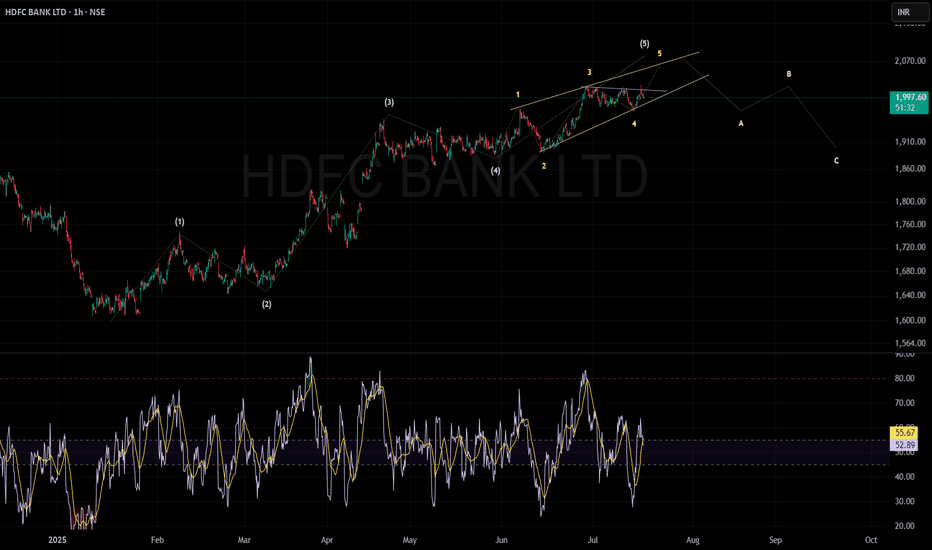

HDFC BANK can move 5th wave upHDFC Bank is currently in the last (5th) wave of an uptrend. This wave is moving inside a narrow, rising wedge pattern called an ending diagonal.

The price can move higher towards ₹2,050–₹2,100 before the trend finishes.

If the price breaks below the bottom of the wedge pattern (ending diagonal), it could confirm a trend reversal, likely leading to a correction.

After the peak, the chart suggests a three-step drop (A, B, and C waves), with possible support around ₹1,910 and then ₹1,850.

The RSI (Relative Strength Index) is around 53, meaning the trend isn't overbought or oversold yet.

In short: The uptrend is close to ending. Watch for a break below the wedge—this could start a move down toward ₹1,910 first, then maybe ₹1,850.

HDFA trade ideas

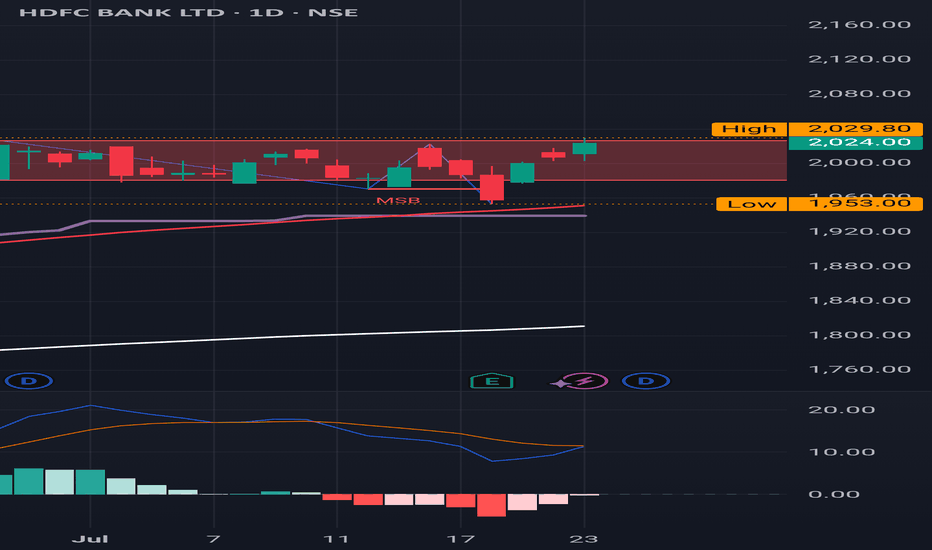

HDFC Accumulation Breakdown Setup?HDFC seems to be building an accumulation range with:

Range High: ₹1955

Range Low: ₹1908

Currently, price is consolidating within this zone. I'm biased to the sell side for now, expecting a potential breakdown below the ₹1908 level.

⚠️ No confirmation yet — it's a “wait and watch” scenario. A strong close below the range low could trigger momentum selling.

💬 What's your view on this setup?

HDFC BANK ANALYSIS – 1H TIMEFRAMENSE:HDFCBANK

Symmetrical Triangle Pattern Forming

A breakout or breakdown is likely soon. Price is consolidating within the triangle range.

HDFC BANK ANALYSIS ON 1 HOUR TIME FRAME

IMPORTANT LEVELS TO WATCH:

Resistance: 1941 – 1958 – 1970

Support: 1913 – 1898 – 1885

📌 Chart Pattern: Price is forming a symmetrical triangle which indicates a potential breakout or breakdown.

A breakout above 1941.75 (purple line) can trigger a bullish move.

A breakdown below 1913.25 (purple line) can attract sellers.

📌 Wait for a breakout confirmation before entering a trade.

👉🏻 @thetradeforecast

Bullish on HDFC BANKHDFC BANK has been showing a Bullish price action off late.

The stock was consolidating since 23Apr-25 and if you notice the price action, there has been clear HL formation.

This has also led to a triangular pattern formation and now we have a breakout.

While I was short on HDFC, I have cut that position now with a loss and taken long.

EQ Target - 2200 level

OPT Target - 2025 level (June series)

P.S. Not a recommendation. Pls do your own due diligence.

HDFC BANK S/R for 19/5/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

HDFC Bank Ltd view for Intraday 15th May #HDFCBANK HDFC Bank Ltd view for Intraday 15th May #HDFCBANK

Resistance 1935 Watching above 1938 for upside momentum.

Support area 1880-1900 Below 1900 ignoring upside momentum for intraday

Watching below 1878 for downside movement...

Above 1900 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

HDFC Bank Ltd view for Intraday 2nd May #HDFCBANK HDFC Bank Ltd view for Intraday 2nd May #HDFCBANK

Resistance 1935 Watching above 1938 for upside movement...

Support area 1910 Below 1920 ignoring upside momentum for intraday

Watching below 1908 for downside movement...

Above 1920 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Shorted HDFC BANKBanking sector is now overbought. It is NIFTY that is now catching up with BN. God knows when that will happen.

For now, HDFC BANK looks like the first from the index that's showing weakness.

Clear rejection from the Highs.

LH formations noticed.

There's also a massive gap that needs to be filled which was created between 11th April close and 15th April open. I've shorted HDFC BANK.

TGT - 1840

SL - 1960

P.S. Not a recommendation. Pls do your own due diligence.

HDFC BANK 1M HDFC Bank appears to be forming a double bottom pattern, indicating the potential for a breakout above the ₹2,200 level in the future.

Disclaimer: The information provided is for educational and informational purposes only and should not be considered as financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Please consult with a certified financial advisor or conduct your own research before making any investment decisions. We are not responsible for any losses incurred as a result of using this information. Stock market investments are subject to market risks; read all related documents carefully.

HDFC Bank Ltd view for Intraday 28th April #HDFCBANK HDFC Bank Ltd view for Intraday 28th April #HDFCBANK

Resistance 1920-1925 Watching above 1926 for upside movement...

Support area 1900 Below 1900 ignoring upside momentum for intraday

Watching below 1896 for downside movement...

Above 1920 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

HDFC Bank Ltd view for Intraday 22nd April #HDFCBANK HDFC Bank Ltd view for Intraday 22nd April #HDFCBANK

Resistance 1950 Watching above 1953 for upside movement...

Support area 1900 Below 1920 ignoring upside momentum for intraday

Watching below 1896 for downside movement...

Above 1920 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

HDFC BANK S/R for 21/4/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

HDFC BANK: Consolidation Breakout of 48 months - is wait over?With Nifty reaching to 26k without the participation of HDFC bank made many investors un-comfortable.

However now, Looks like the wait is about to over as Monthly Consolidation for almost 48 Months - 4 years is visibly broken but yet to give confirmation on candle close.

If the April 2025 candle closes above consolidate area then it will further increase the possibility of 30% up move.

DISC: Only for education purposes. Please consult your financial advisor before making any decision.

HDFC BANK | SHORT| STBTHDFC BANK is clearly struggling at the Highs after the major gap up that happened due to the extended weekend.

A beautiful Mean Reversion trade is setting up and I have taken a short position for a Target to the 1838 price level.

This is a counter trend trade.

PS - Not a recommendation