GBPJPY Technical Outlook – July 15, 2025Looking for Impulse up!

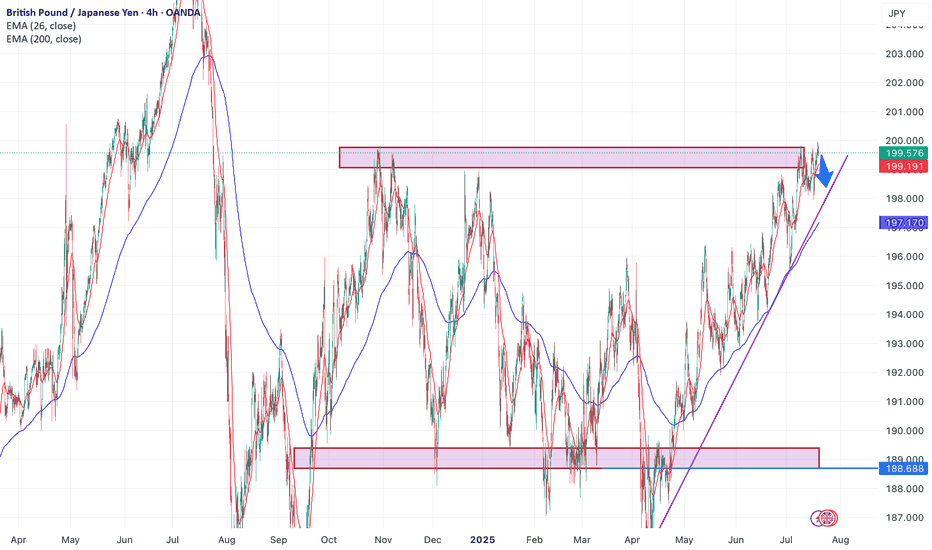

GBPJPY has broken out of a classic bullish flag pattern on the 4H chart, signaling a potential continuation of the recent upside momentum. The breakout follows a strong impulse move from the 197.50 area, followed by a brief descending consolidation. Price has now closed above the flag structure, suggesting buyers are regaining control. A short pullback toward the breakout zone is possible before further upside toward the buy-side liquidity near 201.000. Equal highs are also resting just below this level, providing additional confluence for the upside target. As long as price holds above the 198.50–198.80 support area, the bullish outlook remains intact.

This analysis is intended for educational purposes only.

Learn & Earn!

Wave Trader Pro

GBPJPY trade ideas

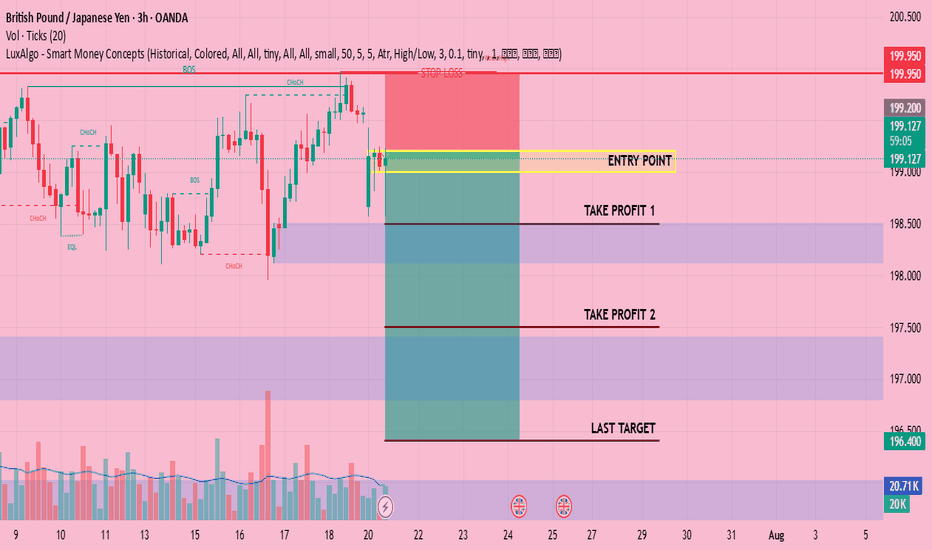

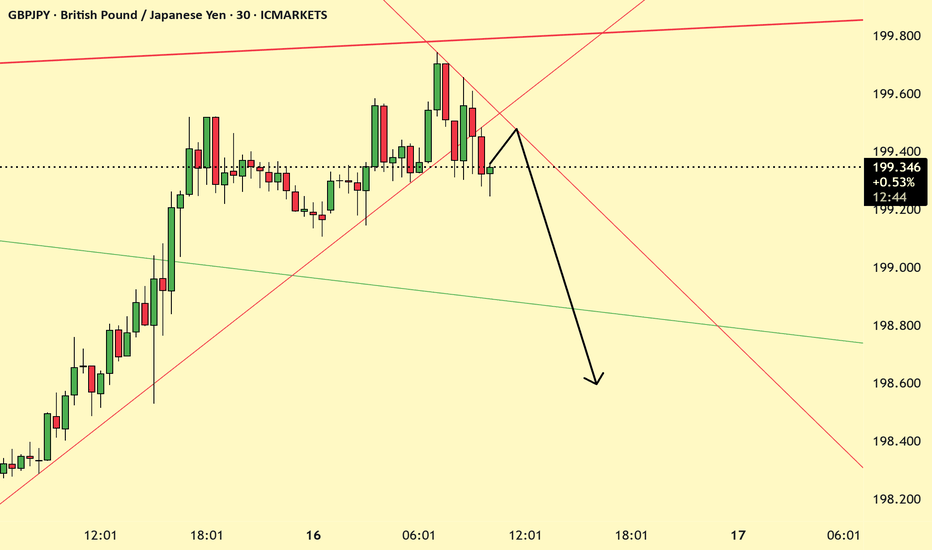

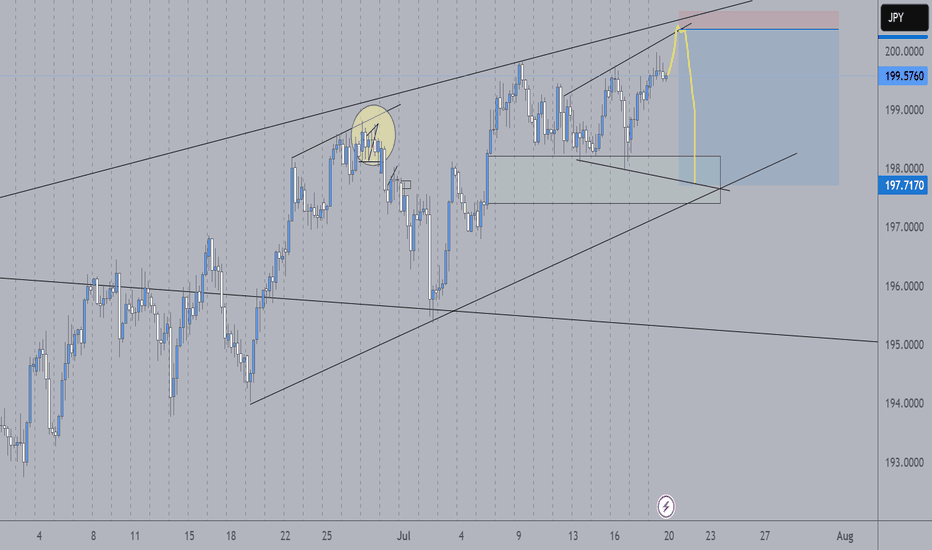

Sell gbpjpyIn the current chart, we are observing a range-bound trading pattern, with the price nearing the upper boundary, which is also a significant psychological level (200) . In the other hand a double top formation has emerged in this area, indicating strong resistance, as the price has previously touched this level multiple times.

As we approach this critical juncture, it is anticipated that the price may decrease and move toward the lower boundary of the range. Notably, there is a purple trend line representing an upward trend, which plays a crucial role in this analysis. As the price descends, it is expected to intersect with this purple line, making it an important area to set the first take-profit (TP) target.

If the price manages to break below the purple trend line, this could indicate a more pronounced bearish trend, providing opportunities to establish additional take-profit levels based on subsequent support or resistance zones. Traders should remain vigilant and adaptable, monitoring price action closely to optimize their trading strategies.

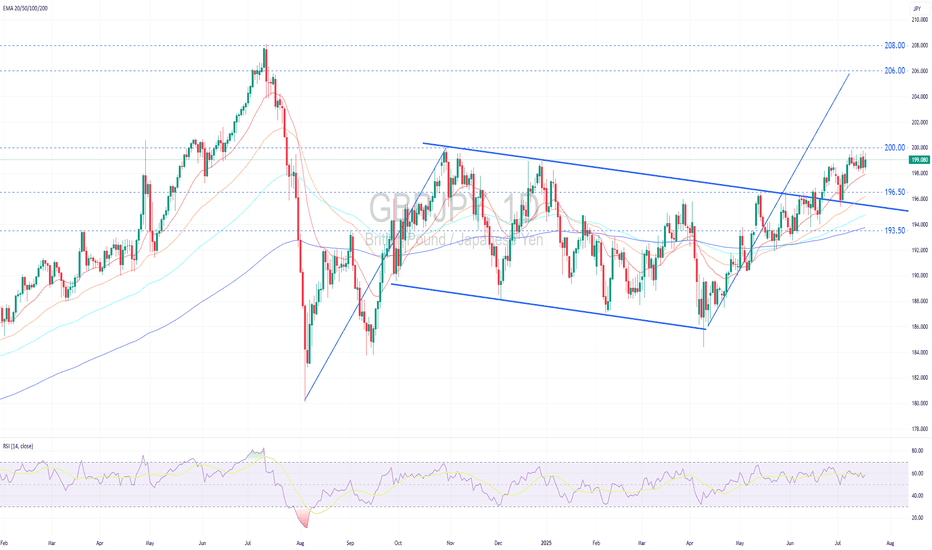

GBPJPY Remains in a Solid Uptrend.GBPJPY remains in a solid uptrend.

Technical Outlook:

GBPJPY remains in a firm uptrend, forming a series of higher highs and higher lows while holding above widening bullish EMAs, signaling strong bullish momentum.

Price is currently consolidating sideways near the recent peak, following a successful retest of the broken descending trendline, a classic bullish continuation setup.

No clear reversal signals have emerged, and the range-bound action suggests accumulation ahead of a potential upward breakout (above 200.00).

A decisive breakout above the psychological resistance at 200.00 would confirm a trend-following breakout, opening upside targets at 206.00 (flagpole projection) and potentially 208.00 (2024 high).

Near-term pullbacks may find support at 196.50 , the prior breakout zone, before resuming the uptrend.

Fundamental Outlook:

The pound is supported by higher-than-expected inflation data for June, with the UK’s Consumer Price Index (CPI) coming in at 3.6%, nearly twice the BoE target. This has led markets to expect that the BoE might delay or pause interest rate cuts at its upcoming meeting in August.

Moreover, the UK Prime Minister’s strong commitment to fiscal discipline has played a pivotal role in reinforcing investor confidence, thereby lending further support to the pound.

In contrast, the BoJ continues to adopt a cautious stance, keeping its policy rate at a relatively low at 0.50%. This conservative approach reflects the central bank’s intent to monitor the economic impacts of US tariff increases before any further action.

The BoJ’s low-rate policy sustains yen carry trades, driving capital outflows into higher-yielding US assets, mostly US treasury bonds, and intensifying downward pressure on the yen.

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

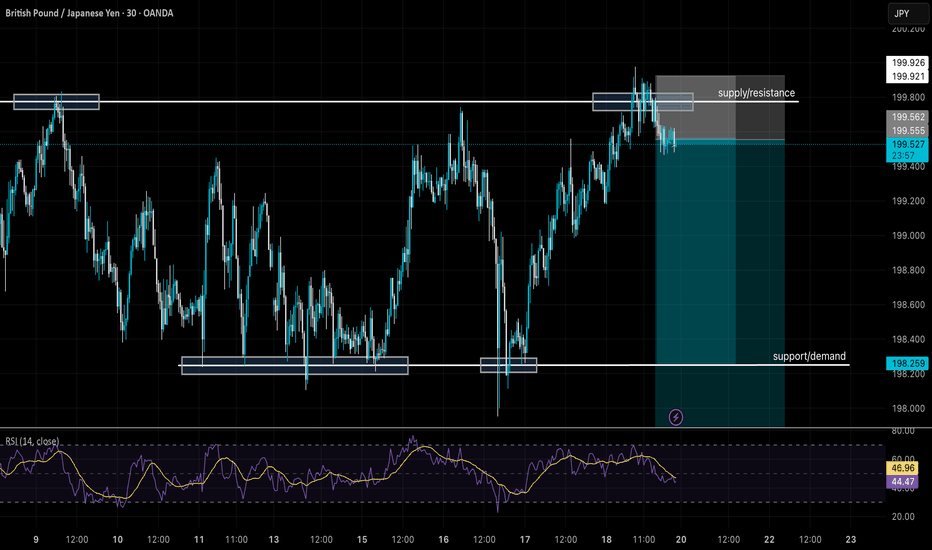

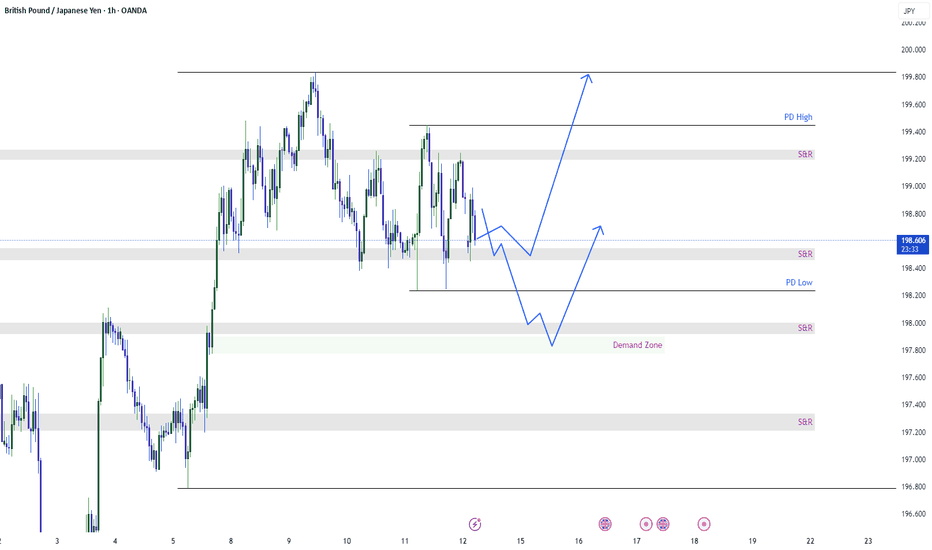

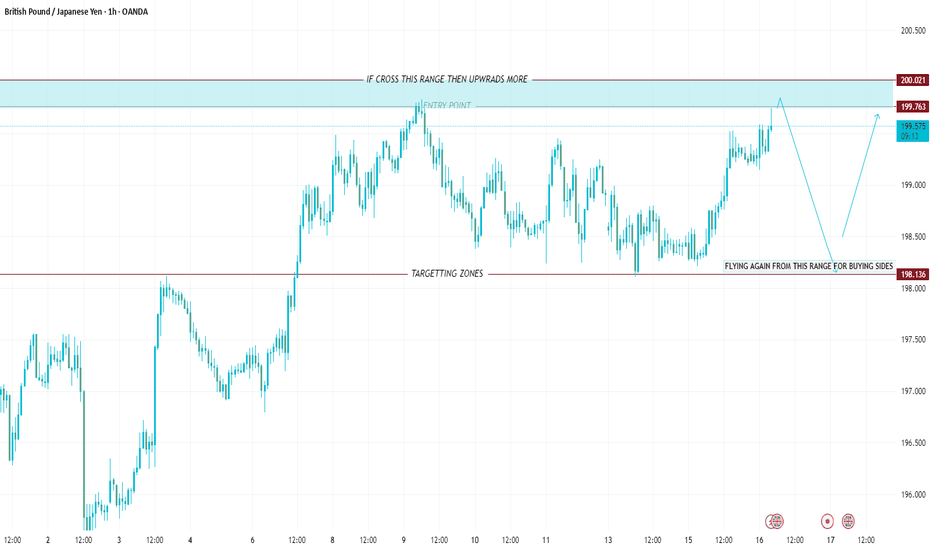

GBPJPY is still in retracementWe can see from the graph GBPJPY is oscillating between the two S&R levels. For today we expect GJ to touch the demand zone and then go higher. Therefore we can expect GBPJPY in go further down and hit the demand zone because it is still retracing. The possibilities for the GJ are shown.

Why election risk means yen volatility could rise this weekThe Japanese yen remains vulnerable ahead of Japan’s Upper House election on July 20.

Polls suggest the ruling LDP-Komeito coalition may lose its Upper House majority. Such an outcome would further weaken Prime Minister Shigeru Ishiba’s position, with his government already operating as a minority in the Lower House.

Adding to the pressure, the U.S. is set to impose 25% tariffs on Japanese goods from August 1—part of a broader protectionist push.

GBPJPY Will Grow! Buy!

Here is our detailed technical review for GBPJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 198.531.

The above observations make me that the market will inevitably achieve 202.938 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

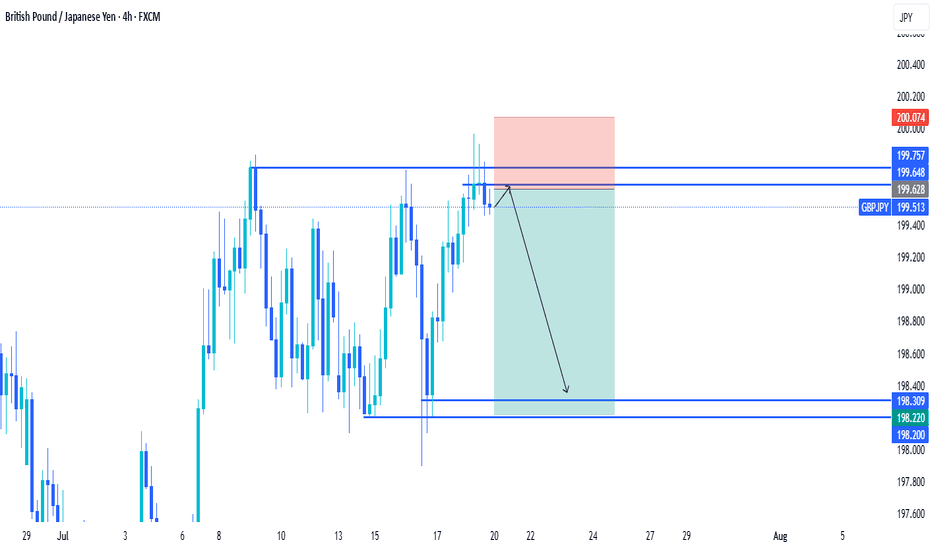

GBP/JPY H4 | Yen weakness to persist?GBP/JPY is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 197.98 which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 196.68 which is a level that lies underneath a swing-low support and the 61.8% Fibonacci retracement.

Take profit is at 199.75 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

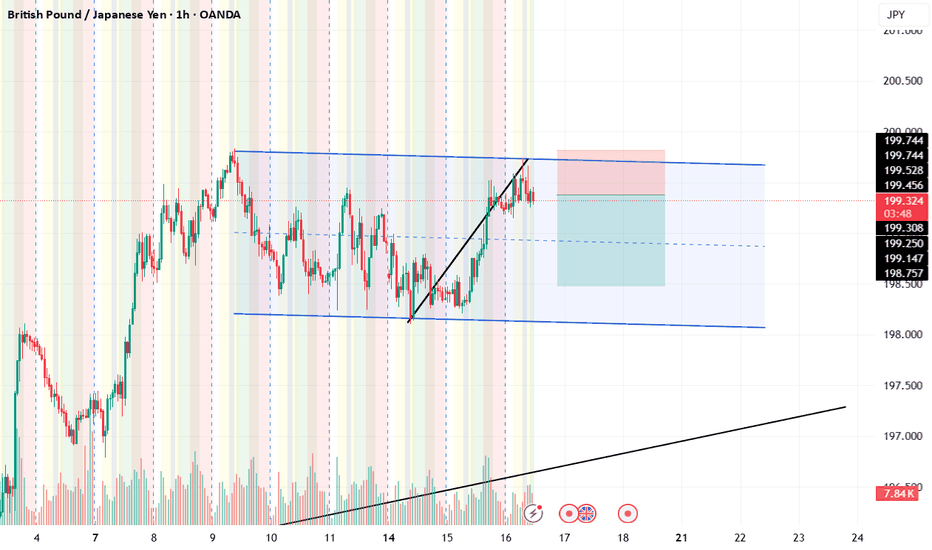

GBPJPY RangingGBPJPY is still in the range. For this range we can trade between the zones drawn. It has taken previous day high already. There is S&R level and supply zone if gets buyer push and crosses previous week high we may expect further bullish momentum. Till now we can trade between zones if we see any bullish signs.

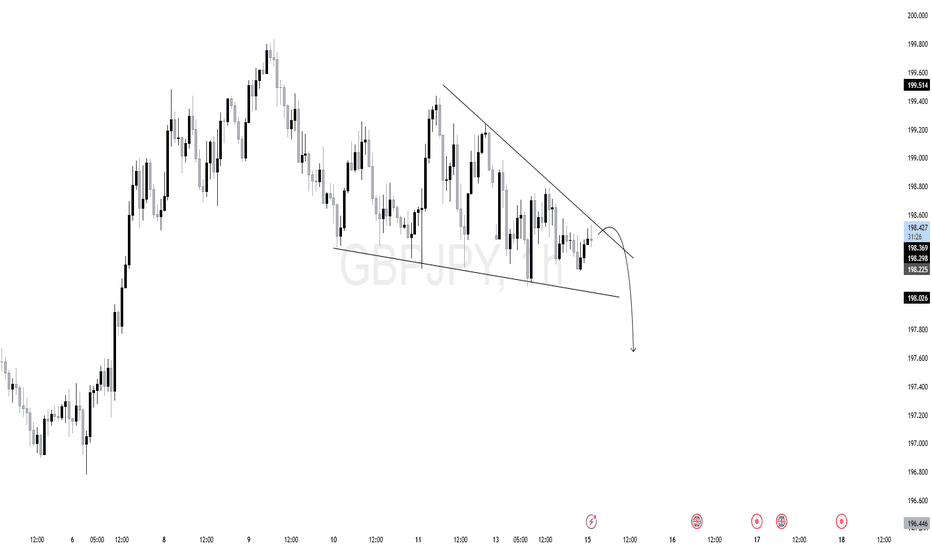

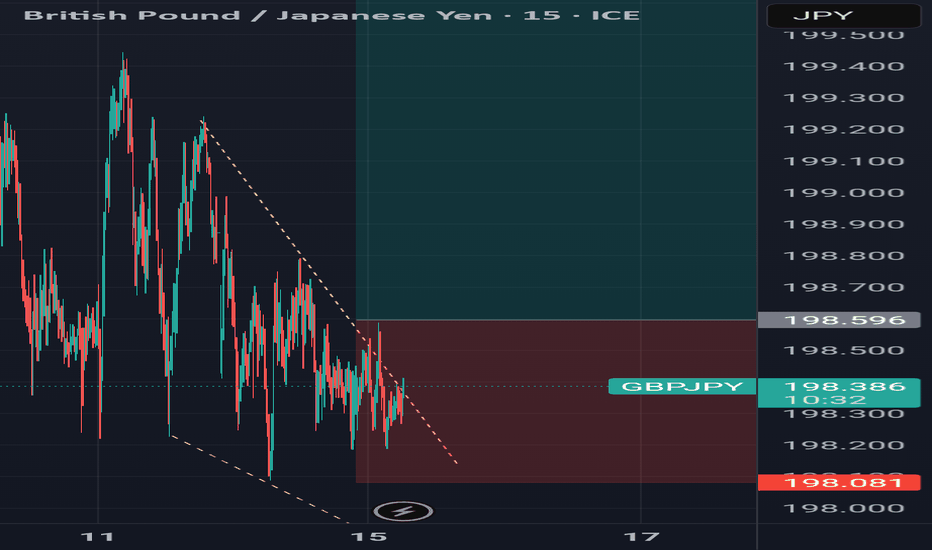

$GJ (GBPJPY) 1HPrice is currently forming a descending triangle pattern, with clear lower highs and a horizontal support zone.

Trendline resistance is actively being respected.

Liquidity is likely building below the horizontal support zone.

A false breakout or sweep above the trendline followed by rejection could trigger institutional distribution.

As long as the descending trendline holds, and no bullish BOS occurs, the structure remains bearish. Look for price to accumulate short positions before expansion.

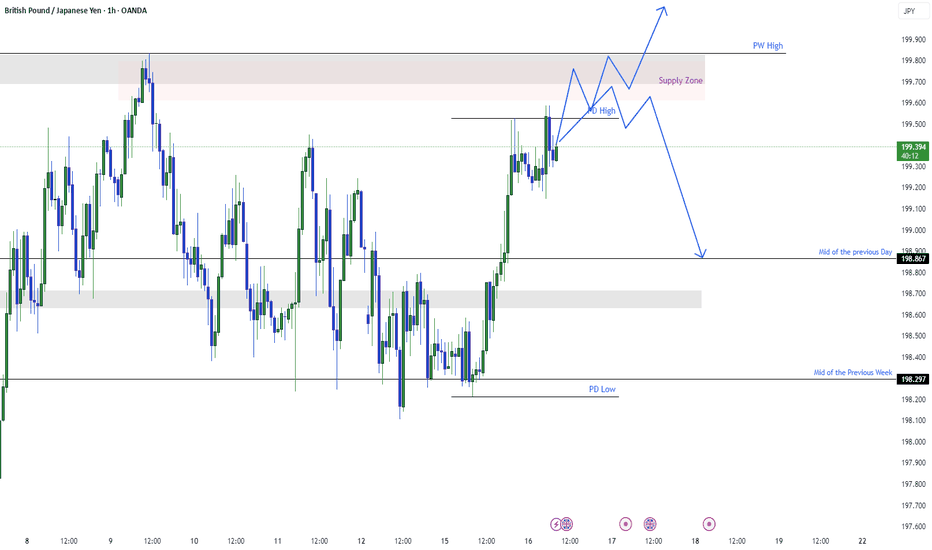

Volatile Times for GBPJPY: What’s Going On Behind the Moves?Good morning, Guys,

I’m anticipating a new short opportunity on GBPJPY once the pair reaches my sell zone level. From there, my target is set at 197.934.

Every like from you is what truly motivates me to keep sharing these insights.

Massive thanks to everyone who shows love and support!

GBPJPY - Bullish Continuation Setup• Pair: GBPJPY

• Bias: Bullish (Buy)

• HTF Overview (4H):

• Strong bullish momentum with clear breaks to the upside.

• No signs of price reaching deeper 4H SSL — continuation more likely.

• MTF Refinement (30M):

• Watching for price to mitigate lower 30M OB zone.

• Expecting bullish continuation from that area.

• Entry Zone:

• Wait for LTF confirmation inside 30M OB.

• Switch to trader mode after valid CHoCH / intent confirmation.

• Targets:

• Structure highs / clean extension into the next liquidity pool.

• Mindset Note:

• Be patient, trust bullish structure. Let price come to you.

Bless Trading!

GBPJPYGBP/JPY is currently trading at 199.535, providing a potential short opportunity from elevated levels.

2. The ideal sell zone lies between 199.500 – 199.700, where price shows signs of rejection.

3. A downside move could test the first support (previous resistance flipped) at 199.000.

4. Further weakness may lead to a drop toward 198.500, the next key demand zone.

5. A break below 198.000 would act as a strong confirmation of bearish momentum.

6. Place a stop-loss above 200.300, as a move above this level would invalidate the sell setup.

7. Price action shows signs of exhaustion after recent bullish runs, hinting at a potential reversal.

8. Selling pressure near the psychological 200.00 level adds to bearish bias.

9. Monitor lower timeframes for bearish engulfing candles or breakdown patterns below 199.00.

10. Below 200.300, the trade favors the bears, aiming for targets down to 198.000 or lower.

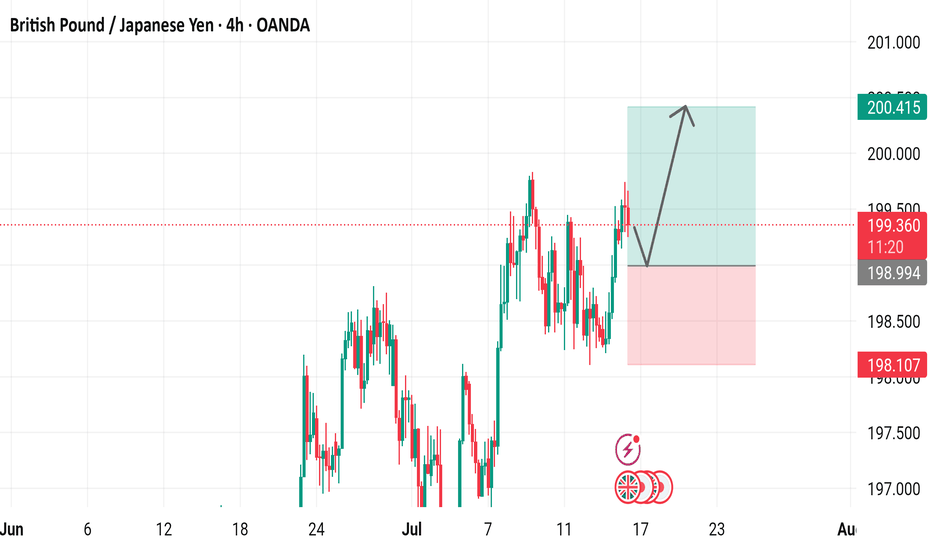

British Pound / Japanese Yen (GBP/JPY) 4-Hour Chart Analysis4-hour performance of the British Pound against the Japanese Yen (GBP/JPY) via OANDA data. The current price is 199.352, reflecting a 0.129 (0.06%) increase. The chart highlights a recent upward trend, with key support levels around 198.107 and 198.994, and resistance near 200.415. A breakout above the recent high is indicated, suggesting potential for further gains.

GBPJPY - Multi-Year Short Update! In our last setup for GBPJPY, we identified a massive diagonal pattern, with price completing wave 4 and preparing for a multi-year drop into wave 5.

Since then, price has played out exactly as forecasted — we've seen a clean impulse lower for wave 1, followed by an ABC correction for wave 2, which looks to have now completed.

This sets the stage for the next major leg — wave 3 of 5 — which historically carries the most power and momentum.

📉 See monthly chart here:

📊 GBP/JPY Wave‑3 Trade Idea

Background:

We’ve completed wave 1 down and wave 2 up (ABC correction).

GBPJPY is now positioned to start a powerful wave 3 down — the most impulsive leg in an Elliott sequence.

🔍 Current Price Action:

Price is rejecting major resistance (previous wave A high + shaded zone)

Structure shows a completed 5-wave move up within C, suggesting exhaustion.

A clean ascending trendline (red) has formed under wave v — a break here signals the first confirmation.

Option 1 – Aggressive Entry:

- Trigger: Break and close below the red trendline (~198.00–197.80 zone) on the daily.

- Entry: On candle close below trendline

- Stop Loss: Above recent high ~199.80 and then breakeven once we move lower

Option 2 – Conservative Entry (preferred):

- Trigger: Trendline break + correction

- Entry: On bearish confirmation and then a correction to indicate further downside

- Stop Loss: Above recent high ~199.80 and then breakeven once we move lower

Take Profit Levels:

- TP1: 192

- TP2: 180

- TP3: 175

- Final Target: Trail for extended move toward wave (3) lows (could be 10,000+ pips over long term)

🔐 Invalidation:

Daily close back above 200.00 or impulsive rally beyond the pink resistance zone invalidates the short bias in the short term.

✅ Summary:

This is a high-conviction, structure-backed setup with:

- Wave count + Fib confluence

- Bearish structure at key resistance

- Confirmation-based trigger (trendline break + retest)

- Excellent long-term risk-to-reward profile

📂 Previous GBPJPY Setups (Track Record):

📌 Free Setup (Big Picture Outlook) – Multi-Year Shorts Incoming (Wave 4 Completion)

✅ Swing 1 – 1,200 Pips (VIP GBPJPY Long)

✅ Swing 2 – 1,000 Pips (VIP GBPJPY Short)

✅ Swing 3 – 1,100 Pips (VIP GBPJPY Short)

✅ Swing 4 – 700 Pips (VIP GBPJPY Short)