike in sell volume at or near OB

📌 RISK MANAGEMENT REMINDER:

💼 Risk 1–2% only. Move SL to breakeven after TP1. Don’t scale in unless confirmation supports continuation.

📌 TRADE VALIDITY & INVALIDATION:

✅ Valid for next 24–48 hours while structure holds

❌ Invalidate if price closes above 0.8425 or breaks structure with bullish momentum

📌 FUNDAMENTAL CONFLUENCE:

EUR pressured by recent zone weakness in economic outlook

GBP supported by relatively stable BoE sentiment

No major EU data surprises expected; risk flows favor GBP

📋 FINAL TRADE SUMMARY:

🔻 SELL EUR/GBP on pullback into 0.8355–0.8375

👉 SL: Above 0.8425

🎯 TP: 0.8300 → 0.8250 → 0.8200

⏳ Validity: 24–48h while structure holds

🚨 Execute ONLY on confirmation – institutional precision only.

EUR/GBP Triangle Pattern - Bearish Breakdown SetupProfessional Analysis of the EUR/GBP Chart

This EUR/GBP (Euro/British Pound) daily chart from OANDA, published on April 3, 2025, highlights a key technical setup based on price action analysis, chart patterns, and support/resistance levels.

1. Market Context: Accumulation & Transition to a Triangle Pattern

Curve Zone Formation (Rounded Bottom):

The market initially exhibited a rounded bottom structure (curve zone) from July 2024 to February 2025, indicating a gradual accumulation phase.

This phase often signals a shift in market sentiment, where sellers lose dominance, and buyers start stepping in.

Breakout from Accumulation:

After reaching the support zone (~0.8250 - 0.8300), price rebounded sharply in March 2025, confirming strong buyer interest.

However, it failed to sustain upward momentum near the resistance zone (~0.8470 - 0.8500), leading to consolidation.

2. Formation of a Symmetrical Triangle Pattern

Lower Highs & Higher Lows:

Price action began forming a symmetrical triangle, a classic consolidation pattern that typically precedes a strong breakout.

The market is currently trading near the apex of the triangle, indicating that a breakout is imminent.

Potential Breakout Direction:

Symmetrical triangles are neutral patterns, meaning they can break either upward or downward.

However, the price structure and resistance rejection suggest a higher probability of a bearish breakdown.

3. Key Levels & Trading Setup

Resistance & Support Zones:

🔴 Resistance Zone (~0.8470 - 0.8500):

This area has repeatedly acted as strong resistance, where sellers have consistently pushed prices lower.

A breakout above this zone would indicate a bullish invalidation of the current bearish bias.

🟢 Support Zone (~0.8250 - 0.8300):

This level has held price multiple times, acting as key support.

A break below this zone would confirm bearish momentum, targeting lower price levels.

4. Bearish Trade Setup

📉 Entry Strategy (Short Position):

Wait for a confirmed breakout below the triangle’s lower trendline (~0.8320 - 0.8350).

A retest of the broken support turning into resistance would provide the best short entry.

📌 Stop-Loss Placement (~0.84764):

Positioned above recent highs and the resistance zone to minimize risk.

This ensures the trade is protected against potential false breakouts.

🎯 Profit Target (~0.81190 - 0.81134):

The projected move aligns with historical support levels, making it a logical target.

This level represents a previous market structure where buyers stepped in.

5. Conclusion & Trade Considerations

✅ Bearish Bias: The price action and pattern suggest a higher probability of a downside breakout.

✅ Defined Risk & Reward: A well-structured stop-loss and target level ensures a solid risk management strategy.

✅ Watch for Confirmation: Traders should wait for a confirmed breakout before entering a trade to avoid false moves.

📊 Overall Verdict: A high-probability short setup is forming, with a clear entry, stop-loss, and take-profit strategy. If the market respects the triangle breakdown scenario, this could lead to a significant bearish move toward the 0.81190 target.

EUR-GBP Risky Short From Resistance! Sell!

Hello,Traders!

EUR-GBP keeps growing

Sharply after the Trump's

Tariff announcement wrecked

Havoc on the markets

But a strong resistance is

Ahead around 0.8446

From where we will be

Expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP POTENTIAL SHORT Q2 W14 Y25 THURSDAY 3RD APRIL 2025EURGBP POTENTIAL SHORT Q2 W14 Y25 THURSDAY 3RD APRIL 2025

Thank you Mr Trump for sending the majority of pairs loopy! We are now faced with exponential and over extending price action. It really is a time to sit patiently. Allow the market to settle and take shape. In an ideal world, this outlook is exactly how we managed our capital as professional risk managers. We say it continuously, our role is to managed capital by way of risk expose. A super by product of managing that risk is making returns. It's a strange concept, yes. " what do you mean our main aim is not to make money" More on that note another time.

If it resonates, let it continue to do so.

A potential set up.

How do you like the plan?

FRGNT X

EURGBP INTRADAY oversold bounce back capped at 0.8385EURGBP INTRADAY oversold bounce back capped at 0.8385

The EUR/GBP pair continues to exhibit bearish sentiment, reinforced by the prevailing downtrend. The key intraday resistance level is at 0.8385, marking the current swing high.

Bearish Scenario:

An oversold rally from current levels, followed by a bearish rejection at 0.8385, would likely target downside support at 0.8340. A break below this level would open the door for further declines toward 0.8307 and 0.8260 in the longer timeframe.

Bullish Scenario:

Alternatively, a confirmed breakout above the 0.8385 resistance, accompanied by a daily close above this level, would invalidate the bearish outlook. This would pave the way for further rallies, with the next resistance levels at 0.8420 and 0.8460.

Conclusion:

The prevailing sentiment remains bearish as long as 0.8385 holds as resistance. Traders should watch for rejection at this level to confirm downside momentum. Conversely, a decisive breakout above 0.8420 would signal a potential shift to a bullish bias, targeting higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP - Sell ideaEntry: 0.84018

SL: 0.84203

TP: 0.83700

Selling EURGBP looks favorable due to recent price action showing a rejection at a key resistance level , indicating potential exhaustion of bullish momentum. Technical indicators like the RSI are approaching overbought territory, suggesting a pullback is likely. The pair has also broken below a short-term ascending trendline, signaling a shift to bearish momentum. Declining volume on recent upward moves supports the case for weakening buyer interest. Additionally, macroeconomic factors, such as stronger UK economic data compared to the Eurozone, could further pressure EURGBP downward.

Another Shot At Catching EURGBP Longs. So for some of you that already follow me, you'd have seen that I first made a attempt to catch the longs of EURGBP the first time and it didn't age well (Link Below)

Now because HTF bias is still bullish, I'm repositioning for a re-entry here. Let's hope this goes as analyzed

EUR/GBP: Inverse Head & Shoulders Breakout Towards TargetChart Overview

Asset: Euro / British Pound (EUR/GBP)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 19:21 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 0.83668

High: 0.83670

Low: 0.83260

Close: 0.83635

Change: -0.00035 (-0.04%)

Price on the Right Axis: The price scale ranges from approximately 0.83100 to 0.84447, with the current price around 0.83642 (ask) and 0.83635 (bid).

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of EUR/GBP, showing price movements from mid-March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a downtrend, declining from around 0.84200 (March 12) to a low of 0.83260 (March 25). This indicates a bearish trend leading into the pattern formation.

Following this decline, the price began to consolidate, forming the Inverse Head and Shoulders pattern, which suggests a potential reversal from bearish to bullish.

Recent Price Action:

On April 2, the price appears to have broken out above the neckline of the Inverse Head and Shoulders pattern, closing above the resistance level with a bullish candle. The current price of 0.83642 is above the breakout level, supporting the bullish thesis.

2. Chart Pattern: Inverse Head and Shoulders

Pattern Identification:

The chart highlights an Inverse Head and Shoulders pattern, a bullish reversal pattern that typically forms after a downtrend. It consists of three troughs:

Left Shoulder: A low around 0.83400 (March 20), followed by a bounce.

Head: A deeper low at 0.83260 (March 25), marking the lowest point of the pattern.

Right Shoulder: A higher low around 0.83400 (March 30), indicating diminishing selling pressure.

The neckline is drawn by connecting the highs between the shoulders (around 0.83600–0.83700), sloping slightly downward in this case.

Pattern Dynamics:

The Inverse Head and Shoulders pattern signals a shift from bearish to bullish sentiment. The left shoulder and head represent selling pressure, while the higher right shoulder indicates buyers stepping in at a higher level, showing increased demand.

The breakout occurs when the price closes above the neckline, confirming the reversal. In this chart, the breakout is confirmed around April 2, with the price closing above the neckline at approximately 0.83600–0.83700.

Breakout Confirmation:

The price broke above the neckline on April 2, with a strong bullish candle closing at 0.83635. The current price of 0.83642 is holding above the breakout level, which is a positive sign for bulls.

The breakout level aligns with the resistance zone, making the move significant as it also clears this key barrier.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 0.83425 (approximately 0.8340–0.8345).

This level corresponds to the lows of the left and right shoulders, where buyers stepped in to defend the price. It also aligns with the lower boundary of the pattern, reinforcing its importance.

Resistance Level:

A resistance zone is marked around 0.83700 (approximately 0.8365–0.8375).

This level corresponds to the neckline of the Inverse Head and Shoulders pattern and a previous high from March 19. It acted as a barrier during the pattern formation but has now been broken, turning it into potential support on a retest.

Target Level:

The target for the breakout is projected at 0.84447.

This target is calculated using the standard method for Head and Shoulders patterns: measuring the height of the pattern (from the head at 0.83260 to the neckline at 0.83700, which is 0.00440) and projecting that distance upward from the breakout point (0.83700 + 0.00440 = 0.84140). The target of 0.84447 is slightly higher, possibly adjusted for the next significant resistance.

The chart indicates a potential move of 0.00627 (0.75%), which aligns with the distance from the breakout level (0.83700) to the target (0.84447).

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 0.83425.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back below the neckline and the right shoulder, the trade is exited with a controlled loss.

The distance from the breakout level (0.83700) to the stop loss (0.83425) is 0.00275, representing the risk on the trade.

Risk-Reward Ratio:

The chart indicates a potential move of 0.00627 (0.75%) to the target.

The risk is 0.00275 (from 0.83700 to 0.83425), and the reward is 0.00627 (from 0.83700 to 0.84447), giving a risk-reward ratio of approximately 2.28:1 (0.00627 / 0.00275). This is a favorable ratio for a trading setup.

5. Additional Annotations

Pattern Components:

The chart labels the Left Shoulder, Head, and Right Shoulder, clearly identifying the structure of the Inverse Head and Shoulders pattern.

A blue arrow labeled “Inverse Head & Shoulder pattern” points to the formation, making it easy to recognize.

Arrows and Labels:

A green arrow labeled “Support Level” points to the 0.83425 zone, indicating where buyers have defended the price.

A red arrow labeled “Resistance Level” points to the 0.83700 zone, highlighting the neckline and the breakout area.

A blue arrow labeled “Target” points to 0.84447, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 0.83425, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 0.83642 (red) and bid price at 0.83635 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) EUR/GBP.

Entry Point: The setup suggests entering after the price breaks out above the neckline of the Inverse Head and Shoulders pattern, which occurred around April 2, 2025, at approximately 0.83700.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the neckline, with the current price at 0.83642, slightly below the high of 0.83670 but still above the breakout level. Traders might wait for a retest of the neckline (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 0.83425.

Rationale: This placement protects against a false breakout. If the price falls back below the neckline and breaches the right shoulder, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (0.83700) to the stop loss (0.83425) is 0.00275, or approximately 0.33% of the entry price.

Take Profit/Target:

Level: The target is set at 0.84447.

Rationale: This target is derived from the height of the pattern projected upward from the breakout point. It also aligns with a logical extension toward the next significant resistance.

Reward: The distance from the entry (0.83700) to the target (0.84447) is 0.00627, or approximately 0.75% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.28:1, which is attractive for a trading setup. For every unit of risk (0.00275), the potential reward is over 2 units (0.00627).

Trade Management:

Trailing Stop: Once the price approaches the target at 0.84447, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at a minor resistance level (e.g., 0.84000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the pattern was bearish, as evidenced by the decline from 0.84200 to 0.83260. The Inverse Head and Shoulders pattern suggests a potential reversal to the upside, with the breakout confirming this shift.

The price action after the breakout will be critical. A strong move toward 0.84000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of an Inverse Head and Shoulders breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

EUR/GBP is influenced by factors like Eurozone and UK economic data, interest rate differentials, and Brexit-related developments. On April 2, 2025, traders should consider:

Economic Data: Key releases like UK GDP, Eurozone inflation, or central bank statements around this time could impact the pair.

Geopolitical Events: Any developments related to UK-EU relations or global risk sentiment could drive volatility in EUR/GBP.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the neckline (0.83700) and falls back below the right shoulder, the setup is invalidated. The stop loss at 0.83425 mitigates this risk.

Resistance at 0.84000:

The price may encounter resistance around 0.84000, a psychological level and a previous high. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near this level.

Market Volatility:

EUR/GBP can be volatile on a 1-hour timeframe, especially around economic data releases. Unexpected news could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for EUR/GBP based on an Inverse Head and Shoulders pattern. The price has broken out above the neckline on April 2, 2025, signaling a potential move toward the target of 0.84447. Key levels include support at 0.83425 (where the stop loss is placed) and the neckline resistance at 0.83700, which the price must hold above to maintain the bullish thesis. The setup offers a favorable risk-reward ratio of 2.28:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on EUR/GBP or check the outcome of this setup, I can assist with that!

EURGBP Bull Flag

Correction is happening inside a clearly defined channel.

Price found support at 61.8% pullback, with bullish divergence, which I´m currently labeling as 2/B.

Although the top of the channel served as resistance, the higher probability is that the channel (bull flag) will be broken, and price will target new recent highs.

DeGRAM | EURGBP broke through the trend lineEURGBP is in a descending channel above the trend lines.

The price is moving from the support level and the lower boundary of the channel.

The chart formed a harmonic pattern, broke the upper trend line and reached the 50% retracement level.

The indicators indicate that a bullish divergence is now being worked out on the 4H Timeframe.

We expect the growth to continue after consolidation above the correction level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

I'm selling EURGBPIf you dont trade this pair directly, you can use it to know which pair is stronger between EUR and GBP. But you should trade it tho, why limit yourself to any pair in particular?

Now, it is better to buy GU than EU as GU will move more massively ie if the analysis hold.

I will like for you to trade it tho, the risk is small when compared to the massive result.

Follow me as my trades are market orders and not limit orders so you will be able to see the trades on time and enter on time.

Ya gazie

EURGBP oversold bounce back capped at 0.8384The EUR/GBP pair continues to exhibit bearish sentiment, reinforced by the prevailing downtrend. The key intraday resistance level is at 0.8385, marking the current swing high.

Bearish Scenario:

An oversold rally from current levels, followed by a bearish rejection at 0.8385, would likely target downside support at 0.8340. A break below this level would open the door for further declines toward 0.8307 and 0.8260 in the longer timeframe.

Bullish Scenario:

Alternatively, a confirmed breakout above the 0.8385 resistance, accompanied by a daily close above this level, would invalidate the bearish outlook. This would pave the way for further rallies, with the next resistance levels at 0.8420 and 0.8460.

Conclusion:

The prevailing sentiment remains bearish as long as 0.8385 holds as resistance. Traders should watch for rejection at this level to confirm downside momentum. Conversely, a decisive breakout above 0.8420 would signal a potential shift to a bullish bias, targeting higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DeGRAM | EURGBP decline in the channelEURGBP is in a descending channel.

The price is moving from the resistance level and the upper boundary of the channel.

The chart maintains a downward structure and has already formed a harmonic pattern.

We expect that the pair will continue to decline after consolidating under the support level, which coincides with the 38.2% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP ShortEURGBP had a good week

good news eurozone

falling oil prices

Rising oil prices boosting again GBP

Also tariffs on Eurozone bringing Euro again under pressure

hedgefunds long,time for me to Sell EURGBP again

i DONT USE PRICE ACTION!!!!!!Because I dont believe in price action

Profit target zone is area where the euro bulls defend their position