GOLDMINICFD trade ideas

Gold breaks down and moves downward, focus on the 3300 markWith the official ceasefire between Iran and Israel, although there are some repeated frictions in the middle, under Trump's mediation, both parties are relatively tolerant. It seems that the war has been declared over. Gold has also fallen sharply. In the early trading, it fell sharply to around 3333 and stabilized. After rebounding to around 3357, it fell again under pressure. During the European trading session, it broke the low and continued. It repeated around 3317/8 and fell again under pressure around 3332. This position has become the key pressure point for the current top and bottom conversion. In the evening, the testimony of Federal Reserve Chairman Powell was also relatively cautious. He believed that inflation had declined, but it was still far from the 2% target. He tended to adjust interest rates after inflation achieved the target. Therefore, the double pressure caused gold to rebound weakly and repeatedly run weakly. At present, the lowest level reached 3304, which is one step away from the 3300 mark. Judging from the current trend, the overall weak pattern continues. In the evening, relying on the 3300 mark, try a long order for the last time, and then do a good job of continuing defense after the break.

6/24 Gold Evening Reference Ideas

Gold is long near 3303/05, defend 3298, target 3320/3330, short at 3298, defend 3305, target near 3276, short at 3330, defend 3337, watch 3316/08

Market next target 🔁 Disrupted Analysis (Bullish Scenario Instead of Bearish)

1. Support Holding Firm:

The analysis assumes the price will drop after failing resistance, but the current price action is showing higher lows, suggesting accumulation.

The support area has been tested multiple times, showing strength.

2. Volume Analysis Contradiction:

Recent green volume bars indicate buying interest at lower levels.

No significant volume spike on the last downward leg, suggesting lack of strong selling pressure.

3. Potential Inverted Head and Shoulders:

The current formation could be the right shoulder of an inverted head and shoulders pattern, a classic bullish reversal setup.

If confirmed, this could lead to a breakout above the resistance area, not a drop.

4. Trendline Breakout Watch:

There's a potential bullish breakout of the descending trendline.

A break above 3,320 USD could invalidate the bearish thesis and suggest a target near 3,340–3,350 USD.

XAUUSD: Post-Crash Buy Zone and Bullish SetupHere's a structured breakdown of today's #XAUUSD (Gold) trading idea, including key levels, wave structure, and risk/reward zones for both short-term and swing traders.

---

🔹 Key Technical Zones (H1 & H4 Charts)

Support Levels

- 3,303 USD – Key support on H4; potential false breakout area

- 3,324–3,327 USD – Wave 5 completion zone and high-probability buy area

- 3,337–3,343 USD – Entry zone for early bullish setups

- 3,340–3,345 USD – Clean long entry; targeting up to 3,450 USD

Resistance Levels

- 3,363–3,365 USD – Sell zone tied to wave 4/5 overlap

- 3,375–3,383 USD – Mid-range resistance; key for short-term profits

- 3,405–3,500 USD – Long-term bullish targets; includes ATH region

---

🔹 Wave Count (H1 Structure)

- Wave X – Recent sell-off ended a potential uptrend; suggests ongoing correction (WXY)

- Wave Y – 5-wave drop toward 3,363–3,365 USD; acting as a short-term sell zone

- Wave Z – Expected final leg down toward 3,324–3,327 USD (ideal buy zone)

- Retracement Setup – Anticipated bullish retrace post-wave 5, with targets back at 3,363–3,376 USD

---

🔹 Order Blocks & FVGs

Buy Zones

- 3,343–3,330 USD – FVG within an order block; strong bullish entry area

- 3,319–3,317 USD – Deep support with short-term target at 3,349 USD

Sell Zone

- 3,363–3,365 USD – Key area for short setups, with targets at 3,342–3,330 USD

---

🔹 Strategy & Key Takeaways

1. Bullish Structure Still Intact

- Rising channel remains valid on H4

- Holding 3,303 USD is critical for confirming bullish continuation

2. Trade Setup

- Long entries near 3,340–3,345 USD

- Target range: 3,450 USD and above

- Tight stops around 3,325 USD recommended for low-risk exposure

3. Wave Completion Zones in Play

- Monitor 3,324–3,327 USD (buy zone) and 3,363–3,365 USD (sell zone) for end-of-wave activity

4. Risk Management Is Key

- Scale into positions

- Respect intraday volatility and breakout traps

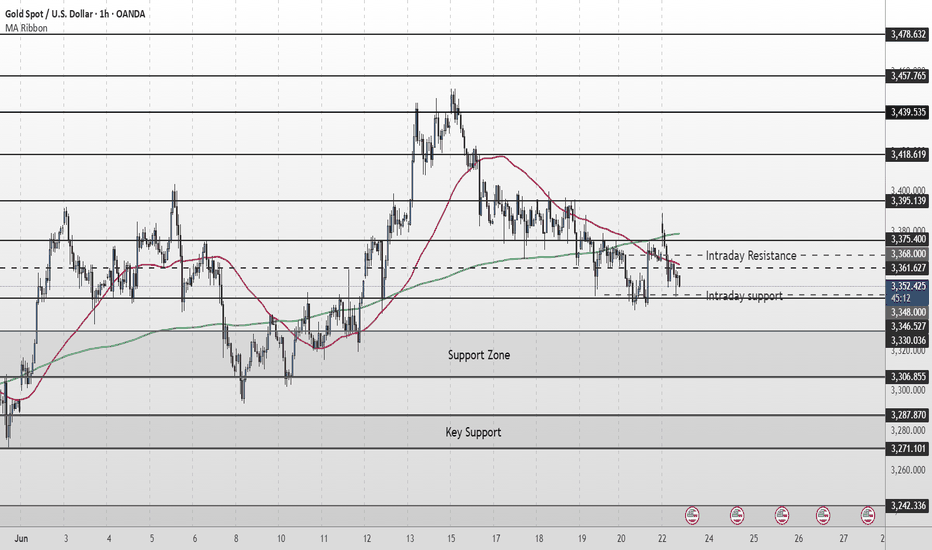

Gold Short Term OutlookYesterday’s chart idea is playing out as analysed.

Gold failed to break above the $3,395 resistance and has now pulled back, currently testing the first support zone — aligned with the 4H 200MA and Daily 50MA.

If this area fails to hold, price is likely to head toward the next key support zone, where we expect a potential reaction.

To resume bullish momentum, we need to see a strong close above $3,346. Key bullish zones remain $3,375 and $3,395.

📌 Key Levels to Watch:

Resistance:

$3,375 • $3,395 • $3,418 • $3,439

Support:

$3,361 • $3,346 • $3,330 / $3,306

$3,287 – Critical demand zone

🧠 Fundamental Focus:

All eyes are on Fed Chair Powell’s testimony today, which may offer clues about the Fed’s rate outlook and inflation stance. Any hint of continued hawkishness could weigh on gold, while dovish commentary may trigger renewed upside interest.

Expect heightened intraday volatility around his remarks — stay cautious.

Gold Short Term OutlookGold is currently trading around $3,368, caught between dynamic moving average resistance and an intraday resistance zone.

Price must break and hold above the $3,378 resistance to open the path toward $3,395. A confirmed break above the key $3,395 level could signal the start of the next bullish leg.

However, repeated failure to break above $3,395 — or even $3,378 — may drag gold lower into key support zones.

📌 Key Levels to Watch:

Resistance:

$3,375 • $3,395 • $3,418 • $3,439

Support:

$3,361 • $3,346 • $3,330 / $3,306

$3,287 – Critical demand zone

🧠 Fundamental Insight:

Gold remains supported amid rising geopolitical tensions. Over the weekend, U.S. airstrikes targeted Iranian nuclear sites, escalating concerns over a broader conflict in the Middle East. This has reignited safe-haven demand, with gold catching a bid despite recent technical pullbacks.

Meanwhile, traders are weighing softer U.S. inflation signals against the Fed’s cautious stance. If tensions persist and economic data weakens, gold could benefit from both risk-off flows and increased speculation around potential rate cuts.

Gold out look Daily Timeframe Analysis

Gold continues to respect its medium to long-term bullish structure on the daily timeframe. Despite the ongoing geopolitical tensions and war-driven headlines, price action has experienced a corrective pullback from the key resistance area near 3430.

Importantly, gold appears to be forming a minor bullish channel within a broader consolidation zone suggesting that price is currently in a range-bound correction phase nested inside a higher-timeframe uptrend. The channel structure reflects healthy consolidation, not a trend reversal.

Chart Reference: Daily Chart

3-Hour Timeframe (Intraday Structure)

The 3H chart shows price recently reacting from the bullish channel support, confluenced with a demand zone and the Fibonacci golden zone indicating a strong technical base. A new fresh demand zone has been created as a result of this reaction.

Price is currently holding above the minor intraday structure at 3365.

If this level holds, short-term targets are 3377 – 3380.

A confirmed break and retest above 3380 opens up the next leg toward 3400 – 3404 resistance.

Chart References:

Fundamental Backdrop

A combination of macroeconomic and sentiment-based indicators support the bullish bias:

COT (Commitment of Traders) data shows institutional positioning remains net long on gold.

Retail sentiment is skewed towards short, which historically supports upside moves.

Seasonal bias for gold typically favors strength during mid-to-late Q2.

US economic indicators show signs of cooling:

Manufacturing PMI & Services PMI have slowed.

Retail sales remain soft.

Inflation readings suggest disinflationary pressure.

These factors collectively weaken the US dollar, adding upside pressure to gold.

Downside Risk / Bearish Scenario

If price fails to hold above 3365 and decisively breaks below the current channel, we could see a deeper correction toward the 3300–3280 area of interest which aligns with a major support, daily bullish trendline, and longer-term reaccumulation zone.

15-Minute Timeframe (Microstructure Insight)

On the 15M chart, gold rallied from the channel base and demand zone, but has since entered a consolidation phase between 3365 and 3372. A Fair Value Gap (FVG) lies just beneath the 3365 pivot — suggesting the potential for a liquidity sweep before any continued move to the upside.

This setup is often a precursor to an aggressive expansion move, particularly during high-volume sessions (London/New York overlap).

Summary

Bias: Bullish (while above 3365)

Immediate Support: 3365

Short-Term Targets: 3377 → 3380 → 3404

Key Resistance: 3430

Bearish Invalidations: Below 3365

GOLD: Will Go Up! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,274.66 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

6/25 Gold Analysis and Trading ViewGood morning, everyone!

Gold experienced a sharp decline yesterday. Technically, the conditions for a rebound are in place, but since a solid bottom structure has yet to form, a retest to the downside is likely during today’s session.

Key levels to watch:

Resistance zone: 3336–3348

Support zones: Primary support at 3313–3303, with additional support around 3296–3282

Today’s overall strategy remains buying on dips as the primary approach, with short opportunities near resistance as a secondary option.

Key scenario to monitor:

If the price drops to around 3280 but fails to rebound toward 3336, and the daily close ends below 3300, then the buy-on-dip strategy will likely continue into tomorrow.

XAUUSD Expecting Bullish movementDowntrend and Reversal

Initially, the market showed a strong bearish trend highlighted by the red and blue descending channel

A bullish reversal followed after a double bottom formation around the 3315 zone which acted as a key support level

Breakout Confirmation

Price broke above the descending channel and is now showing higher highs and higher lows confirming a bullish structure

A bullish break and retest pattern is anticipated at the 3331 3332 zone marked with a horizontal support box

Entry and Target Zone

A long position is suggested after the retest of the support zone around 3331

Target 3370 a major resistance level from the previous price action

Stop-loss Below 3315 just under the recent swing low for risk management

Risk-Reward Ratio

The trade offers a favorable risk-reward setup with the green zone indicating profit potential and the red zone representing risk

Gold fluctuates at high levels, intraday trading points📰 Impact of news:

1. Initial unemployment claims data

📈 Market analysis:

Gold has begun to show signs of bottoming out in the short term in the past two days. Since the daily line bottomed out and pulled up, the daily line closed positive yesterday, and the bulls began to counterattack, and the 1H low was rising. If it doesn't fall further in the short term, it will most likely bottom out and rebound. The upper pressure is at the Bollinger middle track of 3355, which is also the high point of Tuesday's decline. If gold breaks and stabilizes at this price, it will have a larger upward space, and the upper side will look at 3385. In the 4H chart, MACD temporarily forms a golden cross, which is a bullish signal; but the BOLL track pressure is still there, and gold bears still have momentum in the short term. Therefore, on the whole, in the short term, gold should pay attention to the 3350-3360 resistance above. If it encounters resistance under pressure here, it can consider shorting. Pay attention to the 3330-3320 support area below.

🏅 Trading strategies:

SELL 3350-3360

TP 3340-3330-3320

BUY 3330-3320

TP 3340-3350

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

Xauusd market update This chart shows a Gold Spot (XAU/USD) analysis on the 1-hour timeframe. Here's a breakdown of the setup:

---

Key Levels:

Current Price: $3,326.695

Support Zone (Blue Area): ~$3,280 – $3,310

Resistance Zone (Purple Area): ~$3,375 – $3,400

---

Chart Insights:

The price appears to be consolidating in a range (highlighted by the blue support/resistance bands).

There's a dotted projected path showing a possible:

1. Short dip into the lower support zone around $3,280

2. Reversal and sharp move up toward the $3,375–$3,400 resistance zone

---

Interpretation:

This is a bullish setup suggesting a buy opportunity if price dips to the lower blue zone and shows a reversal.

The target lies near the upper purple zone ($3,400).

Traders might watch for:

Bullish candlestick confirmation near the support zone

Breakout from the current consolidation

Volume confirmation on the move upward

---

Would you like a risk-reward analysis or entry/stop/target levels based on this setup?

XAU/USD-Mart money

🚨 Smart Money Sniper Signal – XAU/USD (Gold)

🕒 Timeframe: M15 or H1

📅 Date: June 25, 2025

---

🔍 Market Context

Current price: ~$3,326

Market structure: Bullish on H1

Liquidity grab zone: Observed around $3,322

Order block support: $3,318 – $3,322

RSI: Above 50 (bullish momentum)

---

🟢 Buy Setup (Sniper Entry)

Entry zone: $3,322 – $3,324 (on bullish confirmation)

Confirmation: Bullish engulfing or strong bullish candle on M15

Stop Loss: Below $3,318

Take Profit targets:

TP1: $3,330

TP2: $3,336

TP3: $3,344

🧠 Tip: Use a Risk:Reward ratio of at least 1:2. Set trailing stop once TP1 is reached.

---

🔴 Sell Scenario (If invalidation)

If price breaks below $3,318 with volume:

→ Wait for a retest of the zone and enter SELL

TP1: $3,312

TP2: $3,304

---

🔔 For TalionPromosal (TradingView page)

Use this caption for your idea post:

> 💥 Smart Money Signal (Gold – M15/H1)

Bullish structure still valid. Looking for sniper entry near $3,322 with OB + RSI confluence.

SL below $3,318. TP targets $3,330 / $3,336 / $3,344.

Risk-managed & institutionally aligned setup.

#SmartMoney #XAUUSD #Gold #SniperEntry #TalionPromosal #TradingView

-

Midweek XAUUSD Insight | Dual View SetupPair: XAUUSD

Bias: Bullish

HTF Overview (Left Panel – 3H): Price action has been moving within bullish structure, with a major higher low currently holding strong. This HL is the key pivot I’m watching for continuation.

Refinement Zone (Middle – 30M): We’ve tapped into a 30M OB and are now sitting in mitigation territory. No signs of reversal yet, but the setup is maturing.

Entry Technique (Right Panel – 15M View): Just waiting for that classic Smart Money confirmation — LTF CHoCH, liquidity sweep, then return into OB. Will refine down to 5M for precise entry if price plays out clean.

Entry Zone: Waiting on confirmation around the OB zone

Target Zones: Based on HTF structure continuation

🧠 Mindset Note: Setup is solid, but patience wins. Let the story unfold — we only strike with clarity and precision.

Bless Trading!

6.24 Gold safe haven fades and gold falls

Technical aspect: After the gold price hit the 3400 integer mark overnight, it fell rapidly under the impetus of negative news. The overall fluctuation range is still within the 3330-3400 range we expected. This shows that the current market dominated by news lacks continuity. We make a golden section of the high and low points of the overnight decline to the current level, and the current position of 0.618 is 3370.

Pressure level: 3370\3375\3400

Support level: 3330\3300