Gold (XAU/USD) Technical Analysis:Gold began a corrective move with today’s market open and is currently testing the $3,350 support zone, with further downside potential toward $3,310.

🔹 Bearish Scenario:

If the price breaks below $3,350 and holds, a continued correction toward $3,310 is likely.

🔹 Bullish Scenario:

If the price breaks above $3,365 and sustains momentum, it could open the way toward $3,390, and with further bullish pressure, extend to $3,430.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

GOLD trade ideas

XAU / USD 4 Hour ChartHello traders. I just figured while I am at the computer to post the 4 hour chart now. We can see that we are coming into an area where we will either reject if support forms, or keep pushing down a bit more. We have ISM news here in the US at 10am est. I will update / post any scalp trade set ups on a lower time frame in a bit. Be well and trade the trend. Shout out to Big G. Happy Tuesday

uptrend for GOLD ?According to the chart, we have an ascending channel and the RSI indicator is also in the ascending channel.

Considering the data on the tension between China and Taiwan and the tariff and oil wars between the United States and China, Russia, India, etc., the possibility of gold growth is not far from imagination.

8/5: Watch for Short Opportunities Near 3400Good morning, everyone!

On Wednesday, gold held above the key support area at 3343–3337, and subsequently broke through the 3372–3378 resistance zone, leading to a strong bullish move and solid long-side gains.

Today, attention should shift to the major resistance around 3400. If bullish momentum continues, price may approach the secondary resistance near 3420. However, from a technical perspective, signs of bearish divergence have begun to emerge. Should price continue rising while momentum weakens, the risk of a short-term correction increases accordingly.

Key levels to monitor:

Primary resistance zone: 3404–3416

Intermediate supply area: around 3398

Crucial support zone: 3372–3363 (a hold here could support further upside)

⚠️ Cautionary Note:

The US PMI data release during the New York session could introduce volatility. Be sure to maintain strict risk management and stop-loss discipline during periods of increased uncertainty.

🔁 Trading Bias for Today:

Prefer selling into strength near resistance, while cautiously considering buying on dips near support.

The 3343–3337 area continues to serve as the primary support zone, and price action around this level will be critical in determining the next directional move

Letting the Pullback Happen – Lining Up for the Next BuyPrice just hit that tough resistance at 3,373–3,380 and started to drop—pretty much what I expected for wave (a) top. Now waiting for a wave (b) pullback. Not chasing here, just being patient.

Game plan:

Waiting for price to drop into the 3,330–3,325 support zone.

If I see a nice bounce or bullish candle in that area, I’ll look to go long.

First target: Back to the 3,373–3,380 resistance. If price smashes through, will hold a small portion for a bigger run.

Stop loss: Just below 3,320 or the latest swing low—keeping it tight.

If price goes lower, next buy zone is 3,298, then 3,278. I’ll repeat the same idea.

If price dumps below 3,262, I’m out. No interest in holding longs if support fails.

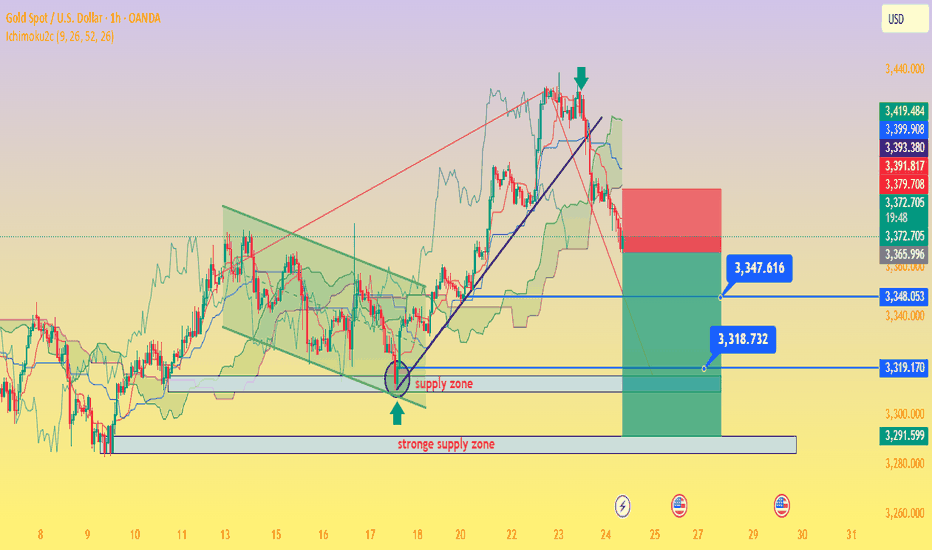

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

Trend continuation or reversal?Gold bounced strongly from the bottom of the higher time frame channel, and we should also consider that this bounce was triggered by news that was negative for the dollar on Friday. Now we need to wait and see whether this move is truly strong or if it's going to turn out to be a fake and head back down toward the bottom of the channel.

XAUUSD TRADE UPDATE MISSED TRADE Hey everyone here’s a trade recap of the week at first we were interested to take buys at 3254 zone as first entry and scale in at 3287 zone but price pulled down slightly missed the first entry and I didn’t execute & the second entry didn’t execute that too and market skyrocket if price activated the first entry we would’ve caught a huge trade today,the first one didn’t activated so I didn’t execute the second entry which is the 3287 zone that buyers came in so we move on and I will keep on sharing potential good setups and have a beautiful weekend guys….

XAUUSD – Smart Money Sell Setup during New York Session | ICT St

Gold (XAUUSD) has just completed a classic liquidity grab above the London session highs, forming a potential Judas Swing as New York begins.

On the 4H timeframe, we clearly have a bearish BOS (Break of Structure), and price has returned to a Premium zone within a bearish FVG and OB (Order Block).

Today is NFP Friday, and after the Fed kept rates steady mid-week, we’re expecting high volatility.

Current price action has swept the overnight liquidity and is now reacting inside a Repricing Block, aligning perfectly with the NY Midnight Open level.

🎯 My Sell Plan (Live Execution):

Sell Limit: 3306.50

SL: 3317.50 (Above OB high)

TP1: 3281.20

TP2: 3268.50

TP3: 3253.90

🧠 Bias: Bearish

🕒 Session: New York

🧮 ADR: 43 pts

📉 Market Structure: Bearish

This setup follows the ICT methodology using time, liquidity, structure, and displacement.

If we break above 3317.50 with strong displacement, the idea becomes invalid.

Let's see if Smart Money takes it down into Friday’s close.

Short position profit. Latest strategyYesterday's gold price fluctuated: it maintained sideways fluctuations in the morning and started a downward channel after the opening of the US market. The Federal Reserve's interest rate decision remained unchanged. In addition, Powell's speech suppressed expectations of a September rate cut. The gold price directly fell to around 3267 and closed the day with a negative line, which exceeded expectations.

Looking back at recent trends, gold prices saw a brief correction on Tuesday after four consecutive days of decline, but failed to sustain the upward trend, falling sharply again yesterday, demonstrating that the weak market remains intact. Judging from today's market, theoretically there is still room for further decline, but before yesterday's low is broken, we don't expect a big drop for the time being; if the support here is effective, the market may tend to correct.

Pay attention to the daily resistance near 3315, and try shorting with a light position; the hourly resistance is near 3301, which is also a good position for shorting; the intraday bull-bear watershed is near 3294. If the market falls weakly and rebounds here, there may be a decline. The target below will first look at 3275. If yesterday's low of 3267 is broken, look further to 3250: On the long side, pay attention to the 3249 support below. If it is close to broken, you can try short-term buying.

【Operation ideas】👇

The bearish strategy in the morning remains unchanged. The short position at 3315 was publicly set up in the morning. The market rebounded to 3314 and then went down directly. The idea of setting up short positions at 3301 in the morning session remains unchanged. Friends who did not follow up with the short positions at 3315 can now add short positions with a light position at 3300.

PEPPERSTONE:XAUUSD ACTIVTRADES:GOLD VANTAGE:XAUUSD ACTIVTRADES:GOLD ICMARKETS:XAUUSD VELOCITY:GOLD PYTH:XAUUSD

SMC ✅ Strengths:

• Previous mitigation of institutional interest zones (1H FVG).

• BOS (Break of Structure) indicating bullish intent.

• Entry located at the 5M OB, which coincides with support and fake out (consistent with liquidity re-entry).

• TP is aligned with the previous resistance and distribution zone, which provides a good RR (2.23).

Good luck Traders

Roadmap to 3982: Key Long Entries and Profit ZonesThe initial long entry zone is between 3290 and 3275 .

From this range, an uptrend is expected to begin, targeting 3416 , which is our first exit point to close the initial long position.

After that, we wait for the next long entry , ideally around 3333 to 3319 . A new upward movement from this range is expected to reach 3455 . At this level, we continue to hold the position while placing the stop loss at the entry level to protect profits.

The next take profit target is 3650 , which may be reached by the end of 2025 or in 2026.

The final target is 3982 , which is likely to be hit in 2026, as the market may not have enough strength to reach it in 2025.

XAUUSD rises due to tariff wars and weak economic dataXAUUSD rises due to tariff wars and weak economic data

Gold climbed to 3,380.00 level on August 7, hitting a two-week high, as renewed U.S. tariff threats and expectations of Federal Reserve rate cuts in September and December boosted its appeal. President Trump announced 100% tariffs on imported semiconductors (excluding U.S.-made), 25% on Indian imports, and 50% on select Brazilian goods. Additionally, Weak U.S. economic data and a cooling labor market further support gold’s rise.

Technically, price has formed the Pennant chart pattern right below the local resistance of 3,380.00. Further breakout of the level and ascending towards 3,440.00 level is expected in short-term.

Gold Price Analysis August 7XAUUSD – Consolidating in a triangle pattern, waiting for an explosion point

Gold is currently consolidating in a triangle pattern, with the structure leaning towards the possibility of forming an ascending triangle – a sign that buying pressure is quietly increasing. The market is waiting for a push to break out of this narrow range.

Recommended trading strategy:

BUY on a break of the resistance zone at 3385: If the price breaks above the upper boundary of the triangle pattern, especially the 3385 mark, this will be a signal confirming the continued bullish momentum. Target is towards the 3419 area.

BUY around the support at 3365: If the price does not break the boundary but corrects to the 3365 area and a candlestick signal confirms buying pressure, this will be an opportunity to enter an order following the bullish wave.

SELL when price breaks and retests the 3365 zone: If price breaks through 3365 and retests unsuccessfully, a corrective trend will be triggered with a target towards the 3333 zone.

Daily Analysis- XAUUSD (Thursday, 6th August 2025)Bias: Bearish

Notes:

- Daily consolidating after Friday spike up

- Looking for price to retrace back down to daily structure

- Potential SELL if there's

confirmation on lower timeframe

- Pivot point: 3390

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

XAUUSDXAU/USD Bullish Bias — Price is rebounding strongly from a key demand zone, with higher lows confirming sustained buying pressure. As long as the demand zone holds, the bias stays bullish, with momentum favoring a move toward the next resistance. Watch for confirmations during London and New York sessions, as gold typically reacts strongly in these hours.