GMXUSDT trade ideas

gmx extremely over sold (easy 400-500% gain)The descending broadening wedge chart pattern is a bullish reversal formation characterized by two sloping and diverging trend lines. This pattern emerges as the price fluctuates between the upper resistance and lower support trend lines, expanding the trading range during a downtrend.

A descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines.

A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines . The upper line is the resistance line; the lower line is the support line.

Each of these lines must have been touched at least twice to validate the pattern.

NB: a line is said to be "valid" if the price line touches the support or resistance at least 3 times.

This implies that the descending broadening wedge pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

A descending broadening wedge does not mark the exhaustion of the selling current, but the buyers’ ambition to take control. The divergence of the two lines in the same direction (increase in price magnitude) informs us that the price continues to fall with movements that are increasingly low in magnitude. The sellers manage to make the price rebound on the resistance line but lose control after the formation of a new lowest point. The highest point reached during the first correction on the descending broadening wedge’s resistance line forms the resistance. A second wave of decline then occurs of more magnitude, signalling the sellers' loss of control after a new lowest point. A third wave forms afterwards but the sellers lose control again after the formation of new lowest points.

During the formation of a descending broadening wedge, volumes do not behave in any particular way but they increase strongly when the support line breaks.

This type of pattern appears on the troughs, it is a bullish reversal pattern.

The break in the resistance line definitively validates the pattern.

The price objective is determined by the highest point at which the descending broadening wedge was formed.

NB: often, the steeper the descending broadening wedge’s trend lines, the faster the price objective is reached.

Statistics of the descending broadening wedge after a bullish movement

In 80% of cases, the exit is bullish.

In 75% of cases, a descending broadening wedge is a reversal pattern.

In 60% of cases, a descending broadening wedge’s price objective is achieved when the resistance line is broken.

In 21% of cases, the price makes a pullback in support on the descending broadening wedge’s resistance line.

I also feel its important to add the staking on this is crazy, and comes from margin fees. app.gmx.io its about 80% at time of post.

trading the decending channel for 300% (long)The descending channel pattern (also called the falling channel) is a bearish chart formation. It develops within pronounced downtrends in asset pricing.

Forex traders view descending channels as evidence of weakened strength in the counter currency. Accordingly, it is frequently used to sell a currency pair and join the prevailing market downtrend.

It appears as two parallel lines in a downward trend, forming resistance and support levels for the price. The upper boundary is formed by connecting the lower highs, while the lower boundary comes from connecting the lower lows.

The descending channel is strictly a bearish chart formation. But it has a bullish alternative called the ascending channel, where everything is completely opposite.

Contrary to trend-following strategies, descending channels may also be used to project a shift in a prevailing bearish trend. This is done by waiting to buy the market on price breaks above the channel’s upper extreme.

To trade reversal breakouts, you buy the market above the upper trend line. In doing so, a new long position is opened. Stop-loss orders are placed beneath the channel, and profit targets are located above the channel.

#1 – Trade the Breakout

One method is to trade the breakout of the channel. This breakout can be to the upside, but also to the downside. This setup is going to be the toughest of the three to trade, due to the false breakouts which occur in the market at a high frequency.

Breakout to the Upside

A breakout to the upside means there is a possible shift from a bearish sentiment to bullish. This strategy will have you buying the break above the channel. It’s recommended that buying into this break should occur after multiple tests of the upper channel line. Reason being breakouts early on in the channel often lead to traps as shorts push the price of the stock back down to the lower end of the channel.

#2- Short the Test of the Top of the Channel

Channels are better suited for traders that place trades within the range. The top of the channel is also known as the overbought territory for all of you Wyckoff traders out there.

This means that as a stock approaches the upper channel, there is a high probability of price returning inside of the channel.

For this strategy, you will place your sell order at the top of the channel and then cover your position as the stock moves in your favor. There is no guarantee the stock will make it all the way back to the support channel, so you need to be prepared for anything.

Also, the price action for stocks trading in channels is often slow and boring. Therefore the trading action will appear erratic at times as price marches to its own beat. This will give you a number of false signals, and head fakes as the action plays out within the channel.

This is why again it’s better to cover as things go in your favor and remember to exercise patience

#3 – Buy the Test of the Bottom of the Channel

Buying the test of the lower portion of the channel can get tricky. This is because you are knowingly buying a stock that is in a weak position. Therefore, you need to tread the waters with caution. That doesn’t mean you can’t take action but you have to be prepared that the stock may not bounce and could just ride the lower portion of the channel lower with no reaction back to the top line.

this trade will utilize number 3 gl guys...

GMXUSDT 30%+ Short opportunity here?I found a possible short opportunity here in one of the largest up-trending tokens in the last 24 hours. You can see by all the previous structure of what I call the EMA (solid red smoothed Heikin Ashi candles) and how the actual price behaves when it break up through the mean. It is short lived (2-4 days) and the average move down is 35.94%.

Keep in mind to have a plan to add to your short if it move higher against you first, so spread a series of smaller short limit orders across 18% above the MA break would be what I am doing. I generally like to fill one short first, and let the price come to my better series of entries. Thus, averaging my entry and this gives me the opportunity to get out if price continues to move up. As I can get out on a retrace at break even or a small profit. Do not attempt this strategy unless you place small orders, don't go higher than 10x leverage and commit to managing the trade for multiple hours to get out unscathed. Something I would do at the start of my trading session, not when I need to get some sleep.

But this strategy works. I am nobody special and currently the #2 lead trader on Bitunix for copy trading at time of writing.

There are two lower highs on the 1H right now! So this is a high probability of profit.

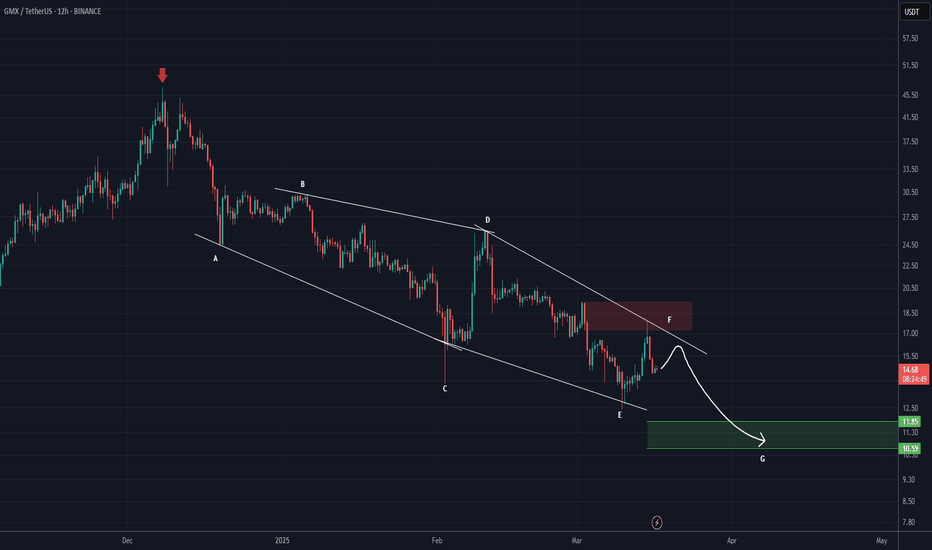

GMX is Still Bearish (12H)From the point where we placed a red arrow on the chart, it appears that GMX has entered a bearish diametric pattern.

It now seems that wave F is nearing completion.

The target is marked on the chart. it could be the green target box. If a daily candle closes above the upper red box, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

GMX/USDTHello friends

Due to the heavy price drop on the indicated support, buyers have provided good support for the price, which has caused a good price growth.

Now you can buy in steps in the indicated support areas.

If you want to be with us in the Alt Season, send us a message.

*Trade safely with us*

GMXUSDT UPDATEGMXUSDT is a cryptocurrency trading at $15.52. Its target price is $30.00, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about GMXUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. GMXUSDT is poised for a potential breakout and substantial gains.

GMX/USDT 1W🩸 TSX:GMX ⁀➷

#GMX_IO. Macro chart Another

💯 Intermediate Target - $67

🚩 Macro Target 1 - $94

🚩 Macro Target 2 - $148

🚩 Macro Target 3 - $220

- Not financial advice, trade with caution.

#Crypto #GMX_IO #GMX #Investment

✅ Stay updated on market news and developments that may influence the price of GMX_IO. Positive or negative news can significantly impact the cryptocurrency's value.

✅ Exercise patience and discipline when executing your trading plan. Avoid making impulsive decisions driven by emotions, and adhere to your strategy even during periods of market volatility.

✅ Remember that trading always involves risk, and there are no guarantees of profit. Conduct thorough research, analyze market conditions, and be prepared for various scenarios. Trade only with funds you can afford to lose and avoid excessive risk-taking.

#GMXUSDT at a Key Level: Reversal Up or Further DropThe BYBIT:GMXUSDT.P price is consolidating after a sharp decline and is currently hovering around $19.870. A breakout above resistance or a drop below support will define the next move.

Two possible scenarios:

🔵 Bullish scenario: Holding above $20.480 activates a long setup towards $22.025.

🔴 Bearish scenario: Losing $19.220 confirms a short setup towards $18.040.

⚡ Best approach – place both scenarios in your watchlist and wait for confirmation.

⚡ This allows traders to avoid guessing and enter only after confirmation.

⏱ 1H Timeframe

━━━━━━━━━━━━━━━━━━━━━━

📈 LONG BYBIT:GMXUSDT.P from $20.480

🛡 Stop Loss: $19.870

✅ Overview:

➡️ BYBIT:GMXUSDT.P is stabilizing around $19.870 - $20.065 (POC), the key liquidity zone.

➡️ The price is attempting a recovery but hasn’t broken $20.210 yet.

➡️ A confirmed breakout above $20.480 would open the way toward $21.250 and $22.025.

⚡ Plan:

✅ Bullish confirmation requires a breakout above $20.480 and consolidation.

✅ Monitor reaction at $20.065 (POC) – the key volume zone.

✅ If the breakout is weak, a pullback to $19.770 is possible.

📍 Take Profit targets:

🎯 TP1: $21.250 – local resistance.

💎 TP2: $22.025 – main profit-taking zone.

🚀 BYBIT:GMXUSDT.P is testing a key level — waiting for a breakout signal!

━━━━━━━━━━━━━━━━━━━━━━

📉 SHORT BYBIT:GMXUSDT.P from $19.220

🛡 Stop Loss: $19.770

✅ Overview:

➡️ If the price fails to break $20.065 and starts dropping, a test of $19.220 is expected.

➡️ A breakdown below $19.220 could trigger a move toward $18.655 and $18.040.

➡️ Volume indicators suggest possible distribution, increasing bearish pressure.

⚡ Plan:

✅ Bearish confirmation requires a break below $19.220 and consolidation.

✅ Watch reaction at $19.770 – if it holds, a reversal could form.

✅ If selling pressure increases, the drop could accelerate.

📍 Take Profit targets:

🎯 TP1: $18.655 – intermediate support.

💎 TP2: $18.040 – deep correction.

🚀 BYBIT:GMXUSDT.P is at risk of a breakdown — expecting a move to $18.040!

GMX Ending Diagonal

Based on the continued drop, I've switched my count to and ending diagonal, and we'd currently be in black 5 to end this downtrend cycle.

There are no bullish signals in place yet. A break of the mid-channel green trendline resistance would be a good indicator that the trend has reversed.

GMX Update

I am now considering GMX is making a more complex pattern, with multiple ABCs. It could be the initial wave of a leading diagonal, but at this moment it's just guesswork.

In the shorter term, I'm waiting for a break of the descending wedge which could signal the end of black C.

Bullish RSI divergence is already present, but without a higher high, it will just sit on my watchlist for now.

GMXGMX/USDT Analysis

📊 Introduction

GMX token is considered one of the high-risk assets in the cryptocurrency market, as its relatively low market cap leads to significant price volatility. However, GMX has attracted considerable attention from investors due to its high growth potential in areas related to DeFi and decentralized contracts. In this analysis, we will examine GMX's price structure within a descending channel and explore the possible scenarios ahead.

🔎 Technical Analysis

Overall Trend in the Descending Channel

Channel Structure: GMX is currently moving within a descending channel and has experienced a sharp price correction after hitting the upper boundary of the channel.

Key Levels:

Resistance Zone (Yellow): The range of $26.50 - $27.26, a break above which could pave the way for a bullish move.

Midline of the Descending Channel: This level plays a crucial role in determining the current trend, and breaking above it would be a strong indication of buyer dominance.

Bullish Scenario (Breakout of Resistance Zone)

If the price breaks the yellow resistance zone and stabilizes above it, a bullish move is likely to gain momentum.

After breaking both the resistance and the midline of the channel, the price will approach the upper boundary of the channel. A breakout here could lead to further upward movement towards target levels.

Take Profit Targets (TP):

TP1: $44.57 - $47.86

TP2: $57.68 - $61.98

TP3: $77.88 - $82

🔍 Key Insight: Due to GMX’s low market cap, a significant influx of liquidity could push the price even beyond these targets.

Relative Strength Index (RSI)

The RSI moving above the midline serves as a critical confirmation, signaling bullish momentum alongside the breakout from the resistance zone and the midline of the descending channel.

Volume

An increase in trading volume during the breakout of the resistance zone and midline is crucial. High volume can prevent fake breakouts and provide confirmation for the continuation of the bullish trend.

🔒 Risk Management Key Points

Suggested Entry Point:

Enter after the breakout of the yellow resistance zone ($26.50 - $27.26) and price stabilization above it.

Stop Loss (SL):

Place the stop loss below the lower boundary of the descending channel to mitigate the risk of potential volatility.

Trade Volume Management:

Given GMX’s high volatility and inherent risk, the trade volume should be adjusted according to the investor's risk tolerance.

✨ Final Conclusion

The analysis suggests that GMX token has significant growth potential, especially if key resistance levels are broken and new liquidity flows into the market. However, monitoring technical confirmations (such as RSI and trading volume) and staying alert to market trends are crucial for successful trade entry.

#GMX (SPOT) IN ( 21.00- 24.50) T.(83.00) SL(19.73)BINANCE:GMXUSDT

#GMX/ USDT

Entry( 21.00- 24.50)

SL 1D close below 19.73

T1 34.00

T2 44.00

T3 62.00

T4 83.00

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP #ROSE #NEO #EGLD

GMXUSDT: Buy Zones in Chaos! GMXUSDT: Buy Zones in Chaos! 💎

Blue box looks okey but green line will probably come.

When the market crumbles, opportunities arise. GMXUSDT is no exception.

Blue Box Zone: This is where I’ll take action. If the price reaches this carefully selected area, it’s a solid buying opportunity.

Remember, trading during such volatile times requires confirmation. Tools like CDV, volume profile, and structure breaks on lower time frames are essential.

Stay calm, stay calculated, and let’s make the most of this chaos. Boost, comment, and follow for more winning strategies! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

#GMX (SPOT) IN (29- 33) T. (85) SL(27.19)BINANCE:GMXUSDT

#GMX / USDT

Entry (29- 33)

SL 4H close below 27.19

T1 35

T2 36

T3 42

T4 85

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX

GMXUSDT: 550% Profit PotentialGMXUSDT on the 4-hour timeframe is exhibiting a strong bullish setup with a potential 550% profit at 10x leverage. This long trade opportunity, identified using the Risological Swing Trading Indicator , is positioned to deliver significant returns. The price has broken through key resistance levels, confirming upward momentum.

Key Levels:

Entry: $29.525

SL: $26.955

TP1: $32.695 🔄

TP2: $37.825 🔄

TP3: $42.960 🔄

TP4: $46.130 🔄

Technical Analysis:

The trade commenced at $29.525, with a protective stop-loss at $26.955, ensuring a favorable risk-to-reward ratio. The price action has remained firmly above the Risological trend line, underscoring the strength of the current uptrend. Fibonacci extensions validate the profit targets, while the breakout above resistance levels signals a likely continuation to the upper targets. This setup demonstrates the precision and reliability of the Risological Swing Trading Indicator in identifying high-potential opportunities with controlled risk.

All the best!

Namaste!

#GMX: Profiting From Decentralized PerpetualsDescription:

This trading idea highlights GMX, the utility and governance token of the GMX protocol, a leading decentralized exchange for perpetual contracts and spot trading. GMX enables traders to execute leveraged positions with low fees and zero price impact, providing a unique value proposition in the DeFi ecosystem. The platform’s innovative architecture and its focus on transparency and security have garnered a growing user base and increased adoption. Additionally, GMX token holders benefit from protocol revenue sharing, further enhancing its appeal as a long-term asset.

Despite its potential, it’s important to recognize that the cryptocurrency market is highly volatile, with prices subject to significant fluctuations due to external factors such as regulatory changes, market sentiment, and macroeconomic trends. Investing in GMX requires careful consideration and a disciplined approach to risk management.

Disclaimer:

This trading idea is for educational purposes only and does not constitute financial advice. Trading cryptocurrencies like GMX involves significant risks, including the possibility of complete loss of capital. Always conduct thorough research, evaluate your financial position, and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

What currencies are Trend 2025?hello friends

This altcoin, which is active in the field of DEFI and can grow well in 2025, is now in a good range with the correction it has made, so it is a step to buy.

The second step is the lower range that we specified for you.

Note that DEX tokens can experience good growth in 2025.

So be sure to have it in your basket.

Be successful and profitable.