GBPNZD Breakout from Consolidation Bullish Momentum BuildingGBPNZD has broken out of its recent consolidation pattern and is showing signs of bullish continuation. Strong GBP fundamentals combined with NZD weakness from global risk-off sentiment and tariffs support this technical move.

Technical Analysis (4H Chart)

Pattern: Breakout from a descending channel with bullish follow-through.

Current Level: 2.2418, trading above the breakout level, confirming momentum shift.

Key Support Levels:

2.2294 – recent breakout support and invalidation point for bulls.

2.2222 – secondary support if a deeper pullback occurs.

Resistance Levels:

2.2500 – near-term resistance and potential target for the breakout.

2.2690 – extended bullish target if momentum continues.

Projection: Likely to continue higher toward 2.2500, with room for 2.2690 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by BOE’s cautious stance on inflation and the relative resilience of the UK economy.

NZD: Pressured by global tariffs, weaker risk sentiment, and limited domestic growth catalysts.

USD Factor: Fed rate cut expectations indirectly support GBP crosses against risk currencies like NZD.

Risks:

Hawkish surprise from RBNZ could strengthen NZD.

BOE dovish signals could stall GBP upside.

Key Events:

BOE meeting and UK CPI.

RBNZ policy decision.

Risk sentiment trends globally.

Leader/Lagger Dynamics

GBP/NZD is a leader among GBP crosses, with GBP strength and NZD weakness driving momentum. It also aligns with EUR/NZD upside moves, reinforcing the bearish NZD outlook.

Summary: Bias and Watchpoints

GBP/NZD is bullish, having broken consolidation with upside targets at 2.2500 and 2.2690. The main drivers are GBP’s policy support, NZD’s risk-off weakness, and global tariff concerns. Watch for BOE and RBNZ updates as potential volatility triggers.

GBPNZD trade ideas

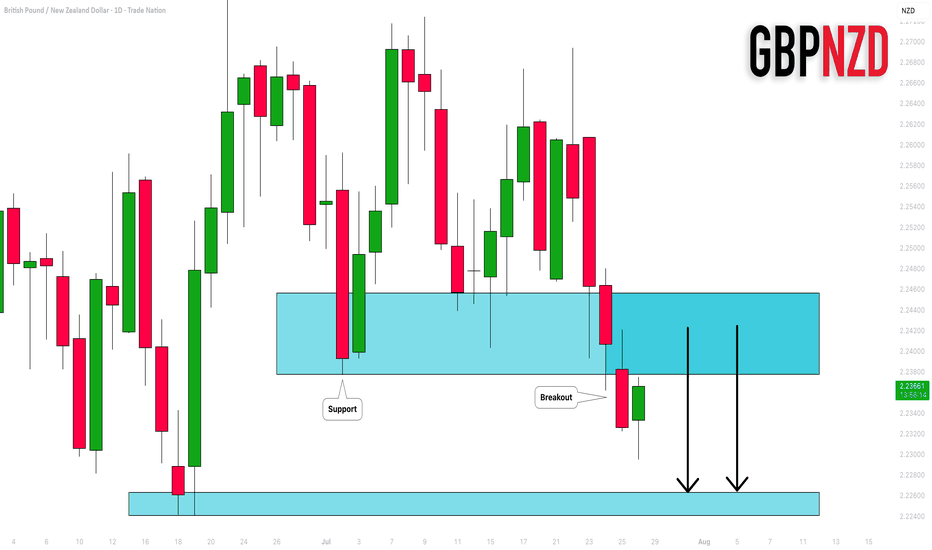

GBP/NZD POTENTIONAL SHORT OPPORTUNITYThis is an idea for GBPNZD's potential short opportunity based on what the technicals indicate.

The trend has been emphasising its bullish approach for almost three years.

Price respected almost 11 times due to the strong resistance within 150 days between 2.265 & 2.275 and bounced off bullish OB on the daily chart and FVG on the weekly chart.

An institutional sharp decline on the weekly chart, followed by a clear wedge, can support a further drop once swept by bearish daily OB. A breakout to the micro wedge (orange) within a macro wedge can also help further down move.

Given that a bearish pin bar followed by a bearish doji is a strong warning signal of potential reversal or bearish continuation that appears inside the micro wedge.

TP1 is considered the first support at the bottom, where the daily OB and the weekly FVG meet at around 2.22000 or the area close to the trendline. If the price breaks through the trendline, TP2 and TP3 will be expected to be achieved.

TP2 may be located at the micro accumulation around 2.20000, and TP3 at the following major support around 2.15000-2.17000 that previously acted as both support and resistance.

Good luck and have a great weekend.

GBP/NZD Bearish Momentum Building: Wolfe Wave Signals a Drop

---

📉 **GBP/NZD Bearish Momentum Building: Wolfe Wave Signals a Drop**

The GBP/NZD pair has shaped up a compelling **Wolfe Wave pattern**, now tipping toward a bearish continuation. The setup is already in motion, with price action showing signs of aligning with a downward trajectory.

🚨 **Key Technical Highlights**

- ✅ Wolfe Wave structure is fully formed and validated.

- 🔻 A break below the **red zone** signals the start of accelerated selling pressure.

- 🎯 Target: Candlesticks are now aiming to touch the **dashed line between wave 1 and wave 4**—the classical Wolfe Wave destination that often dictates reversal equilibrium.

📊 **Why It Matters**

This isn't just a dip—it’s a structurally supported fall backed by harmonic rhythm and clear pattern mechanics. Traders recognizing this alignment could be preparing for a swift ride down, with high conviction backed by wave theory.

⚠️ **Trade Watch**

If price plunges beneath the key red zone, expect velocity. This kind of setup isn’t one to drift—it’s wired for momentum.

---

GBPNZD Under Pressure! SELL!

My dear friends,

Please, find my technical outlook for GBPNZD below:

The price is coiling around a solid key level - 2.2531

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 2.2463

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBP_NZD BULLISH BREAKOUT|LONG|

✅GBP_NZD broke the key structure level of 2.2500

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBP_NZD BEARISH BIAS|SHORT|

✅GBP_NZD has retested

A resistance level of 2.2500

And we are seeing a bearish reaction

With the price going down so we are

Bearish biased now and we will be

Expecting the pair to go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

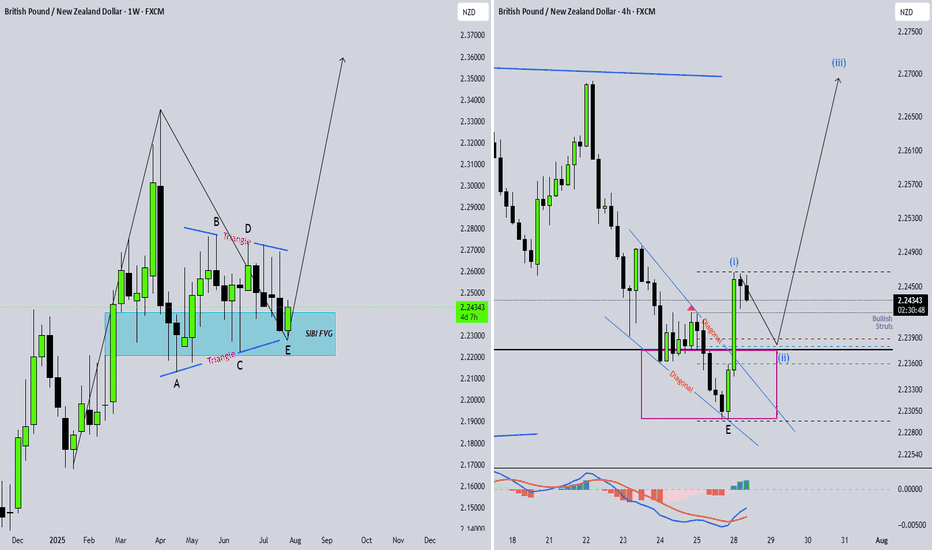

GBPNZD Elliot waves updatePrice is still on the first wave of wave C. Given the current wave structure it looks like we should expect first wave to unfold as a leading diagonal. If we are correct then during the coming week we should expect price to gain momentum to the down side to complete the leading diagonal with the 5th wave. To take advantage of this bearish bias one should find areas of resistance and other confluences to take the trade.

GBPNZD SHORT Market structure bearish at HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Daily Rejection At AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 2.25000

H4 Candlestick rejection

Levels 4.48

Entry 110% GVIBEZ

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

MarketBreakdown | EURCHF, WTI CRUDE OIL, GBPNZD, DXY

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURCHF daily time frame 🇪🇺🇨🇭

The market is testing a strong supply area

based on a solid falling trend line and a horizontal resistance.

Probabilities will be high that the price will retrace from that.

2️⃣ CRUDE OIL #WTI daily time frame 🛢️

The price is very close to a significant demand zone

based on a horizontal support cluster and a rising trend line.

I will expect a bullish reaction to that.

3️⃣ #GBPJPY daily time frame 🇬🇧🇳🇿

The market is trading within a contracting triangle.

The price nicely respected its support line and goes up steadily.

I think that bullish momentum will remain strong and the market

will go up to the resistance line of a triangle.

4️⃣ DOLLAR INDEX #DXY daily time frame 💵

The market is consolidating on a key daily support cluster.

Probabilities will be high that the price will bounce from that.

Today's fundamental news can be a trigger.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD MARKET ANALYSIS AND PRICE PREDICTIONGBPNZD, has experienced a massive Bullish rejection, this rejection has produced Bearish orders for three times, meaning there is a confirmed Bearish Trend. Price Has retested the order block and there is a successful Liquidity Hunt for the Bearish Trend Continuation. The targets are the two unmitigated order block, Entry is now.

Entry. Stop loss And Take Profits are clearly stated on the chat.

GOOD LUCK GUYS!

DISCLAIMER

Any analysis can fail due to markets uncertainties. take full responsibility of your capital and manage your risk!

Short on GBPNZD i'm shorting GBP/NZD due to the liquidity zone below, which suggests a potential downside breakout. The pair is approaching a significant support level where previous buy orders are likely clustered. If price breaks through this zone, stop-loss orders could be triggered, accelerating downward momentum. Additionally, fundamental factors

GBPNZD: Will Keep Falling! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the GBPNZD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

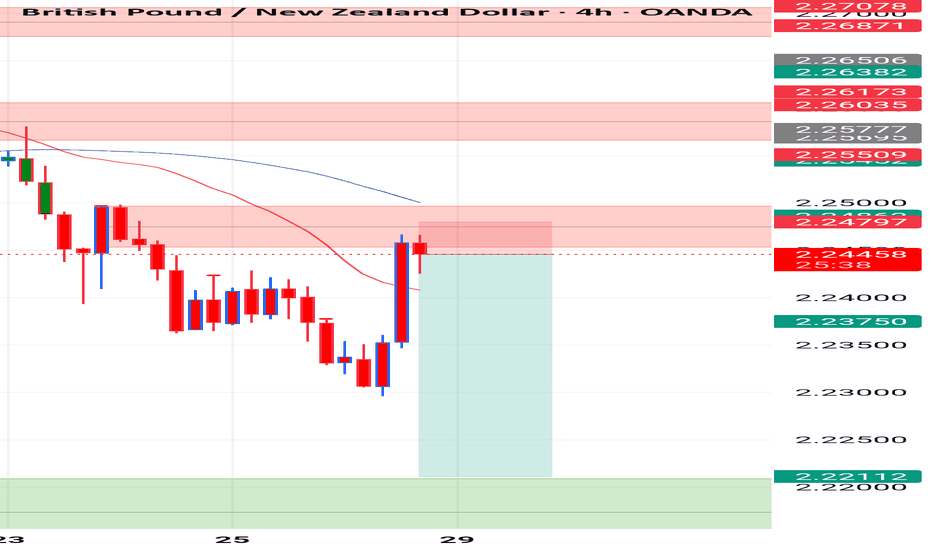

GBPNZD: Important Breakout 🇬🇧🇳🇿

GBPNZD broke and closed below a significant support cluster on a daily.

The broken structure turned into a strong resistance.

I will expect a bearish move from that.

Next support - 2.2264

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

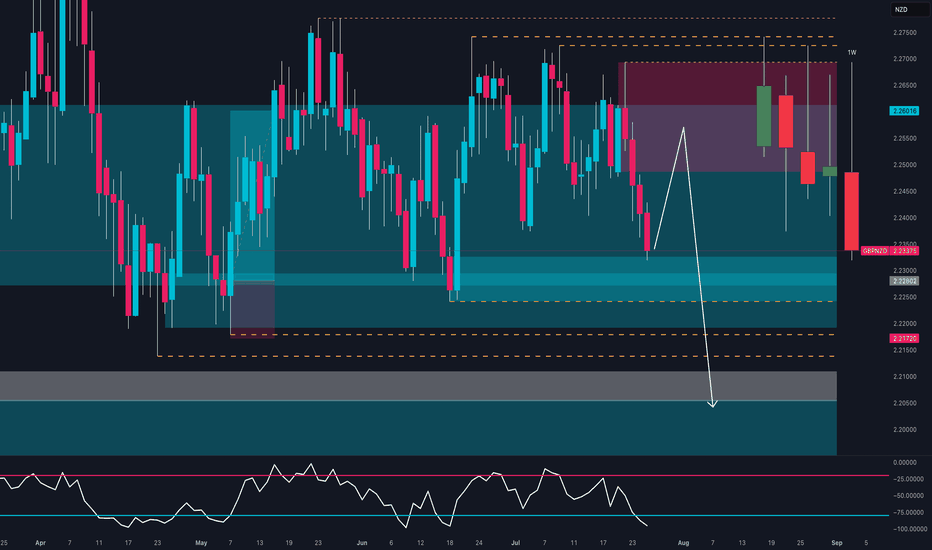

GBPNZD Breakdown – Smart Money Turns Fully Bearish🧠 Macro + COT + Sentiment Context

Commitment of Traders (COT) – Asset Managers

Institutional asset managers are significantly net short on GBPNZD, with positioning at its lowest level of the year and declining sharply since May. This reflects a clear bearish stance from smart money and reinforces the current downward pressure.

Sentiment & Momentum Indicators

DPO: -54.9 → Indicates a moderately bearish momentum phase.

Wyckoff: -20.3 → Price is in a distribution phase, suggesting weakness.

Speed: 3.2 → Low acceleration, but directional bias remains bearish.

Market Mood: Neutral, but leaning into oversold territory.

Seasonality (July 1st – Sept 30th)

Historically, GBPNZD performs positively in this period:

3Y: +1.7%, 5Y: +1.6%, 10Y: +2.3%, 15Y: +2.8%

However, in 2025, price is diverging sharply from seasonal norms. The pair is trading against historical patterns, suggesting a seasonal anomaly where institutional flow is dominating historical behavior.

🧱 Technical Outlook (Daily Chart)

GBPNZD had been consolidating in a clear range between 2.2170 support and 2.2750 resistance since May. The pair has now broken down with a strong, full-bodied weekly candle, closing below the 2.2320 demand zone.

Key Technical Zones:

Supply zone (2.2494–2.2659) → A clear rejection zone that initiated the current selloff.

Demand zone (2.2170–2.2300) → Has been tested twice already, increasing the probability of a clean breakdown.

RSI (Daily) → Currently neutral, with a sequence of lower highs and no bullish divergence in sight — indicating weak momentum.

✅ Conclusion & Trade Plan

Directional Bias: Bearish (Short)

Although seasonality typically supports bullish price action for GBPNZD in Q3, the current context is decisively bearish. Institutional positioning, price structure, and sentiment all confirm a potential shift in direction, reinforced by a confirmed weekly breakdown.

Bearish Targets:

📍 First: 2.2170 (recent support test)

📍 Second: 2.2000–2.1900 (April swing low)

📍 Extension: 2.1750 (base of previous accumulation zone)

Invalidation Criteria:

A weekly close above 2.2490 (supply zone breached)

Bullish RSI divergence + weekly recovery candle