What do you say about selling EURGBP?All our trades from last weeks are still going on well and in good profit too. But they haven't given me what I want. They are all still valid. Especially the CADCHF buy and USDCAD sell.

If you're not in yet, look for an opportunity to enter them as the moves will be massive.

I will post if I see another entry on them.

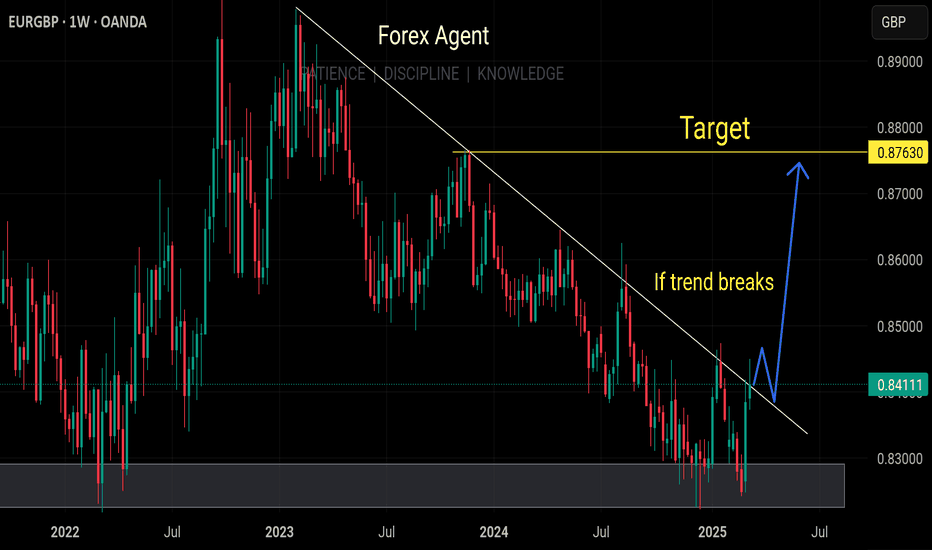

Regarding EURGBP, I think it is ready to sell again. I've been waiting for it. Let's ride it down.

If you dont trade it directly, this means you should focus on buying more GBPUSD instead of EUR as it will move more or sell EUR instead of GBP as it will fall more freely ie assuming we are right. But we will be...

TP1= 0.83600

TP2= 0.83000

TP3= 0.82000

Trade accordingly

GBPEUR trade ideas

EURGBP nearing resistance – Drop toward 0.8370 next?OANDA:EURGBP is getting close to a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past -

This zone is once again a potential point of interest for those looking for short opportunities. Given this, how price reacts here could set the tone for the next move.

If signs of rejection appear: such as long upper wicks, bearish candlestick formations, or a slowdown in bullish momentum, a move toward the 0.83700 is highly possible . However, a decisive breakout above this resistance may invalidate the bearish bias and lead to further upside. Price action at this level will be critical in determining the next move.

Just my perspective on key levels, always confirm setups and maintain solid risk management.

EUR/GBP Forecast (Buy)EUR/GBP Forecast (Buy):

Entry Price: 0.84101

Take Profit (TP): 0.84900 (799 pips above the entry point)

Stop Loss (SL): 0.83680 (421 pips below the entry point)

Rationale for the Forecast:

Current Context:

EUR/GBP is near a support level, indicating a potential upward reversal.

The Take Profit level (0.84900) is close to a key resistance level, which could be reached if the euro strengthens or the pound weakens.

The Stop Loss level (0.83680) is set below a key support level, minimizing risks in case of a downward breakout.

Fundamental Factors:

EUR: Positive industrial production data from Germany could support the euro.

GBP: Weak GDP and industrial production data from the UK could put pressure on the pound.

Technical Factors:

The level of 0.84101 is a support zone where a bounce upwards is possible.

The level of 0.84900 is a resistance zone where profit-taking could occur.

The level of 0.83680 is a zone below key support where the Stop Loss would be triggered.

Recommendations:

Target (Take Profit): 0.84900 (799 pips profit).

Risk (Stop Loss): 0.83680 (421 pips loss).

Risk-Reward Ratio: 1:1.9 (profit nearly twice the risk).

Scenarios:

Optimistic Scenario:

EUR/GBP reaches the 0.84900 level, and the position is closed with a profit.

This could happen if data from the Eurozone improves or UK data weakens.

Pessimistic Scenario:

EUR/GBP breaks below the 0.83680 level, and the position is closed with a loss.

This could occur if Eurozone data worsens or UK data improves.

Conclusion:

The current trade has a favorable risk-reward ratio (1:1.9).

It is recommended to monitor news from the Eurozone and the UK, as they could impact the pair's movement.

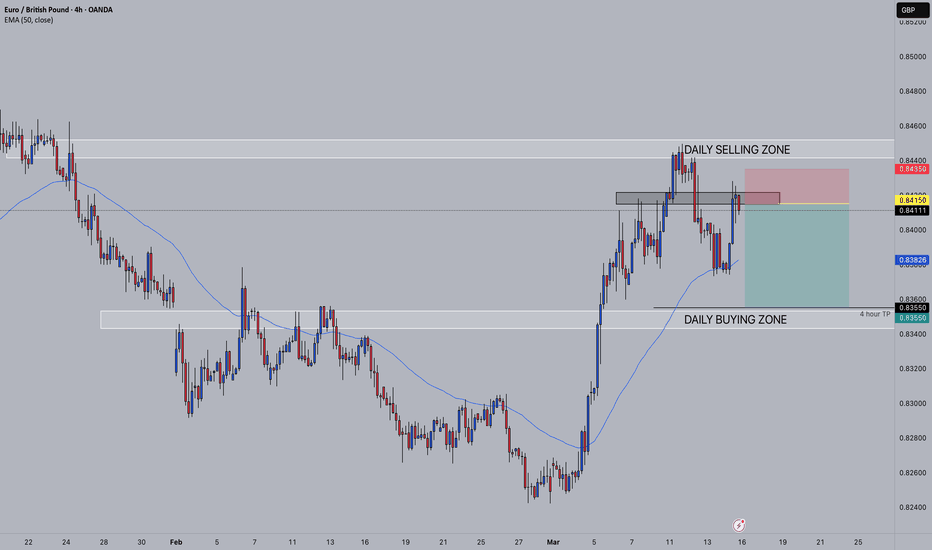

EURGBP Swing SellsThis is my analysis of EURGBP for the coming week. We have respected a strong DAILY SELLING region and now received a confirmation entry to look for sells to the downside on the 4HR. The formation of a H&S with a BOS DOWN supports my sell decision coming from the Daily Selling zone. We will also have a potential buying opportunity at the DAILY BUYING zone if we receive correct confirmation.

Entry : 0.84150

SL : 0.84350 (20 Pips)

TP : 0.83550 (60 Pips)

RR : 3:1

Safe Trading! :D

EUR/GBP "The Chunnel" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/GBP "The Chunnel"Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.83400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (0.83000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 0.84200 (or) Escape Before the Target

Secondary Target - 0.85000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/GBP "The Chunnel" Forex Market market is currently experiencing a neutral trend,., driven by several key factors.

🔱Fundamental Analysis

Interest Rates: The European Central Bank (ECB) has maintained its interest rates at 3.50%, while the Bank of England (BoE) has kept its rates at 4.50%. The interest rate differential is slightly in favor of the GBP.

Inflation: Eurozone inflation is at 5.3% (Jan 2025), while UK inflation is at 3.2% (Jan 2025). The higher inflation in the Eurozone might lead to a rate hike by the ECB.

GDP Growth: Eurozone GDP growth is expected to be around 1.2% in 2025, while the UK's GDP growth is expected to be around 1.5% in 2025.

Trade Balance: The Eurozone has a trade surplus, while the UK has a trade deficit.

🔱Macroeconomic Factors

Unemployment Rates: Eurozone unemployment is at 6.4% (Jan 2025), while UK unemployment is at 3.7% (Jan 2025).

Manufacturing PMI: Eurozone Manufacturing PMI is at 48.5 (Feb 2025), while UK Manufacturing PMI is at 49.3 (Feb 2025).

Services PMI: Eurozone Services PMI is at 52.3 (Feb 2025), while UK Services PMI is at 50.2 (Feb 2025).

🔱Global Market Analysis

Risk Appetite: Global risk appetite is moderate, with investors seeking safe-haven assets amid concerns over inflation and economic growth.

Commodity Prices: Oil prices are stable, while gold prices are rising due to safe-haven demand.

🔱COT Data

Non-Commercial Traders (Large Speculators)

Net Positions: EUR/GBP net positions are slightly bearish, with 55% of traders holding short positions.

Long Positions: Long positions are moderate, with 45% of traders holding long positions.

Short Positions: Short positions are slightly higher, with 55% of traders holding short positions.

Commercial Traders (Hedgers)

Net Positions: EUR/GBP net positions are slightly bullish, with 52% of traders holding long positions.

Long Positions: Long positions are moderate, with 52% of traders holding long positions.

Short Positions: Short positions are slightly lower, with 48% of traders holding short positions.

🔱Intermarket Analysis

Correlation: EUR/GBP is negatively correlated with EUR/USD and positively correlated with GBP/JPY.

Cross-Rates: EUR/JPY and GBP/JPY are trading in a range, indicating a balanced market.

🔱Quantitative Analysis

Trend Analysis: The EUR/GBP is trading in a downtrend, with a bearish bias.

Momentum Indicators: RSI (14) is at 40, indicating a neutral market. MACD (12, 26) is bearish, with a signal line crossover.

🔱Market Sentimental Analysis

Trader Sentiment: Trader sentiment is slightly bearish, with 55% of traders expecting a price decline.

Market Positioning: Market positioning is neutral, with a balanced ratio of long to short positions.

🔱Positioning

Long Positions: Long positions are moderate, with traders holding 45% of long positions.

Short Positions: Short positions are slightly higher, with traders holding 55% of short positions.

🔱Overall Summary Outlook

The EUR/GBP is expected to trade lower, driven by a stronger GBP and a weaker EUR. The bearish bias is supported by fundamental, technical, and sentimental analysis. However, traders should be cautious of potential reversals and use proper risk management techniques.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/GBP "The Chunnel" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/NZD "Euro vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : The heist is on! Wait for the breakout of (0.82650) then make your move - Bearish profits await!"

however I advise placing Sell stop below the support line or Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in swing/retest.

I highly recommend to use alert in your trading platform.

Stop Loss 🛑: Thief SL placed at 1.83000 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.81950 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The EUR/GBP "The Chunnel" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

⚖️Fundamental Analysis

- The European Central Bank's (ECB) monetary policy decisions significantly impact the EUR/GBP exchange rate. The ECB's interest rate decisions influence the euro's value relative to the pound.

- The UK's economic performance, including GDP growth, inflation, and employment rates, also affects the exchange rate.

- Political developments, such as Brexit negotiations and EU-UK trade agreements, can create market volatility and impact the EUR/GBP exchange rate.

⚖️Macro Economics

- Inflation Rates: The ECB's inflation target is below, but close to, 2%. The UK's inflation rate has been above the Bank of England's 2% target. These differences can influence the exchange rate.

- Interest Rates: The ECB's interest rates are currently lower than the Bank of England's rates. This difference can impact the exchange rate.

- GDP Growth: The EU's GDP growth has been slower than the UK's in recent years. This difference can influence the exchange rate.

⚖️COT Data

- Commitment of Traders (COT): The COT report shows that large speculators, such as hedge funds and institutional investors, are currently net short on the euro. This suggests that they expect the euro to weaken against the pound.

- Non-Commercial Traders: Non-commercial traders, such as individual investors and hedge funds, are currently net long on the euro. This suggests that they expect the euro to strengthen against the pound.

⚖️Market Sentimental Analysis

- Market Sentiment: The market sentiment for EUR/GBP is currently bearish, with many analysts expecting the euro to weaken against the pound.

- Positioning: Many traders and investors are currently short on the euro, expecting it to weaken against the pound.

⚖️Trader Positions

- Institutional Traders: 55% short, 45% long

- Retail Traders: 58% short, 42% long

- Hedge Funds: 60% short, 40% long

- Commercial Traders: 52% short, 48% long

- Banks: 50% short, 50% long

⚖️Next Trend Move

- Based on the current market sentiment and positioning, the next trend move for EUR/GBP is likely to be downward, with the euro weakening against the pound.

- However, it's essential to keep in mind that market trends can change rapidly, and unexpected events can impact the exchange rate.

⚖️Quantitative Analysis

- Moving Averages: The 50-day moving average is currently above the 200-day moving average, indicating a bullish trend. However, the short-term moving averages (10-day and 20-day) are below the longer-term moving averages, indicating a bearish trend.

- Relative Strength Index (RSI): The RSI is currently at 40, indicating that the market is oversold and due for a bounce.

- Bollinger Bands: The Bollinger Bands are currently widening, indicating increased volatility.

⚖️Intermarket Analysis

- Correlation with Other Markets: EUR/GBP is currently positively correlated with the EUR/USD and negatively correlated with the GBP/USD.

- Impact of Other Markets: The EUR/GBP exchange rate is likely to be impacted by the performance of the US dollar, as well as the relative economic performance of the EU and UK.

- Commodity Prices: Changes in commodity prices, such as oil and gold, can also impact the EUR/GBP exchange rate.

⚖️Overall Summary Outlook

The EUR/GBP exchange rate is expected to decline in the short-term, driven by the bearish market sentiment and positioning. The euro's weakness against the pound is likely to continue, with a potential target of 0.8200. However, any unexpected positive developments in the EU or negative developments in the UK could lead to a reversal of the trend. Traders and investors should remain cautious and monitor market developments closely.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

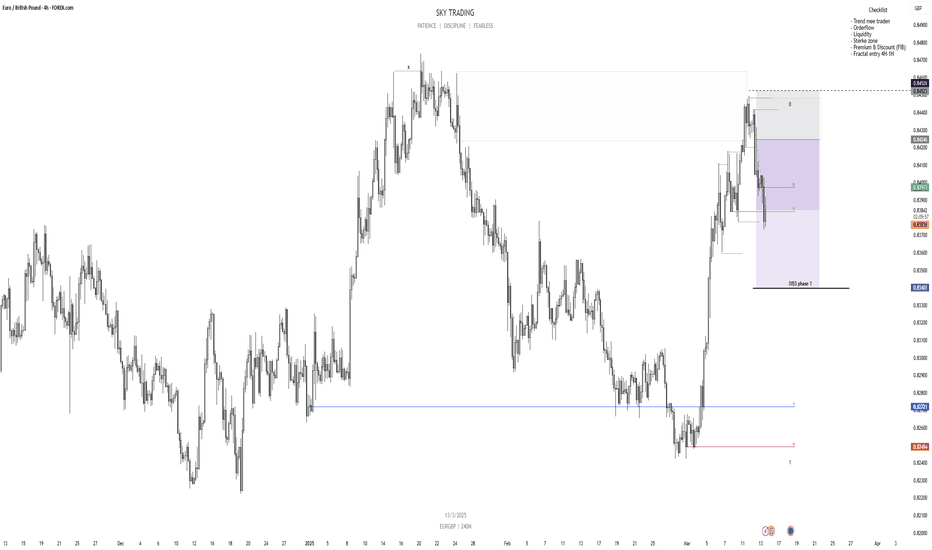

EURGBP continuation ideai have identified a bearish trend which may move until the daily fvg below.. check previous post for the overview. I still have my sell until it hit BE ( i know people will say why didnt u take profit) iam overall 13% this week this if i had taken then id be over 17% but since i am bearish and i have achieved my monthly target this week is amazing lol... however buyside has been cleared + daily fvg has been filled now. either BE or bearish trend will be continued.

1 lesson: ( i am no pro i just share my idea and views) all appreciation to TTrades on his daily bias video man's a gem,,, In a particular time of day i expect downside or upside which i cannot decide overall...

(mistake) knowing friday is reversals but ignored lol u see i am no perfect man.

have a nice weekend guys.

EUR-GBP Growth Ahead! Buy!

Hello,Traders!

EUR-GBP made a retest

Of the horizontal support

Level of 0.8370 and we are

Already seeing a bullish

Reaction so we are bullish

Biased and we will be

Expecting a further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/GBP Short before next leg upEur/Gbp had a big push up and now I expect pullback back to support before price will push back up again.

Looking on weekly chart prices are in clear uptrend. So for longterm trading wait for pullback.

For shortterm trading taking shorts with SL above last high is good place to put a trade today.

TP 0.83360

SL 0.84500

EURGBP Wave Analysis – 13 March 2025

- EURGBP reversed from key resistance level 0.8450

- Likely to fall to support level 0.8340

EURGBP currency pair recently reversed down with the daily Shooting Star from the resistance area between the key resistance level 0.8450 (which has been reversing the price from September) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term ABC correction ii from the end of February.

Given the strength of the resistance level 0.8450 and the overbought daily Stochastic, EURGBP currency pair can be expected to fall to the next support level 0.8340.

EURGBP - Approaching Key Resistance: Is 0.8370 the next target?OANDA:EURGBP is nearing a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past. This zone also aligns with prior supply areas where sellers have stepped in, making it a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 0.83700 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

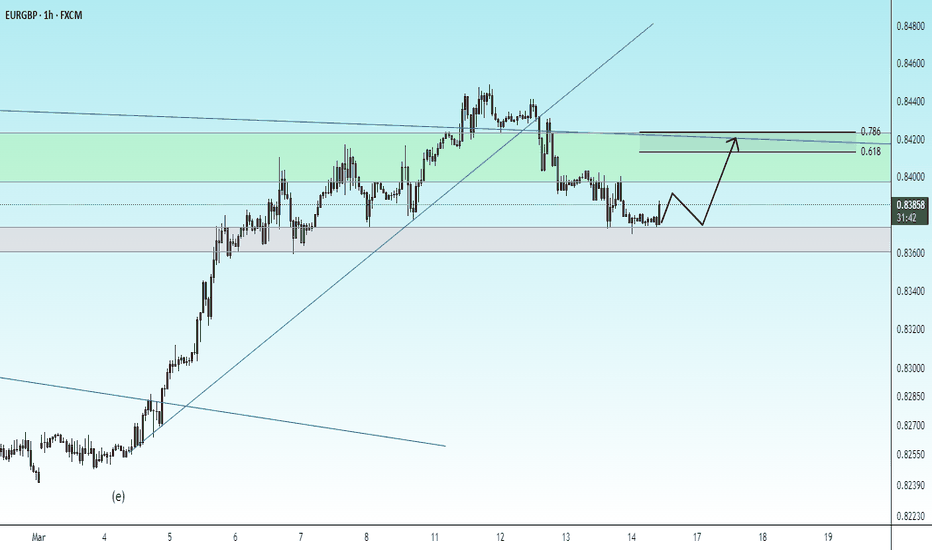

DeGRAM | EURGBP completes the correctionEURGBP is in an ascending channel between the trend lines.

The price has already reached the support level and approached the lower trend line.

Indicators are forming a bullish convergence on the 1H Timeframe.

We expect the growth to resume.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP pullback from the retracement levelEURGBP is in an ascending channel between the trend lines.

The price is moving from the dynamic resistance, which has already acted as a pullback point, and 88.6% retracement level.

The chart formed a harmonic pattern after reaching the upper trend line.

Indicators continue to form a bearish divergence on the 4H Timeframe.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP INTRADAY upside capped at 0.8420Bullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8380, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8360, followed by 0.8340 and 0.8327, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8420 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish bounce off overlap support?EUR/GBP is falling towards the support which has been identified as an overlap support and could bounce tot he 1st resistance which is a pullback resistance.

Pivot: 0.8387

1st Support: 0.8355

1st Resistance: 0.8452

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/GBP - Short Trade IdeaHere we are Respecting the Long Term Liquidity Trend In a Bearish Momentum.

We had a Large Bearish push from this previous supply zone and now I would like to see price move off this Smaller 1H Supply zone and take Sell side Liquidity.

The previous movement has show price reject the Liquidity zone as shown, we have also rejected 71% level which is the Optimal OTE area for price to respond too

Good luck to all traders that follow this. I will also be live in this trade Idea