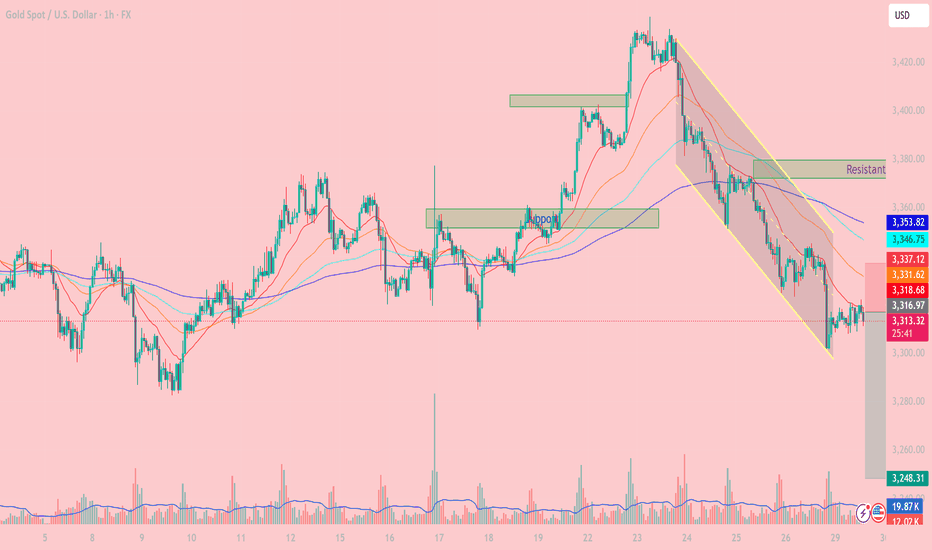

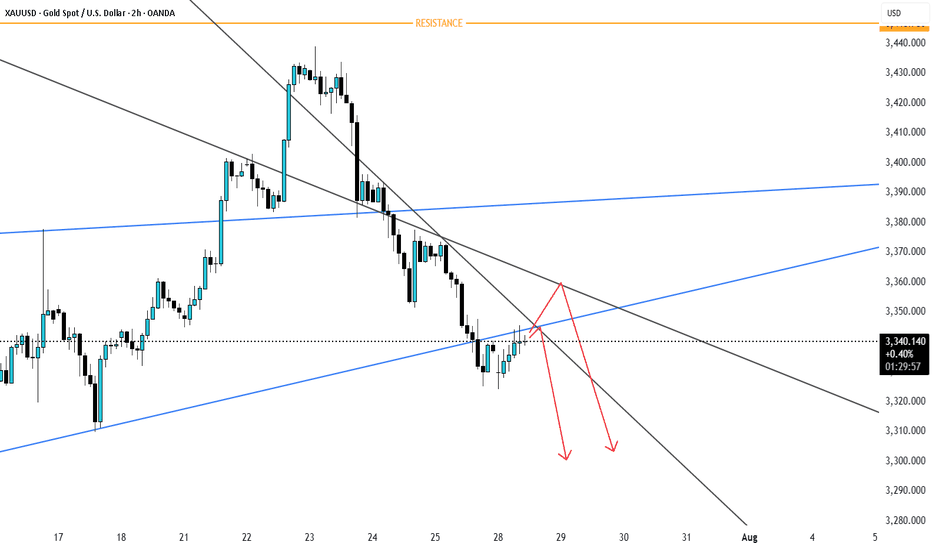

Downward Pressure Resumes After Channel BreakdownXAUUSD OANDA:XAUUSD – Downward Pressure Resumes After Channel Breakdown: Key Levels and Strategy for Today

As of the July 29 session, gold (XAUUSD) remains under short-term bearish pressure, having broken below the descending price channel on the 1H timeframe. The market structure confirms a dominant bearish trend as price continues to trade below the EMAs cluster.

1. Price Action and Market Behavior

XAUUSD is forming a clear sequence of lower highs and lower lows, confirming a short-term downtrend.

Price is currently hovering around $3,316 after breaking below the lower boundary of the channel, signaling potential continuation of the sell-off.

2. Key Resistance and Support Levels

Immediate resistance: 3,337 – 3,346 USD (aligned with EMA20, EMA50 and prior channel resistance).

Major resistance: 3,378 – 3,385 USD (confluence of Fibo and former high).

Near-term support: 3,300 USD (psychological level).

Major support: 3,248 USD (projected target based on measured move from channel height).

3. Technical Indicators

EMA20 and EMA50 are both below EMA200, forming a classic “death cross” – a strong bearish signal.

Volume increased on the breakdown, reinforcing the strength of bearish momentum.

RSI remains below 50, indicating weak bullish retracements and room for further downside.

4. Trading Strategy

Primary Strategy: Sell on Rally

Ideal entry zone: 3,331 – 3,346 USD.

Stop Loss: Above 3,353 USD (above key resistance zone).

TP1: 3,300 USD.

TP2: 3,248 USD (extended target based on breakout structure).

Alternative Strategy: Countertrend Long

Only consider buy setups if strong reversal candles and bullish RSI divergence appear near 3,248 USD.

XAUUSD continues to face downside risk after the channel breakdown. Unless bulls reclaim the 3,337 – 3,346 zone, price is more likely to drift lower toward 3,300 and potentially 3,248. Traders should remain patient and wait for clean setups around these key zones.

Follow for more strategies and remember to save this post if you found it helpful.

Let me know if you'd like a short version for the TradingView caption or hashtags suggestion.

GOLD trade ideas

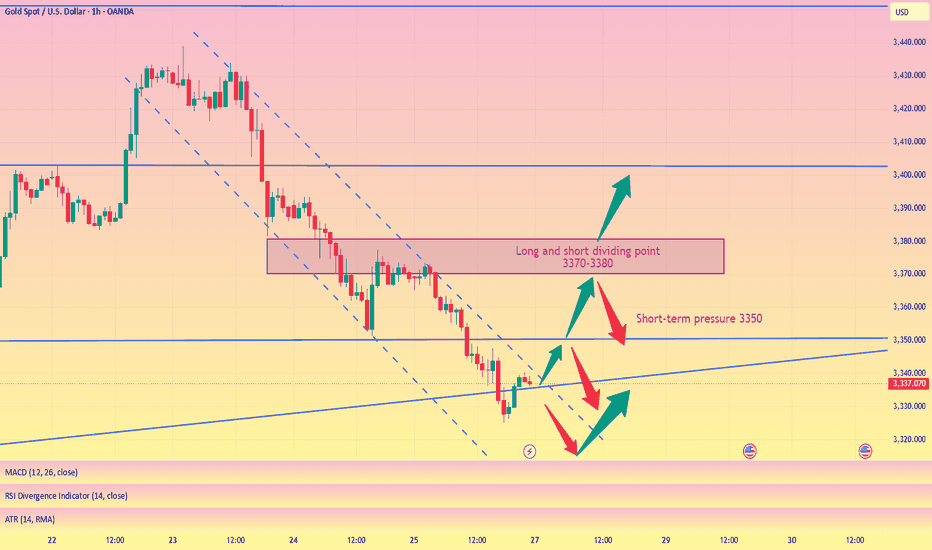

Gold fell below support. What will be the subsequent trend?The 1-hour moving average of gold continues to show a downward short position, indicating that the downward momentum is still sufficient; the wave pattern of gold's current decline remains intact, but the rebound strength is very weak, showing an obvious short trend of gold. Moreover, when gold rebounded in the short term, obvious resistance began to form above 3320, and the upward momentum was slightly insufficient.

From the daily chart, before 3300 fails to fall, it is likely to fluctuate around 3300-3350. On the contrary, if it falls below 3300, it is likely to reach the bottom of the 3385-3375 range.

This week is a super data week. The data of each day may affect the trend of gold on that day, but it will not form a unilateral strong trend. Therefore, the volatility before and after the data is released is likely to be large, so traders should focus on the following data:

1. US ADP employment report, US second quarter GDP preliminary value;

2. Federal Reserve interest rate decision;

3. US PCE annual rate, monthly rate;

4. The last trading day of this week will usher in non-agricultural data.

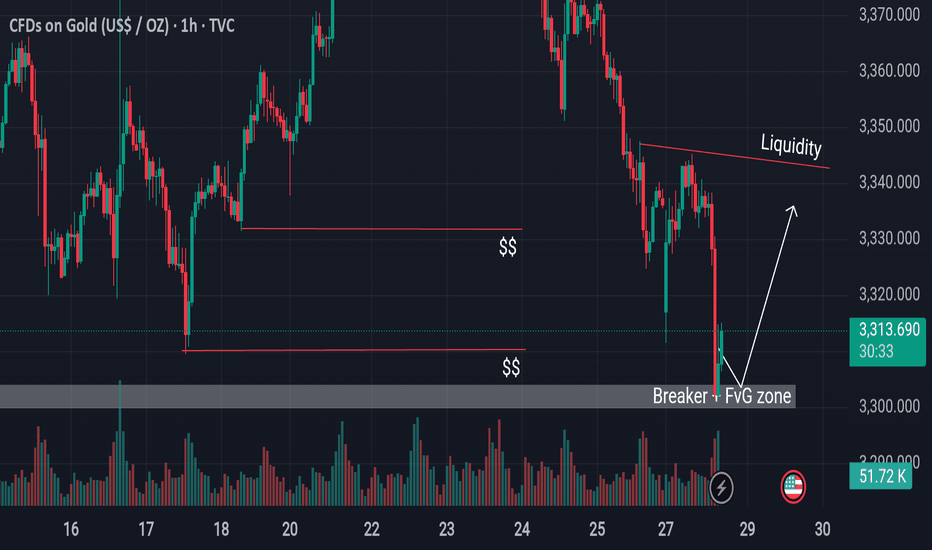

Institutional Footprint Detected Gold Hits FVG + Breaker Block.GOLD has now entered a significant confluence zone, aligning with both a bullish Fair Value Gap (FVG) and a breaker block areas commonly respected by institutional algorithms. In the process, it has also swept sell-side liquidity resting below recent lows, which often serves as fuel for a reversal. This combination of technical factors suggests a high-probability scenario for a bullish bounce from this region.

Traders should closely monitor price behavior around the marked Equal Relative Liquidity (ERL) zone for additional confirmation before executing any trades.

Always conduct your own analysis (DYOR) and manage risk accordingly.

Monday market forecast and analysis ideas#XAUUSD

There will be a lot of data next week, such as the 8.1 tariff deadline that I have repeatedly emphasized, the Federal Reserve decision, NFP data, etc. It can be said that it is relatively difficult to analyze purely from a technical perspective, because there is uncertainty in many data, the data results are often non-linearly correlated with market reactions (good news does not necessarily lead to a rise, and bad news does not necessarily lead to a fall), and large fluctuations can easily form oscillating K-lines with long upper and lower shadows. Therefore, the first arrangement for next week is to participate in trading with a light position and avoid letting emotions control your thinking.

The closing price on Friday was near 3337, proving that the short-term judgment on the rebound momentum of gold is correct, so there are two possible situations on Monday.

1. The first thing we need to pay attention to is 3345-3350 to determine whether it constitutes a short-term pressure level. The weekly line closed with a negative cross star. Combined with the monthly line trend, in terms of support, focus on the trend line support near this week's low of 3325. If this position is not broken, the market is expected to usher in a wave of rebound; if it falls below 3325, the bottom may look to 3310 or even 3295 for support.

2. The rebound momentum of Friday continued on Monday, breaking through 3350 first, and then it is possible to reach the previous high resistance area of 3370-3380. If it encounters resistance here, gold will continue to fall and fluctuate, and the target may even be 3310. If the price remains strong and issues such as interest rate cuts and tariffs are imminent, it means that the short-term downward trend has ended and may even set a new high.

The above content is only a forecast for Monday’s market. It will be greatly affected by data and news, and may be adjusted in real time next week based on intraday trends. You can refer to this, but remember not to be swayed by emotions. We will participate with a light position, and the specific trading strategy can wait for my trading signal.

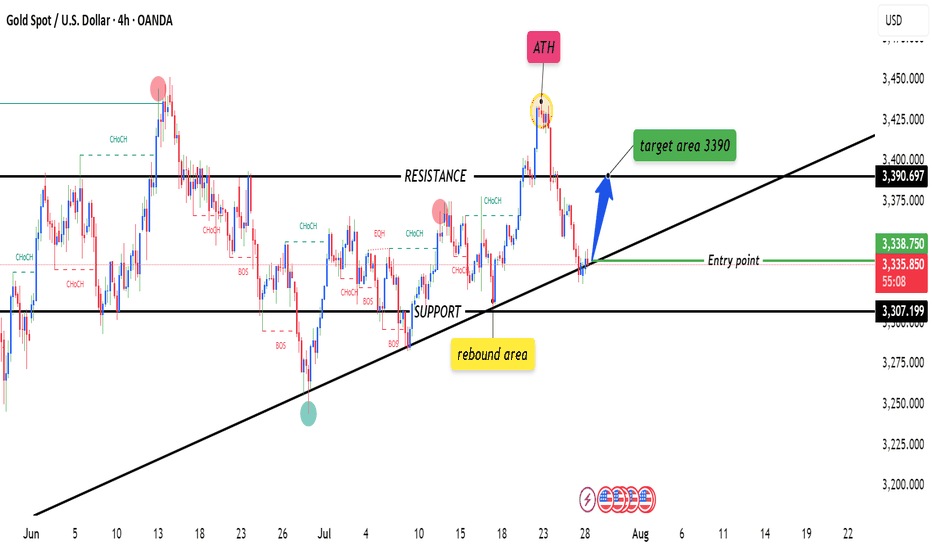

XAUUSD 4HOUR TIME FRAME ANALYSISOn the 4-hour chart, XAUUSD has recently pulled back into a well‐defined demand zone just above 3 330, offering a low-risk entry around 3 338. Here’s how the setup looks:

Trend Context

• Over the past week, gold has carved out a gentle up-slope, tracing higher highs and higher lows from 3 300 up toward 3 395.

• Price dipped back to test the rising 50-period moving average.

Key Levels

• Entry (3 338): Aligns with the confluence of the 50-period MA and a horizontal support zone (3 330–3 340), where buyers staged a rally earlier in the week.

• Stop-Loss (3 307): Placed just beneath the swing low at 3 315 and below the trendline connecting the last two higher lows—giving room for noise while protecting against a deeper reversal.

Momentum & Oscillators

• RSI (14): Currently around 45, rising from the 40 region. This suggests bearish exhaustion is waning and room remains before overbought conditions.

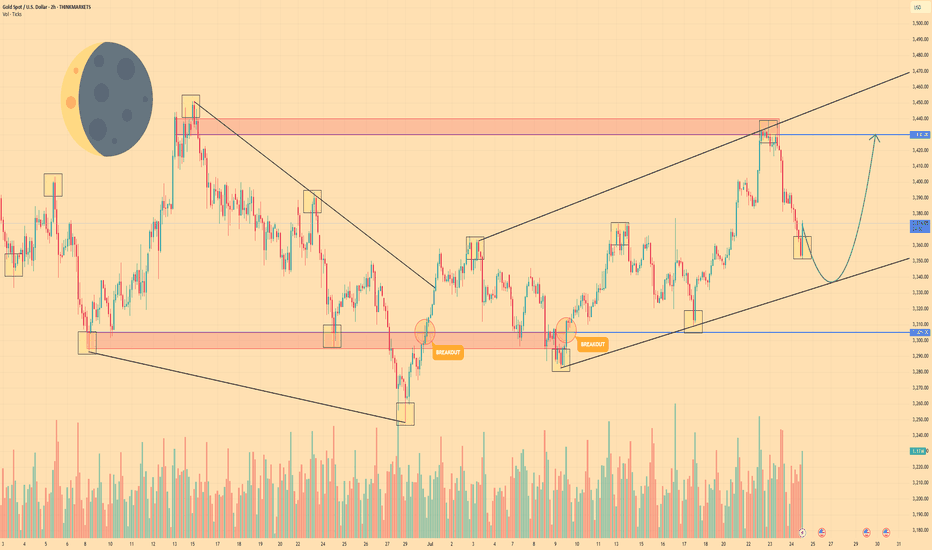

GOLD - Price can make correction and then bounce upHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

The price has been developing within a broadening wedge formation for some time.

This pattern began after the asset found strong support in the key zone around the $3305 level.

Within this structure, buyers recently pushed the price upwards in a notable impulse wave.

This impulse culminated in a test of the wedge's upper boundary and the resistance area near $3430.

After being rejected from that resistance, the price is now in a corrective decline towards the lower trendline.

I expect that this correction will find its footing on the lower boundary, leading to a rebound and a new rally towards the $3430 resistance.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Gold Analysis and Trading Strategy | August 1✅ Fundamental Analysis

🔹 Trump Signs New Tariff Executive Order

On July 31, President Trump signed an executive order imposing a new round of tariffs on countries including Canada and India, while Mexico was granted a 90-day grace period. This move has once again heightened global trade uncertainty, fueling risk-off sentiment and providing support to gold.

🔹 Dollar Strength Limits Gold's Upside

Despite the increase in risk aversion, the U.S. Dollar Index has risen sharply, exerting downside pressure on gold. As a result, the price of gold remains capped, with a tug-of-war between bulls and bears dominating market dynamics.

🔹 Key U.S. Economic Data in Focus

The U.S. Non-Farm Payrolls (NFP) report is the major event on the calendar today. It is expected to be a decisive driver for short-term gold direction:

If the data is bullish for gold (e.g., weak job growth or slower wage increases), gold may retest the 3340 level.

If the data is bearish for gold (e.g., strong job gains or higher wages), gold may break below 3260, continuing its downward trend.

Ahead of the data release, gold is likely to remain in a consolidation range, with market participants generally adopting a cautious stance.

✅ Technical Analysis

🔸 Daily Chart Structure:

Gold printed a gravestone doji yesterday, characterized by a long upper shadow, indicating strong selling pressure at higher levels. The overall trend remains weak. After four consecutive daily declines followed by a minor rebound, another strong bearish candle has emerged, signaling a continuation of the downtrend.

🔸 Hourly Chart Structure:

On the 1-hour timeframe, gold remains below all major moving averages, which are aligned in a bearish formation. Despite multiple rebound attempts, each high has been lower than the last, reflecting diminishing bullish strength. The second U.S. session high was capped around 3310. If today's rebound fails to break above that level, the bearish trend remains dominant.

🔴 Resistance Levels: 3305 / 3315 / 3340

🟢 Support Levels: 3275 / 3260 / 3245

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3305-3310 area. Target: 3285-3270;If support breaks, the move may extend to 3250.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3245-3250 area. Target: 3265-3275;If resistance breaks, the move may extend to 3285.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

Will gold continues the uptrend from now?I have notice that price retraces in 5 waves before continued go up, from Jun 2025 onwards until now (refer to chart above), and now price has went for 5 waves, and had break the last lower low level. I am going to anticipate the long with my strategy, projecting to higher high of this up trend.

MACRO CONTEXT & NEWS FLOW IMPACT — "WHY THE HELL IT MOVED"🔥 I. MACRO CONTEXT & NEWS FLOW IMPACT — "WHY THE HELL IT MOVED"

Yesterday’s move was a classic institutional fakeout followed by controlled accumulation. Today is retest day. Watch VWAP and order flow like a hawk. Don’t chase, wait for reversion and load at value.

📅 Date: July 30, 2025

📰 Event:

US Employment Cost Index: Lower than expected

Core PCE: Cooled off

Market Implication: Fed easing is now on the table.

DXY Weakens → Real yields drop → Gold gets bought like crazy.

👊 Institutional Logic:

Rate-sensitive assets (Gold, Bonds) exploded after the release.

Algorithmic reaction to macro signal: DXY down → XAU bid hard → MegaBar explosion.

BUT institutions needed liquidity to enter big → they faked a breakdown first.

That’s institutional deception 101.

📉 II. DAILY CHART ANALYSIS — THE BIG BOYS' GAMEBOARD

🗺️ Structure:

Price dropped from 3,355 to 3,258 in 3 days — a high-velocity markdown.

On July 30, Price printed a Megabar reversal (Massive range, delta-flush, volume spike).

VAH = 3,294.90 capped upside.

POC = 3,288.91, and VAL = 3,282.90 held beautifully.

🔍 Institutional Pattern:

This is a classic “Flush > Absorb > Mark-up” sequence.

Textbook from “Technical Analysis and Stock Market Profits”:

“Volume confirms intention, range confirms commitment. A wide bar with climax volume at low implies the exhaustion of sellers and transfer of ownership.”

🔑 Key Daily Stats:

📉 Delta Flush: -584K

🔁 Reversal Delta: +70K

🔊 Volume spike: >450K (Well above 30-day volume MA)

💡 Inference:

This bar did not print because of retail buying. It’s smart money rebuying from panic sellers.

⏱️ III. 4H / 1H TIMEFRAME: ORDERFLOW & REACCUMULATION

📌 4H Chart:

📍 Megabar with -191K delta near 3,258 (Volume: 191.14K)

Immediate absorption by dark blue and green delta bars — this was not retail reversal.

VWAP reversion in play — price gravitates toward 3,294 (VWAP anchor zone)

🔁 1H Chart:

Rapid stair-stepping: Each hourly candle had higher lows and strong deltas.

Volume built from super-POC 3,289 to super-VWAP 3,295.25.

Final hour: exhaustion wick → distribution into resistance.

🧠 Institutional Tactic:

They used Volume by Price congestion to hold price between FVRP bounds:

Low Volume Nodes (LVNs) = acceleration zones

High Volume Nodes (HVNs) = consolidation + absorption zones

🔍 IV. 15M / MICROSTRUCTURE — WHERE THE GAME WAS REALLY PLAYED

🔬 VWAP Stack Analysis:

VWAP: 3,294.61

D-VWAP: 3,289.30

Super-VWAP Cluster held price in check — real institutional price magnet.

🔄 Delta Flow (15m):

Delta climbed from -3.15K → +3.21K in 1.5 hours.

Imbalance flipped bullish near POC.

🎯 FPVR Mapping (Volume Profile Right Side):

Thickest distribution volume occurred at 3,287 – 3,295

Value tightly packed = fair price.

Institutions are loading in value, not chasing.

⚙️ V. INDICATOR & MOMENTUM SIGNALS — INSTITUTIONAL CONFLUENCE ZONES

Tool Signal

VWAP Anchored VWAP tagged and respected — classic institution level

SMA50 Capped daily move (3,342) — still a long-term bearish lid

HMA5/9 Bullish crossover on 15m/1H – signals momentum alignment

Volume MA Volume climax confirms effort at lows, signaling phase change

🔩 VI. TECHNICAL SEQUENCING OF EVENTS (STEP BY STEP)

Asia Session: Tight range, price floats around VAL (3,282)

London Session: Fake breakdown to 3,258 – traps late shorts

NY Pre-News: Choppy price action within FRVP range

Macro News Drop: Megabar → -191K delta flush

Next Candle: Delta flips +21.2K → Absorption confirmed

Price Walks Up: Controlled bid to VWAP

End of Day: Distribution at VAH → price capped by VWAP band

💣 Final move = algorithmic mean reversion + VWAP auction completion

🧬 VII. ADVANCED ORDERFLOW INTERPRETATION

⚔️ MEGABAR (The Trap Setup):

Volume = 191K+

Delta = -191K (yep, full-on flush)

What happened?

→ Late shorts + stop runs + SL hunters got rekt.

→ Institutions absorbed, switched algo, and reversed.

🧱 FVRP (Fair Value Range Profile):

Defined by VAL (3,282.90) and VAH (3,294.90)

Institutions play inside this range for risk efficiency

They accumulate low and distribute high within it

🔄 Delta Rotation:

Delta Rotation = Shift from Negative Accumulation → Positive Distribution

Classic rotation confirms phase transition

🧠 VIII. INSTITUTIONAL OBJECTIVE (WHAT THEY WANTED)

Primary Goal: Create liquidity void below → Enter large long positions

Secondary Goal: Return to VWAP zone and unload

Tertiary Goal: Signal to market: "We're in control, stay out or get punished"

This is textbook Volume Profile Auction Theory in motion.

🎯 IX. HYPOTHETICAL TRADE SETUP (EDUCATIONAL PURPOSE ONLY)

🧾 Trade Plan: Institutional VWAP Reversion Play

Order Type: Buy Limit

Entry: 3,287.00

Stop Loss: 3,279.00 (below VAL & invalidation)

Take Profit: 3,300.00 (Super-VAH zone)

Confidence: 85%

R/R: 1:1.6

💡 Justification:

Entry at POC + SMA50 cluster

Stop below structural invalidation zone

Target near major supply

This is the exact playbooks funds run during reaccumulation rotations

🧠 X. EDUCATIONAL TAKEAWAY — WHAT YOU SHOULD LEARN

Volume is truth. If volume spikes at lows, it’s not weak hands — it’s smart money flipping.

VWAP is magnet. Everything mean-reverts back to VWAP in controlled auctions.

Delta tracks aggression. Sharp delta reversals = algorithm switch.

Megabar = signal. Huge candle + volume + delta = possible phase shift.

FRVP = roadmap. Price doesn’t move randomly — it moves to balance imbalances.

🔚 CONCLUSION — YESTERDAY’S LESSON

July 30, 2025 wasn’t just a bullish day — it was a textbook institutional deception-reversion cycle. If you understand:

How the news was used

How the megabar printed

How the volume clustered

How the VWAP held

… then you’re not trading blindly.

You’re trading with the damn architects of the market.

Has gold bottomed out on July 30?

Key Influencing Factors

Negative Factors:

A stronger US dollar: A rebound in the US dollar index is suppressing gold prices.

Recovering risk appetite: Market demand for safe-haven assets is weakening.

Rising real interest rates: Expectations of Fed policy are impacting the cost of holding gold.

US-EU trade agreement: Easing geopolitical tensions will weaken gold's safe-haven appeal.

Potentially bullish variables:

Federal Reserve policy signals: A dovish statement on Wednesday could boost gold prices.

Geopolitical risks: Uncertainties such as the Sino-US trade negotiations and the situation in the Middle East remain.

Technical Analysis

Trend Analysis:

Short-term weakness (four consecutive negative daily candlestick patterns), but the broader bullish trend remains.

Key support level: 3300-3285 (falling below or falling to 3250); resistance level: 3330-3345 (breaking through may end the pullback).

Key Levels:

Downward Support: 3310-3300 (short-term), 3285 (strong support). Upper resistance: 3335-3345 (trend reversal expected after a breakout).

Trading Strategy

Short-term Trading:

Long positions primarily at low levels: Try a light buy position in the 3300-3310 area, with a stop-loss below 3285 and a target of 3330-3345.

Short selling at high levels is auxiliary: If it rebounds to 3335-3345 and is under pressure, you can short sell with a stop loss above 3350 and a target of 3310-3300.

Follow up on the breakout: If it breaks through 3345 strongly, you can chase long positions; if it falls below 3285, be wary of a rebound after a false break.

Medium- to Long-term Strategy:

Watch for potential bottoming opportunities near 3285. If it stabilizes, place long positions in batches, betting on dovish signals from the Federal Reserve or escalating geopolitical risks.

Risk Warning: Data-sensitive period: This week's Federal Reserve decision and economic data may trigger significant volatility, so position management is crucial. US Dollar Trends: The US dollar and gold prices show a significant negative correlation, so the US Dollar Index should be monitored closely.

Risk of false break: There may be a trap below 3300, which needs to be confirmed in combination with the K-line pattern.

Summary: Gold is under short-term pressure, but the medium- to long-term bullish outlook remains unchanged. Focus on the effectiveness of support in the 3300-3285 area and the direction of the Federal Reserve's policy. We recommend a flexible approach, using key breakthroughs as a guide for directional analysis, and cautiously holding positions before data releases.

Gold holds Bearish Structure- SELLGold: Price is Exhibiting Head & Shoulders Strcure on 4H & 1 H chart. 4 H chart is Bearish, Daily chart is Neutral to bearish. Price is under the IChimuku Cloud in 4 H.

Daily chart is forming a death cross (20 SMA cutting 50 SMA) which might be completed in 1 day or Two.

Currently Gold is trying to recover losses and on retracement journey. I am expecting Price to test the 3347-3354 Zone of resistance where 4H 200+100 SMA + TL resistances+ Structure resistance will likely to Push price back to 3320 & 3300 Support Zone.

If price breaks the 3300 level. Then this daily candle break may take price to 3280 Support Level.

Good Luck

Short Gold! Intraday short plan for gold

4H: price broke below lower edge of the continuation range

Short‑term needs to pull back further

Wait for a retracement before going short

Entry: 3330–3334

Stop loss: above 3351

Intraday targets:

Target #1: 3295–3301

Target #2: 3285

Target #3: 3255–3260

#institutional order flow #trading #gold

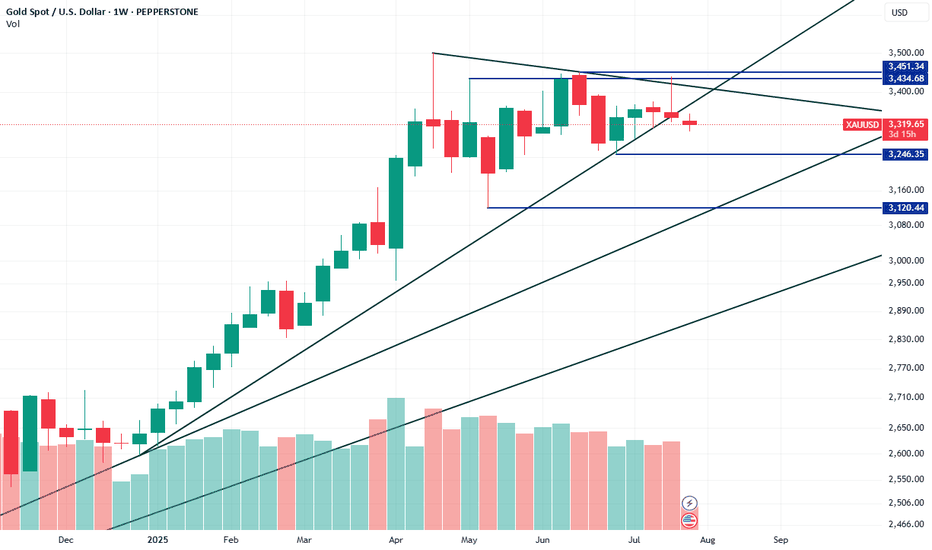

XAUUSD could potentially drop down to 3120XAUUSD has broken its most recent descending trendline on the Weekly chart, signaling a possible short-term reversal. It’s now approaching a higher-timeframe descending trendline, which could act as resistance. The next key demand zone is around 3246; if that fails, the more significant demand lies at 3120. Despite this pullback, the macro trend remains bullish. Notably, institutional traders increased their net long positions by over 40,000 contracts last week, bringing the total to more than 253,000, reflecting a potential shift in sentiment.

XAUUSD Next swing is Ready Gold is currently below rising channel also completion of structural support chart . Eyes on DXY

What's possible scanarios we have?

▪️I will wait next for my buy trades at 3290-3285 area but what we have to watch during that time H4 candle closing.

▪️Secondly if H4 candle closing below 3278-3275 this upside move will be invalid

Additional TIP: let the market comes to you