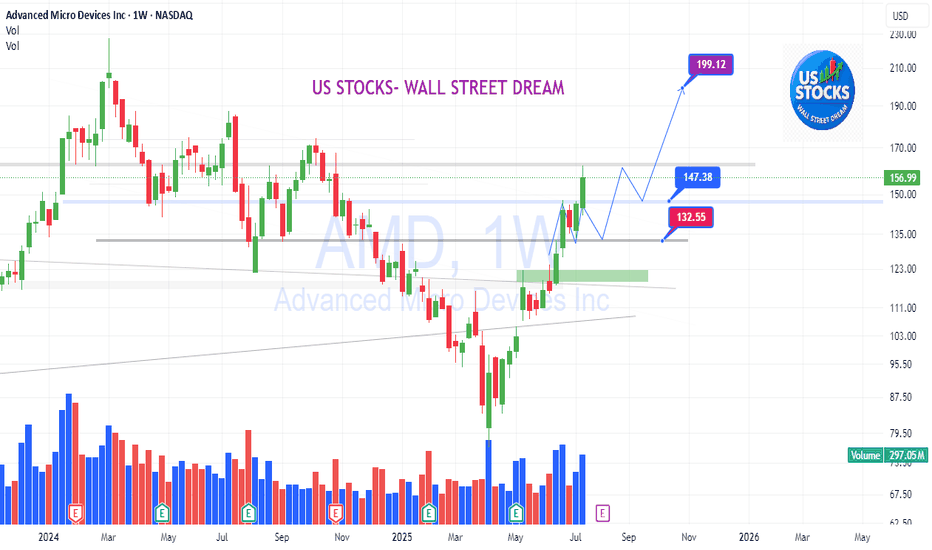

Short - AMDTime period for this play : week to months

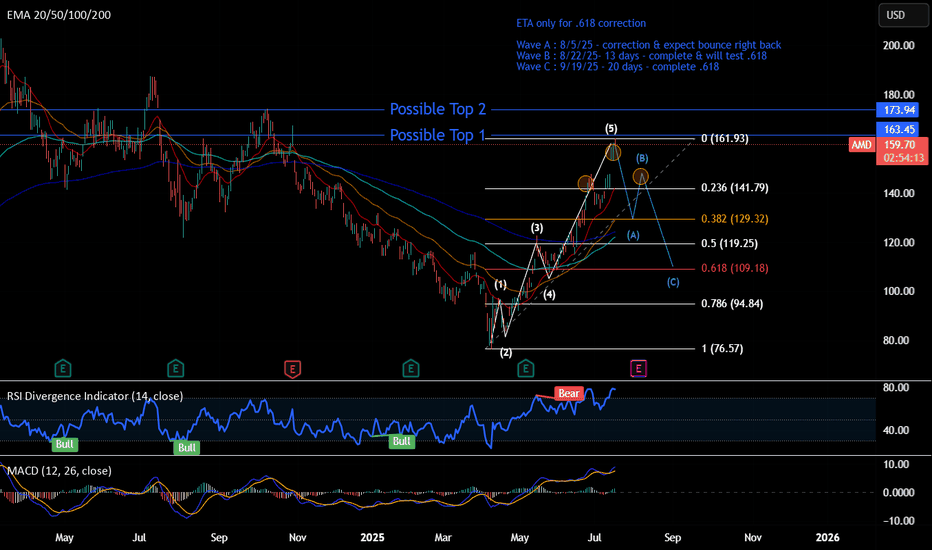

Analysis : Elliot wave 12345 ABC. Expect hitting .618 and bounce back up to go higher.

Pattern if wave B completed : Head & Shoulder

Price Target: Wave ABC

ETA Timeline for correction. Please refer to the chart.

Upcoming events:

Tariff active on 8/1/25 -

Key facts today

Advanced Micro Devices (AMD) is expected to gain market share in PCs and servers as Intel faces cash issues and chip delays, with J.P. Morgan predicting AMD will outperform Intel.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.27 EUR

1.59 B EUR

24.91 B EUR

1.61 B

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

FIGI

BBG00FZMG118

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

AMD Analysis! Bullish 🔷 📝 AMD Analysis – GEN Methodology & Fibonacci Projection NASDAQ:AMD

✅ Chart Technique:

The blue overlay represents a historical price pattern (GEN Projection) applied to the current AMD chart using Bar Pattern Projection.

This technique forecasts potential timing and price movement based on si

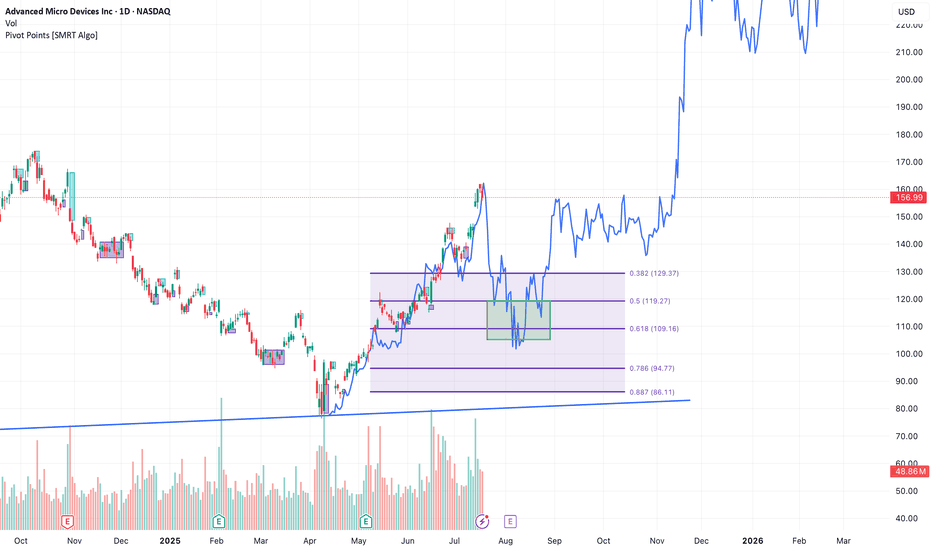

7/15 AMD short AMD just reached a major resistance level and is expected to pull back toward the $135 area. While it may not signal a full trend reversal, a retracement from today’s high is likely.

If the 7/15 candle forms a red shooting star, it would provide further confirmation.

May the trend be with you.

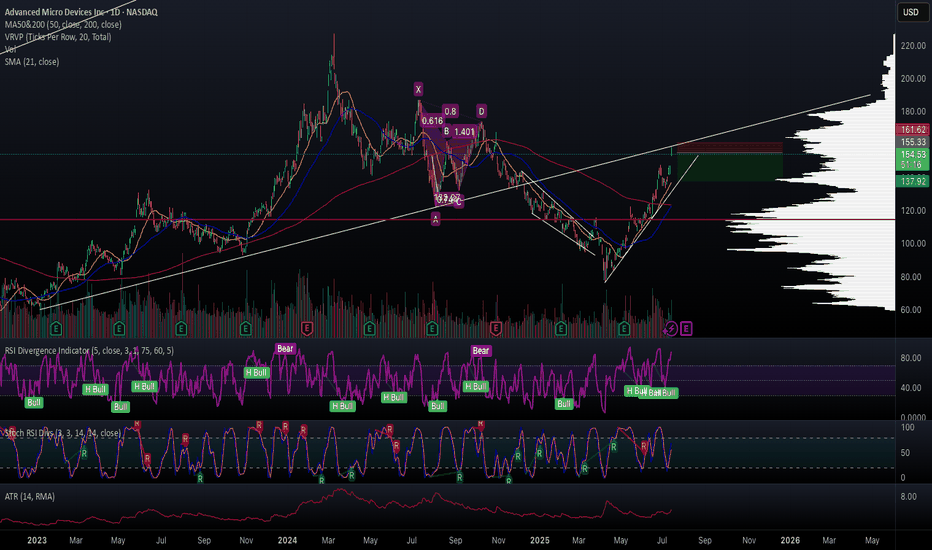

Why I Went Long on AMD Near the 2025 Lows🔍 Reason for the Trade

This wasn’t just a “buy the dip” setup — this was a calculated trade based on strong confluence:

✅ Multi-Year Demand Zone

Price returned to a massive support level that’s held since 2020. This zone had previously triggered multiple large bullish reversals.

✅ Falling Wedge Br

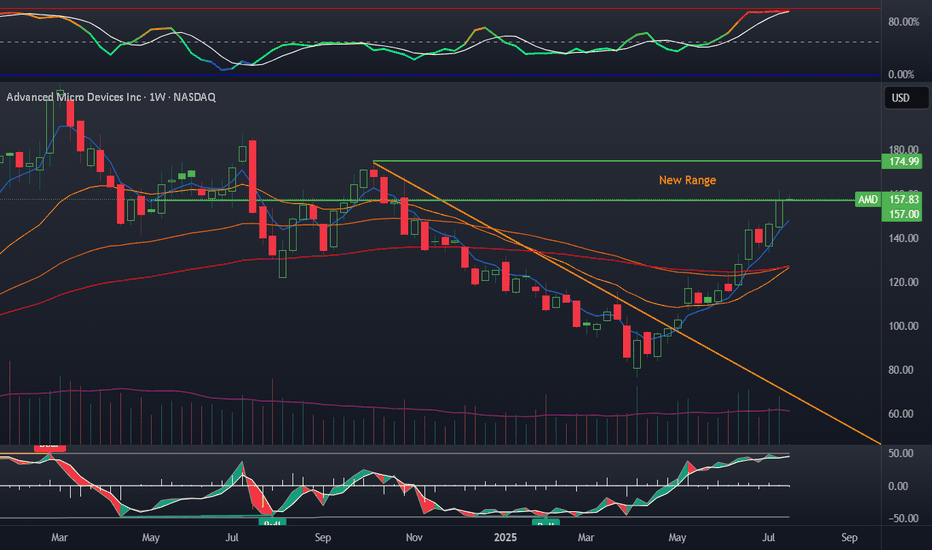

AMD 1W: If Not Now — Then When?The weekly chart of AMD looks like it’s holding its breath: a well-defined falling wedge, double bottom support, and price pressing right against long-term trendline resistance. Everything’s in place — now it just needs to break and run, preferably without tripping over nearby Fibonacci levels.

The

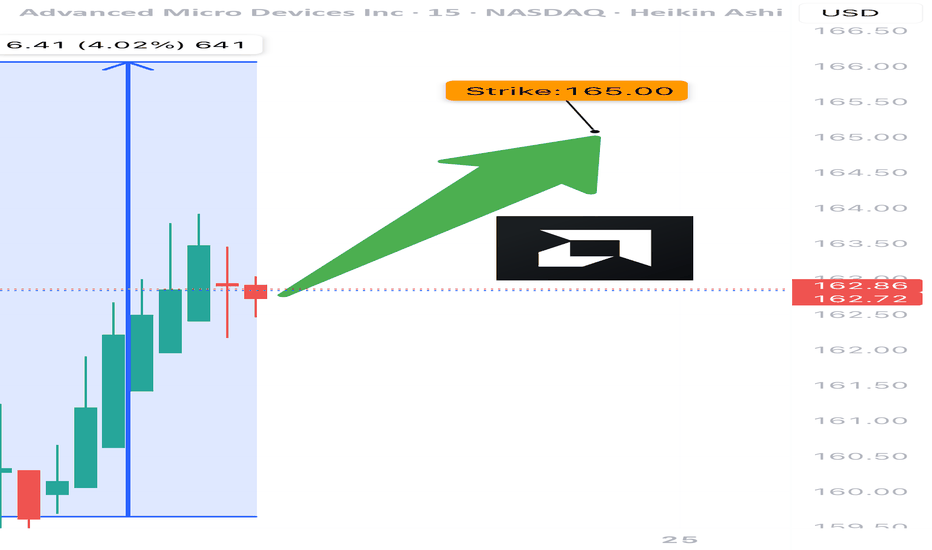

AMD TRADE ALERT (07/24)

🚨 AMD TRADE ALERT (07/24) 🚨

Options flow is screaming bullish 📈

🧠 Key Insights:

• Call/Put Ratio: 1.80 (🔥 heavy call bias)

• RSI: Daily 75.5 / Weekly 77.2 = strong momentum

• Volume = weak ⚠️ but sentiment remains bullish

• High gamma risk = explosive potential near expiry

💥 TRADE IDEA

🟢 Buy AMD

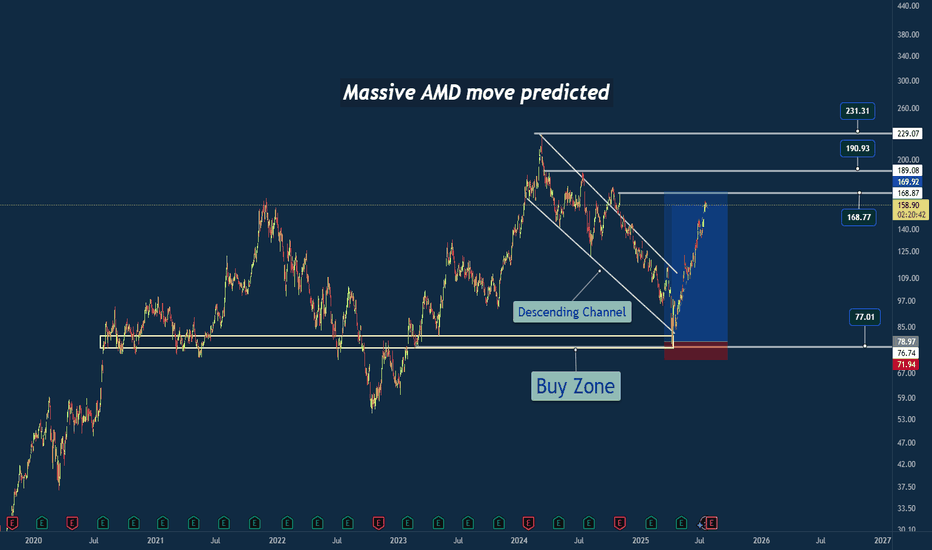

AMD: Potential Mid-Term Reversal from Macro SupportPrice has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished.

Weekly

As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years).

1

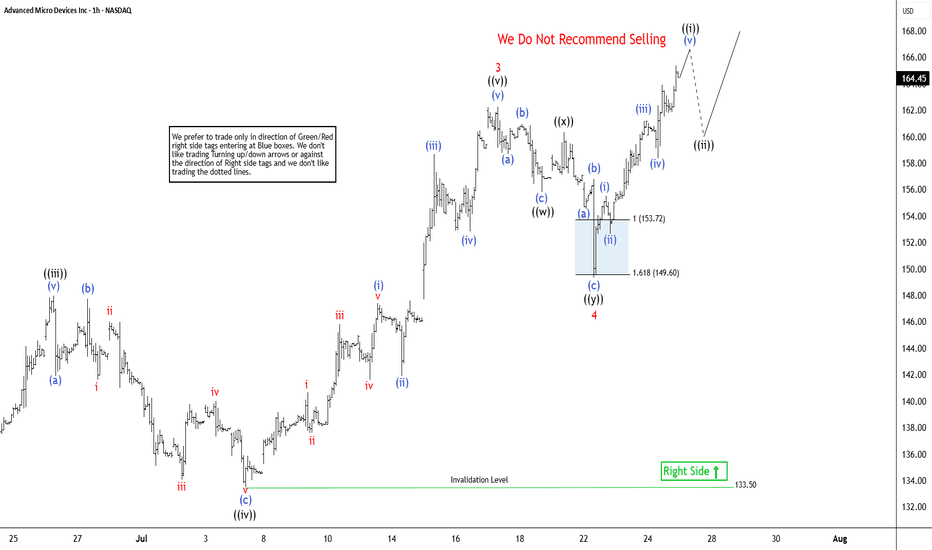

Elliott Wave Outlook: AMD Expects Pullback Soon Before RallyThe Advanced Micro Devices Inc., (AMD) favors rally in impulse Elliott Wave sequence from 4.09.2025 low & expect upside in to 168.36 – 190.36 to finish it. Impulse sequence unfolds in 5, 9, 13, 17…., swings & ends with momentum divergence. In daily, it ended pullback in 3 swings at 75.22 low in blue

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

6.05%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.58%

Maturity date

Jun 1, 2032

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

4.16%

Maturity date

Mar 24, 2028

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

4.07%

Maturity date

Sep 24, 2026

See all AMD bonds

Curated watchlists where AMD is featured.

Frequently Asked Questions

The current price of AMD is 142.18 EUR — it has increased by 2.87% in the past 24 hours. Watch ADVANCED MICRO DEVICES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange ADVANCED MICRO DEVICES INC stocks are traded under the ticker AMD.

AMD stock has risen by 2.98% compared to the previous week, the month change is a 18.25% rise, over the last year ADVANCED MICRO DEVICES INC has showed a 5.33% increase.

We've gathered analysts' opinions on ADVANCED MICRO DEVICES INC future price: according to them, AMD price has a max estimate of 171.06 EUR and a min estimate of 94.94 EUR. Watch AMD chart and read a more detailed ADVANCED MICRO DEVICES INC stock forecast: see what analysts think of ADVANCED MICRO DEVICES INC and suggest that you do with its stocks.

AMD stock is 3.12% volatile and has beta coefficient of 2.05. Track ADVANCED MICRO DEVICES INC stock price on the chart and check out the list of the most volatile stocks — is ADVANCED MICRO DEVICES INC there?

Today ADVANCED MICRO DEVICES INC has the market capitalization of 223.77 B, it has increased by 10.42% over the last week.

Yes, you can track ADVANCED MICRO DEVICES INC financials in yearly and quarterly reports right on TradingView.

ADVANCED MICRO DEVICES INC is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

AMD earnings for the last quarter are 0.89 EUR per share, whereas the estimation was 0.87 EUR resulting in a 1.64% surprise. The estimated earnings for the next quarter are 0.41 EUR per share. See more details about ADVANCED MICRO DEVICES INC earnings.

ADVANCED MICRO DEVICES INC revenue for the last quarter amounts to 6.88 B EUR, despite the estimated figure of 6.59 B EUR. In the next quarter, revenue is expected to reach 6.29 B EUR.

AMD net income for the last quarter is 655.36 M EUR, while the quarter before that showed 465.60 M EUR of net income which accounts for 40.76% change. Track more ADVANCED MICRO DEVICES INC financial stats to get the full picture.

No, AMD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 28 K employees. See our rating of the largest employees — is ADVANCED MICRO DEVICES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ADVANCED MICRO DEVICES INC EBITDA is 5.52 B EUR, and current EBITDA margin is 20.11%. See more stats in ADVANCED MICRO DEVICES INC financial statements.

Like other stocks, AMD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ADVANCED MICRO DEVICES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ADVANCED MICRO DEVICES INC technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ADVANCED MICRO DEVICES INC stock shows the strong buy signal. See more of ADVANCED MICRO DEVICES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.