GOLDCFD trade ideas

Gold May Rise Technically after Testing the $3,300 Zone📊 Market Overview:

Spot gold is trading around $3,295–$3,301/oz, influenced by slightly lower U.S. Treasury yields and a softer dollar tone. Analyst consensus from Reuters projects gold likely to stay above $3,220/oz through 2025 and possibly hit $3,400 in 2026 amid continued safe-haven demand

📉 Technical Analysis:

• Key resistance: $3,320 / $3,345

• Closest support: $3,274 – $3,280

• EMA09: Price is currently below the 9 period EMA on H1, indicating a short-term bearish bias.

• Candlestick / volume / momentum: There was a minor bounce from the support zone around $3,274, but volume remains low. RSI isn't oversold, suggesting room for technical pullback.

📌 Outlook:

Gold may experience a technical rebound if it holds above $3,280. A breakout above $3,320 would likely require clear catalyst—such as weak U.S. data or a dovish Fed tone.

💡 Suggested Trading Strategy:

SELL XAU/USD: $3,320 – $3,323

🎯 TP: 40/80/200 pips

❌ SL: $3,326

BUY XAU/USD: $3,279 – $3,282

🎯 TP: 40/80/200 pips

❌ SL: $3376

XAUUSD Outlook – July 29, 2025

Gold enters a high-risk environment starting today.

All eyes are on Jerome Powell's speech, which will signal whether the Fed remains firm on its hawkish stance or adopts a more dovish tone.

📈 That said, a broader look at the chart suggests the market has already aligned itself with the dominant trend.

🗓️ In addition to today’s speech, tariff-related news expected on Friday doesn’t seem likely to disrupt the ongoing bullish momentum in gold — or in crypto markets, for that matter.

🧠 That’s the general market read I'm sensing right now, but we’ll have to see how it unfolds.

🎯 Personally, I still view the $3290 level as a solid buy zone, with the potential to become one of gold’s historical bottoms.

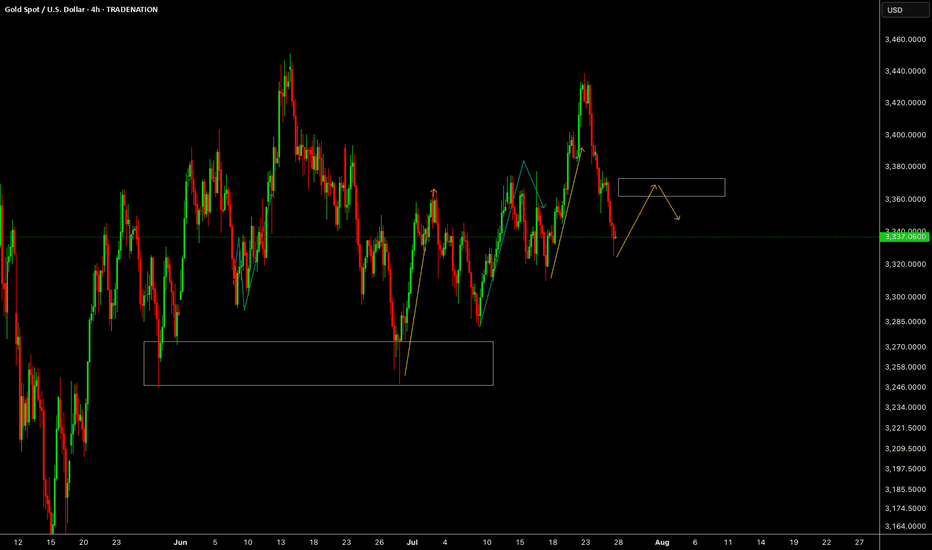

GOLD Falls Back Toward the $3,300 ZoneOver the past four trading sessions, gold has depreciated more than 3.5%, showing a renewed and steady bearish bias around this major safe-haven asset in the short term. Selling pressure has remained strong recently, as confidence in financial markets has gradually improved. Investors have responded positively to the latest trade agreement developments, which have temporarily reduced concerns surrounding the trade war. As a result, demand for safe-haven assets has declined, directly impacting gold, one of the most important hedging instruments currently in the market.

Sideways Range Remains Active

Since late April, gold has been unable to establish a clear directional bias, and has remained trapped within a sideways range, with resistance around $3,400 per ounce and support at $3,300 per ounce. So far, price action has not been strong enough to break out of this structure. However, gold is now testing important support levels, where sellers could begin to face stronger barriers as the price attempts to break through the bottom of the established range.

RSI: The RSI line has consistently crossed below the neutral 50 level, indicating that selling momentum is becoming more dominant. If this trend continues in the short term, it could reinforce the presence of bearish pressure in upcoming sessions.

MACD: The MACD histogram has started to move below the zero line, suggesting that the momentum of the moving averages has shifted firmly to the downside. This reflects a strong bearish tone, and if this continues, selling pressure could become more relevant in the short term.

Key Levels:

$3,400 per ounce – Major Resistance: This level marks the recent all-time high for gold. If buying momentum pushes the price back above this zone, it could trigger a renewed bullish bias and set the stage for a sustained upward trend in the sessions ahead.

$3,300 – Current Barrier: This level defines the lower bound of the short-term channel. A break below this support could confirm a dominant bearish bias, potentially lasting for several trading sessions.

$3,200 – Final Support: This marks the lowest price level reached by gold in recent months and lies below the 100-period simple moving average. If the price drops to this zone, it could trigger the start of a new short-term downtrend on the chart.

Written by Julian Pineda, CFA – Market Analyst

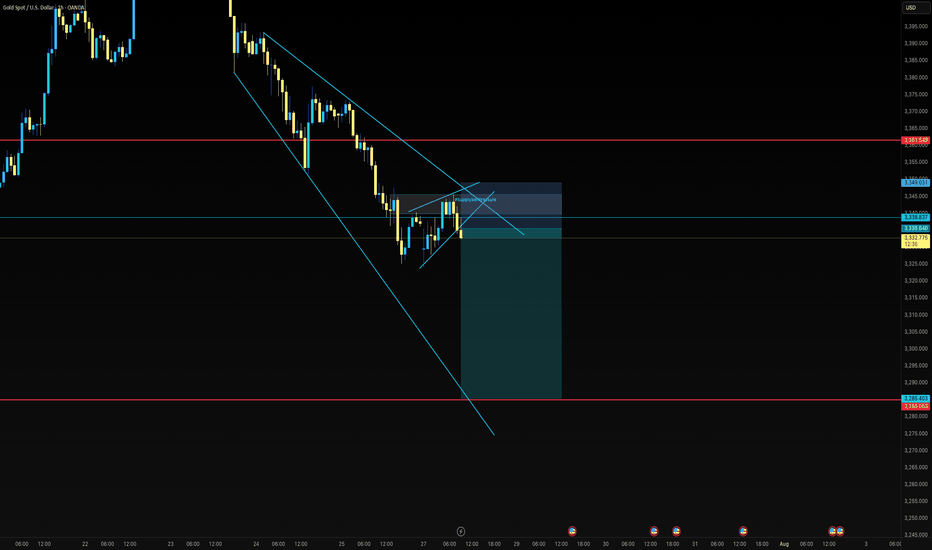

XAUUSD on Bearish values and volume Gold is currently below rising channel and holding the Range of 3320-3335,although yesterday implusive drop is incompleted without testing 3290-3280

Eyes on DXY

What's possible scanarios we have?

▪️I will wait next for my sell trades at 3338-3345 area but what we have to watch during that time H4 candle closing.if H4 & H1 candle close above I will not hold or renter sell also below 3320 we have implusive drop.

▪️Secondly if H4 candle closing above 3345 this down move will be invalid and Price-action will reached 3370.

#XAUUSD

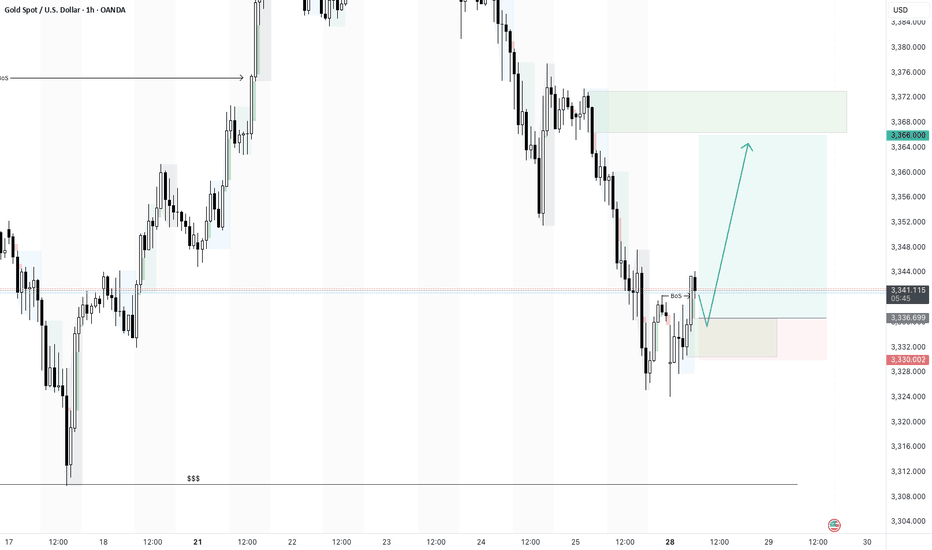

XAUUSD 28/2/25 - Morning bullish pushBased on the 1hr- there is a break of structure and i am looking for a bullish move this morning.

There is a chance that this trade fails as there is a 4hr equal low liquidity below which could draw the price to.

Im still going to take this trade and let price do its thing today.

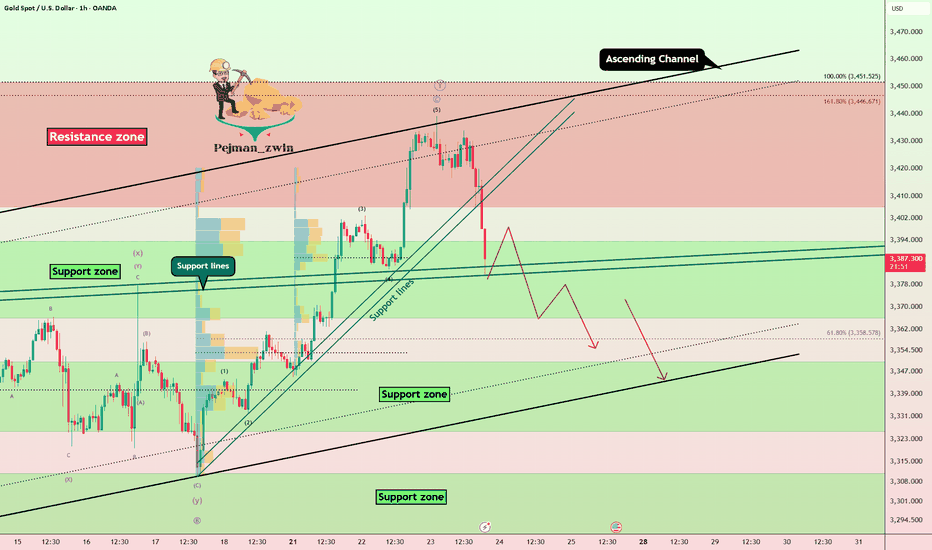

Gold Fails at Resistance, Elliott Wave Signals Deeper CorrectionGold ( OANDA:XAUUSD ) started to rise after the Richmond Manufacturing Index(Actual:-20/Forecast:-2/Previous-7) index was announced, but failed to break the upper line of the ascending channel and the Resistance zone($3,451-$3,406) .

Gold has now broken through the Support lines and is attempting to break through the next Support lines and Support zone($3,394-$3,366) .

In terms of Elliott Wave theory , it appears that the main wave Y has completed above the ascending channel.

I expect that given the momentum of gold's decline , gold will be able to break the Support zone($3,394-$3,366) and Support lines and fall to at least $3,356 . The next target could be the lower line of the ascending channel .

Note: Stop Loss (SL) = $3,423

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold Market Opens the Week with Bullish Hedge Toward 3370'sGold market opens the week by hedging into fresh demand at 3320's, building a bullish sentiment.

The price action now aims to mitigate 3370's, aligning with the continuation of the upward trajectory if structure holds. follow for more insights , comment and boost idea

XAUUSD 15m XAUUSD Possible Pullback Buy SetupThis is what I'm looking at currently for gold. The breakout from the range and reclaim of previous resistance as support indicates buyers are in control, but market is approaching heavy resistance above, so I'm looking for “buy dips” rather than chasing late longs.

XAUUSDXAU/USD represents the exchange rate between one troy ounce of gold (XAU) and the US dollar (USD). It shows how much in US dollars is required to purchase one ounce of gold. This pair is widely traded across forex and commodities markets and is considered a key indicator of global economic stability and investor sentiment.

Historically, gold was pegged to the US dollar under the Bretton Woods Agreement from 1944 to 1971. During this period, one ounce of gold was fixed at $35, and the US government guaranteed the convertibility of dollars into gold. In 1971, President Richard Nixon ended the gold standard, allowing gold to trade freely on global markets. This led to significant volatility in the price of gold, which began to reflect real-time market forces such as supply, demand, inflation, and geopolitical events.

In the decades that followed, gold experienced several major price movements. In 1980, gold surged to around $850 per ounce due to high inflation and geopolitical instability. It then declined and remained relatively low through the 1990s, reaching a low near $270 in 2000. Starting in the mid-2000s, gold began a strong upward trend driven by concerns about inflation, financial crises, and central bank policies, culminating in a peak near $1,920 in 2011 during the Eurozone crisis and Federal Reserve monetary easing.

In 2020, gold hit a new all-time high around $2,070 during the global uncertainty of the COVID-19 pandemic. Since then, it has continued to be influenced by economic data, interest rate decisions, inflation trends, and geopolitical developments. In 2024 and 2025, gold has remained strong, supported by central bank buying and expectations of future rate cuts. As of August 2025, the current price of gold has reached $3,363 per ounce, reflecting heightened demand and ongoing macroeconomic uncertainty.

XAU/USD is influenced by many factors, including the strength of the US dollar, inflation expectations, geopolitical risks, and investor demand for safe haven assets. When the dollar weakens or global uncertainty increases, gold typically gains value. Traders and investors often use gold to hedge against economic instability, inflation, or currency devaluation.

Today, gold remains one of the most important assets in global markets, and XAU/USD continues to be a major pair for both short-term traders and long-term investors.

XAUUSD TRADE UPDATE MISSED TRADE Hey everyone here’s a trade recap of the week at first we were interested to take buys at 3254 zone as first entry and scale in at 3287 zone but price pulled down slightly missed the first entry and I didn’t execute & the second entry didn’t execute that too and market skyrocket if price activated the first entry we would’ve caught a huge trade today,the first one didn’t activated so I didn’t execute the second entry which is the 3287 zone that buyers came in so we move on and I will keep on sharing potential good setups and have a beautiful weekend guys….

Zones for the rest of August (if no ATH)Just simple zones, ignore. I want to compare to the end of the month later.

Keep trading simple. These are the zones I made after drawing from 4H all the way to 5 minute candle for precision. I already have my own speculation but feel free to use it for your own.

Goodbye, trade safe.

Gold Price Target: 3380-3400+, Set a Trailing StopGold Price Target: 3380-3400+, Set a Trailing Stop

As shown in Figure 4h:

Gold finally rallied this weekend.

Despite recent heavy losses for long positions, the past two days have been encouraging.

We ultimately managed to successfully buy the dip in the 3280-3300 range and recover all our losses.

Gold prices continue to rise, and everyone is asking if it's time to sell.

Now is the critical time to exit.

We must acknowledge one fact:

Gold currently presents a huge opportunity.

Of course, the risks are also increasing.

At times like these, I always emphasize that the best approach is to set a 10-point trailing stop.

Even if gold prices soar, we can move with them.

This non-farm payroll data was a huge disappointment.

It was a truly positive surprise for gold.

The market expected 110,000 new jobs, but the result was a disappointing 73,000, a decrease of half from the previous month.

The market went into a tizzy after the outperformance. But even more shocking news is yet to come: Non-farm payrolls for May and June were revised downward by a combined 258,000.

This means the June gain was revised downward from 140,000 to 14,000.

The May gain was abruptly revised downward from 140,000 to 19,000.

The strong data of the past two months was completely false.

Market followers have become the "clowns" of the Fed and Trump.

Now you understand why everyone praised Powell's hawkish speech two days ago.

Because Powell said: "Only if there is a severe decline in employment will we consider cutting interest rates."

Just this Wednesday, some good non-farm payroll data was released.

This undoubtedly gave the market a false impression.

Everyone believed that a rate cut was impossible, and the probability of a September cut had dropped to 40%.

However, today's poor non-farm payroll data, combined with revisions to May and June data, revealed the truth.

The job market has been dismal over the past quarter.

The market reacted quickly, and gold prices soared on this sentiment.

My advice is to buy gold at a low price and hold on.

For investors who have successfully bought in the 3280-3300 level in recent days, I recommend setting a 10-15 pip trailing stop-loss.

Gold prices are likely to continue their upward trend next Monday.

Our next target is above 3380-3400 points.