GBPUSD trade ideas

GBPUSD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

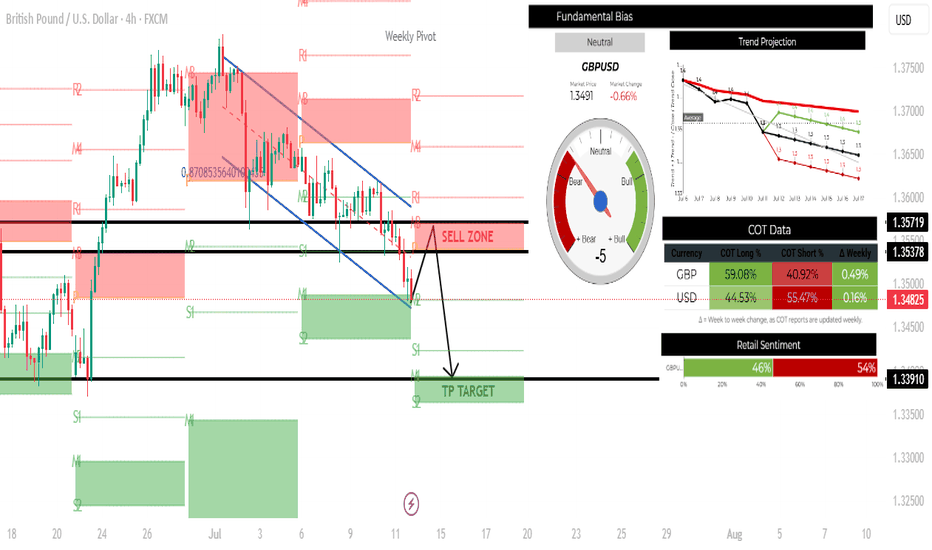

GBPUSD H4 SHORT SETUP: 14-18 JULY 2025TECHNICAL ANALYSIS

Price and market both bearish, with price currently at support. This pair will have to pull back to the resistance level before bears can look to short.

FUNDAMENTAL ANALYSIS

The currency pair GBPUSD has a score of -3, indicating that the base currency is weaker than the quote currency. The trend projection also shows further downside.

The COT report is slightly neutral for both currency pairs, and retail sentiment is 54% bearish. Although the COT is neutral, in a trade like this, the trend is your friend until technical indicators suggest otherwise.

GBPUSD LONG TERM GBPUSD Live Trading Session/ GBPUSD analysis #forex #forextraining #forexHello Traders

In This Video GBPUSD HOURLY Forecast By World of Forex

today GBPUSD Analysis

This Video includes_ (GBPUSD market update)

GBPUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on GBPUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

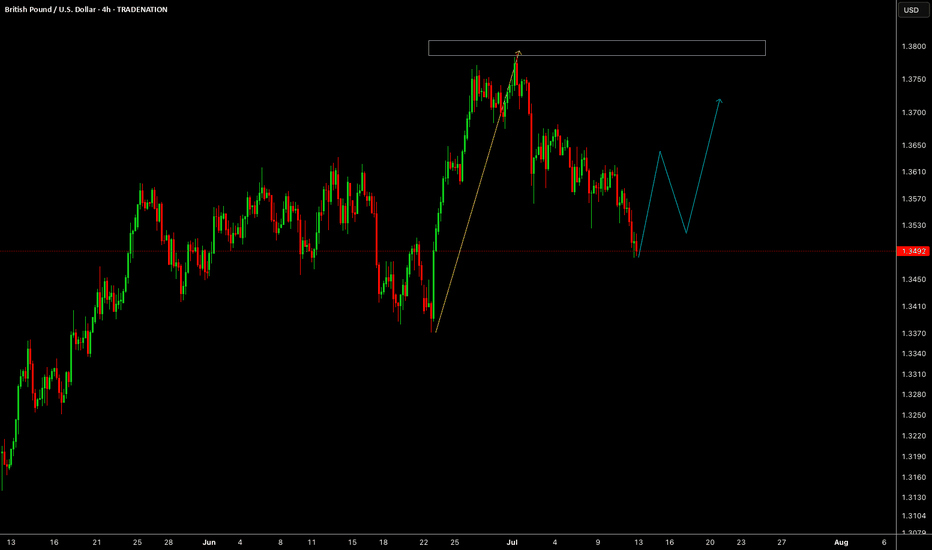

GBPUSD - Also continued downside continuationLooking at GU. This is a little bit ahead of its time in comparison to EU.

And what i mean by that is EU is a lot further away from its 4H demand zone compared to GBP so it will be super interesting to see how we react at the level we are fast approaching on GU.

I am in a short position as of Friday. I will be posting a video tomorrow showing exactly how and why i got short on GU so stay tuned for that one.

As always if there is anything else i can be of assistance with give me a message and i will be happy to answer any questions you may have

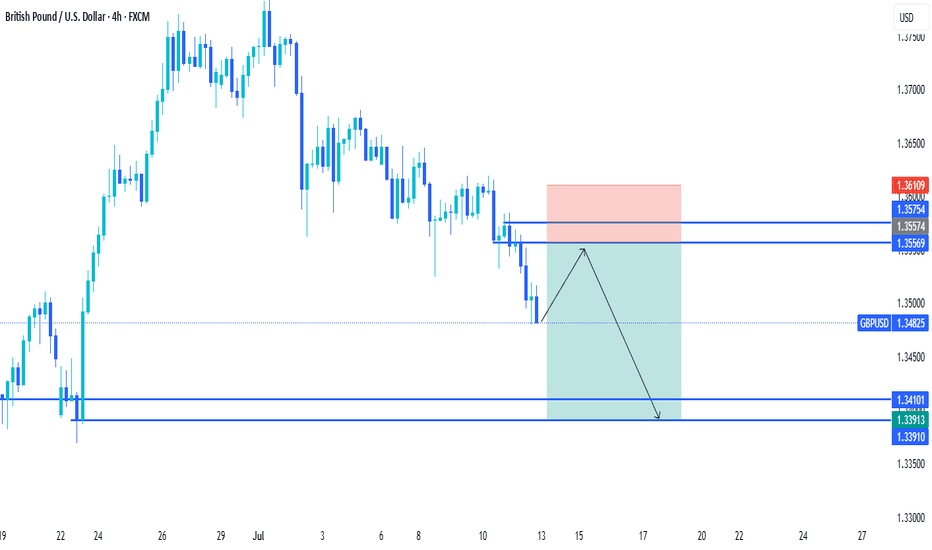

GBP/USD - Potential TargetsDear Friends in Trading,

How I see it,

PIVOT @ 1.35300

High TF Bullish:

1) The Daily bullish trend is still intact at this time.

2) We need a strong bounce/breach and hold above PIVOT

for 1D trend to continue.

Potential for more downside:

1) If price remains below PIVOT, potential for further downside

remains high.

Keynote:

Monitor price action closely around 1,34000 area.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time to study my analysis.

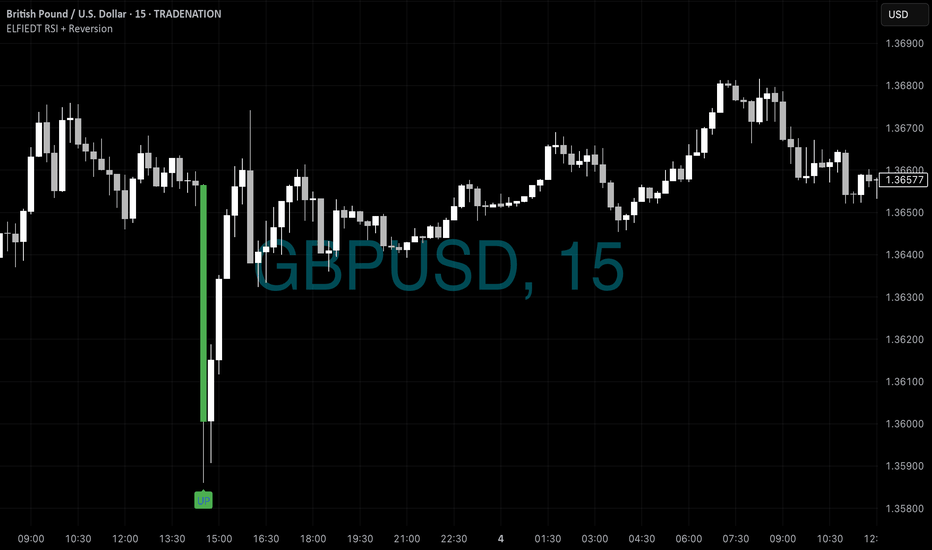

GU - Longs📉📈 GBPUSD 15min – ELFIEDT RSI + Reversion Catches the Knife

🧠 Precision Signal | Zero Delay | Real Trade Example

The ELFIEDT RSI + Reversion indicator once again proves its edge — this time on a sharp GBPUSD selloff, where it called the bottom within a single bar of the low.

🟩 Perfect “UP” Signal After Flash Crash

During the NY session, GBPUSD experienced a sudden and aggressive selloff, dropping nearly 80 pips within a few candles.

While many traders panic or chase the move, the indicator calmly printed a high-conviction UP signal at the bottom wick of the final dump candle.

🔹 Hypothetical Trade Idea:

Entry: On candle close after the UP signal

Stop-loss: Just a few pips below the signal wick (tight risk)

Reward: Price rallied over 100 pips in the following hours — perfect mean reversion setup with minimal drawdown

✅ No delay.

✅ No repaint.

✅ No guesswork.

🔍 Why It Matters

Most indicators react late — this one anticipated exhaustion right at the turn.

The result: a low-risk, high-reward setup, spotted live, not in hindsight.

💼 Want access to more advanced versions?

This is only the public edition of ELFIEDT RSI + Reversion.

Advanced builds include:

Multi-timeframe confirmation

RSI trendline breakouts

Hidden divergences

3SD band expansions

Smart signal stacking logic

📩 Message now to apply for access — limited seats for serious traders only.

#GBPUSD #ReversalTrade #ELFIEDT #SmartSignals #ForexTrading #15mChart #MeanReversion #PrecisionTools #TradingView

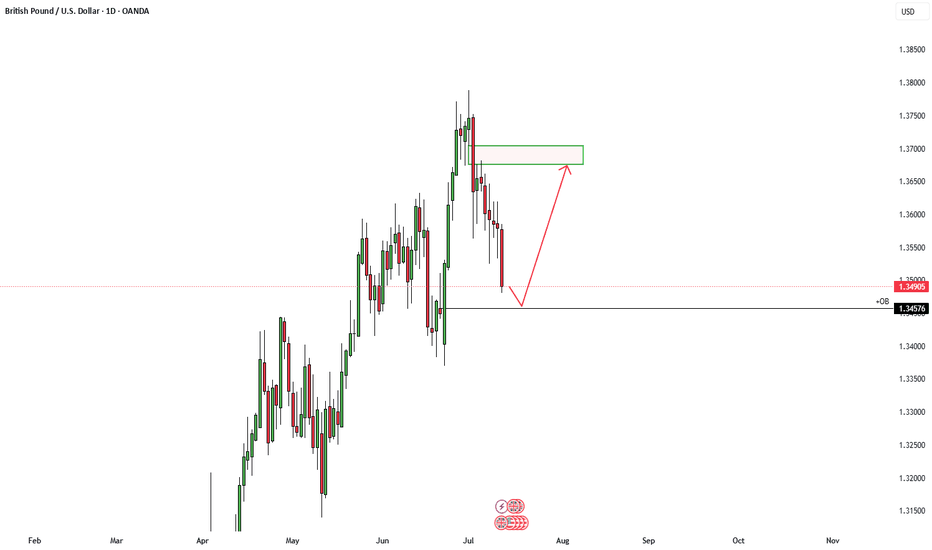

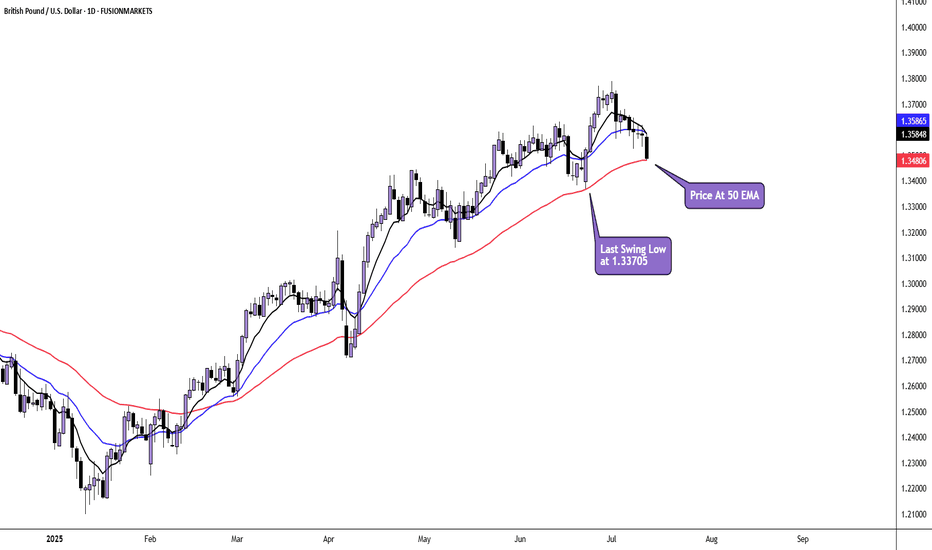

GBP/USD Daily AnalysisPrice is in a daily uptrend and has pulled back to the 50 moving average.

Here, price may find support and set up for another bullish impulse.

However, if price breaks the last swing low at 1.33705, we may have seen a top formed and a change in sentiment.

If you agree with this analysis. look for a trade that meets your strategy rules.

GBP/USD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

It makes sense for us to go long on GBP/USD right now from the support line below with the target of 1.361 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/USD - H1- Bearish Flag (07.07.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.3520

2nd Support – 1.3460

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Swing Long! Buy!

Hello,Traders!

GBP-USD is trading in a

Long-term uptrend along

The rising support support

Line and the pair will soon

Hit it and from there we will

Be expecting a bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.