Not a perfect setup, but it's AMZN, so I'm in at 211.65.It may be a touch early to take this trade, but I"d always rather be early than late on AMZN trades. This particular setup isn't exactly like the first 2 ideas I posted about AMZN, but it's been very profitable in general, even if it hasn't done that well on AMZN recently. That said, results of tr

Key facts today

Amazon (AMZN) reported Q2 2025 revenue of $167.7 billion, beating estimates by 3.4%. Non-GAAP profit was $1.68 per share, exceeding forecasts by 26%. Q3 revenue guidance is $176.8 billion.

Amazon is expanding same-day grocery delivery to 2,300 U.S. locations by 2025, with free service for Prime members on orders over $25, and reaching 4,000 smaller cities.

Amazon is reducing plastic packaging due to recycling issues and is optimizing box sizes to cut shipping costs. The new 'Ships in Product Packaging' program aims to minimize extra materials.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.1 PLN

245.16 B PLN

2.64 T PLN

9.65 B

About Amazon.com

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

FIGI

BBG01NX6JDG2

Amazon.com, Inc. engages in the provision of online retail shopping services. It operates through the following business segments: North America, International, and Amazon Web Services (AWS). The North America segment includes retail sales of consumer products and subscriptions through North America-focused websites such as amazon.com and amazon.ca. The International segment offers retail sales of consumer products and subscriptions through internationally-focused websites. The Amazon Web Services segment involves in the global sales of compute, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

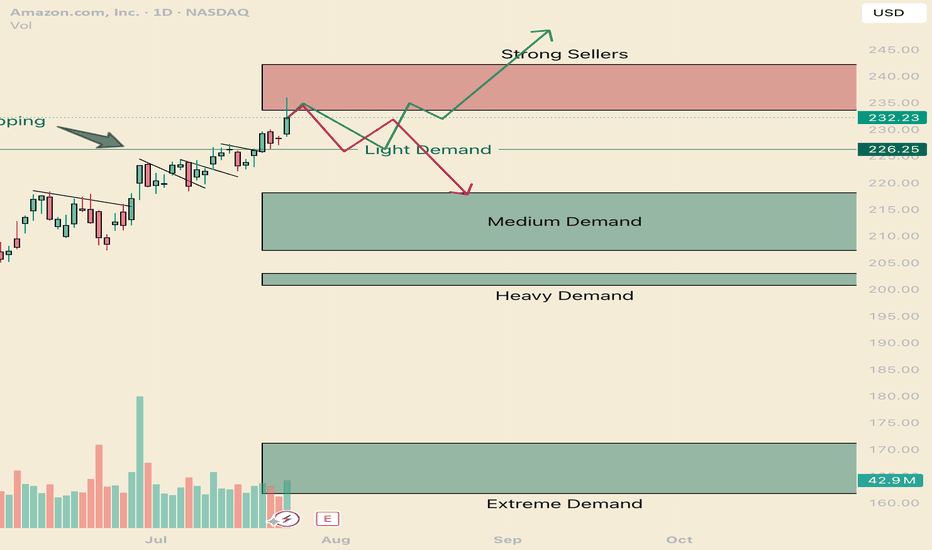

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers

learn how to read and use Angle of Descent

Angle of Descent is the inverse of Angle of Ascent. However, the downtrend runs faster and steeper than the uptrend. WHY? Because the uptrend builds on uncertainty and doubt from retail groups, while Dark Pools and professional traders buy quietly with the that the stock is at bargain prices and wi

AMZN - Amazon Hit The 80% profit Target. Trend change ahead?On this chart we have 2 forks.

Orange: the pullback fork

It shows us where the equilibrium is — at the centerline, which the market respected to the tick (1).

After that, there were several bars that formed support (2).

When the CIB line was broken (3), the market gapped above the orange centerli

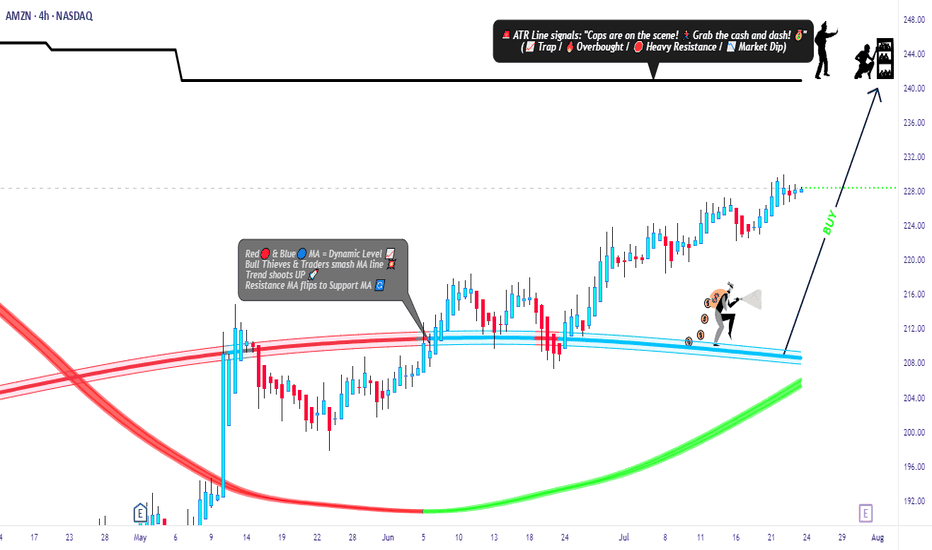

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN),

Amazon Stock Chart Fibonacci Analysis 080625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 216/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

AMZN's Path towards 240AMZN: Primed for a Rebound? 🚀 Bullish Signals Emerging!

•Pivotal Support Holding Firm: The price has found robust demand around the 215 support zone 🟢, a critical area that has demonstrated its strength in halting previous declines. This level is proving to be a formidable floor, absorbing selli

Buy Low , Sell High MythOn hindsight, it is easier to say , sell high and buy low since you can see the price movments happening already! On a day to day basis, it is much harder as the price patterns are evolving...

Plus the media would do what it is supposed to do - create sensational headlines to capture your readershi

AMZN Breaking Out of Golden Fib Zone–Next Stop $243 or Pullback?📊 Market Breakdown

AMZN is trading at $222.69, having just broken out of the Golden Fib Zone ($211–$224) after bouncing off the equilibrium (~$206). The breakout puts price on track to test the Premium/Supply Zone ($242.88), but RSI at 56 shows there’s still gas left before hitting overbought territ

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AMZN is featured.

Frequently Asked Questions

The current price of AMZN is 820.3 PLN — it has decreased by −0.19% in the past 24 hours. Watch AMAZON stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GPW exchange AMAZON stocks are traded under the ticker AMZN.

AMZN stock has risen by 3.04% compared to the previous week, the month change is a 0.20% rise, over the last year AMAZON has showed a 22.80% increase.

We've gathered analysts' opinions on AMAZON future price: according to them, AMZN price has a max estimate of 1,116.46 PLN and a min estimate of 802.69 PLN. Watch AMZN chart and read a more detailed AMAZON stock forecast: see what analysts think of AMAZON and suggest that you do with its stocks.

AMZN reached its all-time high on Feb 4, 2025 with the price of 974.8 PLN, and its all-time low was 622.9 PLN and was reached on Apr 7, 2025. View more price dynamics on AMZN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMZN stock is 0.00% volatile and has beta coefficient of 1.34. Track AMAZON stock price on the chart and check out the list of the most volatile stocks — is AMAZON there?

Today AMAZON has the market capitalization of 8.62 T, it has increased by 2.76% over the last week.

Yes, you can track AMAZON financials in yearly and quarterly reports right on TradingView.

AMAZON is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

AMZN earnings for the last quarter are 6.06 PLN per share, whereas the estimation was 4.79 PLN resulting in a 26.44% surprise. The estimated earnings for the next quarter are 5.65 PLN per share. See more details about AMAZON earnings.

AMAZON revenue for the last quarter amounts to 605.18 B PLN, despite the estimated figure of 586.14 B PLN. In the next quarter, revenue is expected to reach 647.25 B PLN.

AMZN net income for the last quarter is 65.55 B PLN, while the quarter before that showed 66.36 B PLN of net income which accounts for −1.23% change. Track more AMAZON financial stats to get the full picture.

No, AMZN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 13, 2025, the company has 1.56 M employees. See our rating of the largest employees — is AMAZON on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMAZON EBITDA is 489.69 B PLN, and current EBITDA margin is 19.15%. See more stats in AMAZON financial statements.

Like other stocks, AMZN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMAZON stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMAZON technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMAZON stock shows the sell signal. See more of AMAZON technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.