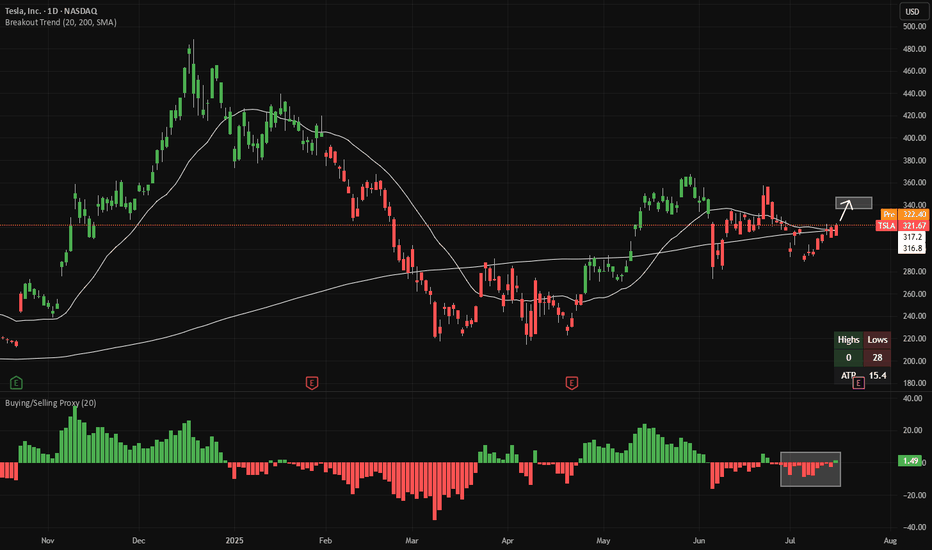

Long TSLA - buyers almost have controlThe buying/selling proxy (bottom panel) is showing signs of net-buying in TSLA. This makes 20-day highs (area indicated in the main chart) more likely to come next. That's around $349.

There is good risk/reward to buy TSLA here, with a stop-loss if the buying/selling proxy flips back to net-selling (red bars). If a 20-day high is made, the candles will change color from red to green.

Both indicators (Breakout Trend and Buying/Selling Proxy) are available for free on TradingView.

TL0 trade ideas

TSLA - Explosive Bounce TSLA Before the Drop? | EW Analysis My primary view is that we’re in the final stages of an ending diagonal, which could lift the price to new all-time highs, potentially between $460 and $650. Wave 4 of this structure appears to have completed after precisely tagging key Fibonacci support, and since then, we've already seen a strong bounce from that low. I’m now watching for the development of the final wave in this pattern, which could deliver gains of over 100% from current levels.

However, I’m not fully convinced by the internal shape of the diagonal so far. That’s why I’m also have an alternative scenario: in this case, the recent low may have marked the end of Wave 2 within a much larger diagonal. If true, this opens the door to a much more extended rally potentially reaching $1,000 before we see a major correction.

That said, this second scenario is not my preferred one, and a decisive break below the recent lows would invalidate both counts.

Tesla’s Next Move: Bullish Play Amid AI and Volatility Current Price: $313.51

Direction: LONG

Targets:

- T1 = $319.00

- T2 = $329.15

Stop Levels:

- S1 = $307.75

- S2 = $303.60

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Tesla.

**Key Insights:**

Tesla’s recent AI innovation and its expanding robo-taxi footprint signal long-term growth potential while short-term volatility requires strategic entry points. Market sentiment has significantly improved with positive news about the integration of Gro 4 AI, enhancing Tesla’s autonomous vehicle advancements. Trading at critical levels, Tesla offers a potential buying opportunity near key support zones.

The rallying investor focus on Tesla’s technological edge places it among the leaders in automation-driven growth. Despite macroeconomic pressures, Tesla’s proactive efforts in leveraging cost efficiencies and scaling autonomous solutions are helping to sustain bullish momentum.

**Recent Performance:**

Tesla demonstrated notable resilience during a turbulent earnings season, holding strong amidst mixed market signals. Recent delivery figures reflected a 13% year-over-year decline, which stirred concerns. Yet, the stock was buoyed by positive AI-related news and the market-wide optimism surrounding automation technologies, enabling Tesla to maintain its pivotal price range.

**Expert Analysis:**

Analysts acknowledge Tesla’s robust innovation pipeline centered around driver assistance and robo-taxi functionality powered by the Gro 4 AI platform. Concerns related to Elon Musk’s focus and governance have tempered enthusiasm for some traders, but these have largely been offset by Tesla’s strategic actions to sustain revenue and growth. Tesla’s prominent role in setting the market narrative for autonomous vehicles and broader EV adoption ensures ongoing support from long-term investors.

Tesla’s recent moves are growing investor confidence as it seeks to hedge against broader economic uncertainties and mitigate risks around regulatory changes. Its expansion strategy continues to highlight its leadership within the EV space, while early adopters of its AI-driven solutions may set the pace for sustainable revenue expansion.

**News Impact:**

The integration of Gro 4 AI is expected to significantly enhance Tesla’s robo-taxi and autonomous vehicle functionality, enabling it to capture market share in urban mobility services. Tesla’s announcement of an expanded robo-taxi fleet targeting key metropolitan areas could help offset delivery declines and drive future recurring revenues. While concerns about Elon Musk’s governance persist, ongoing innovation continues to support Tesla’s bullish outlook in global EV markets.

**Trading Recommendation:**

Tesla’s current price action signals an advantageous entry point for a long position, reinforced by recent bullish news and industry-leading innovations. Short-term traders can target $319.00 and $329.15 while maintaining disciplined stop-loss levels at $307.75 and $303.60. With strong support from institutional sentiment and expanding AI applications in its product line, Tesla offers substantial upside for bullish investors.

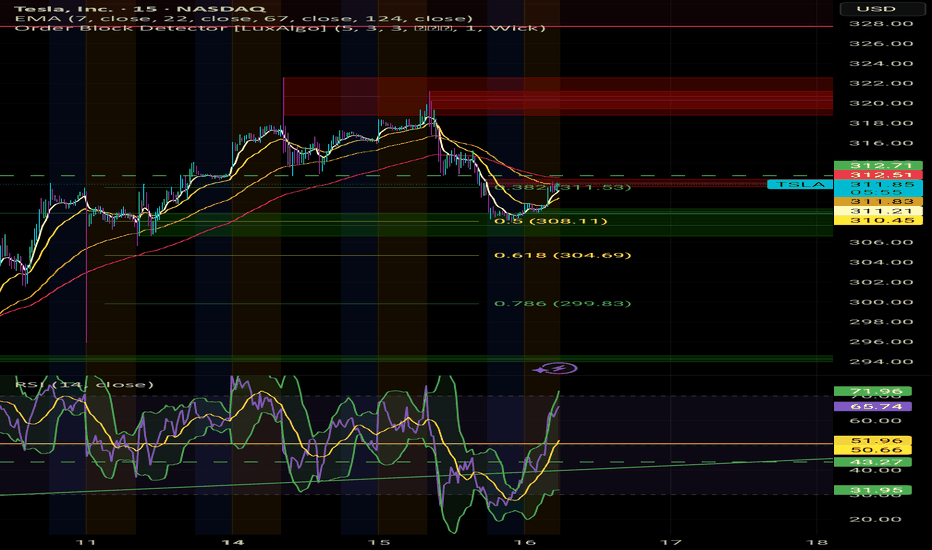

TSLA TA – Call Side Dominance Nearing Resistance-July 14TSLA GEX Analysis – “Call Side Dominance Nearing Critical Resistance 💥”

GEX Snapshot:

* Highest Positive GEX / Resistance: $320 – This is where call positioning is heaviest and likely where dealer hedging could resist further upside.

* Call Walls:

* $317.5 (44.18%)

* $320 (High NetGEX)

* $335–$340 (Intermediate resistance, weaker positioning beyond)

* Put Walls:

* $300 (48.79% support)

* $295 / $290 (3rd/2nd tier walls)

Options Oscillator:

* IV Rank (IVR): 16 (Low)

* IVx avg: 64.5

* Call Positioning: 69.8% (very bullish skew)

* GEX: 🔰 Bullish

🎯 Options Trade Setup:

Direction: Cautiously Bullish – but close to key resistance!

⚡ Aggressive Bullish Setup:

* Entry: Near $312.75 (current price)

* Strike: Buy $317.5C or $320C expiring this week

* Target: $320+

* Stop: Close below $308

* Note: Watch dealer hedging around $320. If TSLA breaks $320 with strength, gamma squeeze toward $335 is possible.

🛡️ Bearish Reversal Setup (if rejected at $320):

* Strike: Buy $310P or $305P (next week expiry)

* Trigger: Rejection at $320 + breakdown below $311

* Target: $304–$300

* Stop: Above $321

📉 TSLA 1-Hour Chart Analysis – “Breakout Zone or Fakeout Trap? Watch These Levels 🎯”

Structure:

* TSLA broke above the CHoCH and BOS zones between $308–$310. Price is consolidating under the $317.5–$320 resistance (also seen on GEX).

* There’s a clean ascending wedge/channel forming – upper boundary is near $320, and the lower trendline is near $304.

Key Zones:

* Supply Zone (Purple): $317.5–$320 (watch for rejection or breakout)

* Support: $309.8 (BOS zone), then $304 (trendline + demand overlap)

* Demand Zone: $293.5–$296 (origin of last rally)

🛠️ Trade Scenarios:

🔼 Bullish Continuation:

* Entry: Break and hold above $320

* TP1: $325

* TP2: $335

* SL: Below $311

🔽 Bearish Pullback:

* Entry: Rejection at $317.5–$320 zone and break below $309

* TP1: $304

* TP2: $296

* SL: Above $320

✅ Summary:

* GEX favors calls but $320 is a critical gamma wall – if broken, it opens room toward $335+.

* On the chart, watch the rising channel and upper resistance at $320.

* Bullish momentum is still intact unless $309 fails.

* Stay nimble: scalp calls on breakout, or prepare for a reversal put if there's rejection and structure break.

Disclaimer: This analysis is for educational purposes only and not financial advice. Trade at your own risk with proper risk management.

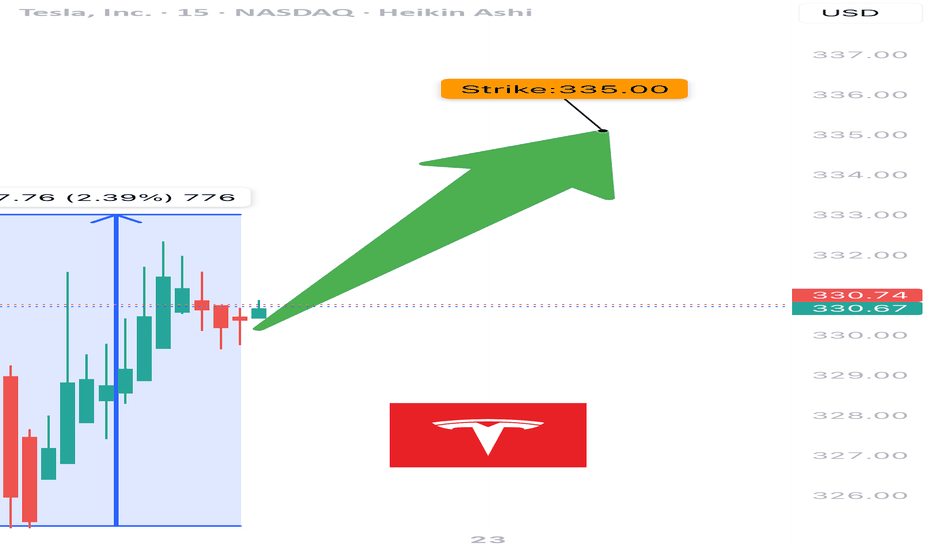

$TSLA Weekly Call Play – 07/22/25

🚀 NASDAQ:TSLA Weekly Call Play – 07/22/25

RSI Bullish 📈 | Options Flow Strong 🔁 | Volume Weak 💤 | 3DTE Tactical Entry

⸻

📊 Market Snapshot

• Price: ~$332–335 (spot near strike)

• Call/Put Ratio: 🔁 1.24 – Bullish Flow

• Daily RSI: ✅ 57.6 – Rising momentum

• Weekly RSI: ⚠️ 54.8 – Neutral / flattening

• Volume: ❌ Weak – Institutional absence

• Gamma Risk: ⚠️ Moderate (DTE = 3)

• VIX: ✅ Favorable

⸻

🧠 Trade Setup

{

"Instrument": "TSLA",

"Direction": "CALL",

"Strike": 335.00,

"Entry": 9.90,

"Profit Target": 15.00,

"Stop Loss": 6.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔬 Sentiment Breakdown

Indicator Signal

📈 Daily RSI ✅ Bullish – confirms entry

📉 Weekly RSI ⚠️ Flat – no long-term edge

🔊 Volume ❌ Weak – no institutional bid

🔁 Options Flow ✅ Bullish (C/P = 1.24)

💨 VIX ✅ Favorable for upside trades

⏳ Gamma Decay ⚠️ High risk (3DTE)

⸻

📍 Chart Focus

• Support Zone: $328–$330

• Breakout Watch: $335+

• Target Zone: $340–$345

• ⚠️ Risk Watch: Volume divergence + gamma decay on low move

⸻

📢 Viral Caption / Hook (for TradingView, X, Discord):

“ NASDAQ:TSLA bulls flash 335C with confidence, but volume’s asleep. RSI’s in, gamma’s ticking. 3DTE lotto with caution tape.” 💥📉

💵 Entry: $9.90 | 🎯 Target: $15.00+ | 📉 Stop: $6.00 | ⚖️ Confidence: 65%

⸻

⚠️ Who This Trade Is For:

• 🔁 Options traders chasing short-term call flows

• 📈 Momentum scalpers riding RSI pop

• 🧠 Disciplined risk managers eyeing 3DTE setups

⸻

💬 Want a safer bull call spread (e.g., 330/340) or risk-defined iron fly for theta control?

Just ask — I’ll build and optimize it for you.

TESLA 400 BY END OF YEAR !! 5 REASONS !!!

1. **Strong Earnings and Revenue Growth**

Tesla has a track record of exceeding earnings expectations. If the company reports robust financial results in Q3 and Q4—driven by higher vehicle deliveries and growth in its energy storage business—investors are likely to gain confidence. This could push the stock price upward as Tesla demonstrates its ability to scale profitably.

2. **Advancements in Autonomous Driving**

Tesla’s Full Self-Driving (FSD) technology is a game-changer in the making. If Tesla achieves significant progress toward Level 4 or 5 autonomy—where vehicles can operate with little to no human intervention—it could position the company as a leader in transportation innovation. Such a breakthrough would likely excite investors and drive the stock price higher.

3. **Battery Technology Innovation**

Tesla is working on developing cheaper, longer-lasting batteries, which could lower production costs and improve profit margins. If the company announces advancements in battery tech—such as improvements from its Battery Day initiatives or new manufacturing processes—it could signal a competitive edge, boosting the stock to $400.

4. **Global Expansion and Production Increases**

Tesla’s new Gigafactories in Texas and Berlin are ramping up production, while potential market entries like India loom on the horizon. Increased output and access to new customers signal strong growth potential. If Tesla successfully scales its operations, investors may see this as a reason to push the stock price toward $400.

5. **Favorable Market Trends and Government Policies**

The global shift toward sustainable energy and electric vehicles (EVs) is accelerating, supported by government incentives and regulations favoring clean energy. If EV adoption continues to rise and policies provide a tailwind—such as subsidies or stricter emissions standards—Tesla, as an EV leader, could see increased demand and a higher stock valuation.

While reaching $400 by year-end is ambitious, Tesla’s strong brand, innovative edge, and leadership under Elon Musk could make it achievable. That said, risks like market volatility and growing competition from other EV makers could pose challenges. If these five factors align, however, Tesla’s stock has a solid shot at hitting that target.

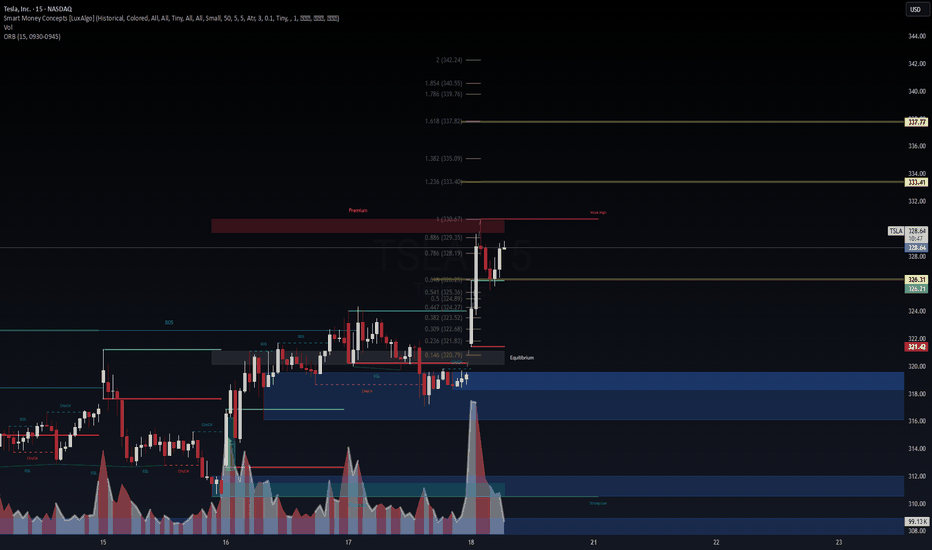

$TSLA Fibonacci Expansion Targets in Play – VolanX Precision Le🔋 NASDAQ:TSLA Fibonacci Expansion Targets in Play – VolanX Precision Levels

TSLA just powered through a clean bullish reversal from the discount zone and now trades inside the premium supply block near 330.67. This zone aligns with:

📍 0.886 Fib (329.35)

📍 Weak high at prior inefficiency

📍 VolanX ORB resistance (326.21–330.67)

🧠 WaverVanir VolanX Setup:

✅ CHoCH → BOS → Premium Tap

✅ ORB (15) broken to upside with volume (76.6K)

🟡 Currently testing equilibrium/premium confluence

🎯 Fibonacci Expansion Targets:

1.236 → 333.40

1.382 → 335.09

1.618 → 337.77

2.0+ range → 342–347 (if melt-up continues)

⚠️ Trade Logic:

A pullback to 326.30 may serve as a re-entry zone.

Watch for rejection at 330.67 — if it fails, bulls could reclaim control into the 333–337 fib cluster.

Macro + flows suggest continuation, but premium rejection remains possible. Stay nimble.

📌 #TSLA #Tesla #WaverVanir #VolanXProtocol #SmartMoneyConcepts #ORB #Fibonacci #LiquidityZones #BreakoutSetup #TradingView #OptionsFlow #Scalping #MacroMomentum

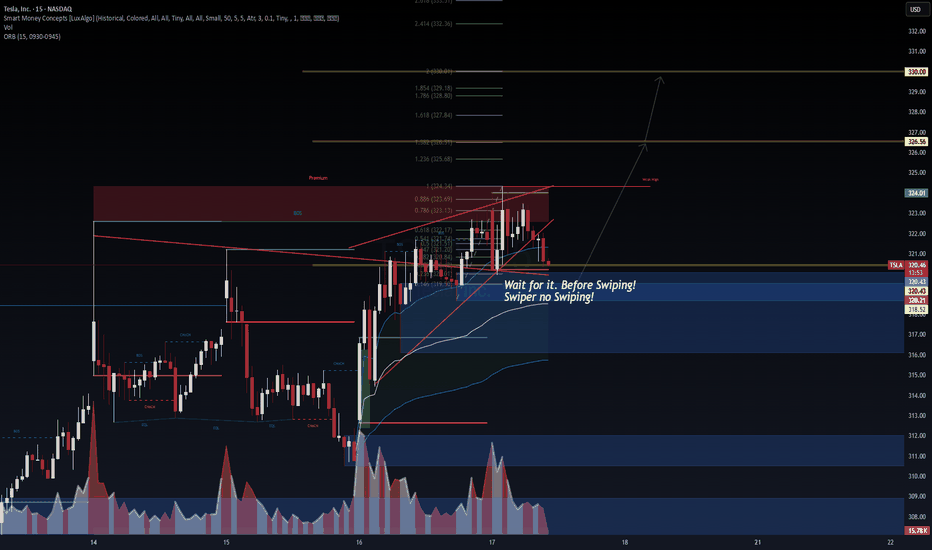

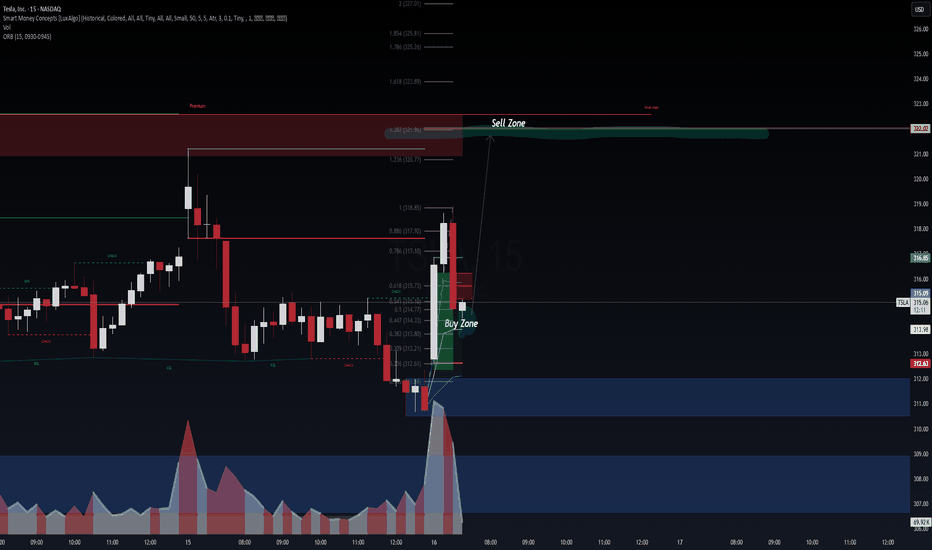

TSLA: Time for the 2/3 rally?TSLA remains tightly wedged inside a bullish pennant, hovering just above the ORB high (324.01) and within the premium SMC zone. Smart Money structure is clear:

🔹 Bullish BOS + CHoCH stacking

🔹 Fibonacci confluence from 0.618 to 0.886 holding strong

🔹 Hidden demand resting at 320.21 / 318.66 zone

🧠 VolanX DSS Logic:

Break above 324.34 unlocks liquidity toward 1.236 = 325.68, then key magnet zone 326.56

Liquidity sweep + micro pullback ideal entry signal

Volume shows absorption at each higher low → bullish intent

🎯 Trade Plan (15m):

Entry: 322.00–324.00 with confirmation

Target: 326.56 → 328.18

Invalidation: Below 320.21 BOS flip

ORB + Fib + SMC stack = High-conviction directional play

💬 Price may seek inefficiencies left in prior imbalance zones below, but current order flow favors upside continuation.

📢 This analysis is powered by the VolanX Protocol under WaverVanir DSS — where liquidity meets logic.

#TSLA #WaverVanir #VolanX #SMC #DayTrading #Fibonacci #ORB #SmartMoneyConcepts #Tesla #MacroEdge #OptionsFlow

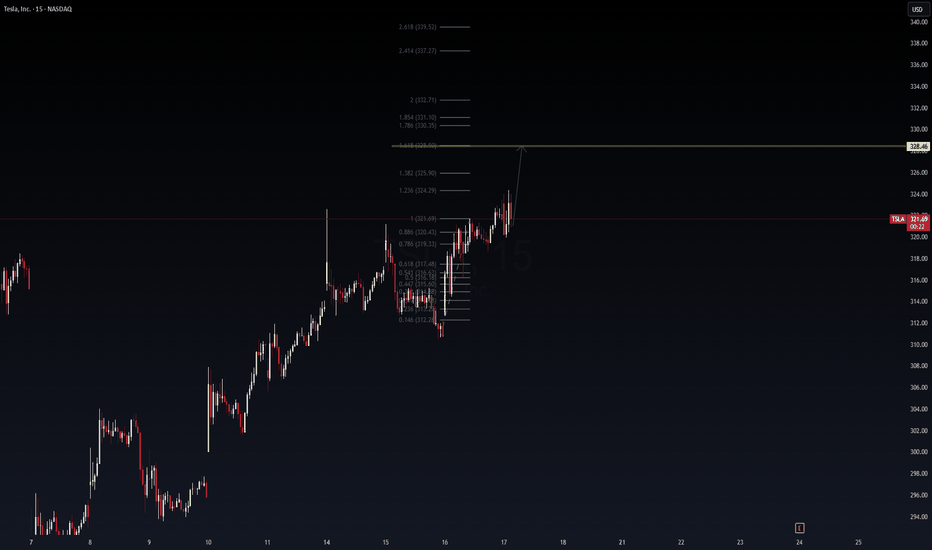

TSLA Fibonacci Launchpad: 328.46 in Sight? (15-min Daytrade Setu🔋 TSLA Fibonacci Launchpad: 328.46 in Sight? (15-min Daytrade Setup)

Posted by WaverVanir_International_LLC | Powered by VolanX Protocol

TSLA continues to show bullish continuation structure on the 15-min timeframe. After a textbook retracement to the golden pocket (0.618–0.786), bulls defended $315-$317 zone and reclaimed $321 resistance.

📌 Technical Thesis

Clean impulsive wave from $312.24 → $321.69

Consolidation → Breakout structure with low selling volume

Fib extension targets 1.618 at $328.46, followed by confluence zones at $331 and $332.71

Price respecting higher lows, forming micro bull flag

📈 Entry Idea:

Intraday breakout confirmation above $324.29 (1.236 extension)

Risk-managed long setup with stops below $320.43 (0.886)

Target zones: $328.46 → $330.35 → $332.71

⚠️ Risk Note:

Heavy resistance expected around $328–$332 zone. Scalp profits near extensions or trail stops tight.

🔮 VolanX Signal Score: 7.5/10

Favoring upside continuation unless macro catalyst shocks sentiment.

#TSLA #DayTrading #Fibonacci #Scalping #VolanX #WaverVanir #TechStocks #OptionsFlow #AITrading #PriceTargets #TeslaTraders

Is the BullRun over? I don't think so. $TSLAYesterday we saw a somewhat heavy fall in Indexes, and it probably scared alot of retail Bulls outs.

However, it seems we've fallen straight into potential medium term supports across multiple stocks in the markets.

I'm convinced we will get a good economic data print today.

This would open the door to new ATHs, again, in the Indexes.

For this to play out, the local bottoms established over night need to hold.

Stocks SPOT ACCOUNT: TESLA stocks buy trade with take profitStocks SPOT ACCOUNT: MARKETSCOM:TESLA stocks my buy trade with take profit.

Buy Stocks at 297 and Take Profit at 319.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

TESLA My Opinion! SELL!

My dear friends,

Please, find my technical outlook for TESLA below:

The price is coiling around a solid key level - 313.47

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 303.67

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

TESLA: Bearish Forecast & Bearish Scenario

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell TESLA.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

How We’ll Trade Earnings This Season Earnings season is almost here — and if you're with QS, you’re already holding the most powerful edge in the market.

Let me walk you through how QS trades earnings, why we built 💸earning-signal, and how you can use it most effectively this quarter.

---

📜 A Little History: The Birth of 💸earning-signal

When QS launched in early April, we started with just two short-term signals:

⏰0dte

📅weekly-options

Both focused on short-term options trades.

Then came TSLA earnings in late April. That’s when we launched our very first 💸earning-signal — and nailed the prediction.

Since then?

We’ve had one of the best earnings win streaks on the internet. Period.

📌 Don’t take my word for it — check:

#✅signal-recap for the track record

#🤑profits and #🤩member-testimonials for real wins from members

---

🤖 Why We Built a Separate Earnings Signal

Earnings are not regular trading days. The dynamics are completely different.

On normal days, a stock might move <1%

On earnings? 10–20% swings are common

This is what we call a “pivot event” — and it requires a different engine to predict.

That’s why we separated:

📅 #weekly-options → normal day-to-day setups

💸 #earning-signal → high-volatility earnings plays

---

🧠 How a Human Would Trade Earnings...

If you wanted to manually trade an earnings report, you’d need to analyze:

Past earnings reactions

Analyst expectations

Earnings call language

Financial statement surprises

Options IV & skew

Post-earnings stock behavior

This would take hours (or days) — and most retail traders don’t have time.

---

⚙️ How QS AI Does It Instead

We built 💸earning-signal to do all that work for you — and more.

✅ It pulls in all the data above

✅ Runs it through 5 top LLM models (each acts as an independent analyst)

✅ Aggregates their insights + calculates probability-weighted direction & strategy

✅ Uses fine-tuning to learn from its past prediction success/failures

This means: faster decisions, deeper insights, and better accuracy — every week.

We don’t just run predictions. We let the AI learn from past mistakes and self-improve each quarter.

---

💥 Results Speak for Themselves

Last season, we nailed:

TSLA

MSFT (10x–20x winners!)

NVDA

AAPL

And many more...

All based on this unique AI-driven earnings analysis stack.

This season?

We’re going harder, faster, and even smarter. 📈

🎯 The goal is clear:

Make 💸earning-signal the #1 earnings prediction system in the world.

---

🧩 Final Notes

Earnings are 10x harder to trade than regular days

But with QS, you’re equipped with 500x the speed and insight of an average trader

Upgrade if you haven’t yet: #💰upgrade-instructions

Earnings season kicks off next week

Let’s get it.

Let’s win big.

Let’s make season 2 of 💸earning-signal our most legendary yet. 🚀💸