XUA/USD) Bearish Trend Read The captionSMC Trading point update

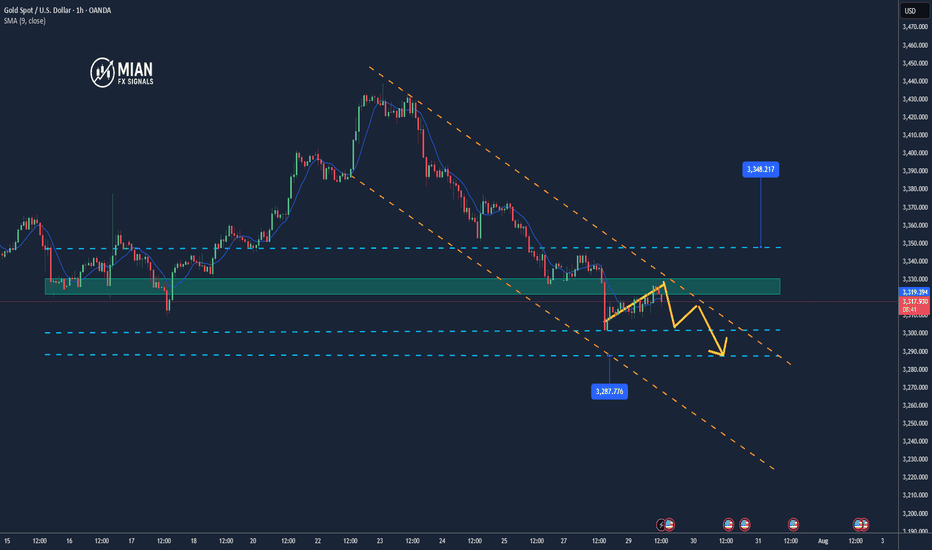

Technical analysis of (XAU/USD) on the 1-hour timeframe, targeting a move toward the $3,310–$3,315 support zone. Here's the full breakdown:

---

Technical Analysis – Gold (1H)

1. Fair Value Gap (FVG) Supply Zones

Two FVG supply zones are marked where price previously dropped sharply:

Upper FVG zone near $3,385.49 (with red arrow: expected rejection point)

Lower FVG zone near $3,352.47

Price is expected to reject from either zone, resuming the bearish move.

2. Market Structure: Lower Highs, Lower Lows

The chart shows a clear bearish structure, with consistent lower highs and lower lows.

The current price action suggests a potential pullback into FVG, followed by another leg down.

3. Key Support Zone (Target Area)

The yellow box between $3,315.22–$3,310.99 represents a strong demand/support zone and is marked as the target point.

This level has acted as a prior accumulation zone and is likely to attract buying interest again.

4. EMA 200 Resistance

Price is trading below the 200 EMA (currently at $3,365.87) — indicating a bearish bias.

EMA also aligns near the lower FVG zone, reinforcing the area as a potential reversal point.

5. RSI Indicator

RSI at 35.38 is nearing oversold territory but still shows downward pressure.

No divergence or reversal signal yet — supports the continuation view.

Mr SMC Trading point

---

Summary

Bias: Bearish

Current Price: $3,337.02

Supply Zones (FVG):

$3,385.49 (stronger supply)

$3,352.47 (minor supply)

Support Target: $3,315.22–$3,310.99

Structure: Bearish (LL-LH formation)

EMA: 200 EMA acting as dynamic resistance

RSI: 35.38 – still bearish momentum

---

Please support boost 🚀 this analysis)

GOLD trade ideas

Gold Drops After Failing to Hold Above $3322📊 Market Overview:

Gold initially surged above the $3322 resistance, hitting $3329 amid Fed pause expectations. However, a rebound in the US dollar and profit-taking triggered a sharp drop back to $3315, signaling weakening bullish momentum.

📉 Technical Analysis:

• Key resistance: $3322 – $3330

• Nearest support: $3308 – $3300

• EMA09 (H1): Price has fallen below EMA09 → turning short-term trend bearish

• Candlestick / Volume / Momentum:

• Failed breakout above $3322 with strong bearish H1 reversal

• Increasing volume during the drop → rising selling pressure

📌 Outlook:

Gold may continue declining in the short term if it fails to hold above $3312. Bears have taken control after the failed breakout attempt. Risk increases for a move toward $3300–$3295.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD : $3318 – $3321

🎯 TP: 40/80/200 pips

❌ SL: $3325

🔺 BUY XAU/USD: $3295 – $3292 (only with clear bullish signal)

🎯 TP: 40/80/200 pips

❌ SL: $3288

GOLD: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse GOLD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 3,296.556 will confirm the new direction upwards with the target being the next key level of 3,310.375 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Gold Market Eyes Daily Demand Zones at 3270–3315Gold market aligns with daily candle formation, seeking to mitigate substantial demand zones between 3270 and 3315. This area may provide the necessary liquidity for a potential bullish reaction, pending confirmation. follow for more insights , comment and boost idea

Will gold continues the uptrend from now?I have notice that price retraces in 5 waves before continued go up, from Jun 2025 onwards until now (refer to chart above), and now price has went for 5 waves, and had break the last lower low level. I am going to anticipate the long with my strategy, projecting to higher high of this up trend.

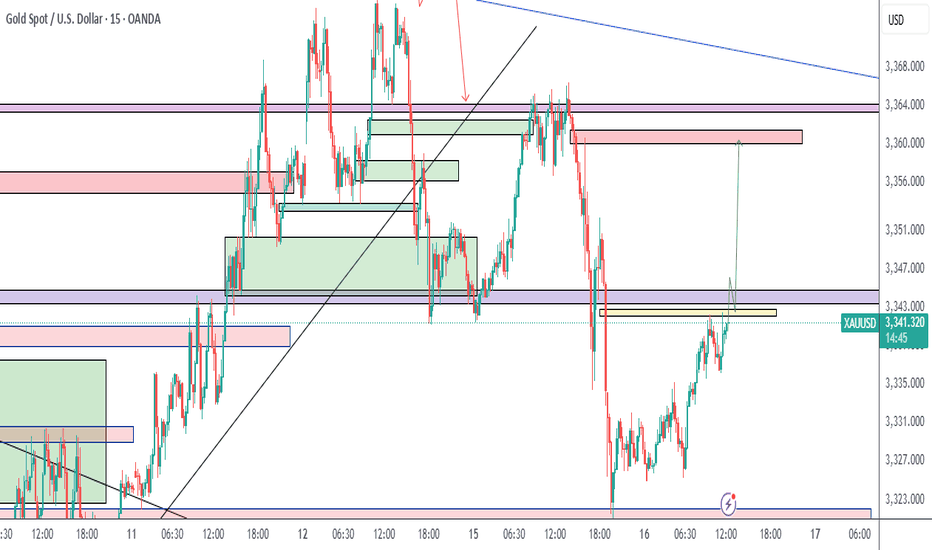

Gold Spot / U.S. Dollar Analysis (15-Minute Chart)Key Levels

Support Levels:

Immediate: 3,294.000 (S/L level)

Next: 3,280.000

Resistance Levels:

Immediate: 3,304.000 (Entry level)

Next: 3,308.000, 3,316.250, 3,320.000

Profit Targets:

Tiered levels up to 3,328.000 (highest target).

Price Action & Trends

Current Trend:

The price is bullish (+0.84% today) but hovering near the entry level (3,299.000) and testing 3,302.700.

The presence of multiple profit targets above suggests a bullish bias in the trade setup.

Critical Observations:

Price recently dipped to 3,294.000 (S/L) but rebounded, indicating buying interest at support.

The 3,304.000 level (entry) now acts as resistance. A breakout above could target 3,308.000+.

Volume & Momentum:

Not visible in the screenshot, but the upward movement suggests moderate bullish momentum.

Trade Setup Analysis

Entry: 3,299.000

Stop-Loss: 3,294.000 (5 USD below entry)

Profit Targets:

3,304.000 (Breakeven+)

3,308.000 → 3,328.000 (Scalping opportunities).

Risk-Reward Ratio:

If targeting 3,328.000, the RR is ~5:1 (29 USD profit vs. 5 USD risk).

Actionable Insights

Bullish Scenario:

Hold if price sustains above 3,304.000 (entry resistance).

Next target: 3,308.000.

Bearish Caution:

If price falls below 3,294.000 (S/L), exit to limit losses.

Watch for rejection at 3,304.000 (potential reversal).

Market Context:

Gold is sensitive to USD strength and geopolitical events. Monitor broader trends for confirmation.

Learn What is PULLBACK and WHY It is Important For TRADING

In the today's post, we will discuss the essential element of price action trading - a pullback.

There are two types of a price action leg of a move: impulse leg and pullback.

Impulse leg is a strong bullish/bearish movement that determines the market sentiment and trend.

A pullback is the movement WITHIN the impulse.

The impulse leg has the level of its high and the level of its low.

If the impulse leg is bearish , a pullback initiates from its low and should complete strictly BELOW its high.

If the impulse leg is bullish , a pullback movement starts from its high and should end ABOVE its low.

Simply put, a pullback is a correctional movement within the impulse.

It occurs when the market becomes overbought/oversold after a strong movement in a bullish/bearish trend.

Here is the example of pullback on EURJPY pair.

The market is trading in a strong bullish trend. After a completion of each bullish impulse, the market retraces and completes the correctional movements strictly within the ranges of the impulses.

Here are 3 main reasons why pullbacks are important:

1. Trend confirmation

If the price keeps forming pullbacks after bullish impulses, it confirms that the market is in a bullish bearish trend.

While, a formation of pullbacks after bearish legs confirms that the market is trading in a downtrend.

Here is the example how bearish impulses and pullbacks confirm a healthy bearish trend on WTI Crude Oil.

2. Entry points

Pullbacks provide safe entry points for perfect trend-following opportunities.

Traders can look for pullbacks to key support/resistances, trend lines, moving averages or Fibonacci levels, etc. for shorting/buying the market.

Take a look how a simple rising trend line could be applied for trend-following trading on EURNZD.

3. Risk management

By waiting for a pullback, traders can get better reward to risk ratio for their trades as they can set tighter stop loss and bigger take profit.

Take a look at these 2 trades on Bitcoin. On the left, a trader took a trade immediately after a breakout, while on the right, one opened a trade on a pullback.

Patience gave a pullback trader much better reward to risk ratio with the same target and take profit level as a breakout trader.

Pullback is a temporary correction that often occurs after a significant movement. Remember that pullbacks do not guarantee the trend continuation and can easily turn into reversal moves. However, a combination of pullback and other technical tools and techniques can provide great trading opportunities.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis : Channel Break, Demand Zone + SR - Interchange"High-Probability Zone Reaction & SR Flip Confirmation"

Gold (XAUUSD) is currently reacting from a significant support zone after completing a bearish breakout from a well-established ascending channel. The market structure indicates both threat and opportunity depending on how price behaves around key levels ahead.

🔍 Structure Breakdown & Price Behavior:

🔹 1. Rising Channel Violation

Over the past few weeks, price was comfortably moving inside a well-respected ascending channel, making higher highs and higher lows.

Recently, however, price broke below the lower boundary, which is often a bearish signal—indicating a possible trend reversal or a deeper correction phase.

Such breakdowns suggest buyers are losing control, and bearish sentiment is gaining strength.

🔹 2. Supply Zone Reaction & Drop

Before the breakout, we observed a sharp rejection from a high point, triggering a sell-off.

The price completed its move into a previously defined supply zone, resulting in a strong bearish impulsive leg that pushed it outside the channel.

This move shows clear institutional distribution—where large sellers unloaded positions around that zone.

📍 Key Zone Focus:

🟩 Previous Reversal / Demand Zone (Green Box)

Price is now sitting in a historically strong demand zone, which acted as a major reversal point in the past.

This area is marked as the first zone of interest where buyers might step back in to defend.

The green box represents a liquidity pocket where institutions previously accumulated positions—hence it’s a strong bounce candidate.

🟦 SR Interchange Zone (Blue Box)

The next major level above current price is the SR Interchange zone, around 3,320–3,340.

This level was previously broken and now acts as resistance.

It's crucial because it represents the battle zone where the market will decide whether to continue bearish or shift back bullish.

🧠 Market Psychology & Order Flow Insight:

The recent aggressive selling pressure from the highs, followed by a bounce from the demand zone, shows a shift from euphoria to fear.

Sellers are active at supply, while buyers are attempting to defend the previous demand.

The market is currently in decision mode—and the SR flip zone (3,320–3,340) will be the judge.

A break and retest above this level signals strength and potential for a trend resumption.

A failure to reclaim it would confirm bearish dominance and open doors for deeper targets.

🔄 Possible Scenarios Ahead:

📈 Scenario 1 – Bullish Rejection & Breakout:

If buyers successfully hold the 3,280–3,260 demand zone and push price above the SR Interchange zone, we can expect:

📍 Target 1: 3,360 (mid-term resistance)

📍 Target 2: 3,400–3,420 (previous high & upper trendline)

This would confirm a fakeout from the channel and a bullish continuation pattern.

📉 Scenario 2 – Failure at Resistance & Drop Continuation:

If price fails to reclaim the interchange zone, expect a retest of the green demand, followed by a potential drop toward:

📍 3,260 – local support

📍 3,240 – major support (unfilled demand below)

📍 3,220–3,200 – ultimate downside target

This would solidify a bearish market structure, confirming the sellers are in control.

🧭 Key Levels To Watch:

Level Type Price Range Significance

Supply Zone ~3,400–3,420 Major institutional selling area

SR Interchange (Blue) ~3,320–3,340 Critical resistance / flip zone

Current Price ~3,297 Watching reaction for momentum shift

Demand Zone (Green) ~3,280–3,260 Key support / bounce zone

Major Demand Pending ~3,240–3,220 Next support level if drop continues

✅ Conclusion:

Gold is at a critical inflection point.

The recent bearish breakout signals weakness, but the current support zone may provide a short-term bullish setup if buyers defend it effectively. A successful reclaim of the SR flip zone will shift sentiment bullish again. Otherwise, a deeper correction is likely.

This setup is ideal for both swing and intraday traders—look for confirmation signals at the current support and SR zone before executing trades.

Will Upcoming Data Determine the Next Gold's Direction?Macro approach:

- Gold retreated this week, reversing early gains to trade near four-week lows amid renewed US dollar strength and caution ahead of the Fed's policy decision.

- The retreat was mainly pressured by stronger-than-expected US economic data and a tentative revival in risk appetite, offsetting pockets of safe-haven demand.

- Key drivers included robust US GDP growth for 2Q, a bounce in consumer confidence, and the Fed's steady rates with a more hawkish tone, suggesting cuts may be further out.

- Meanwhile, recent US-EU and US-China trade deals eased some global uncertainty, damping gold's appeal as a hedge.

- Market participants also eyed the labor market's continued cooling, but resilient consumer spending further buoyed the dollar.

- Gold may remain volatile, with potential upside if upcoming US PCE inflation and NFP reports disappoint expectations. Any escalation in trade tensions or signals of Fed policy easing could renew support for gold prices.

Technical approach:

- XAUUSD fluctuated within the range of 3285-3560, which is below the broken ascending trendline. The price between the two EMAs awaits an apparent breakout to determine the next trend.

- If XAUUSD breaks below the support at 3273, confluence with EMA78, the price may plunge to retest the following support at 3167.

- On the contrary, remaining above the support at 3273 may lead XAUUSD to retest the resistance at around 3560.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Gold Faces Strong Rejection Below $3,365 – Bearish Wave Ahead?Gold is currently trading around $3,359, showing signs of exhaustion after climbing from the $3,248 low. The chart illustrates a textbook scenario of channel rejection after testing the upper boundary of the descending wedge and failing to break above the $3,365–$3,392 resistance zone. Price is now hovering just below the diagonal black trendline, indicating a potential lower high formation and setting up for another bearish wave.

📌 Key Technical Highlights

Resistance Zone: $3,365–$3,392

This area marks the confluence of the black long-term trendline, the top of the descending purple channel, and the previous high at $3,392.

Price attempted a "Possible Retest" as annotated on the chart and is now starting to pull back—showing signs of bearish rejection.

Bearish Scenario (Blue Arrows):

Multiple downward arrows show likely bearish paths if the current resistance holds.

Key short-term targets:

$3,337, $3,320, $3,303, Strong support at $3,293–$3,248

Further downside may test extension levels toward $3,220–$3,200 by early August if momentum builds.

⚠️ Bearish Confirmation Criteria

Failure to close above $3,365 (black trendline)

Breakdown below $3,337 followed by $3,320

Strong selling pressure supported by fundamentals (e.g. USD strength, Fed hawkish stance)

✅ Invalidation / Bullish Outlook

A decisive breakout and close above $3,392.73 would invalidate the bearish structure.

In that case, targets would shift toward:

$3,412, $3,434, $3,490 (long-term trendline intersection)

However, today's U.S. CPI (Consumer Price Index) release adds a layer of volatility and potential trend disruption, making this a high-risk trading day.

📊 CPI News Impact – What to Watch

High CPI (Stronger than forecast):

- Increases expectations of further Fed tightening → strengthens USD → bearish for gold

- Likely scenario: sharp drop toward $3,337 → $3,320 → $3,293

Low CPI (Weaker than forecast):

- Signals disinflation → weakens USD → bullish for gold

- Possible breakout above $3,365 → retest of $3,392 → if broken, target $3,412 and $3,434

Neutral or as expected CPI:

- Likely leads to whipsaw — fakeout on both sides

- Caution advised — wait for candle close confirmations post-news

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold Awaits Fed Rate Decision – Key Levels & Volatility AheadGold is currently trading near $3,332, showing a minor recovery after recent downward momentum. The price action on the 1-hour chart highlights a short-term ascending structure, which often acts as a corrective move rather than a strong bullish trend. The market previously saw significant selling pressure from above $3,355–$3,360, creating a short-term supply zone. Unless the price breaks and holds above this zone, the overall momentum remains bearish.

The chart also shows a projected price path where gold could push slightly higher toward $3,355, meet resistance, and potentially reverse downward again. Key support lies at $3,320, and if this breaks, we could see gold testing $3,290–$3,280 levels, aligning with the black trend line support. However, if bulls manage to break above $3,360, it would signal potential upside continuation toward $3,380–$3,400.

Key Points

- Key Resistance Levels: $3,355 and $3,360 (critical supply zone).

- Key Support Levels: $3,320 (short-term), followed by $3,290–$3,280 (major trendline support).

- Expected Short-Term Move: Possible push toward $3,355 → rejection → decline back toward $3,320 and possibly $3,290.

Bullish Breakout Scenario: A strong close above $3,360 could push price toward $3,380–$3,400.

Overall Bias: Bearish while trading below $3,360.

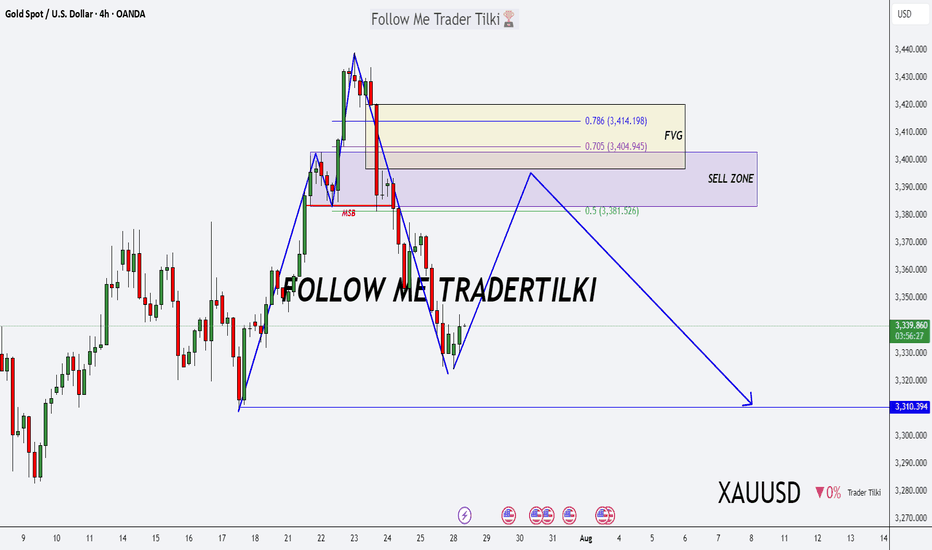

4hr Chart

Price remains under pressure below the descending trendline. A small pullback toward $3,345–$3,350 is possible, but as long as price stays under this resistance, the bias remains bearish with potential downside targets around $3,300–$3,280.

Key Levels:

- Resistance: $3,350 → $3,381 → $3,394

- Support: $3,324 → $3,281 → $3,254

Today’s FOMC interest rate decision is a key driver for Gold. Here’s the quick analysis:

- If Fed Hikes Rates or Maintains Hawkish Tone:

- Strong USD likely → Gold could face more selling pressure.

- Key support zones: $3,324 – $3,300, then $3,281 and $3,254.

- If Fed Pauses or Turns Dovish:

- Dollar weakens → Gold may bounce toward resistance zones.

- Upside levels: $3,355 – $3,360 and higher toward $3,381 – $3,394 (Fib levels).

Expect high volatility; $3,300 is a critical support to watch. A dovish Fed may give Gold short-term relief, but a hawkish stance could accelerate the downtrend.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

XAUUSD - 29/7/25 - continued bearish There was quite strong bearish momentum yesterday during the US session. Going into Asian session and London session today there is a consolidation bullish. There is a 4 hour zone marked out where i am looking for a retest and continuation bearish to a key zone below where a reversal pivot is expected and then continuing bullish with the larger trend.

Gold Bulls Charging to 3305 But What’s Waiting There?Gold has recently taken support from the lower levels and has also shown a Break of Structure (BoS) to the downside. Currently, there is Imbalance and Internal Draw on Liquidity (IDM) resting around the 3305 level. The market appears to be moving upward to mitigate that imbalance. It's important to closely monitor this zone, as once the market reaches and fills this area, there is a high probability of a potential rejection or bearish move from that level

Gold 31 July – Bearish Bias Holds, Watching Supply ZonesGold (XAUUSD) Analysis – 31 July

Market structure is now aligned across both higher and lower timeframes:

H4: Bearish

M15: Bearish

This alignment strengthens the probability of trend-continuation setups in favor of the dominant downtrend.

🔄 Current Market Behavior:

The M15 chart is currently in a pullback phase, retracing toward its previous lower high and approaching a key supply zone.

📍 Key Supply Zones to Watch:

Zone 1 – Immediate Supply Zone (3299 – 3305)

• First area of interest where price may react.

• If respected and followed by M1 confirmation, a short setup could be initiated.

• Watch for signs of exhaustion or sharp rejection.

Zone 2 – Higher Supply Zone (3326 – 3332)

• If the first zone fails, this becomes the next high-probability area.

• Well-aligned with the broader bearish structure — expect stronger reaction potential.

• Suitable for cleaner high RR short trades if price reaches this level.

✅ Execution Plan:

• Observe how price behaves inside the marked zones.

• Only plan short entries after M1 confirmation — this adds precision and prevents premature entries.

• Stay patient. Let the market come to you and reveal intent before acting.

📌 Summary:

Bias: Bearish

Structure: H4 and M15 both support downside bias

Zones in Focus:

– Primary: 3299–3305

– Secondary: 3326–3332

Execution: Wait for confirmation before entering.

Risk-Reward: Maintain 1:3 RR minimum (e.g., 40 pip SL, 120 pip TP).

Let the structure guide your setups — not impulse.

📘 Shared by ChartIsMirror

GOLD recovers after many days of declineOANDA:XAUUSD has recovered after several days of declines. Investors will focus on the Federal Reserve's interest rate decision on Wednesday, which is expected to cause significant market volatility.

Gold hit a three-week low of $3,301 an ounce on Monday, before recovering somewhat on Tuesday after falling for a fourth straight day as the dollar erased some of its earlier gains, boosting demand for the precious metal.

Falling US Treasury yields and a weak US jobs report also prompted investors to buy gold.

Data released by the U.S. Labor Department on Tuesday showed the number of jobs added fell in June after two straight months of gains.

The number of jobs added in June fell to 7.44 million from a revised 7.71 million in May. The median forecast of economists in a survey was 7.5 million.

Focus on the Federal Reserve's decision

The Federal Reserve will announce its interest rate decision at 01:00 IST on Thursday; Federal Reserve Chairman Powell will hold a press conference on monetary policy at 01:30 IST on the same day.

The market generally expects the Federal Reserve to keep interest rates unchanged, with the focus on whether Fed Chairman Powell's speech will provide any clues about the timing or pace of future rate cuts.

The market sees a very low chance of a rate cut in July and a roughly 40% chance of another rate cut in September, up from about 10% last month, according to the Chicago Mercantile Exchange's FedWatch tool. Investors will be closely watching the statement and Fed Chairman Powell's remarks at his post-meeting press conference for fresh clues on the timing of the next rate cut.

- If Powell opens the door to a rate cut in September, citing the recent trade deal as a reason to ease uncertainty, US Treasury yields could fall immediately, paving the way for gold prices to rise.

- On the other hand, if Powell avoids committing to a rate cut at this meeting, citing recent rising inflation data, gold prices could fall.

Gold typically performs well in low-interest-rate environments because it does not pay interest and its appeal increases when returns from other assets decline.

Technical Outlook Analysis OANDA:XAUUSD

Gold has recovered from the key $3,300 price point and is holding above $3,310, which is also the nearest support. However, the current recovery is not technically enough to create a short-term uptrend, or conditions for a sustained price increase. In terms of position, gold is under pressure with the 21-day EMA as the nearest resistance at around $3,340 – $3,350. If gold falls below the 0.382% Fibonacci retracement level, it will be eligible to open a new downtrend with a target of around $3,246 in the short term, more than the 0.50% Fibonacci retracement level.

On the other hand, RSI is below 50, and the current 50 level acts as momentum resistance in the short term. If RSI slopes down, it will signal bearish momentum with more downside ahead. For gold to qualify for bullish expectations, it needs to at least push price action above EMA21, then retrace back to the price channels and finally break above the 0.236% Fibonacci retracement level to confirm bullish conditions. The upside target could be towards $3,400 in the short term, more like $3,430 – $3,450.

For the day, the technical outlook for gold prices tends to lean more towards the downside, with the following notable points listed.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,340 – 3,350 – 3,371 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3280 - 3282⚡️

↠↠ Stop Loss 3276

→Take Profit 1 3288

↨

→Take Profit 2 3294

Gold Alert: Key Levels for Potential Sell Setup!Good morning, my friends 🌞

Here’s today’s gold analysis. I'm expecting a decline in gold prices, specifically from the 3,383–3,420 level.

Once a correction starts around that zone, my target will be 3,310. Gold has been riding a strong uptrend, and if we reach those levels, I’ll be expecting a pullback and opening a sell position accordingly.

Please set your stop loss based on your personal margin preferences.

Your likes and support are my biggest motivation for continuing to share these analyses. Thank you to everyone showing appreciation 🙏

GOLD Weekly Idea💡Why Gold Pulled Back

- Gold pulled back today after hitting $3439.04, just below resistance at $3451.53. Traders took profits ahead of key Fed and trade headlines. Right now, it’s trading around $3414.48, down 0.50%.

- The dip came after the U.S.-Japan trade deal eased geopolitical tension, cutting safe-haven demand. Plus, U.S. bond yields are climbing (10-year at 4.384%), which adds pressure on gold.

Support is building at $3374.42, with stronger buying interest expected around $3347.97 and the 50-day moving average at $3336.40 — a key level bulls want to defend.

Short-term looks a bit weak, but as long as gold holds above the 50-day MA, the bullish trend remains intact. Longer-term, weakness in the dollar, central bank gold buying, and concerns about Fed independence could push prices higher.

🔍Watching the Fed’s July 29–30 meeting next

The golden direction in the volatile trend

💡Message Strategy

The market is currently in a wait-and-see phase ahead of major fundamental events. With the Federal Reserve's interest rate decision and key data such as second-quarter GDP and the core PCE price index set to be released, traders are generally cautious. Gold has stabilized slightly after a series of declines, but a meaningful reversal has yet to materialize. The divergence between bulls and bears is intensifying, and the market is on the verge of a breakout. This week's gold market is driven by uncertainty surrounding macroeconomic expectations and the Fed's monetary policy.

After four consecutive trading days of gains, the US dollar index has slowed its gains, temporarily retreating to around 99. Traders are still betting on a September Fed rate cut, with the market placing a 64% probability on a September rate cut. However, this week's release of Q2 GDP and the core PCE price index data will significantly impact this outlook.

If GDP and inflation data are weak, this will reinforce market expectations of easing and potentially attract renewed buying for gold. Conversely, strong data could dampen expectations of a rate cut, supporting a stronger dollar and putting pressure on gold.

Furthermore, the Federal Reserve is about to hold its interest rate meeting. While it's almost certain that interest rates will remain unchanged, Powell's speech will be a key focus for the market. Any signals regarding internal disagreements, adjustments to the inflation path, or adjustments to the policy framework could trigger significant market volatility. From a global perspective, geopolitical risks have been relatively stable recently, providing no sudden support for gold.

📊Technical aspects

Gold is showing signs of a short-term rebound, but the technical structure still indicates a weak rebound, with no confirmed trend reversal. A break above 3350 would be considered a temporary stabilization, while a break below 3300 would reopen the downside. Current market sentiment is in a "wait for a signal" phase.

Gold currently has limited downward space, and data factors are accelerating this week. Gold is likely to undergo a long-short conversion, so our trading strategy uses a small stop loss to counter the larger space for gold's shape conversion.

💰Strategy Package

Long Position:3290-3305,SL:3280,Target: 3340-3360

GOLD Long After Lower Dip - Catching PullbackOANDA:XAUUSD / TVC:GOLD Long Trade, with my back testing of this strategy, it hits multiple tp, here price will pullback up.

Price will bounce in this zone.

I kept SL slight big to be safe because TP levels are good so I don't want to get pushed out because of tight SL.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice