PLTR Just Had a Rug Pull – Here’s What I’m Watching👀

So PLTR had a solid ru lately — we broke out of that long downtrend in April, started building higher lows, and ripped all the way to the $125 zone. But yesterday? Oof. Big red candle straight off resistance. That move flushed through the trendline and parked price right around $108 — a level we really need to hold or it starts to look weak.

🧠 My Thought Process:

* Daily Chart shows we’re still in an overall uptrend since March, but this latest pullback is sharp. MACD is starting to roll over, and Stoch RSI already crossed down. I don’t like that combination when we’re at resistance.

* 1H Chart confirms the break of the rising trendline. We dropped fast on volume, found a floor around $107–108, and now we’re just consolidating. Could be a base forming — or a bear flag.

🧲 GEX and Options Insight:

* Gamma ma shows $121–125 as the heavy call resistance zone. That’s our ceiling for now.

* On the downside, $100 is massive PUT support, and there’s a wall sitting at $98.72, which I think could be a magnet if bulls don’t step up.

* GEX is super bearish right now — three red circles, and CALL$ is up at 26.7%, meaning there’s a good amount of overhead pressure. IV rank is also high, so premiums are inflated.

⚔️ Trade Ideas I’m Considering:

1. Bearish short-term:

If we break below $107, I might go for a Put debit spread targeting $100–98. That setup keeps risk-defined and aligns with the GEX magnet zone.

2. Neutral bounce play:

If we reclaim $110+ and start seeing strength with volume, maybe a short-dated Call scalp up to $115, but I’d be quick to cut it. That GEX wall at $121 is brutal resistance.

🔁 Summary:

Right now, PLTR is at a decision zone. The bulls lost momentum, and the options flow is leaning bearish. If we get a bounce, ’m not chasing unless we clear $111–113 with strength. Otherwise, I’ll be watching for a grind lower toward $100–98.

This week might be chop, so I’ll stay nimble.

Disclaimer: This is just my view and how I’m planning. Do your own DD and manage your risk.

PTX trade ideas

From Gut to Algorithm: How AI Is Changing the Game for TradersArtificial Intelligence isn't just changing tech — it’s rewriting the rules of trading and investing.

What used to be the domain of seasoned floor traders and intuition-driven bets is now increasingly dominated by algorithms, machine learning models, and predictive analytics.

Here is how AI changing the markets — and what it means for traders like you.

📈 AI in Action: How It’s Used in Markets

AI impacts trading in ways both seen and unseen. Here’s how:

Algorithmic Trading:

High-frequency trading (HFT) firms use AI to make thousands of trades per second, exploiting tiny inefficiencies.

Sentiment Analysis:

AI scans news articles, social media, and earnings calls to gauge market mood before humans even blink.

Predictive Analytics:

Machine learning models digest millions of data points to forecast stock movements, currency fluctuations, and market trends.

Portfolio Management:

Robo-advisors like Betterment or Wealthfront use AI to automatically rebalance portfolios — making decisions humans might overthink.

Risk Management:

Banks and hedge funds use AI to predict and manage market risks faster than traditional risk teams ever could.

🤖 Why AI Is a Game-Changer for Traders

AI isn’t just about speed. It's about edge.

✅ Processing Power:

AI can analyze complex patterns across decades of historical data — something a human could never do in a lifetime.

✅ Emotionless Trading:

AI doesn’t panic, get greedy, or revenge trade. It executes the plan — consistently.

✅ Adaptive Strategies:

Machine learning models evolve over time, adjusting to changing market conditions without needing a human hand.

⚠️ The Dark Side: Risks and Challenges

AI isn’t magic. It introduces new risks into markets:

Flash Crashes:

Algorithms can amplify volatility — causing sudden, violent moves like the 2010 Flash Crash.

Overfitting:

AI models might "learn" patterns that don’t actually exist, leading to disastrous real-world trades.

Market Homogenization:

If everyone uses similar AI models, trading strategies become crowded — making the market more fragile.

Ethical Concerns:

Who is accountable if an AI trader manipulates a market unintentionally? Regulators are still catching up.

🧠 What This Means for You

Whether you’re a day trader, swing trader, or long-term investor, understanding AI is becoming a competitive necessity.

Retail traders are starting to access AI-powered tools once reserved for institutions.

Custom indicators, predictive models, and smart portfolio managers are more available than ever.

But remember: AI is a tool, not a crystal ball.

Human judgment, risk management, and emotional discipline still matter.

In the end, the best traders will be those who can combine machine intelligence with human intuition.

in conclution:

Markets have always rewarded those who adapt.

AI isn’t replacing traders — it’s changing what trading looks like.

The future belongs to those who can learn faster, adapt smarter, and trade sharper.

Stay curious.

Stay strategic.

Stay ahead.

put together by: @currencynerd

courtesy of: @TradingView

Palantir has a 7 peg ratio, it was cheap at 2. now what?palantir stock is trading at 7x its growth rate in pe, over 200 pe.

Warren Buffett and Peter Lynch would hate this valuation, even though the business is great.

Id be a buyer at 33, roughly where the 200 week or 1000 day moving average is, but thats because I want bargain prices and growth stocks.

PALANTIR Channel Up intact. Eyeing $185 on this rally.Palantir (PLTR) has been trading within a 2.5-year Channel Up and is currently on its most recent Bullish Leg following the approach f the 1W MA50 (blue trend-line).

Having also rebounded on its long-term RSI Support Zone, the buying pressure is the strongest we've seen inside this pattern, having recovered all loses in just 4 weeks.

Given that the most usual rally was +183.03%, we expect this Leg to reach at least $185.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

PLTR | Neutral-to-Short | Overvaluation | (May 2025)PLTR | Neutral-to-Short | Overvaluation + Hype Exhaustion Risk | (May 2025)

1️⃣ Short Insight Summary:

Palantir has been riding the AI hype wave, but valuations are extremely stretched. Despite strong growth, price action shows signs of slowing — making this a "watch closely" rather than "chase blindly" setup.

2️⃣ Trade Parameters:

Bias: Watching for short setup — not entering yet

Entry Zone: If price retests $19–20 and stalls again

Stop Loss: Above $121.50 (breakout continuation risk)

TP1 (potential short): $117.00 — minor structure support

TP2: $15.50 — deeper pullback zone

TP3 (optional): $113.90 — if broader correction plays out

3️⃣ Key Notes:

✅ Fundamentals at a Glance:

Revenue: $2.87B | Net Income: ~$460M

Market Cap: $291B (!) — over 10x revenue, signals extreme overvaluation

P/S Ratio: 19x

Price to Cash Flow: 272x — typical range for healthy companies is 20–40

EPS and Book Value: Weak vs market cap (Tangible BV: $2.13)

Beta: 2.45 — very volatile

✅ Business Model:

Palantir builds AI-driven software for government and commercial use. Notably, government revenue and commercial segments both grew ~40% YoY — great performance, but possibly priced in already.

❌ Current Market Behavior:

Everyone's talking about PLTR — hype levels are extremely high

Price currently sitting near previous all-time highs

Technicals show signs of exhaustion — money is slightly flowing out on 30min charts

Daily chart still bullish, but 4H shows price stalling — a correction seems likely

A dip to ~$19 or lower (4–5% pullback) would be normal, even healthy

❌ Short Setup Caution:

Although the chart leans bearish short term, this is a hype-driven stock. Fighting it blindly with a short could be risky. If a correction does set in, it's more likely to be a measured move rather than a full trend reversal — for now.

4️⃣ Follow-up Note:

I’ll be watching for a short opportunity if rejection confirms near $20–21. No position for now — observing price behavior closely as hype may still carry it higher in the short term.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

Down to 70$ ?The quarterly report just above expectations

P/E ratio over 600

The double top on the chart

The spending cuts by the US government, which is the main client

All the ingredients are there for a significant decline that could go down to the blue support where the 200-day SMA (blue line) will be located, around $70.

Pltr $151 🧠 Palantir Bull Thesis: $136–$150 Short-Term Target (Post-Earnings)

Price Target Range:

Base Target: $136

Stretch Target: $150 (if momentum breakout + macro align)

Catalyst 1: AI/Defense Earnings Blowout

Expected EPS: $0.13 → if actual EPS surprises (e.g., $0.15+), it signals significant operating leverage from AI/Foundry.

Recent Government Deals: NATO, U.S. military, and foreign defense contracts bolster revenue visibility.

Commercial Growth Spike: Analysts expect over 60% YoY growth in commercial sector revenue — if confirmed, valuation multiple expansion becomes justified.

Catalyst 2:

Cup & Handle breakout formed over the last 6 weeks

Break above $124 (previous high) triggers bullish continuation

RSI is resetting from mid-60s — giving room for a momentum ignition

Golden cross: 50EMA crossing above 200EMA last week

📊 If earnings gap the stock above $128, short-covering + AI momentum chase can push a rapid breakout to $136–$150.

Catalyst 3: Options Flow + IV Crush Setup

Implied Volatility > 95% pre-earnings → massive call open interest buildup at $130–$150

Call/Put ratio above 2.3 (bullish skew)

If IV collapses post-earnings and the move is directional, market makers will need to hedge deep OTM calls → gamma squeeze potential

Catalyst 4: Sentiment + Social/Institutional Attention

Palantir trending on Reddit, Twitter, and TikTok

Citadel and BlackRock increased positions in Q1

High institutional ownership (~40%) with increasing fund inflows into AI/Defense names

Quantum Forecast & AI Narrative Momentum

AI stocks (NVDA, SMCI) have led market-wide rallies

Palantir being seen as the “AI software layer for government + enterprise”

CEO Alex Karp has already hinted at "transformational government contracts" and new AI modules — this creates anticipation buying even before guidance is raised

Risk-Reward Snapshot

Case Price Range Probability

Base Bull Case $136 55%

Stretch Case (Gamma Squeeze + Beat + Upgraded Guidance) $150+ 30%

Neutral Post-Earnings Drift $118–124 15%

Risk Factors:

Market-wide risk-off event (Fed, macro surprise)

AI rotation cools off

EPS beats but guidance disappoints

IV crush limits upside unless price gaps violently

If Palantir beats EPS by >15%, raises guidance, and gaps over $128 post-earnings, a momentum/gamma squeeze could push it toward $136–$150, fueled by AI mania, defense exposure, and short positioning.

Want a matching chart or visual post for this thesis?

as always safe Trades

Good PalantirianNoticed recently there is very few NASDAQ:PLTR stock for sale on the market. As a good and kind trader I decide to borrow ad sell couple of NASDAQ:PLTR like a good move to provide liquidity to the market and help other traders to obtain so passionately desired Palantir stock.

Dear Palatirians pls don't get me wrong. I'm not betraying our faith, just need to step back for a while

$PLTR Update: New Long Entry at $82 in a Strong Uptrend!Palantir Technologies Inc. ( NASDAQ:PLTR ) continues its “Strong Uptrend” on a 1-week chart. 📈 We bought at $21.84 and sold at $121.81 previously. Now at $114.65, we’ve entered a new long position at $82. The Trend Score is 8/8, but a short-term projected price of $123.2 ( -9.1% ) and bearish MACD suggest a potential pullback.

How to Trade This Setup:

• Monitor the Trend: The uptrend is strong with high volume, but bearish signals indicate caution—watch for momentum shifts.

• Set Targets: Resistance 1 at $137.66 is a target; Support 1 at $75.65 is key if a pullback happens.

• Adjust Risk: With bearish MACD, consider tightening stops or taking partial profits from $82.

What’s your next move on NASDAQ:PLTR ? Let’s discuss in the comments! 💡 #Trading #PLTR #Analysis

PalantirPalantir has continued to push higher, but if you look at MACD, it is running into resistance. Also, it is within the white target box for an impulsive wave, and has officially hit the yellow 1.0 if it is to be an abc pattern for the (a) of minor B. Due to the impulsive looking structure it seems to be turning into, and the duration/level of this move higher, I am officially making the bullish count my primary. That being said, the yellow count can still play out, but given the current price action and time duration, I find the white count most plausible.

We're due for a consolidation lower regardless of what count comes to fruition. Both patterns point to an abc move next to the $80 area if it is to be standard. The part that comes after that is what will answer the question of which count is correct. Once we get that move lower, if it is in the form of an abc, I will try to enter into a long position around the 0.618 retracement fib. That will be the least risky place to enter.

If the white count is what is playing out, then a minor wave 3 will come after the consolidation lower. If the yellow count is to play out, then it will be a minor C wave that takes us to the $120's. Either way you look at it, I am forecasting price to move significantly higher after our next move lower.

Let me know if any questions linger. I have added an orange label above the white box to signify we can still very easily get another high for minor wave 1. Once we do have a top in, I will add some retracement fibs to track the move lower.

Potential Breakout in PalantirPalantir Technologies has been consolidating as the broader market struggled, and some traders may look for its uptrend to continue.

The first pattern on today’s chart is the February 24 high of $99.01. PLTR peaked near that level in late March and again last week. However the stock cleared the resistance yesterday, which may signal a breakout.

Second, prices consolidated at the 50-day simple moving average but have now escaped from it. Is the intermediate-term trend getting more bullish?

Third, the 8-day exponential moving average (EMA) is above the 21-day EMA. MACD is also rising. Those patterns may reflect bullish short-term momentum.

Finally, the software company is a highly active underlier in the options market, averaging more than 700,000 contracts per session in the last month. (It ranks in the top five of the S&P 500, according to TradeStation data.) That could help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

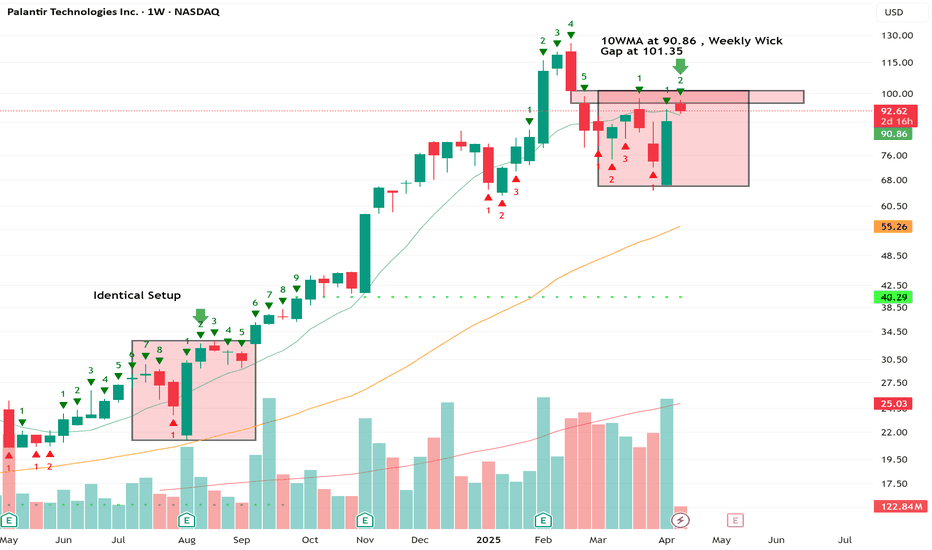

$PLTR Trade: Buy $90.86 , Target $101.35Beep Beep. Hope everyone is taking care of their trading accounts during this volatile phase in the markets. I noticed an identical setup on the weekly from back in August 24' and I'm looking to take advantage. We have a trend reversal on the Tom Demark sequential that helps identify trend exhaustion through a 9 Count. Currently on a 2 Count, we're testing the gap while simultaneously testing the 10WMA at 90.86.There is also a weekly gap at 101.35 ... Entry would be the 10WMA. Target the weekly Gap. Trade is as follows:

Trade Idea - Swing NASDAQ:PLTR $95 Calls 4/25

Entry - 10 WMA @ $90.86

Target - Gap on Weekly at $101.35

$PLTR 50%+ decline ahead, $39-56 targetNASDAQ:PLTR looks like it's topping here and that it has a long road to the bottom.

If we continue to reject at this resistance, then it's likely that we'll at least see the $56 target on the downside, but I think the $44 target is the most likely area to see a bounce.

Bulls should enjoy a 50%+ drop from here. You've been warned.