GOLD - Monthly breakout retest may confirm multi-year bull cycleHello everyone, what are your thoughts on the long-term outlook for XAUUSD?

Looking at the monthly chart (1M), we can clearly see that XAUUSD has broken out of the long-standing ascending channel that has held since 2015 — a major signal suggesting the start of a new bullish cycle. Price is now retesting the previously broken trendline, hinting at the possibility of a fresh upward leg to resume the longer-term bullish trend we've seen recently.

Personally, I'm targeting $3,600 in the medium term, and potentially $4,000 by 2026–2028 if institutional capital continues to rotate back into safe-haven assets like gold.

What about you — do you think BTC/USD will rise or fall in the coming years?

And what’s your target for it?

GOLDCFD trade ideas

xauusdxauusd Focus on red line

From the price level of 3368 and above, gold is expected to pull back at least until the Stochastic on the M30–H1 timeframes reaches oversold levels.

After that, a bullish continuation is likely, pushing the price up to around 3400.

This area will be a critical decision point — determining whether the market will continue its uptrend or reverse into a downtrend.

If the H4 chart prints a reversal candlestick pattern, it would indicate the beginning of a bearish trend, which could potentially lead to a downward movement of up to 20,000 points.

GOLD Local Short! Sell!

Hello,Traders!

GOLD made a retest

Of the horizontal resistance

Of 3313$ and we are already

Seeing a bearish reaction and

We will be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Spot / U.S. Dollar Analysis (15-Minute Chart)Key Levels

Support Levels:

Immediate: 3,294.000 (S/L level)

Next: 3,280.000

Resistance Levels:

Immediate: 3,304.000 (Entry level)

Next: 3,308.000, 3,316.250, 3,320.000

Profit Targets:

Tiered levels up to 3,328.000 (highest target).

Price Action & Trends

Current Trend:

The price is bullish (+0.84% today) but hovering near the entry level (3,299.000) and testing 3,302.700.

The presence of multiple profit targets above suggests a bullish bias in the trade setup.

Critical Observations:

Price recently dipped to 3,294.000 (S/L) but rebounded, indicating buying interest at support.

The 3,304.000 level (entry) now acts as resistance. A breakout above could target 3,308.000+.

Volume & Momentum:

Not visible in the screenshot, but the upward movement suggests moderate bullish momentum.

Trade Setup Analysis

Entry: 3,299.000

Stop-Loss: 3,294.000 (5 USD below entry)

Profit Targets:

3,304.000 (Breakeven+)

3,308.000 → 3,328.000 (Scalping opportunities).

Risk-Reward Ratio:

If targeting 3,328.000, the RR is ~5:1 (29 USD profit vs. 5 USD risk).

Actionable Insights

Bullish Scenario:

Hold if price sustains above 3,304.000 (entry resistance).

Next target: 3,308.000.

Bearish Caution:

If price falls below 3,294.000 (S/L), exit to limit losses.

Watch for rejection at 3,304.000 (potential reversal).

Market Context:

Gold is sensitive to USD strength and geopolitical events. Monitor broader trends for confirmation.

Beyond the Chart – GOLD Market Technical Analysis🧠 OANDA:XAUUSD Market Outlook: Gold (XAU/USD)

✅ Bullish Case (Upside Bias)

• Price has reclaimed multiple Fair Value Gaps (FVGs) on the way up.

• Holding above the 0.382 Fib level (3293) indicates moderate bullish momentum.

• A confirmed breakout above 3301 (0.5 Fib) may open the path to key resistance levels:

• 3308 (0.618 Fib)

• 3314 (0.705 Fib)

• 3319 (0.786 Fib)

📌 This move is likely a retracement rally within a broader downtrend — unless price reclaims above 0.786 with strength, confirming a shift in structure.

⸻

🛠️ Trading Plan

• Bullish Setup: Long above 3301, targeting 3308 → 3314, with tight stops.

• Bearish Setup: Look for rejection patterns at 3308–3314 zone, targeting a move back to the 3280 area.

⸻

📘 Disclaimer: This is educational content and not financial advice. Always do your own analysis and manage your risk accordingly

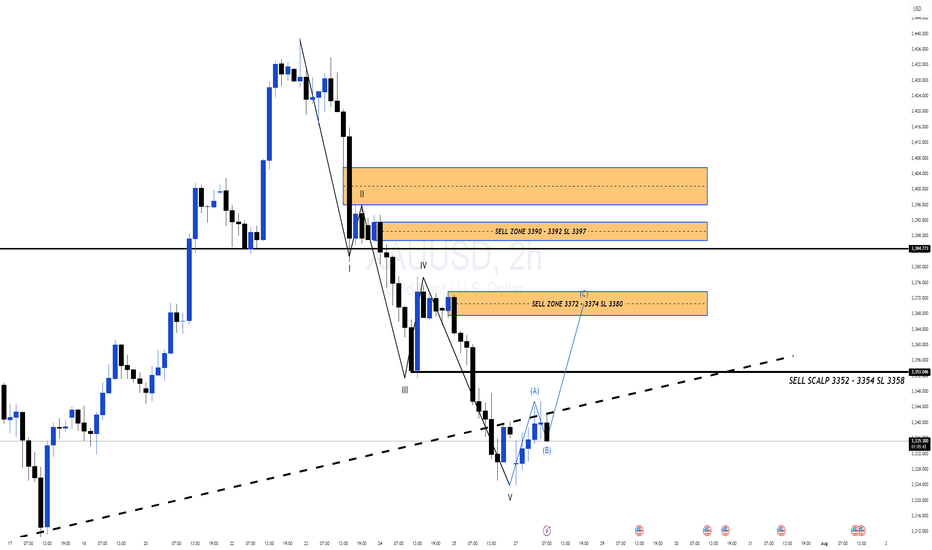

XAUUSD: Market Analysis and Strategy for July 29Gold Technical Analysis:

Daily chart resistance: 3345, support: 3285

4-hour chart resistance: 3340, support: 3300

1-hour chart resistance: 3330, support: 3308.

After last week's sharp decline, gold continued its decline yesterday, breaking below its opening low and continuing its downward trend, reaching a low near 3300. In the short term, selling pressure is strong, but the rebound is weak, with a rebound high of 3330.

In terms of intraday trading, yesterday's low of 3301 was followed by a rebound. Focus on the resistance range of 3330-3338. Selling is recommended if the price is trading sideways between 3330-3338, with a defense of 3340. If it falls below 3300, the next target will be 3285.

Sell: 3338

Buy: 3302

Sell: 3300

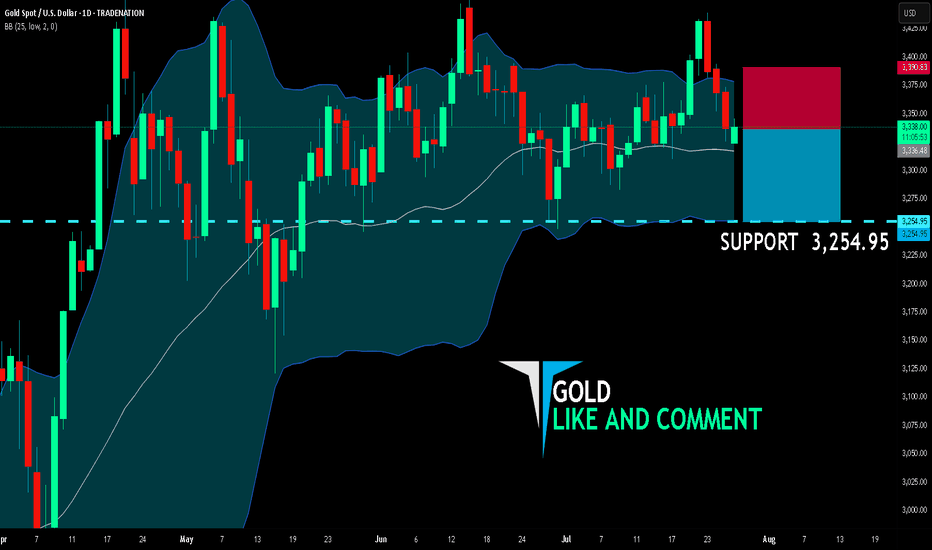

GOLD SENDS CLEAR BEARISH SIGNALS|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,336.48

Target Level: 3,254.95

Stop Loss: 3,390.83

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bounce From Final Liquidity or Start of a Bullish Move? Bounce From Final Liquidity or Start of a Bullish Move?

After the FOMC event, gold completed a sweep of the final liquidity zone at 3269–3271 and rebounded strongly, in line with the broader bullish trend. The price has now recovered sharply and is gradually returning to the liquidity zones left behind after yesterday’s sharp drop.

📍 At the moment, gold is reacting around 3295, which aligns with a CP (Compression Point) Zone on the M30 chart. We're seeing a slight pullback here, and another retracement could occur before a strong upward continuation — potentially breaking out of the descending trendline that’s formed over recent days.

📊 Trading Plan & Key Levels

✅ BUY ZONE – Trend Continuation Setup

Entry: 3286–3284

Stop Loss: 3278

Take Profits:

3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → …

💡 This is a prime area to look for re-entries into the dominant bullish move. Price action left a clean liquidity zone below after the aggressive upside reaction — ideal for riding the next wave.

❌ SELL ZONE – Only Valid Below VPOC

Entry: 3328–3330 (Volume Point of Control)

Stop Loss: 3335

Take Profits:

3324 → 3320 → 3315 → 3310 → 3305 → 3300

🔻 This is a high-probability short only if price stays below 3330. If gold closes above this VPOC region, the structure shifts to bullish and we should look for sells higher up — around 335x–337x zones.

📅 Monthly Candle Close – Watch for Indecision

As it’s the last trading day of the month, note that the past two monthly candles have printed doji-like wicks, signalling indecision and liquidity grabs. The market is still waiting for a clearer signal from the Fed on the first potential rate cut of the year.

🚫 Avoid emotional trading. This is a highly reactive environment, so careful risk management is key.

🧭 Final Thoughts

Gold continues to respect market structure and liquidity theory. The first major test lies at the 3313 resistance level — if broken, it opens the door to stronger bullish momentum toward the broader VPOC zone.

⏳ Be patient and only act when price confirms your bias.

Gold Trade plan 30/07/2025Dear Traders,

This chart represents the XAU/USD (Gold / U.S. Dollar) pair on a 4-hour timeframe. The market is showing a series of Fibonacci retracements and key levels, with potential price action zones marked for future movements.

Key Levels:

Resistance Zones: At 3,422.105 (near the green line), followed by the 3,386.171 level (Fibonacci 0.618).

Support Zones: Major support is visible near 3,282.131 (bottom of the chart), with additional minor support levels at 3,305.000 and 3,293.000.

Mid-range Support: Around 3,369.987.

Potential Price Action:

The price recently dropped from higher levels, breaking below the previous support levels. The market seems to be testing lower support zones.

A potential move down towards 3,284.116 or 3,282.131 is likely if the current support levels do not hold.

Conversely, if price action holds the current support zone (3,329.040), a retest of the higher resistance at 3,350.163 could occur.

Fibonacci Levels:

Retracement Levels: The Fibonacci retracement is drawn with key levels, particularly around 3,372-3,378 and 3,349-3,357, acting as strong support or resistance.

Extensions: There is potential for the price to move towards the 3,420 region if resistance levels break.

Strategy Suggestion:

Short Position: Targeting lower levels near 3,282.131 or 3,284.116.

Long Position: If price holds above 3,329.040, target resistance at 3,350.163 and beyond.

Regards,

Alireza!

Gold Market Outlook – 1H ChartGold (XAU/USD) continues to show bearish momentum with lower highs and consistent structural breakdowns. Price is currently consolidating just above a key support zone (~3315), forming a descending triangle pattern — often a bearish continuation signal.

If the support breaks, the next liquidity zones lie around 3270–3250, with a deeper target near 3225, as highlighted by the green demand areas. Fundamental catalysts ahead (as shown by US economic events) could act as triggers.

GOLD BUY TRADE IDEA • Price Action Context:

• Recent bearish leg shows a clear shift from premium to discount territory.

• Market is approaching a higher timeframe demand zone around $3,277 – $3,299 (highlighted red zone).

• Notable inducement below recent lows suggests engineered liquidity to fuel a potential reversal.

• Current Market Structure:

• After a deep retracement, price is expected to tap into the discount zone, where institutional buy orders may be resting.

• Anticipated bullish reaction following a liquidity sweep of the lows and demand mitigation.

• Smart Money Flow:

• Inducement ➝ Liquidity Grab ➝ Demand Tap ➝ Bullish Reaction setup in play.

• Internal structure likely to shift bullish after a sweep, potentially forming a higher low and aiming for a BOS (Break of Structure) on the upside.

• Upside Target:

• Short-term target area: $3,360 – $3,380.

• Possible continuation toward premium if internal structure confirms strength.

🧠 Smart Money Narrative:

1. Induced sell-off below structure for liquidity collection.

2. Approaching major POI (Point of Interest) in discount.

3. Anticipated entry point for institutions to buy gold at value.

4. Reversal expected toward premium imbalance areas.

XAU/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 4-hour timeframe, showing both a potential retracement and a bullish continuation.

---

Technical Breakdown:

1. Current Market Structure:

Price recently made a strong bullish push from the key support level (~3,329–3,335), breaking structure to the upside.

It is now approaching a Fair Value Gap (FVG) and resistance zone between 3,380.47 and 3,396.19.

2. Key Zones Identified:

FVG / Resistance Zone: 3,380.47–3,396.19 — where price might initially reject (red arrow) due to unfilled imbalance and previous supply.

Key Support Zone: 3,329.27–3,335.31 — potential area of re-entry or demand if price pulls back.

EMA 200 (Blue): Currently at 3,335.58, aligning with key support.

3. Price Path Scenarios:

Primary Expectation: Price may tap into the FVG, face rejection, then pull back into the key support level for a higher low.

From there, it is projected to bounce back strongly toward the ultimate target at 3,438.73, marking a 3.19% upside move.

4. RSI (14):

RSI at 64.77, indicating strong bullish momentum but not yet in overbought territory. Favorable for continuation, but a short-term correction is possible.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish (after a short-term rejection)

Entry Zones:

Watch for rejection at 3,380–3,396

Look to enter on a retest of 3,335–3,329 support

Target Zone: 3,438.73

Invalidation: Sustained breakdown below 3,329 or bearish engulfing with high volume

EMA & RSI Support: EMA 200 backs bullish bias; RSI confirms momentum

Please support boost 🚀 this analysis)

XAUUSD Weekly Outlook – August 4–8, 2025New Month. New Week. New Questions.

Will the market reward hesitation — or bold reaction?

Will POTUS pump price with policy noise, or will smart money fade the manipulation?

August is historically a quieter month for hedge funds — but don’t mistake silence for safety. It's also the time when the Fed retreats to Jackson Hole, reflecting and recalibrating. Will September bring another rate cut… or another twist?

Stay sharp. This isn’t a month to sleep on.

"Last week's game plan played out nearly to perfection — well, almost! Let’s dive in and break down where gold could be headed next week."

Gold kicks off August with a strong breakout above $3360, powered by a weakening U.S. dollar, rising global risk appetite, and persistent institutional demand. With Jackson Hole on the horizon and shifting Fed expectations, volatility is set to spike. The big question: will gold extend above premium, or retrace to rebalance?

After the last rejection near 3440, price broke cleanly below its ascending channel. Now, gold appears to be forming a potential lower high around the broken trendline — a rejection here could trigger a drop toward the key $3250 support zone.

🟡 XAUUSD – August Macro Outlook

💰 Price: $3362

📅 Date: August 3, 2025

📈 Bias: Bullish but extended — high in premium

🔸 Monthly Overview

📊 Trend: Bullish continuation (CHoCH April 2023)

🧱 Supply Zone: 3350–3439 → monthly wick trap

⚠️ RSI 80+, price nearing 100% Fib extension

🔮 Breakout above 3439 → 3505 / 3610 next

🔻 Rejection → pullback to 3270 / 3180

🔸 Weekly Outlook

💥 Structure: Strong bullish, EMA stack intact

🟥 Final HTF Supply: 3350–3439 (currently testing)

🟦 Demand Below: 3270 → 3215 → 3070

🎯 Targets if breakout: 3505 → 3560 → 3610

🔸 Daily Structure

⚔️ Now testing: 3355–3375 → last valid supply

🎭 Above that → internal trap at 3398–3412

🧨 Final ceiling at 3430–3439 — breakout or reversal?

🔸 H4 / H1 Key Zones

🟥 Supply: 3360–3375 / 3385–3398 / 3430–3439

🟫 Flip Long Zone: 3322–3310

🟦 Bullish Demand: 3285–3260 → 3222–3205

⚠️ RSI elevated, watch for reaction not breakout

🔹 Execution Plan

✅ Above 3439 → Expansion to 3505 / 3610

🔁 Pullback to 3325 / 3285 → Sniper long zones

🔻 Rejection from 3375 → Short scalp → Target 3320

📌 3439 = Key Monthly Pivot

🟢 Hold above → New expansion wave

🔴 Fail below → Retrace toward value

Extended:

🔸 Scenario 1: Breakout and Expansion

If bulls push through 3375 with conviction and break above 3439, gold enters a fresh leg of macro price discovery. This would activate a clean expansion path toward:

3405 (short-term extension)

3505 → 3560 → 3610 (Fibonacci projections)

3740 (full trend extension if momentum persists)

This scenario requires solid bullish confirmation, especially on H4 or D1 structure. Traders should look for LTF OB re-entries or bullish flags above 3350 to join the trend safely.

🔸 Scenario 2: Rejection and Retrace

If gold rejects from the 3360–3375 zone and fails to hold above it, a controlled retracement is likely. Key downside targets include:

3325 → first flip zone for re-entry

3285 → origin of the latest rally (strong buy zone)

3215–3180 → high-timeframe demand and imbalance fill

Only a breakdown below 3260 would threaten the bullish structure and shift bias toward neutral or bearish.

🔸 Conclusion

Gold is approaching its inflection point. The macro trend is intact, but momentum is stretched, and the market now demands clear validation.

📌 3439 remains the weekly pivot:

Above → Expansion toward 3500+

Below → Retracement to reclaim value

For next week, the most probable path is early consolidation inside 3360–3375, followed by a decisive reaction — either continuation toward 3405+, or a corrective drop toward 3325/3285 to reset structure.

Disclaimer: For educational context only.

#XAUUSD #Gold #SmartMoney #TradingAnalysis #SMC #USD #GoldOutlook

Potential bearish drop?The Gold (XAU/USD) has reacted off the pivot and could drop to the 1st support.

Pivot: 3,306.31

1st Support: 3,239.07

1st Resistance: 3,357.09

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold (XAU/USD) Daily Trading Plan - 28th July 2025🔺 Technical Analysis

Gold opened the Asian session this week with a slight retracement, testing the 0.382 Fibonacci Retracement level before bouncing back strongly to last week's closing price around 3339. This move further solidifies the price action from a technical perspective.

Notably, gold has broken through a minor resistance on the M15 timeframe, invalidating the bearish structure and forming a full-bodied H1 candle. This sets the stage for a potential corrective uptrend to unfold.

On the Daily timeframe, the initial session's decline retested the bullish trendline and bounced back within the boundaries of the flag pattern. It's likely that this week, the price will continue towards the end of this pattern, providing a clearer confirmation of the medium-term trend.

🔺 Key Macroeconomic News

This week promises to be volatile with several crucial economic announcements, particularly as it marks both the end of the month and the start of a new one. Two key events that traders should pay close attention to are:

FOMC Interest Rate Decision: Always a focal point for the market, with significant impact on safe-haven assets like gold.

Non-Farm Payroll (NFP) Report: Vital US labour market data, capable of triggering substantial movements in both the USD and gold.

Therefore, be prepared for potential market shocks and exercise careful risk management.

📈 Trading Strategy & Considerations

Given the technical setup and upcoming macroeconomic events, consider the following:

Potential Corrective Uptrend: The invalidated bearish structure on M15 and the strong H1 candle suggest a short-term bullish bias for a corrective move.

Daily Flag Pattern: Monitor price action as it approaches the end of the flag pattern on the Daily timeframe for medium-term trend confirmation.

High Volatility Ahead: Exercise extreme caution around the FOMC and NFP announcements. These events can lead to significant and rapid price swings.

Risk Management: Prioritise strict risk management. Consider reducing position sizes or employing wider stop-losses during high-impact news events.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose.

XAUUSD 4H – Massive Sell Setup: Gold Crash Incoming? Gold (XAUUSD) just tapped into a key liquidity zone near the 38.2% Fibonacci retracement at $3,364, followed by a sharp rejection. This aligns with the upper channel resistance and a bearish confluence from previous supply zones.

Price has failed to break above the dynamic EMA cluster and is showing signs of exhaustion after a relief rally. If momentum follows through, this could mark the beginning of a deeper selloff targeting major downside levels.

Short Setup

Entry: Around $3,349–$3,364 (rejection zone)

SL: Above $3,379

🚨Strong bearish engulfing candle confirms seller pressure

🎯 Take Profit Targets (Fibonacci):

TP1: $3,305 (38.2%)

TP2: $3,275 (61.8%)

TP3: $3,241 (Full move – 100% Fibonacci extension)

This setup offers high risk-reward if the rejection holds and price breaks below the mid-zone structure at $3,330. A drop below $3,305 could accelerate the move as liquidity gets swept.

Gold big data is here! Gold prices are igniting the market!Market News:

Spot gold fluctuated narrowly in early Asian trading on Wednesday (July 30), currently trading around $3,325 per ounce. London gold prices recovered some of their losses on Tuesday after falling for the fourth consecutive day, as the US dollar gave up some of its earlier gains, boosting international demand for gold. Declining US Treasury yields and a weak US labor market report also prompted investors to buy gold. The gold market is currently at a critical turning point. Fundamental buying and selling factors are in fierce competition: on the one hand, easing global trade tensions are suppressing safe-haven demand; on the other hand, falling US Treasury yields and expectations of a possible Federal Reserve shift are providing support. Meanwhile, progress in US-China trade negotiations, Trump's tough stance on Russia and the Middle East, and ongoing geopolitical tensions continue to add further uncertainty to the future of the gold market. Furthermore, attention will be paid to the Bank of Japan and Bank of Canada's interest rate decisions, the US second-quarter GDP data and the July ADP employment data. Second-quarter GDP data from Germany and the Eurozone also warrant attention.

Technical Review:

Gold bottomed out and rebounded, stopping at the 3310 level before rising sharply above the 30 mark. The daily chart closed with a small positive candlestick pattern. The 10/7-day moving averages remain converging, suppressing the 57 level above. The RSI stopped below the 50-day moving average and adjusted downward, with the price trading below the middle Bollinger Band at 40. A four-hour chart golden cross formed and pointed upward. The hourly MACD momentum bar is above zero, while the RSI is flattening, indicating a neutral trend. Gold technically remains in a wide range of fluctuations. The trading strategy is to sell high and buy low. Plan to buy low at 3318/06 and sell high at 3346/58. The release of important data today will affect the original technical trend of gold and silver, increasing volatility. Be aware of market risks.

Today's Analysis:

Although gold rebounded yesterday, the momentum wasn't particularly strong, with the upward trend remaining erratic. Bullish volume remains insufficient. Today's key events will be the non-farm payroll report and the Federal Reserve's interest rate decision. Pre-market activity is unlikely to see a significant upturn, so we'll have to wait for the data to provide direction. Expect volatility before the release! The slope of gold's 1-hour rebound doesn't necessarily indicate a deep V-shaped pattern. Gold hasn't yet reversed, and a second bottom is possible. Only if gold doesn't break a new low during this second bottoming out could a double bottom form. Gold is still expected to decline in the Asian session. If gold rebounds and comes under pressure, continue selling. A deep V-shaped reversal is only possible if gold breaks through and stabilizes at the 3345 level. Until then, continue selling at high prices.

Trading strategy:

Short-term gold: Buy at 3310-3313, stop loss at 3300, target at 3340-3360;

Short-term gold: Sell at 3343-3346, stop loss at 3355, target at 3310-3300;

Key points:

First support level: 3310, Second support level: 3292, Third support level: 3284

First resistance level: 3338, Second resistance level: 3346, Third resistance level: 3358

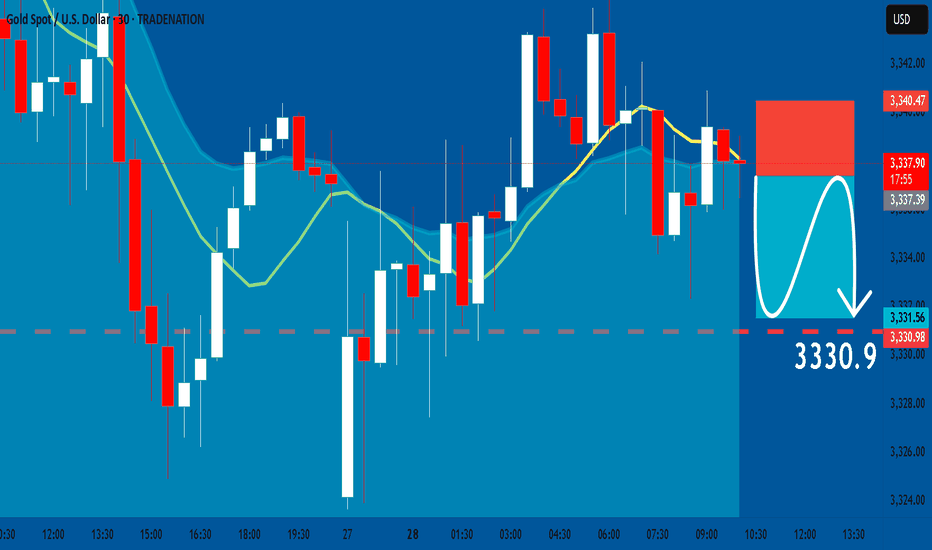

GOLD: Short Trade with Entry/SL/TP

GOLD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GOLD

Entry Point - 3337.3

Stop Loss - 3340.4

Take Profit - 3330.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Is Gold 3400 Still Far Away?

💡Message Strategy

The spot gold market experienced a V-shaped reversal trend.Driven by unexpectedly weak U.S. non-farm payrolls data and risk aversion triggered by Trump's new tariff policy, gold prices rose nearly 2% on Friday to a one-week high of $3,347.66 per ounce, up 0.4% for the week. The Federal Reserve kept interest rates unchanged, but weak employment data rekindled expectations of a September rate cut, increasing the appeal of gold as a non-yielding asset.

At the same time, Trump's decision to impose tariffs of 10%-41% on many countries has exacerbated market concerns about global trade tensions and boosted the safe-haven demand for gold.

📊Technical aspects

The 1-hour moving average of gold has begun to turn upward, and the 1-hour moving average of gold has a double bottom structure. However, gold should not have such a large pullback for the time being. After the non-farm payrolls on Friday, gold fell back to the 3335 line and then began to fluctuate upward at a high level. The 3335-3345 area was also an important platform support in the early stage. Therefore, gold will mainly be bought on dips above 3335 next week.

💰Strategy Package

Long Position:3345-3355,SL:3325,Target: 3380-3400