GOATUSDT Retest at Key Demand Zone – Accumulation or Breakdown?🔍 Comprehensive Technical Analysis

After experiencing a prolonged downtrend since late 2024, GOATUSDT finally broke out of a long-term descending trendline in early May 2025 — a potential early signal of a medium-term trend reversal. However, the price has now pulled back, retesting a major support zone that coincides with the previous breakout structure.

---

🧱 Key Zone: Demand Area + Trendline Retest

Price is currently trading within a crucial demand zone between $0.090 – $0.100, which previously acted as a major resistance and now serves as support. This area is technically significant due to:

Confluence of horizontal support and the retest of the descending trendline.

A previous accumulation zone that led to a breakout.

Clear historical buyer reaction from this region.

---

📐 Price Structure & Pattern

Descending Triangle Breakout: Successfully broken to the upside in May.

Support-turned-Resistance-turned-Support: A classic structure flip.

Horizontal Consolidation: Price is ranging in a narrow zone, indicating either accumulation or distribution.

---

🐂 Bullish Scenario (Potential Rebound):

If the price holds and bounces with increased volume from the $0.090 – $0.100 zone, it could confirm a strong accumulation phase and initiate the next leg up.

🎯 Bullish targets:

1. $0.15745 — Minor resistance

2. $0.21071 — Psychological and technical resistance

3. $0.24889 — Fibonacci extension level

4. $0.41017 — Mid-term breakout target

> Bullish confirmation: Bullish engulfing or hammer candle with high volume from the demand zone.

---

🐻 Bearish Scenario (Breakdown Risk):

If the price breaks below $0.093 and closes with strong bearish volume, this may confirm weakness and trigger a deeper correction.

📉 Downside targets:

$0.06500 — Minor historical support

$0.04900 — Previous base level

$0.03550 — All-time low (critical support)

> Bearish confirmation: Clean breakdown followed by a failed retest back into the range.

---

📊 Strategic Summary:

GOATUSDT is currently at a pivotal decision point. The zone between $0.093–$0.100 acts as a battleground for bulls and bears. A bounce could signal accumulation and a bullish reversal, while a breakdown could lead to continuation of the bearish trend.

🎯 Key focus: Price action and volume reaction at the demand zone.

---

🧲 Bullish Narrative Catalysts:

Renewed interest in low-cap altcoins

Gradual increase in volume since the breakout

Selling pressure weakening near key support

#GOATUSDT #CryptoBreakout #TrendlineRetest #TechnicalAnalysis #AltcoinAnalysis

#DemandZone #SmartMoneyConcepts #BreakoutOrFakeout

GOATUSDT trade ideas

GOAT / USDT : Watch closely for a breakdownGOAT/USDT - Watch Closely!

Currently testing the critical support trend line.

Bullish Scenario: If it holds here and bounces, we could see a potential upward move.

Bearish Scenario: A breakdown below this support would confirm further downside, and I'd be leaning bearish in that case.

Pro Tip: Wait for confirmation before entering – either a strong rejection off support for bullish entry or a clean break for a bearish setup.

Stay alert and trade wisely!

GOAT Looks Bullish (12H)It seems that a wave A of a higher-degree structure has completed, and the price is forming a triangle at the bottom, preparing for an upward movement in the form of either a wave B or a new impulse wave. Since this wave belongs to a higher degree, we expect the upcoming bullish wave to take time and show a significant upward retracement.

Try to avoid entering during pumps, and instead focus on entries during price corrections.

As long as the green zone holds, the price has the potential to move upward.

A daily candle closing below the invalidation level will invalidate this outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

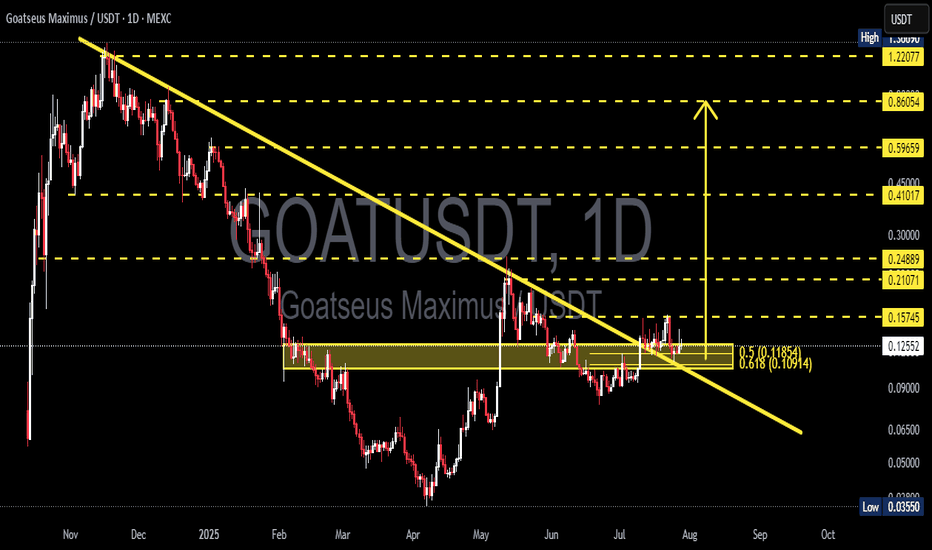

GOATUSDT Breakout Retest: Ready for the Next Bullish Leg?The daily chart of GOATUSDT reveals a significant technical development as price breaks out of a long-term descending trendline and is now performing a crucial retest of a key support zone. This movement is attracting attention from swing traders and mid-term investors alike.

---

🔍 Pattern Analysis & Market Structure

Main Pattern: Breakout from a long-standing descending trendline (yellow line) that has capped price action since November 2024.

Key Consolidation Zone: A visible accumulation area (yellow box) between 0.10914 (Fib 0.618) and 0.11864 (Fib 0.5), now being retested as new support.

Fibonacci Retracement: Applied from the peak to the bottom to identify logical target zones and potential resistance.

Breakout Confirmation: Price cleanly broke above the trendline, pulled back to retest support, and is showing signs of holding — a potential bullish continuation signal.

---

🟢 Bullish Scenario

If price holds above the 0.11–0.12 zone:

The breakout is validated and opens room for a continued rally.

Key upside targets based on Fibonacci levels:

🔼 0.15745 – first resistance

🔼 0.21071 to 0.24889 – mid-range resistance cluster

🔼 0.41017 to 0.86054 – longer-term price targets

Bullish confirmation via price action or volume spikes can solidify this outlook.

---

🔴 Bearish Scenario

If price fails to hold the support zone:

A breakdown below 0.10914 invalidates the breakout, indicating a false breakout trap.

Downside targets may include:

0.09000 – local support

0.06500 and 0.03550 – major historical support zones

This scenario would likely reignite bearish momentum.

---

⚠️ Conclusion

GOATUSDT is currently at a critical technical crossroad. The recent breakout and retest could signify a structural trend reversal. If the current support holds, the potential for upside is significant. However, a failure here could lead to deeper correction or consolidation.

---

📌 Key Levels to Watch:

Support: 0.109 – 0.118

Resistance: 0.15745 / 0.21071 / 0.24889 / 0.41017

#GOATUSDT #CryptoBreakout #TechnicalAnalysis #AltcoinSeason #TrendlineBreakout #SupportResistance #FibonacciLevels #SwingTrade #PriceAction #CryptoTA

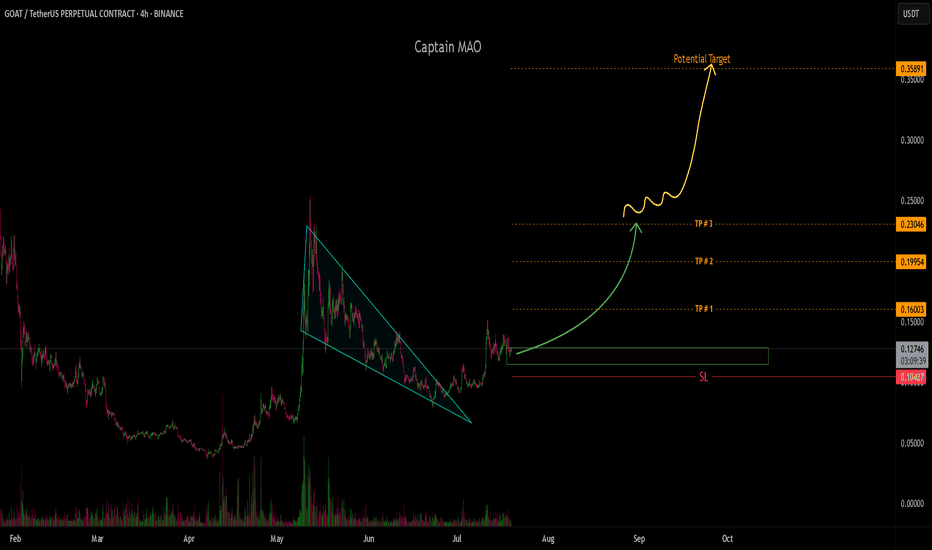

IS it a time for GOATUSDT? 100% potential profit TP - 0.24 $After an extended downtrend, the 4-hour chart of Goatseus Maximus (GMAX) / USDT is showing signs of stabilization and a potential trend reversal. The price has found support in the $0.11–$0.12 range, where accumulation appears to be taking place — characterized by higher lows and an early structure of upward movement.

The WaveTrend (WT_LB) indicator is currently in the oversold zone and beginning to turn upward. This behavior often suggests that selling pressure is weakening and the market may be preparing for a bullish move. A green cross on this indicator can be interpreted as an early buy signal.

Additionally, the moving averages (MA 10, 30, 60, and 120) are starting to flatten out, indicating a potential transition out of the previous downtrend. If the price can break and hold above these averages, it may trigger increased buying interest and momentum.

From a technical standpoint, the $0.14 level remains a key short-term resistance. A successful breakout above this level could open the way for a move toward $0.18, followed by a potential run-up to $0.24, which previously acted as a significant resistance zone and rejection point.

In summary, the current technical setup suggests that if bullish momentum continues and key resistance levels are broken, a move toward $0.24 is achievable in the mid-term.

Potential TP: 0.24 USD

GOATUSDT 1D#GOAT is currently retesting the broken descending trendline along with the daily SMA50, both aligning with the key support zone marked on the chart — and so far, it's holding well.

📌 In case of a successful bounce from this zone, the potential upside targets are:

🎯 $0.16803

🎯 $0.20650

🎯 $0.25008

🎯 $0.31640

🎯 $0.38272

🎯 $0.47713

🎯 $0.59740

⚠️ As always, use a tight stop-loss and practice proper risk management.

GOAT/USDT - LOCAL TOPholding strong above the 0.11 price zone, showing signs of re-accumulation between 0.11 – 0.133. The bullish market structure remains intact, with buyers defending key support and gradually pushing price upward.

This consolidation phase suggests that GOAT is gearing up for a move back toward the previous local top and potentially higher.

GOAT/USDTKey Level Zone: 0.11750 - 0.11850

LMT v1.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

GOAT – Symmetrical Triangle Meets Bearish Pennant (4H & 2H)📉 MIL:GOAT is showing compression across timeframes:

🔹 On the 4H chart, it's hugging the lower trendline of a symmetrical triangle — support test in action.

🔸 Meanwhile, the 2H chart is shaping into a bearish pennant — pressure is building fast.

⚠️ This is a decision point. A bounce keeps structure intact, but a breakdown could trigger deeper downside.

👁️ Watch closely — next move may set the tone for short-term momentum.

First MEME coin created by AI Agent - GOATGoatseus Maximus Aka GOAT, currently traded around $0.85 with all time high of $1.35 at 17th November 2024. GOAT also faced significant corrections today.

Current lower time frame chart 4H, I can see there is possible breakout and the price action will be back to $1 soon. I think this is the last chance to buy GOAT.

Note: As moneys are currently flowing in CRYPTOCAP:BTC , expect some will flow to others utility and bluechips coins, such as CRYPTOCAP:ETH , CRYPTOCAP:SOL and the previously dethroned $XRP.

GOAT ANALYSIS (6H)It seems that GOAT is completing its corrective waves. This correction appears to be a double correction.

The second part of this correction looks like either a diametric or a symmetrical pattern.

There is potential for rejection toward the green zone if it reaches the red zone.

A daily candle closing above the invalidation level will invalidate our bearish outlook.

invalidation level: 0.17751

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Goatseus Maximus GOAT$GOAT – Memecoin Breakdown

🔹 Price: $0.1005 (+0.11%)

🔹 Market Cap: $100.51M (+0.11%) | FDV: $100.51M

🔹 24h Volume: $43.48M (+134.27%) | Vol/Mkt Cap: 43.26%

🔹 Network: Solana | Max Supply: 1B GOAT

📜 History & Phenomenon

Goatseus Maximus (GOAT) is a memecoin created by the AI bot Truth Terminal, which became famous in the crypto community for its meme-posting. Inspired by the satirical Goatse Gospel, the token quickly skyrocketed past SEED_TVCODER77_ETHBTCDATA:1B in market cap, becoming the first Pump fun project to hit this milestone.

AI Truth Terminal promoted MIL:GOAT so aggressively that it even caught the attention of Marc Andreessen #a16z , who sent the bot $50,000 in BTC. The token’s hype led to its listing on #Binance Futures, fueling further speculation.

📈 Prospects & Risks

✅ Highly engaged community, cult-like meme status

✅ Growing interest – strong trading volume dynamics

⚠ Extreme volatility, no intrinsic value

💡 Conclusion

GOAT is a pure memecoin created by an AI that went viral due to its absurd backstory. It's an interesting speculation asset but requires caution. 🚀

GOAT found a bottom?GOAT price has fallen past the data on this chart so hard to get any confluence with any previous support levels. Maybe there are none.

On lower timeframes there is some bullish action so just a wait and see for me for now.

If price retraces but continues bullish momentum (i.e. HL) there's opportunity to enter long with a stop below the previous low.