GBPSEK trade ideas

GBPSEK on a retracement move 🦐GBPSEK on the 4chart reached the daily descending trendline and for rejected.

The price is now retracing and we can expect a test of the 0.5 / 0.618 Fibonacci retracement.

According to Plancton's strategy if the price will pèrovide us a sign of inversion we can set a nice order.

–––––

Follow the Shrimp 🦐

Keep in mind.

• 🟣 Purple structure -> Monthly structure.

• 🔴 Red structure -> Weekly structure.

• 🔵 Blue structure -> Daily structure.

• 🟡 Yellow structure -> 4h structure.

• ⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

Know Where You Stand In the Forex Market!Hello Traders,

I have Written This Educational Post for you to understand just "How Small WE are in the Forex Market"

I hope The information Provided is Informative & Educational for NEW and Old Forex Traders!

Before We Start, Dont forget to Comment, Like, Follow & share :)

Lets Begin -

There are various players in the Foreign Exchange (Forex) market and all of them are important in one way or the other. In this chapter, we take each one of them and check their major attributes and responsibilities in the overall Forex market. Interestingly, internet technology has really changed the existence and working policies of the Forex market-players. These players now have easier access to data and are more productive and prompt in offering their respective services. Capitalization and sophistication are two major factors in categorizing the Forex market players. The sophistication factor includes money management techniques, technological level, research abilities, and the level of discipline. Considering these two broad measures, there are 6 Major Forex market players

6 Major Forex market players

Commercial and Investment Banks

Central Banks

Businesses and Corporations

Fund Managers, Hedge Funds, and Sovereign Wealth Funds

Internet-based Trading Platforms

Online Retail Broker-Dealers (retail Traders)

The following figure depicts the top-to-bottom segmentation of Foreign Exchange Market players in terms of the volume they handle in the market.

Central Banks

A central bank is the predominant monetary authority of a nation. Central banks obey individual economic policies. They are usually under the authority of the government. They facilitate the government’s monetary policies (dealing in keeping the supply and the availability of money) and to make strategies to smoothen out the ups and downs of the value of their currency. We have earlier discussed about the reserve assets. Central banks are the bodies responsible for holding the foreign currency deposits called "reserves" aka "official reserves" or "international reserves". The reserves held by the central banks of a country are used in dealing with foreign-relation policies. The reserves value indicates significant attributes about a country’s ability to service foreign debts; it also affects the credit rating measures of the nation. The following figure shows the central banks of various European countries.

Commercial and Investment Banks

Banks need no introduction; they are ubiquitous and numerous. Their role is crucial in the Forex network. The banks take part in the currency markets to neutralize the foreign exchange risks of their own and that of their clients. The banks also seek to multiply the wealth of their stockholders. Each bank is different in terms of its organization and working policy, but each one of them has a dealing desk responsible for order processing, market-making, and risk management. The dealing desk plays a role in making profits by trading currency straight through hedging, arbitrage, or a mixed array of financial strategies. There are many types of banks in a forex market; they can be huge or small. The most sizeable banks deal in huge amounts of funds that are being traded at any instant. It is a common standard for banks to trade in 5 to 10 million Dollar parcels. The biggest ones even handle 100 to 500 million Dollar parcels. The following image shows the top 10 forex market participants.

Businesses and Corporations

All participants involved in the forex market do not have the power to set prices of the currency as market makers. Some of the players just buy and sell currency following the prevailing exchange rate. They may seem to be not so significant, but they make up a sizeable allotment of the total volume that is being traded in the market. There are companies and businesses of differing sizes; they may be a small importer/exporter or a palpable influencer with a multi-billion Dollar cash flow capability. These players are identified by the nature of their business policies that include: (a) how they get or pay for the goods or services they usually render and (b) how they involve themselves in business or capital transactions that require them to either buy or sell foreign currency. These "commercial traders" have the aim to utilize financial markets to offset their risks and hedge their operations. There are some non-commercial traders as well. Unlike commercial traders, the non-commercial ones are considered speculators. Non-commercial players include large institutional investors, hedge funds, and other business entities that trade in the financial markets for profits. The following figure shows some prominent businesses and corporations in Forex markets.

Fund Managers, Hedge Funds, and Sovereign Wealth Funds

This category is not involved in defining the prices or controlling them. They are basically transnational and home-country’s money managers. They may deal in hundreds of millions of dollars, as their portfolios of investment funds are often quite large. These participants have investment charters and obligations to their investors. The major aim of hedge funds is to make profits and grow their portfolios. They want to achieve absolute returns from the Forex market and dilute their risk. Liquidity, leverage, and low cost of creating an investment environment are the advantages of hedge funds. Fund managers mainly invest on behalf of the various clients they have, such as the pension funds, individual investors, governments and even the central bank authorities. btw Sovereign wealth funds that manage government-sponsored investment pools have grown at a fast rate in the recent years.

Internet-based Trading Platforms

Internet is an impersonal part of the forex markets nowadays. Internet-based trading platforms do the task of systematizing customer/order matching. These platforms are responsible for being a direct access point to accumulate pools of liquidity. There is also a human element in the brokering process. It includes all the people engaged from the instant an order is put to the trading system till it is dealt and matched by a counter party. This category is being handled by the "straight-through-processing" (STP) technology. Like the prices of a Forex broker's platform, a lot of inter-bank deals are now being handled electronically by two primary platforms: the Reuters web-based dealing system, and the Icap's EBS which is short for "electronic brokering system that replace the voice broker once common in the foreign exchange markets. Some online trading platforms are shown below.

Online Retail Broker-Dealers

The last segment of the Forex markets, the brokers, are usually very huge companies with huge trading turnovers. This turnover provides the basic infrastructure to the common individual investors to invest and profit in the interbank market. Most of the brokers are taken to be a market maker for the retail trader. To provide competitive and popular two-way pricing model, these brokers usually adapt to the technological changes available in the Forex industry. A trader needs to produce gains independently while using a market maker or having a convenient and direct access through an ECN. The Forex broker-dealers offset their positions in the interbank market, but they do not act exactly the same way as banks do. Forex brokers do not rely on trading platforms like EBS or Reuters Dealing. Instead, they have their own data feed that supports their pricing engines. Brokers typically need a certain pool of capitalization, legal business agreements, and straightforward electronic contacts with one or multiple banks.

Thank you for reading this article , I hope it was informative and educational !

I will see you all in the Next Educational Post

Regards

Global Fx Education

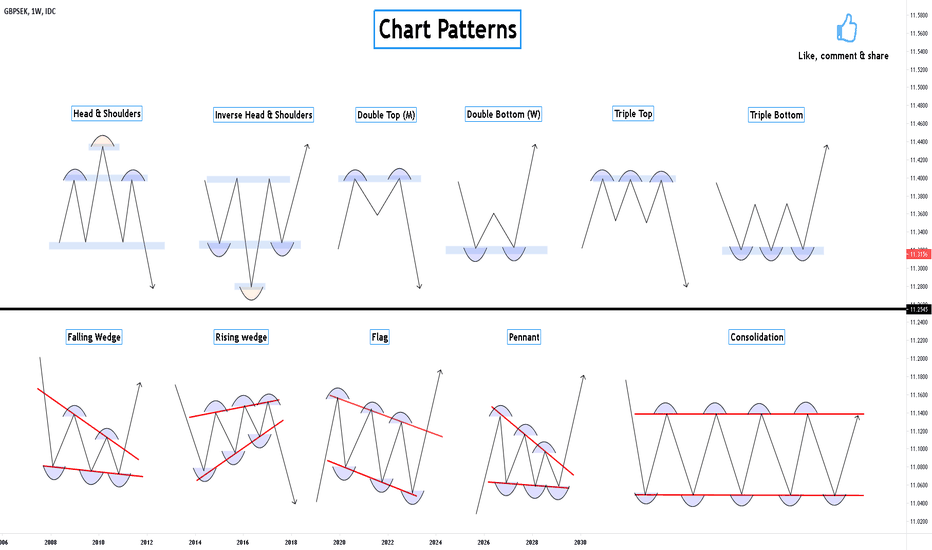

11 Chart Patterns you need to know in 2021Hello Traders,

Here is some Educational Chart Patterns that you should know in 2021.

Most of these patterns are seen daily in Stocks, Forex and different markets across the globe.

I hope you will find this information educational & informative.

Your support is appreciated with a like & Comment

Head and Shoulders Pattern

A head and shoulders pattern is a chart formation that appears as a baseline with three peaks, the outside two are close in height and the middle is highest.

In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal.

Inverse Head and Shoulders Pattern

An inverse head and shoulders is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to predict reversals in downtrends

An inverse head and shoulders pattern, upon completion, signals a bull market

Investors typically enter into a long position when the price rises above the resistance of the neckline.

Double Top (M) Pattern

A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs.

It is confirmed once the asset's price falls below a support level equal to the low between the two prior highs.

Double Bottom (W) Pattern

The double bottom looks like the letter "W". The twice-touched low is considered a support level.

The advance of the first bottom should be a drop of 10% to 20%, then the second bottom should form within 3% to 4% of the previous low, and volume on the ensuing advance should increase.

The double bottom pattern always follows a major or minor downtrend in a particular security, and signals the reversal and the beginning of a potential uptrend.

Tripple Top Pattern

A triple top is formed by three peaks moving into the same area, with pullbacks in between.

A triple top is considered complete, indicating a further price slide, once the price moves below pattern support.

A trader exits longs or enters shorts when the triple top completes.

If trading the pattern, a stop loss can be placed above resistance (peaks).

The estimated downside target for the pattern is the height of the pattern subtracted from the breakout point.

Triple Bottom Pattern

A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears).

A triple bottom is generally seen as three roughly equal lows bouncing off support followed by the price action breaching resistance.

The formation of triple bottom is seen as an opportunity to enter a bullish position.

Falling Wedge Pattern

When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move.

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline.

Before the lines converge, price may breakout above the upper trend line. When price breaks the upper trend line the security is expected to reverse and trend higher.

Traders identifying bullish reversal signals would want to look for trades that benefit from the security’s rise in price.

Rising Wedge Pattern

This usually occurs when a security’s price has been rising over time, but it can also occur in the midst of a downward trend as well.

The trend lines drawn above and below the price chart pattern can converge to help a trader or analyst anticipate a breakout reversal.

While price can be out of either trend line, wedge patterns have a tendency to break in the opposite direction from the trend lines.

Therefore, rising wedge patterns indicate the more likely potential of falling prices after a breakout of the lower trend line.

Traders can make bearish trades after the breakout by selling the security short or using derivatives such as futures or options, depending on the security being charted.

These trades would seek to profit on the potential that prices will fall.

Flag Pattern

A flag pattern, in technical analysis, is a price chart characterized by a sharp countertrend (the flag) succeeding a short-lived trend (the flag pole).

Flag patterns are accompanied by representative volume indicators as well as price action.

Flag patterns signify trend reversals or breakouts after a period of consolidation.

Pennant Pattern

Pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis.

It's important to look at the volume in a pennant—the period of consolidation should have lower volume and the breakouts should occur on higher volume.

Most traders use pennants in conjunction with other forms of technical analysis that act as confirmation.

Consolidation Pattern

Consolidation is a technical analysis term used to describe a stock's price movement within a given support and resistance range for a period of time. It is generally caused due to trader indecisiveness.

Consolidated financial statements are used by analysts to evaluate parent and subsidiary companies as a single company.

Thanks for Reading, ill see you in the next Educational Post

Global Fx Education

GBP/SEK Forming SupportI previously stated I was expecting this to drop a bit more but it seems to have formed some support in the current area but it is at 0.382 FIb so that is fine. I recommend waiting for the MACD to show some more signs of bullishness and EMA's to cross or come very close to crossing before entering a long. TP is at -0.272 Fib and SL just below 0.5 Fib as shown on the chart

GBPSEK on a double bottom 🦐GBPSEK on the 4h chart created a double bottom over a weekly structure.

The price after the attempt to break the below got rejected back up.

IF the price will break the minor resistance we can set a nice long order according to Plancton strategy.

–––––

Follow the Shrimp 🦐

Keep in mind.

• 🟣 Purple structure -> Monthly structure.

• 🔴 Red structure -> Weekly structure.

• 🔵 Blue structure -> Daily structure.

• 🟡 Yellow structure -> 4h structure.

• ⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

Leave a comment that is helpful or encouraging. Let's master the markets together

Leave a comment that is helpful or encouraging. Let's master the markets together