SID trade ideas

IMPORTANT LEVEL FOR SBI BANK525-535 IS is an important level for sbi bank.this level is 50%fibonacci retracement level of last move and also it has the huge volume happening in this level which is showing in the fixed range volume profile.so let"s see what happened if it corrects or not and if so how this level reacts in this movment?

STATE BANK OF INDIA( SBIN) Up or Down?This stock had broken out of Weekly and Monthly trading channels and has bee trading higher. This stock is going to go higher and higher. Only thing to worry about is Volume. Volumes are coming down. Implication of falling Volumes can be Profit Booking in a Shorter Time Frame.

Conclusion: Bullish on Long term & Bearish on Short Term!

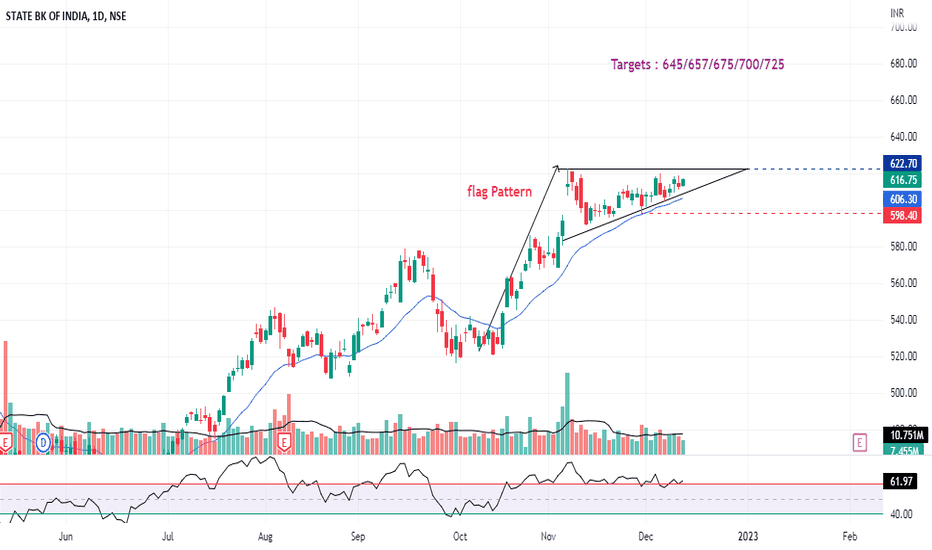

SBIN : Breakout Candidate (Flag Pattern)#SBIN : King of PSU Banks in a kind of Flag structure, Breakout Candidate Soon.

Good Strength in all 3 Time Frame (D/W/M)

Banking Sector will Grow as long as Indian Economy grows.

Take 10% & keep Trailling.

Happy Trading !!!

Keep Sharing, Loving & following to Learn more.

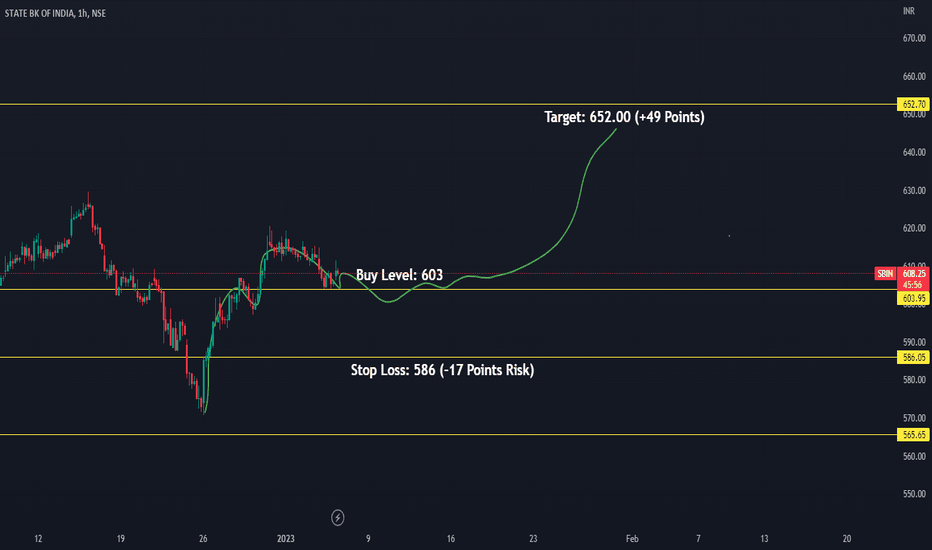

STATE BANK OF INDIA INTRADAY SETUPA small correction in SBI ( State Bank of India ) long term market is still bullish and market moving towards a demand zone for a retest if there is a successful retest then market move above last high .....right now correction.

ENTRY @ 610

STOP @ 612 ( LOW RISK )

TARGET @ 598.50