SID trade ideas

SBINHello and welcome to this analysis on STATE BANK OF INDIA

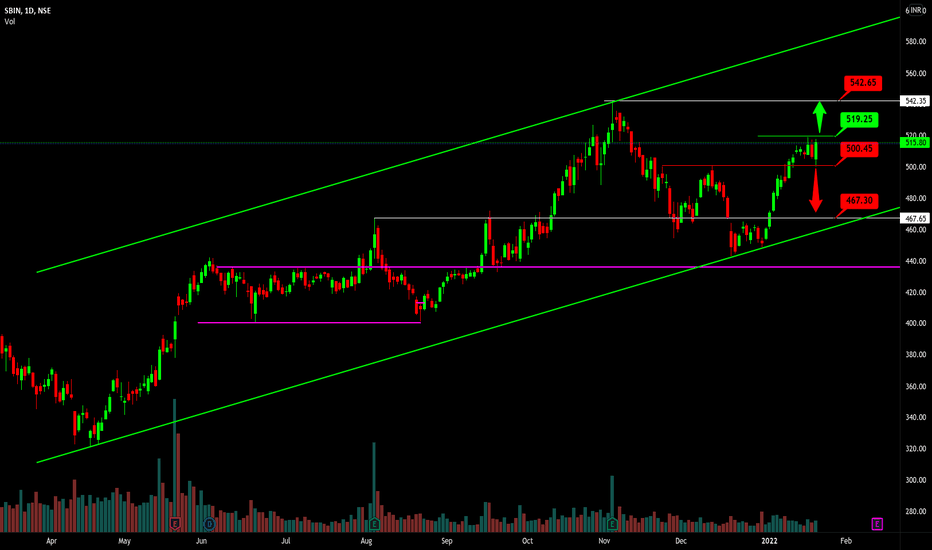

On FEB 15, it showed a very strong reversal after 5 days of steady decline from 550 to sub 500.

Currently on the hourly time frame it is completing a bullish flag and pole pattern suggesting upside levels of 535-540 as long as it does not break below 510.

Good Risk Reward set up here

SBIN | Good Sell Opportunity. Go Short!If you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

SBIN - 1DSBI came up with very good numbers over the weekend. if the stock gaps down and bounces from 500-510 level this proposal is a high probability and can go up to 570-580 before reversing for the C wave correction. if this plays out then it will be bear trap followed by bull trap.

This chart is for educational purpose and not a trading idea.

Short $SBIN CMP ₹475.30Short $SBIN CMP ₹475.30. Falling channel pattern. Stock price recently broke 50 SMA with volume. It may retest 50 SMA but MACD is showing no signs of positive volume so it may not be successful. Lowers lows on day chart. Intermediate support ₹450 area. Short term target is 200 SMA which is ₹420 area.