GBPJPY trade ideas

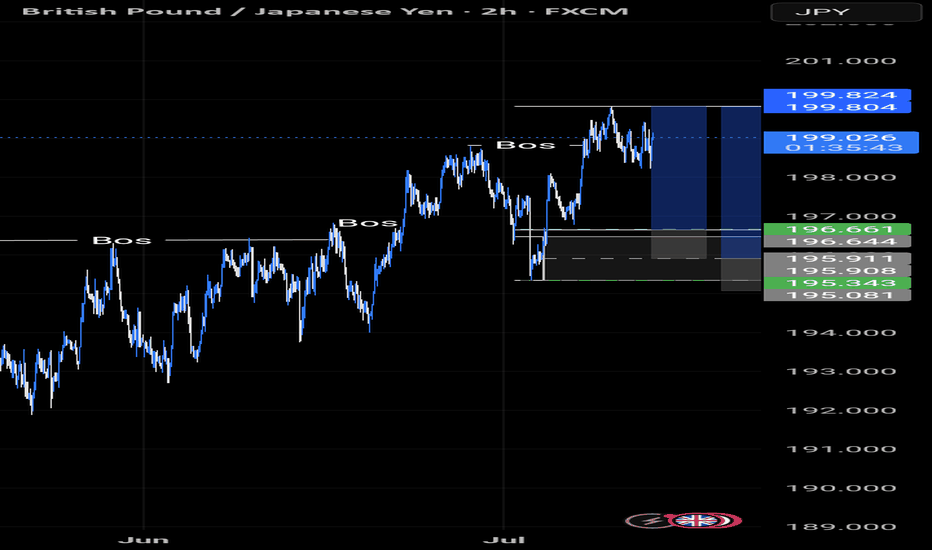

GJ Counter Pullback Likely to Daily DemandHello Traders,

On GJ, price remains in a daily counter-trend pullback phase. This has just been confirmed by a 4-hour break and close below the weak swing low (LL). To stay aligned with the overall bullish trend, I’m expecting a deeper pullback into the daily demand zone before price resumes its upward movement.

"GBP/JPY: High-Risk Pips Grab – Escape Before Cops! 🏴☠️ GBP/JPY "Dragon Heist" – Bulletproof Bullish Raid (High-Risk, High-Reward) 🚨

🔥 Attention Market Pirates & Profit Raiders! 🔥

(Day/Swing Trade Plan – Long Entry Focused)

🔑 Entry Zone (Vault Cracked!):

"The Dragon’s loot is unguarded! Bullish pullback = prime stealing opportunity."

Buy Limit Orders: Layer entries near 15M/30M swing lows (wick/body). DCA-friendly!

Thief Pro Tip: Scalpers ride long-only waves. Swing traders? Stack slowly, escape rich.

🎯 Target (Escape Routes):

200.600 (or bail early if cops (resistance) swarm!)

🚨 Red Zone = High-Risk Take-Profit (Overbought? Reversal? Police (bears) lurk here!)

⛔ Stop Loss (Emergency Exit):

4H Swing Low/High (Wick-based) – Adjust for risk/lot size!

No martyr trades! SL = your heist survival kit.

📢 Breaking News (Fundamental Edge):

Dragon’s bullish fuel? Macro data, COT reports, sentiment—CHEK THE LIiNKk 👉🔗 (Don’t skip homework!)

💣 Trading Alerts:

News = Landmines! Avoid new trades during releases.

Trailing SL = Your Getaway Car (Lock profits, dodge volatility.)

💥 Boost This Heist!

Smash 👍, hit 🔔, and fund our next raid! Every boost = more stolen pips for the crew.

Stay tuned—another heist drops soon! 🤑 #ForexBandits

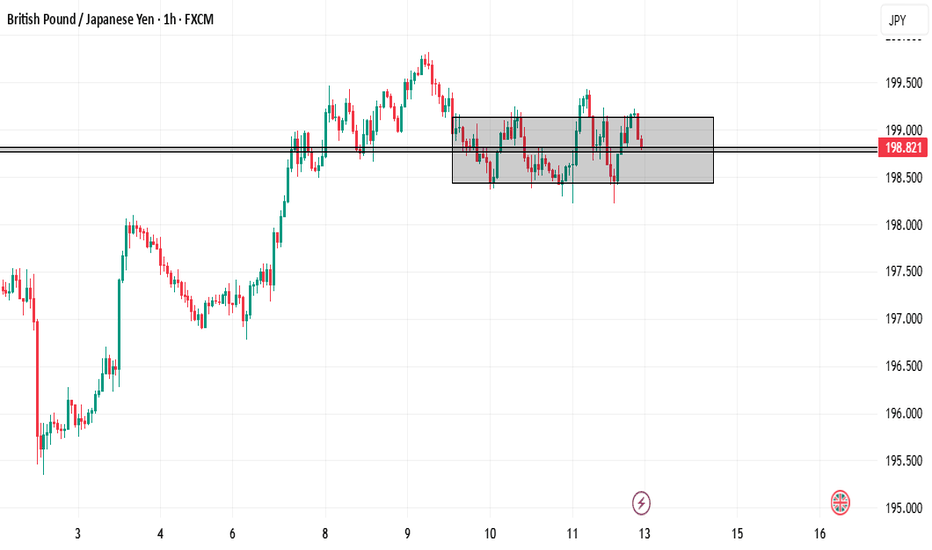

GBPJPY: Bullish Structure Still IntactGJ created a new HH then turned sideways. More consolidation or a deeper pull back could be seen before the next rally.

Last BOS: Break above 199.70 → confirmed bullish strength

H4 Demand Zone (Pullback): 198.30–198.60

Liquidity Above: Clean pools at 200.30 – 200.70

H1 Key Zone: 198.60–198.90 (H1 OB + unfilled FVG) → currently being tested.

Momentum Trigger: BOS above 199.30 to confirm buyers stepping back in.

M15 Micro-Structure: Slightly bearish (short-term), sweeping liquidity under 198.80.

What to Watch: M15 bullish BOS above 199.10–199.30 for intraday buy confirmation.

🟢Entry Zone 198.30 – 198.60

SL 197.90

TP1 199.70

TP2 200.30

TP3 201.00

❌ Bullish Invalidation

H1 close below 197.90 → bullish bias neutralized, expect deeper retrace into 197.20 – 197.50.

GBPJPY SELL IDEA- Weekly chart - Price reached an ATH on the weekly and closed below the major resistance with upward wick rejections - Signal for a downtrend for the new week

- Daily chart - The Last two daily closes (Thurs & Fri) were an inverse bearish pin bar and a weak bullish candle with upward wick rejections

- H4 Chart - Consolidating at the major resistance, but last highs were LHs and LLs

- H1 Chart - Consolidating at the major resistance, but last highs were LHs and LLs

Entry for sells would be break out of the consolidation on H4 and retest on lower Tfs - H1, M30 and M15

GBPJPY: Still BullishPrice has pulled back and is currently reacting to H1 OB at 197.00–197.20

* FVG Support: Between 196.80–197.10

* Watch for: Bullish BOS above 197.50 to confirm buyers stepping back in

* Confirmation Needed: M15 bullish BOS above 197.50–197.60 for buy entry

🟢Entry: 196.80 – 197.10

Stop Loss: 196.4

TP1: 198

TP2: 198.6

TP3: 200

Breakout Option: If price pushes above 198.30 (M15 BOS + retest), you can enter.

❌ Bullish Bias Invalidation

H1 close below 196.40 → signals potential deeper retracement

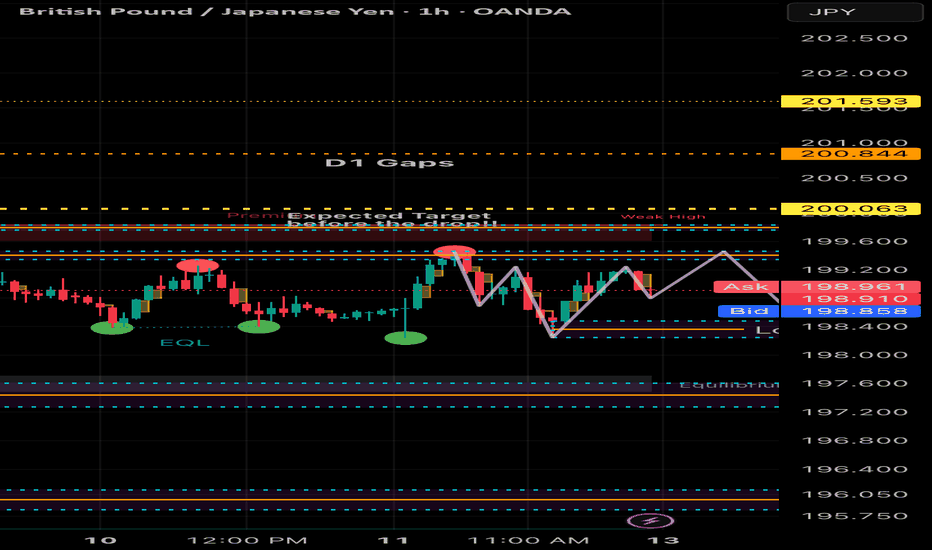

GBPJPY Short Trade - COT TradeOANDA:GBPJPY Short trade using COT Data - institutional bias, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

GBPJPY Will Go Lower From Resistance! Sell!

Here is our detailed technical review for GBPJPY.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 199.046.

The above observations make me that the market will inevitably achieve 196.674 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY Wave Analysis – 9 July 2025- GBPJPY reversed from long-term resistance level 199.65

- Likely to fall to support level 198.00

GBPJPY currency pair recently reversed from the strong long-term resistance level 199.65 (former strong resistance from October, November and July) standing near the upper daily Bollinger Band.

The downward reversal from the resistance level 199.65 is likely to form the daily Shooting Star reversal pattern.

Given the bearish divergence on the daily Stochastic indicator and the strength of the resistance level 199.65, GBPJPY currency pair can be expected to fall to the next support level 198.00.

GBP/JPY BEARISH AB = CD PATTERN Potential Short Opportunity fromMarket Structure

Price formed a Higher High (HH) and is now completing a Bearish AB=CD harmonic

pattern

The Potential Reversal Zone (PRZ) has been tapped

RSI shows bearish divergence at the second HH, suggesting weakening bullish

momentum

Technical Details:

Pattern: Bearish AB=CD with clear symmetry

Key zone: PRZ between 198.684 and 199.128

Bearish RSI divergence adds extra confluence

Potential Sell Stop strategy below structure for safer entry confirmation

Bias Bearish (Pattern Completion + Divergence)

Short bias is activated only on the confirmation, either by sell-stop break or strong

rejection candles inside PRZ

If the price breaks above 199.128, the bearish setup is invalidated

Trade Plan

Action Level / Condition

Sell Entry Below 198.684 (Sell Stop Trigger Zone)

Stop Loss Above 199.128 (invalidation of PRZ)

Target 1 198.066

Final Tp 197.564

✅ Wish you best of luck and happy trading!

GBP/JPY: Total Confluence Targeting 202.05 BreakoutThis is a high-conviction trade setup based on a powerful confluence of fundamental drivers and multi-timeframe technical alignment. We are anticipating a bullish breakout in GBP/JPY, catalyzed by the upcoming UK GDP data release. The price action has formed a classic "coiled spring" pattern, indicating a significant buildup of energy before a potential move higher.

The analysis is based on pure price action, structure, and macroeconomics. The chart is kept intentionally clean to highlight the strength of the setup itself.

The Fundamental Why 📰

Two core data-driven factors underpin this trade:

1️⃣ Macro Policy Divergence: The primary long-term driver is the stark monetary policy difference between a relatively hawkish Bank of England (BoE), which is still fighting inflation, and an ultra-dovish Bank of Japan (BoJ). This fundamental imbalance creates a natural tailwind for GBP/JPY.

2️⃣ Positive Leading Indicators: Recent economic data from the UK has shown surprising strength. Both the Services and Manufacturing PMIs for June beat expectations, suggesting underlying resilience in the economy. This points to a higher probability of an upside surprise in Friday's GDP figures, which would be the direct catalyst for a breakout.

The Technical Picture 📊

Our confidence comes from a rare "Total Confluence," where every timeframe tells the same bullish story.

The Monthly Chart (Strategic View): Shows a powerful, multi-year uptrend that has decisively broken the critical 8-year resistance from the 2015 highs. The macro trend is undeniably bullish.

The Weekly Chart (The Confirmation): Confirms the uptrend is resuming now after breaking out of a year-long bullish continuation pattern. The "resting" phase appears to be over.

The 4-Hour Chart (The Setup): This is the "coiled spring." Price is consolidating in a very tight range right underneath the key breakout level of 199.45. This shows a lack of sellers and a buildup of buying pressure.

Fibonacci Confluence: Our take profit target is not random. It aligns perfectly with the 1.272 Trend-Based Fibonacci Extension, giving us objective, mathematical confirmation for the target at 202.05.

The Trade Plan ✅

This is a "set and forget" breakout strategy. The order should be placed as a Buy Stop to capture the momentum as it breaks higher.

📉 Asset: GBP/JPY

👉 Entry (Buy Stop): 199.85

⛔️ Stop Loss: 198.75

🎯 Take Profit: 202.05

🧠 Risk/Reward: 1:2

This analysis is for educational purposes. Always conduct your own research and manage your risk appropriately. Good luck.

gbpjpyLet’s take a look at the #GBPJPY pair. Despite continuing in a clear uptrend confirmed by the weekly close and the start of this week, I wouldn’t rush into buying at the current levels just yet. 🚀📈

On the chart, I’ve marked two potential entries with different zones to watch. We’ll need to see if the price pulls back to these areas and finds support before considering a position. 🔍📉

As always, these setups are not fully confirmed, so it’s better to approach them with caution—either by using smaller position sizes or by ensuring that the combined risk of both trades does not exceed what you would risk on a single trade. ⚠️📊

Managing your risk carefully and waiting for a clearer confirmation can help protect your capital and maximize your chances of success. Patience and discipline remain key! 💪💼

GBPJPYTargeting 1:7 RR this trade can be risky but have good potential as Price can even Take me out ( touch me SL then go UP ) so be cautious but yes its a good trade and has reason low liquidity retailers are trying to push price below and later retailers will try to buy at Double bottom same will be done by institutional and sellers will be taken out then buyers will be taken out so it will go up then can go down than back up